Rates as of 04:00 GMT

Market Recap

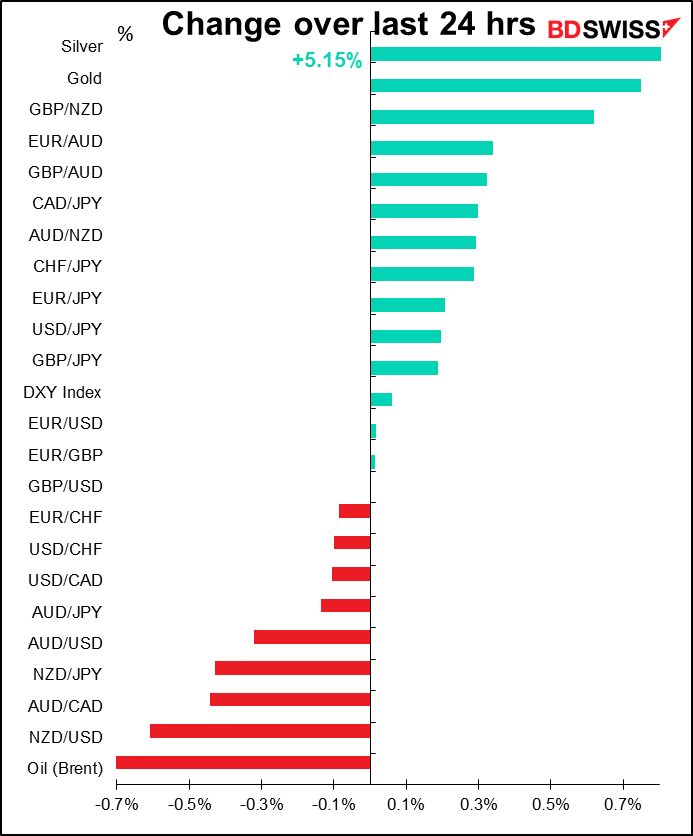

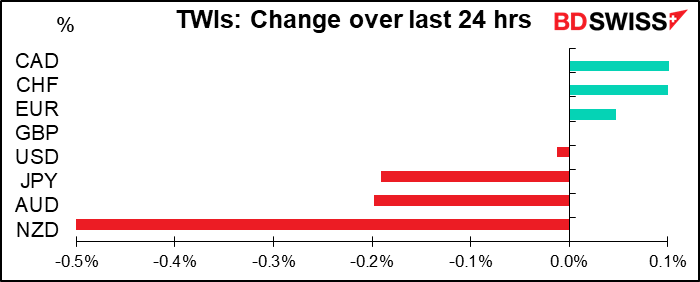

After an unusually volatile day we get an unusually quiet day, with only NZD showing any major move – a natural reaction to the Reserve Bank of New Zealand (RBNZ) meeting yesterday morning. As I mentioned yesterday, the key takeaway from the RBNZ meeting is that they’re preparing more loosening measures to use if necessary, including not only negative rates but also buying foreign assets – a deliberate effort to weaken the currency. The market is just doing it for them, thereby saving the RBNZ some money.

Otherwise it was a generally trendless day. During the European afternoon/US morning, the “risk-on” sentiment pushed USD down, especially vs EUR and GBP: EUR/USD hit a high for the week of 1.1864 and GBP/USD managed to poke its nose back above 1.3120, a level that it just briefly breached on Tuesday. JPY fell on all the crosses.

Risk sentiment turned around late in the US session as it became clear that the Russians oh sorry the Republicans were not going to compromise and the Senate adjourned until 8 September with no agreement on a new stimulus package. Bye-bye Miss American Pie! This was the day the music died for millions of Americans who depend on government funds nowadays to live. As Paul Krugman wrote recently, not only will that devastate those people’s incomes and push total consumer spending down by over 4%, but the multiplier effect means it could produce a 4%-5% fall in GDP (vs the 6.5% rise that the market is expecting in Q3). No wonder risk sentiment turned around.

Oh, and in case that’s not bad enough, Dr. Robert Redfield, head of the US Centers for Disease Control and Prevention, warned that if people don’t take appropriate precautions (which they won’t – this is America), skyrocketing cases of COVID-19 combined with the annual flu season could create the “worst fall” that “we’ve ever had.” (Fall = autumn) Economic Armageddon combined with a plague of Biblical proportions – how’s the dollar likely to react?

I also wonder how the electorate is likely to react. Nov. 3rd – Election Day — can’t come soon enough.

Despite the switch in risk sentiment, silver though managed to climb another 5%. So what else is new?

