Rates as of 04:30 GMT

Market Recap

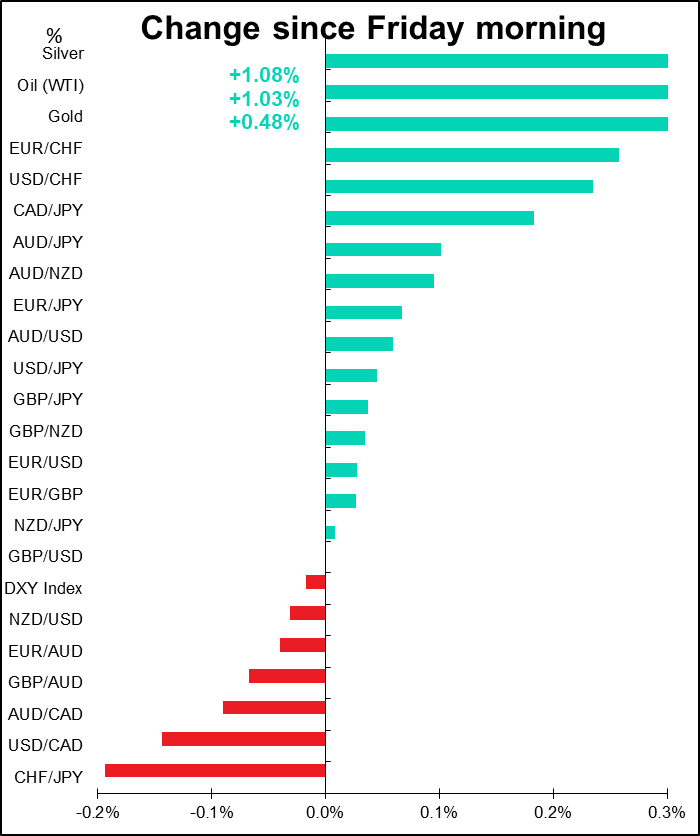

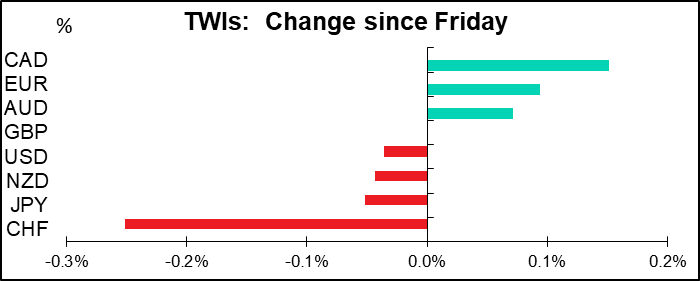

Among the dullest days I’ve ever seen. Not only was there little movement in any of the major currencies, we’ve got nothing on the schedule today to create any volatility, either. It’s a basically “risk on” day, with Chinese stocks up sharply (Shanghai +1.6%, Shenzhen up 2.4%). That would explain why CHF is the biggest loser.

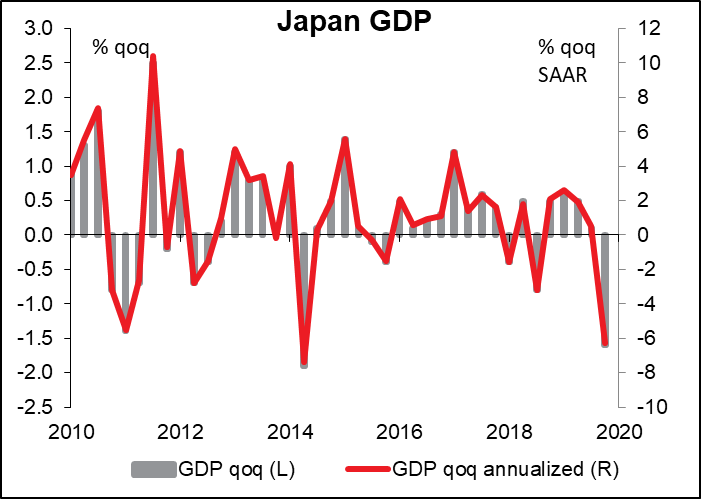

The lack of movement in JPY is really telling. Overnight we got Q4 GDP figures from Japan that can only be described as catastrophic. GDP was expected to be down 3.8% qoq SAAR, which would be bad enough; instead it was down an astonishing 6.3% qoq SAAR. And this was before the coronavirus hit!

