Rates as of 05:00 GMT

Market Recap

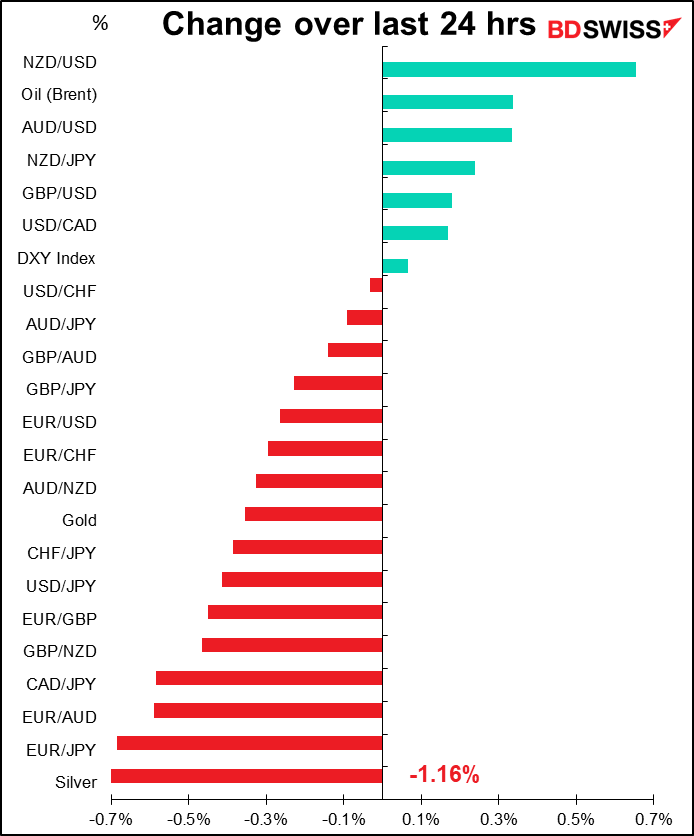

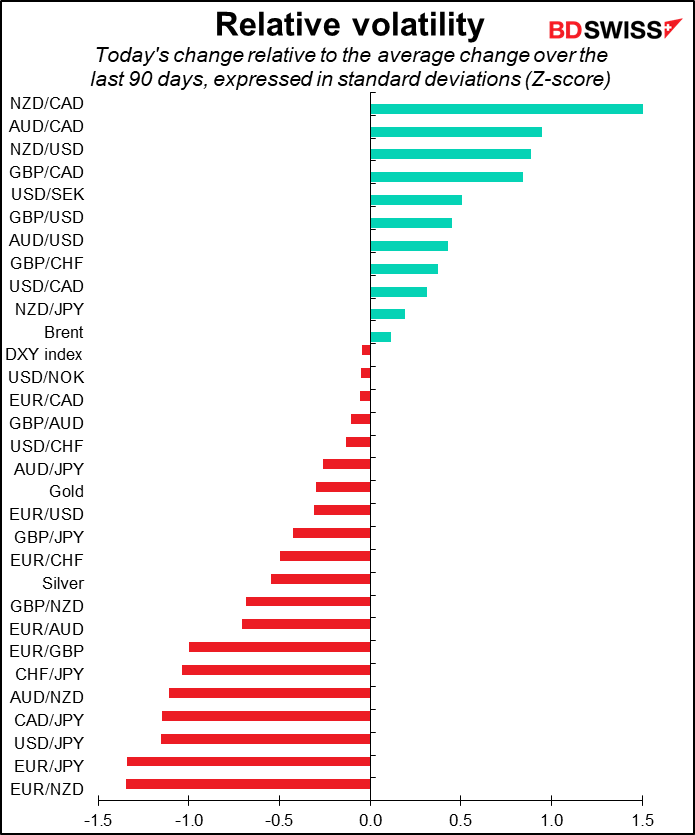

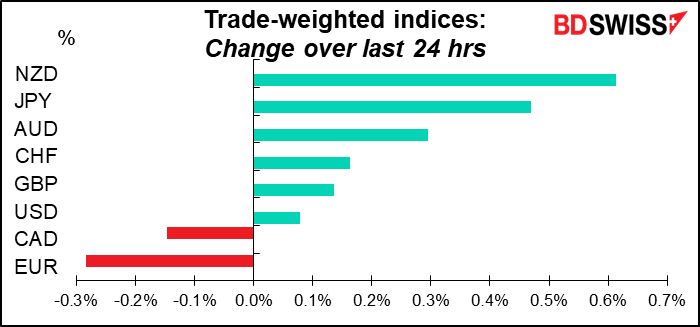

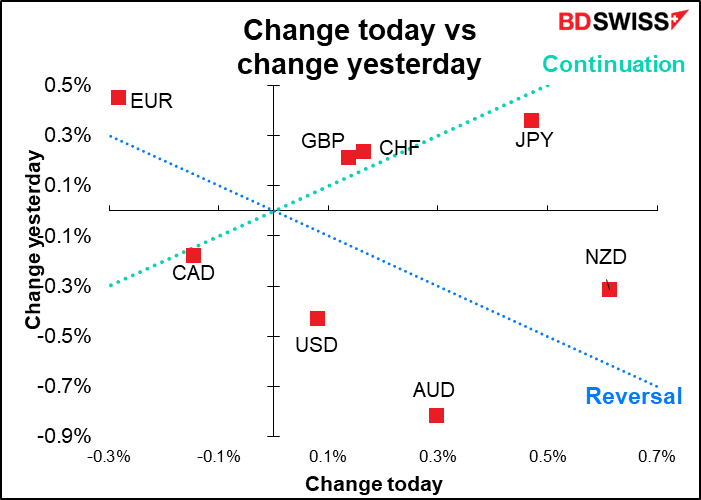

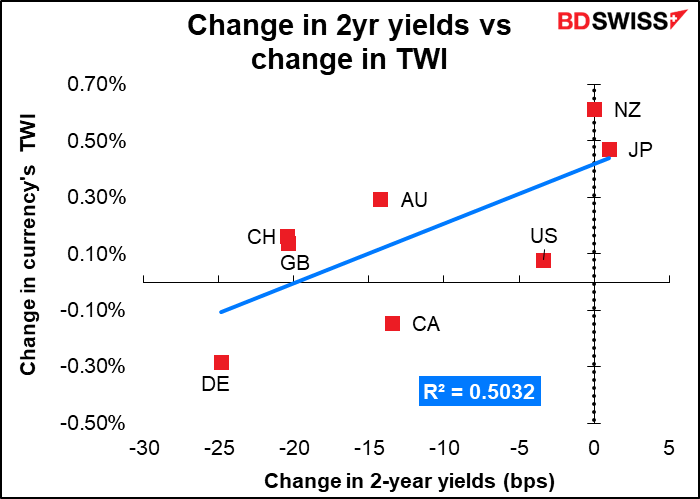

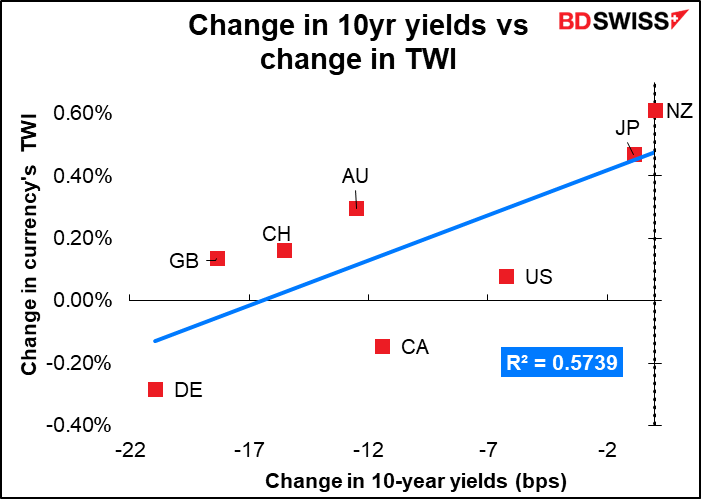

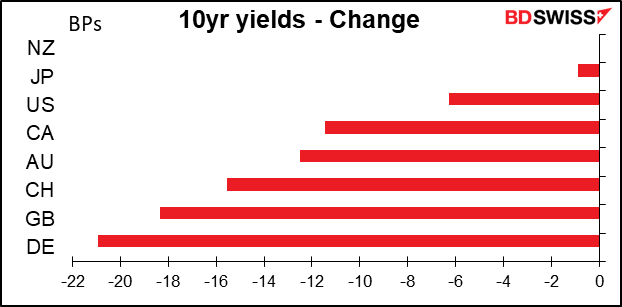

NZD was the best-performing currency over the last 24 hours but I’m stumped to say exactly why, particularly since New Zealand was on holiday today. Or maybe that’s it —because they’re on holiday, NZ was the one bond market where yields didn’t fall. That seems to be the best explanation as the change in yields explains about half the change in the major currencies.