Today’s market

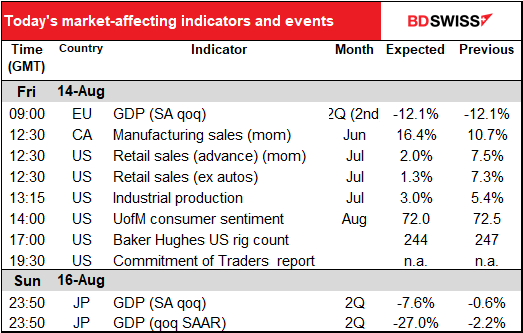

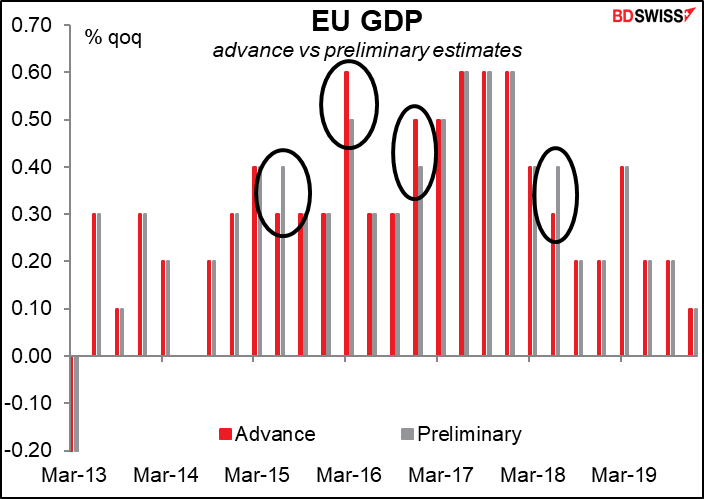

The day starts with the second estimate of EU 2Q GDP. This is rarely revised and if it is, it’s only by ±10 bps.

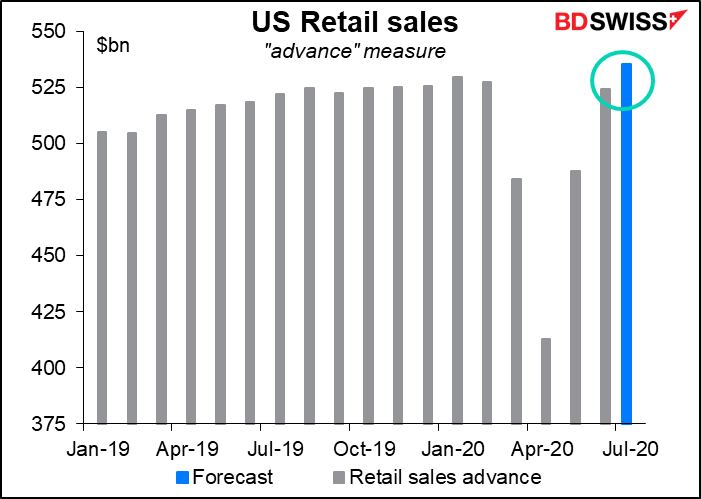

Next up is US retail sales, which is the most important indicator of the week as the health of the US consumer is crucial. (Remember “my spending is your income”?) The consensus forecast has risen somewhat since I wrote about this indicator last week. Then the market was looking for the headline figure to be up 1.6% mon; now it’s 2.1%. That’s enough to bring sales not only back to but exceeding the level of January and February. Sales excluding autos are expected to be almost back there too. The report could be encouraging for investors.

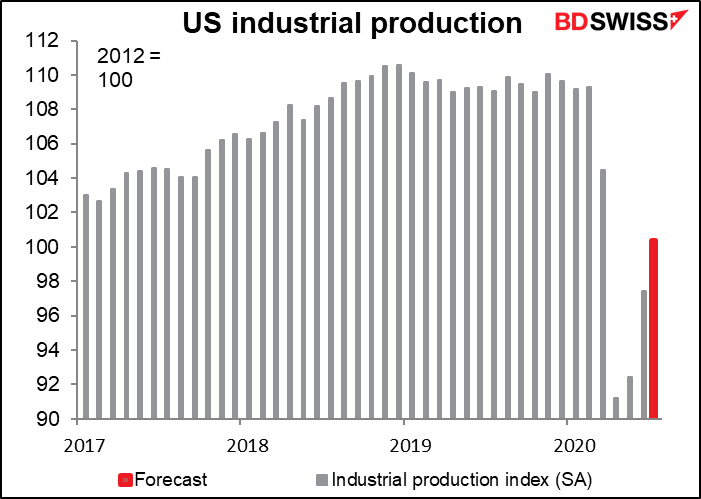

US industrial production on the hand is only rebounding gradually and is expected to remain well below pre-other pandemic levels, indeed even below March’s level.