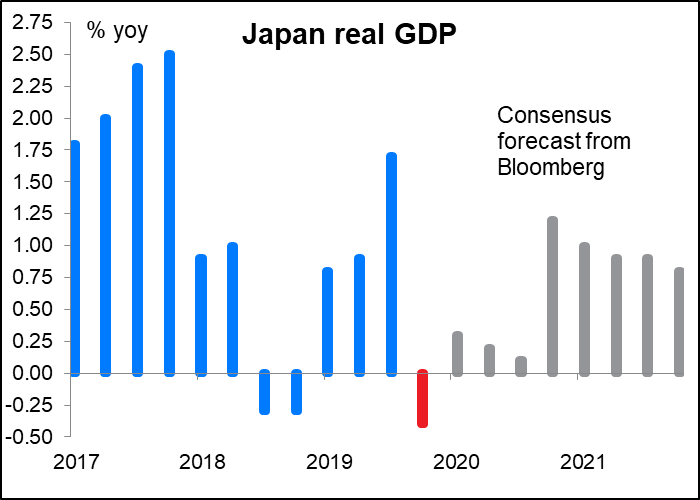

As you can guess, here too the consensus forecast of a short decline followed by a gradual recovery is likely to prove optimistic. (Note that this graph is GDP yoy and so the figures are not the same as in the graph above.)

What’s kind of amazing is that:

- The second-largest economy in the world (China) is effectively shut down because of the virus;

- The third-largest economy in the world (Japan) just printed -6.3% qoq SAAR GDP before the virus hit;

- The fourth largest economy in the world (Germany) printed +0.0% qoq GDP (+0.4% yoy) and a 45.3 manufacturing PMI before the virus

- The US stock market is at a record high.

Which one of these does not belong with the others?

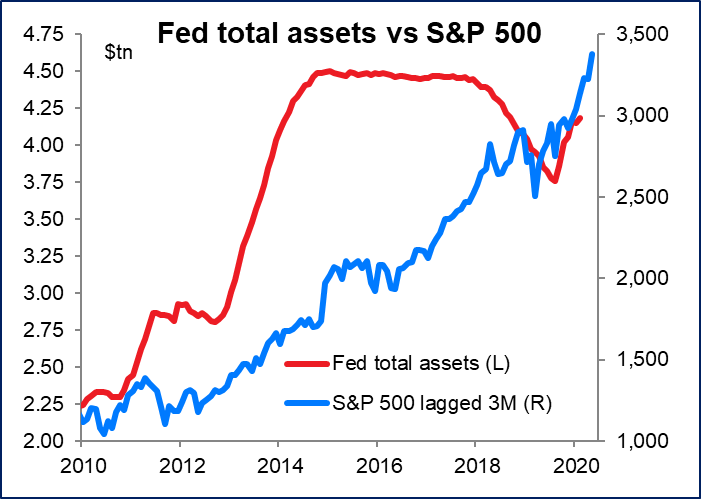

Of course it could be that money is fleeing Asia, which is likely to be hardest hit by the virus, and moving to the US, which may be seen as somewhat isolated in this contagion. It could also be that the US stock market is responding to the $423bn expansion of the Fed’s balance sheet since September. But if the latter, then why hasn’t the dollar depreciated?

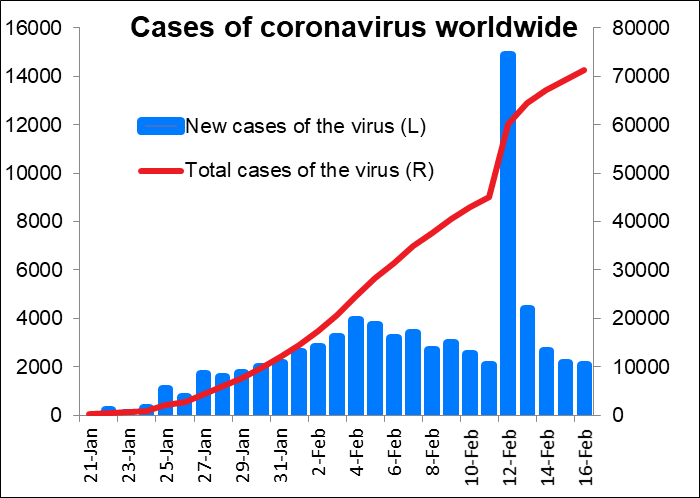

Virus update: trend back to previous

After soaring on one day when Wuhan Province revised its method of calculating the number of people infected with the virus, the official figures now show the trend back to where it was before the revision. If you believe the numbers.

Commitments of Traders (CoT) Report

The CoT report showed traders continuing to get long USD and short EUR. This was the third consecutive week that they increased their DXY longs. Positions are not yet at an extreme though, suggesting that the trend can easily continue for quite some time.

