After a relatively empty schedule last week, there’s a lot more going on this coming week. I fear though that it’s likely to be drowned out by any news about the COVID-19 virus and particularly its spread in the US.

The first week of the month is always dominated by the US nonfarm payrolls (NFP). This week we also have two central bank meetings: the Reserve Bank of Australia (RBA) on Tuesday and the Bank of Canada (BoC) on Wednesday. Neither is expected to cut rates, but everyone will want to see what their take is on the economic outlook as the virus spreads around the globe. There will be an OPEC-plus meeting in Vienna on Thursday and Friday as the group tries to get to grips with the sudden plunge in demand and prices in the wake of the virus. Finally, the Democratic Party in the US will hold its “Super Tuesday” round of presidential primaries, which may determine who gets to challenge Trump at the November election (assuming Trump is still in office then).

NFP: not what it used to be, but still what it is

The NFP is still a major focal point for the market each month, but not like it used to be. The Economist magazine had an article last month entitled “Traders lose interest in America’s jobs report. Markets react less to jobs data than they did before the financial crisis” They explained that “The reason for the subsequent lack of interest is that falling unemployment is no longer a good guide to the Fed’s actions.” That is to say, the Fed’s mandate is to achieve “maximum employment” and “stable prices.” The US is already beyond what they had thought was “maximum employment,” which they had estimated to be somewhere between 4.0%-4.3% unemployment (it’s currently 3.6%). That means job growth could slow considerably and the unemployment rate rise notably before they would consider loosening policy to boost employment. On the other hand, with inflation still below target, they’re not going to raise rates even if employment increases further. In short, neither a good nor a bad figure is likely to cause them to change policy any time soon.

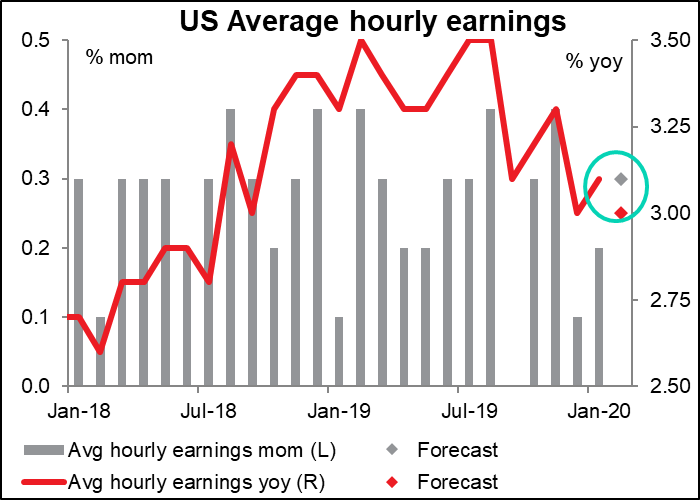

While everyone focuses on the NFP, the Fed is probably watching the average hourly earnings figure more closely. There are two reasons. One, since the unemployment rate is already well below what they thought the US economy could accommodate without causing a surge in inflation, they are wondering whether the unemployment rate is a good guide to how tight the labor market is. Some members of the rate-setting Federal Open Market Committee (FOMC) have argued that wage growth, not the unemployment rate, is a better guide to how tight the labor market is. That is, if growth in wages isn’t accelerating, it means employers can still find new workers without bidding up the price of labor. Therefore by definition the labor market isn’t tight. On the other hand, wages rising at an accelerating pace would show that it’s getting harder and harder to find workers.

Secondly, the Committee wants to see inflation get back up closer to their 2% target. They therefore hope to see a tighter labor market feeding through to higher wages, which will force companies to raise their prices – the “Phillips curve” that describes the relation between wage growth and inflation. The Phillips curve is unusually flat nowadays – not just in the US, but in many other countries as well – posing a puzzle for policy makers everywhere as economies no longer function the way they learned in grad school.

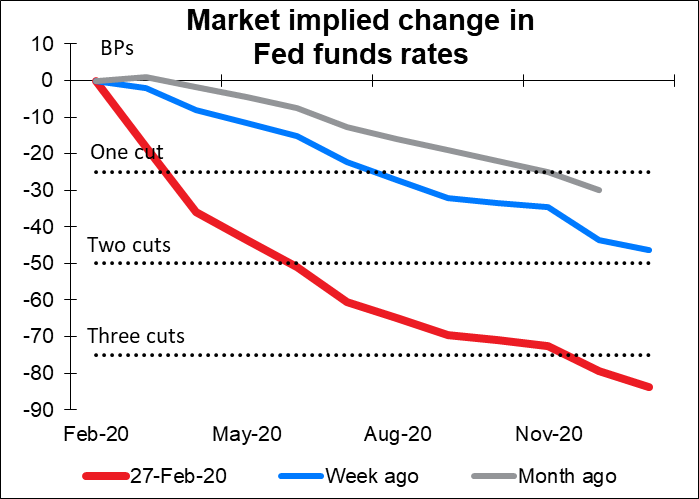

Does it matter? The market is already positive the Fed is going to cut. A month ago, investors were pricing in one rate cut this year. A week ago, two rate cuts. Now, three cuts. I doubt if the NFP or average earnings could be either so bad or so good as to change peoples’ minds either way.

In fact, the entire US yield curve out to 30 years is at or below the overnight Fed funds rate. When that happens, usually the Fed comes into line with the market, not the other way around.

In any case, the market is looking for a figure that’s slightly better than usual but nothing out of the ballpark. The forecast for the NFP number is 190k, which is slightly higher than the six-month average for the initial figure of 172k but below the average of the final figure of 205k. So really it would be well within the recent trend.