Between rapidly improving retail sales and slowly improving production, which will dominate the dollar’s direction? It depends. The market seems to weight these two about the same so it’s not clear which would take precedence under normal circumstances. My guess is that retail sales will be seen as the necessary predecessor to production; that is, there has to be a recovery in demand before there can be a recovery in output. So output may be seen as the lagging indicator and an increase in sales the leading indicator. In that case, the dollar can still rally on these figures, but boy will it take a leap of faith.

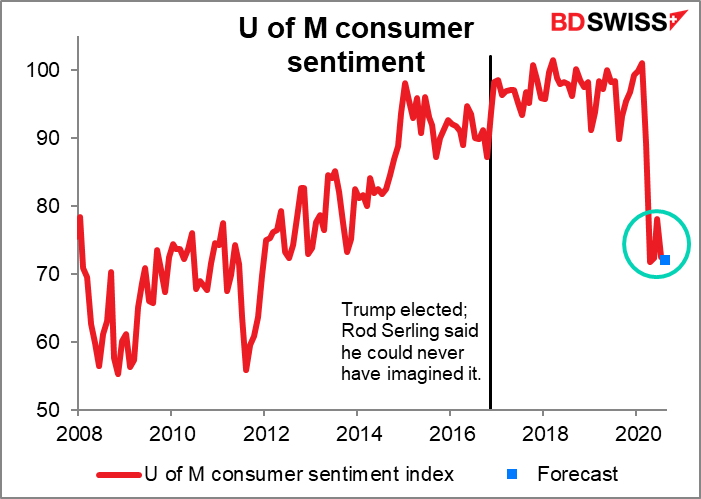

U of Michigan consumer sentiment is expected to remain around the same level that it’s been since the pandemic began. My question is, why hasn’t it gone down further as the virus rages out of control thanks to the incompetent government? The answer has to be survivor bias – they only survey people who are still alive.

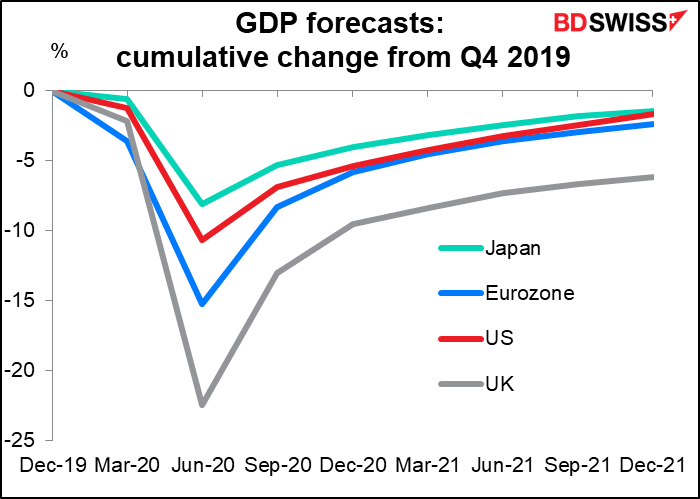

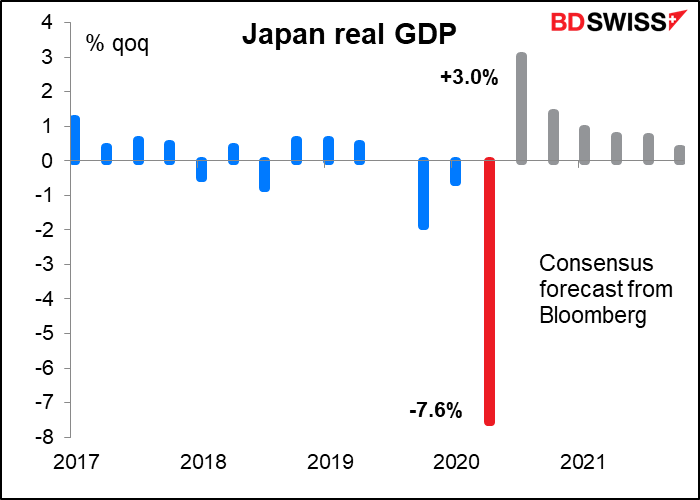

Then on Monday morning, before Europe starts up again, we get the big indicator for the week from Japan: Q2 GDP. It’s expected to be down -7.6% qoq, which isn’t bad the way things are going – the US was -9.5% qoq, Eurozone -12.1%, and I don’t even dare mention the UK (-20.4%, and no, that’s not SAAR, it’s just qoq.)

If the Q2 dip is relatively shallow, the Q3 rebound is also expected to be relatively modest too: +3.0% qoq vs +4.2% qoq in the US, +8.2% qoq in the Eurozone and +12.2% qoq in the UK. Nonetheless that’s expected to be enough to keep Japan mildly ahead of the pack for a few more quarters. Unfortunately there doesn’t seem to be any “growth divergence play” with JPY. On the contrary, solid growth may restore risk appetite and lead Japanese investors to put more money abroad, thereby weakening the yen.