That of course leads to another question: why the big decline in bond yields overnight? Especially in Europe, where yields on 10-year Bunds fell 21 bps, the most in over a decade (which would also explain why EUR was the worst-performing currency).

Apparently people are increasingly worried about a recession as Fed Chair Powell reiterated that the Fed’s commitment to fighting inflation is “unconditional” in his testimony to the Senate banking panel. (Nothing really new in his testimony; again, he didn’t view a recession as inevitable but acknowledged that rising energy and food prices, which the Fed can’t do anything about, will make it more difficult to bring inflation back down to 2% while preserving the labor market.)

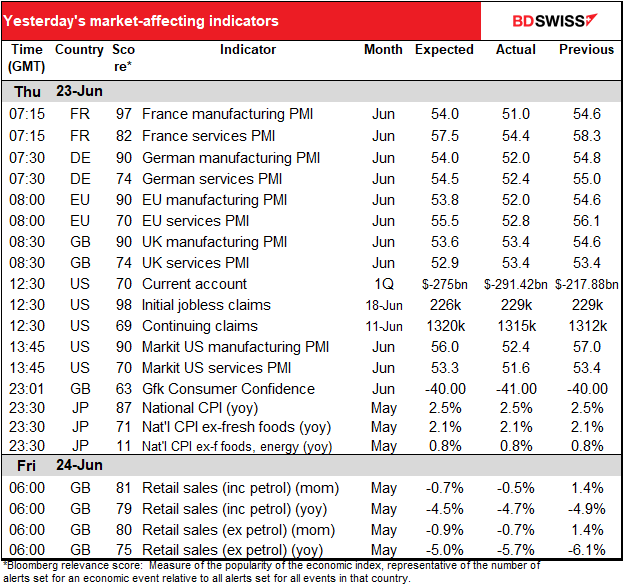

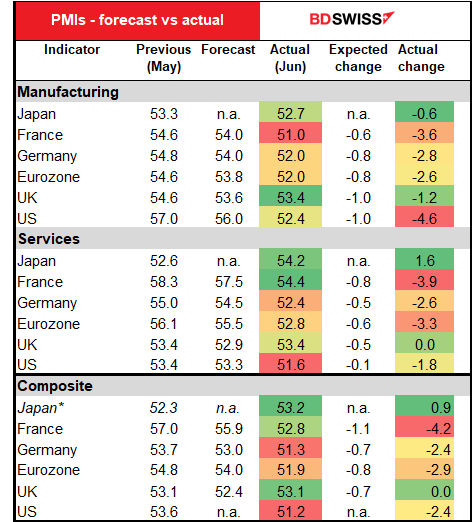

In addition, yesterday’s preliminary purchasing managers’ indices (PMIs) were pretty dismal for the Eurozone and the US but surprisingly good for Japan and the UK. US manufacturing fell especially sharply, as did French (and hence Eurozone) services. Japan’s services on the other hand improved noticeably while UK services were unchanged. The threat of ever-tighter monetary policy even as economies slow increased fears of a recession and led to lower bond yields.