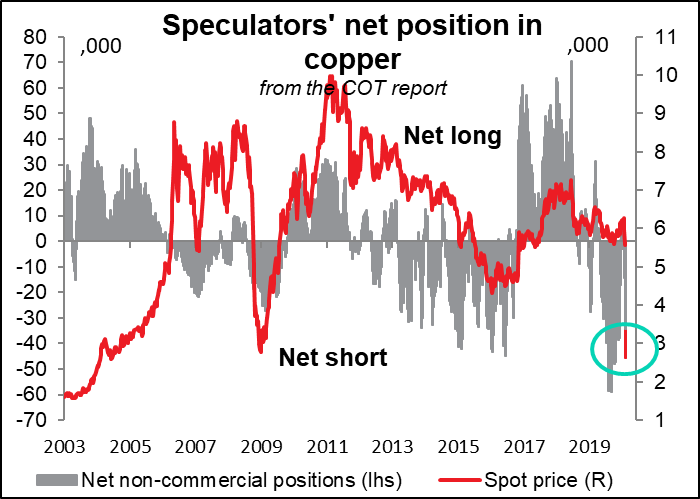

Cutting AUD shorts and adding to JPY shorts was a serious “no virus worries” vote. I’m surprised that people are so confident that this is just going to blow over. That’s the signal we’re getting from the stock markets, too. I do hope they’re right! On the other hand, they increased short copper positions by one-third, bringing it to near record-short levels. Given copper’s role as an indicator of health for the Chinese economy (China consumes 53% of all the copper used in the world), maybe the FX market and the metals market are watching different indicators?

Specs increased NZD shorts but cut AUD shorts. That worked out OK until Tuesday, the day that these figures were calculated, but really fell apart the next day!

They also reduced CAD longs.

Today’s market

There is absolutely nothing on the schedule today. No major European indicators, the US and Canada are on holiday, and nothing big in Asia etiher. The minutes of the latest Reserve Bank of Australia meeting should not hold any surprises after the Statement on Monetary Policy was released 10 days ago.

So as I learned when I was a journalist, if there’s nothing to say, write it short.

I just want to call your attention to this article from the UK newspaper The Independent. It reinforces my view that even the best case for Britain in Brexit – a rapid and successful conclusion to the many, many trade negotiations that the UK will have to hold with countries all over the world – won’t possibly be any better than what they have now, and is likely to be worse. That’s GBP negative long-term.

Studies expected to show the UK will gain little from post-Brexit trade deals with the US and the big Asian economies are being suppressed by the government, The Independent can reveal.

Analyses were completed as long ago as 2017 into the probable impact on growth from agreements long hailed as the prize for leaving the EU, but ministers are refusing to release them.

One trade expert said he had little doubt they were being concealed because they would – like independent studies – reveal that significant damage from new trade barriers with the continent will far outweigh the gain from other deals.

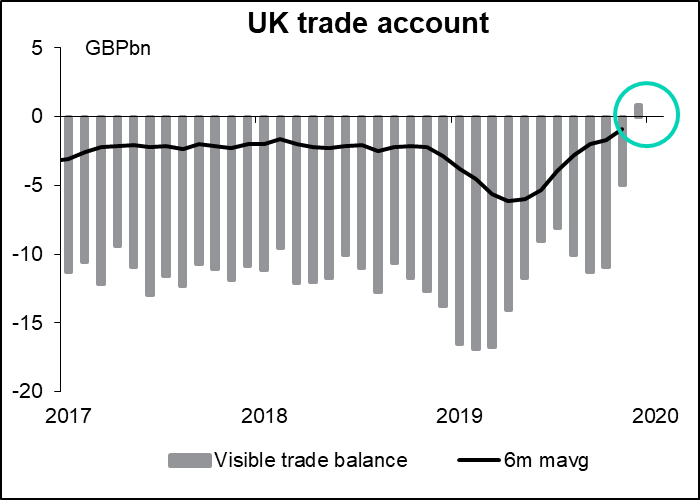

I’d also like to say a word about the astonishing UK trade figures that were out last week. They showed the country with the first surplus in trade in goods on record (data going back to 1998, so not so long ago, but…)

Apparently this was largely an optical illusion. Movement of gold held by private institutions is recorded as imports and exports, even though it’s just being held in a bank vault somewhere deep in a basement in the City. It’s being reported that apparently, one (US?) bank shifted its gold from being “unallocated” to being “allocated.” This changed it from UK ownership to US ownership, which counts as an export even though the gold is still sitting in the same vault. Meanwhile, the Office of National Statistics is trying to develop a trade series that strips out gold to avoid such issues.