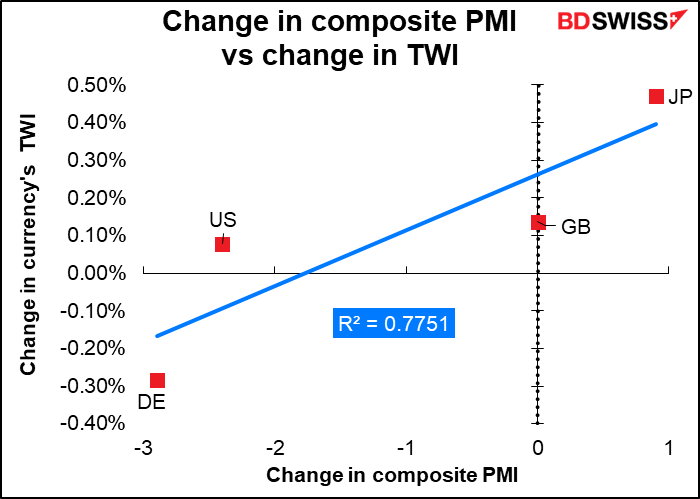

In fact if we chart the change in the composite PMIs vs the change in the trade-weighted indices we get an even better fit – the PMIs explain 78% of the variation in the change in currencies (although it’s hard to tell with such a small sample).

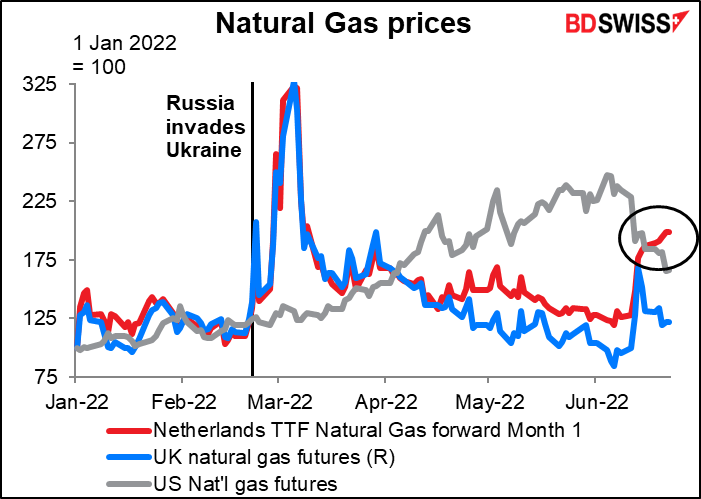

EUR was also hit by worries about Russia turning off the gas taps to Europe. After Russia cut capacity to Germany by 60% over the last week, Germany declared a gas crisis and activated the second phase of its three-stage gas emergency program, in which companies are allowed to pass on price increases to customers. The third phase would be rationing, which would be a huge blow to its manufacturing sector.

Although European stock markets were generally low thanks to the PMIs, the S&P 500 and NASDAQ managed to close higher (+1.0% and +1.6% respectively). That’s probably because the increasing fears of recession are causing investors to price in a shallower path for US rates despite Chair Powell’s pledges to do “whatever it takes” to get inflation down. So it seems we’re back to “bad news is good news” for the stock markets.

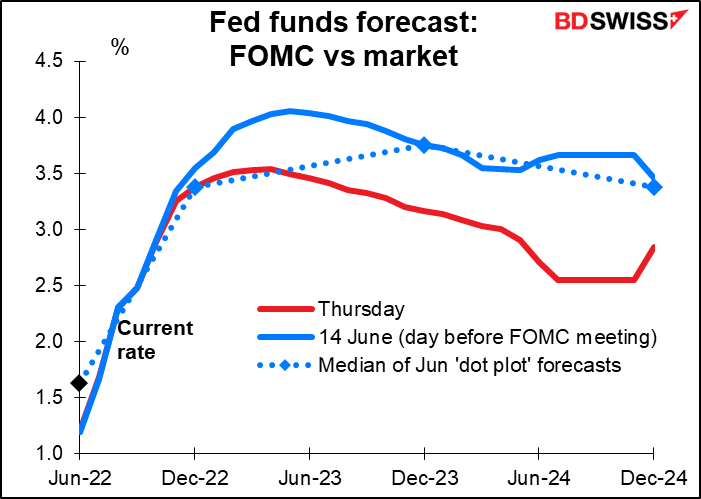

Fed funds futures rose further yesterday, i.e. priced in less rate tightening.

The market is now forecasting a much shallower increase in rates and a much lower terminal rate (the highest rate that the fed funds will reach) than it was even before the last FOMC meeting and its 75 bps hike. Moreover the market is predicting much lower rates for end-2023 and end-2024 than the Committee members are.

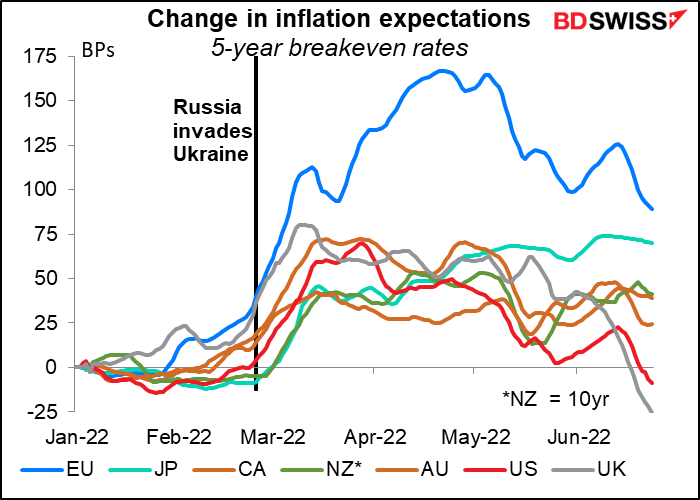

We can see the fears of recession reflected in inflation expectations. Breakeven inflation rates are now lower in the US and the UK than they were at the beginning of the year despite higher energy prices. Even Eurozone inflation expectations have come down dramatically. This is not just central banks regaining the market’s confidence in their ability to fight inflation; it’s the market’s confidence in recession.

Elsewhere, the UK Conservative Party lost two by-elections yesterday, as expected. In one, the centrist Liberal Democrat party won a seat with a majority of 6,000 that the Conservatives had won last time with a majority of over 24,000. The Liberal Democrats said it was the biggest ever majority to be overturned at a British parliamentary by-election. This is likely to send shudders down the spines of PM Johnson’s fellow Conservatives (if indeed they have spines to shudder) and increase pressure on PM Johnson to step down. However he’s already rejected that idea, saying it’s common for governing parties to lose mid-term by-elections. Yes but that combined with 148 (41%) of his party’s Members of Parliament (MP) voting against him in a no-confidence vote less than three weeks earlier…

Politics doesn’t seem to be a major issue for the pound nowadays, though. Perhaps the market doesn’t think PM Johnson will be ousted, given the absence of any notably more popular candidates. Or perhaps investors feel that if Tweedledum is ousted he’ll just be replaced by Tweedledummer and nothing will change, given the intractable Northern Ireland question and the Conservative Party’s commitment to finding a solution that doesn’t exist.

Today’s market

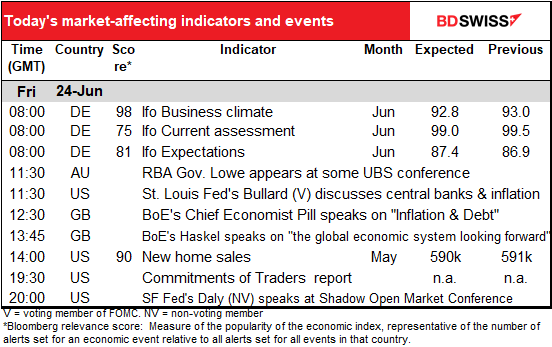

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

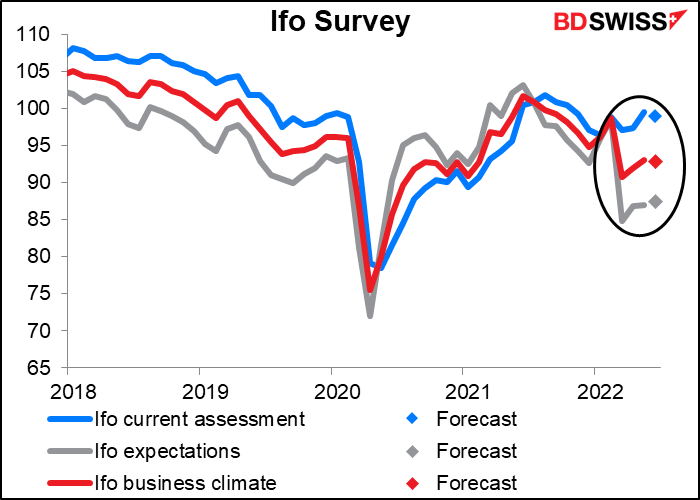

The Ifo survey is expected to be mixed – current assessment down a bit but expectations up a bit, with the result that the overall business climate index is forecast to be down a tiny bit.

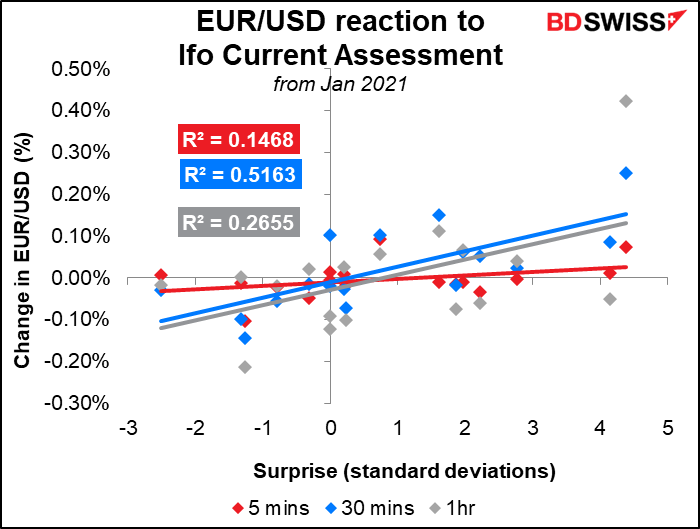

Which of the three indices should you watch? My research suggests that the current assessment has the closest relationship with the subsequent movement of EUR/USD, more so than the overall headline “business climate” index.

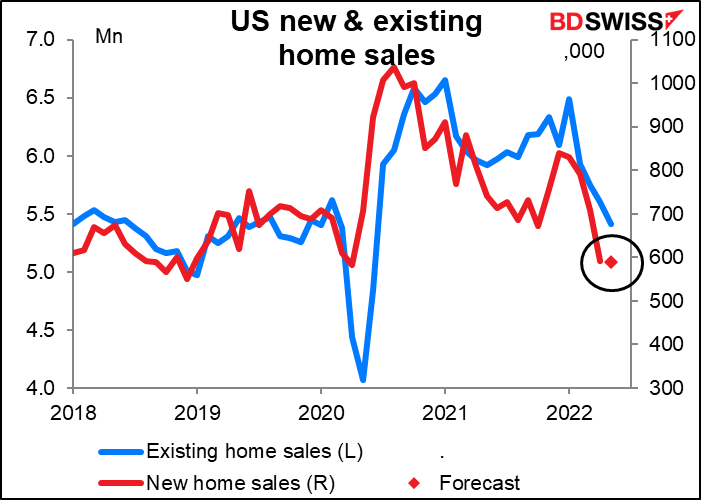

Then only a lot of talkers until the US opens for business and we get the new home sales. They’re expected to be up slightly, but that’s just an expected rebound from the nearly 17% mom decline the previous month (which was mostly due to builders holding houses off the market due to uncertainty about the cost of completing them). Tuesday’s US existing home sales came in slightly better than expected at -3.4% vs -3.7% expected.