The unemployment rate is forecast to fall back to 3.5%, where it was for most of Q4 last year. That’s the lowest it’s been since it hit 3.4% in June 1969, back when the Beatles’ “The Ballad of John and Yoko” and Elvis Presley’s “In the Ghetto” were in the Top 10. The difference between now and Q4 last year though is that the participation rate in January was 63.4, up from 63.2 then. The participation rate bottomed out in September 2015 at 62.4% and has been creeping up ever since. It’s still well below the record (63.7, set in March 2000) but it’s headed in the right direction. The same unemployment rate at a higher participation rate shows a stronger labor market. That would tend to be positive for the dollar, at least momentarily.

The forecast for average hourly earnings (AHE) this month is the same as it was last month: +0.3% mom and +3.0% yoy. I think it would be serious if the yoy rate of growth slips below 3.0% — it’s been above that level since August 2018. As I mentioned above, a slower rate of growth in earnings suggests slack in the labor market, regardless of what the unemployment rate is (at least according to traditional economics). In my view, this is the main point people should be focusing on: does earnings growth start to accelerate or does it continue to slow? Or does it level off, as the market is predicting? I expect the currency market to react more to the AHE than to the NFP number itself.

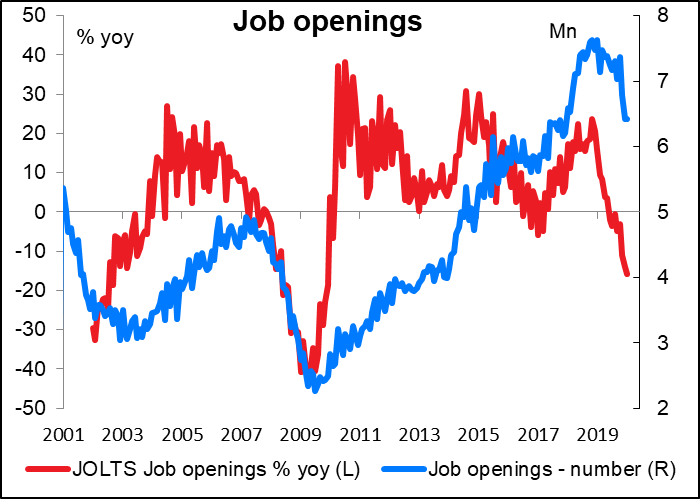

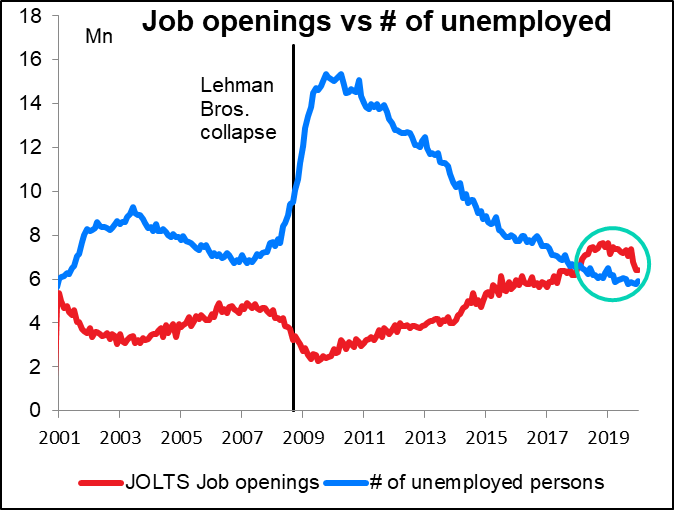

While the employment data is excellent, there are signs that we may have reached a turning point for the labor market. First off, the number of job openings has peaked. It’s now down on a year-on-year basis.

If the current trend continues, the number of unemployed persons will once again exceed the number of job openings. This limits the possible increase in employment.

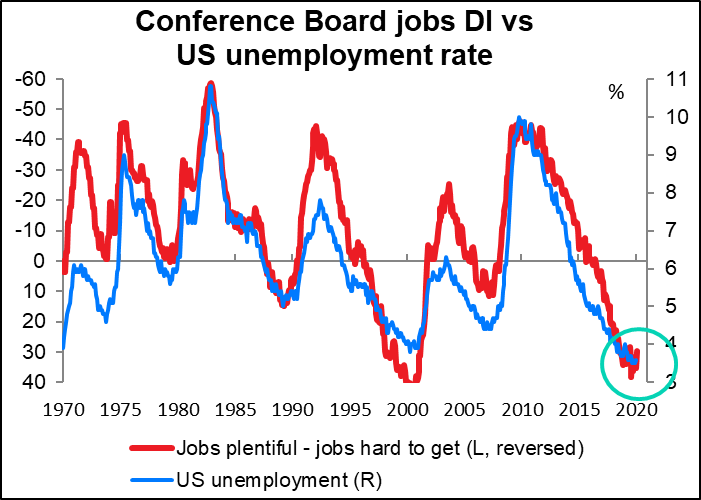

Secondly, the “jobs plentiful” minus “jobs hard to get” indicator from the Conference Board consumer confidence survey has peaked. In the past, a turning point in that indicator has signaled a turning point for the US unemployment rate. The labor market therefore bears watching, although it’s not yet a deciding factor for the Fed.

Central bank meetings: the RBA and BoC

The two central bank policy committees that meet during the week are not expected to change rates, but they will be closely watched nonetheless (as usual) to see what their take on the COVID-19 virus is. So far, officials have been cautious – they’ve expressed concern but they obviously don’t want to spread panic in the markets. Besides, they’re economists, not epidemiologists, and they don’t know anything more than anyone else does (unless they get some confidential briefings from the health authorities, which is entirely possible).

The RBA will be especially closely watched, as Australia’s economy is intimately entwined with China’s. At their last meeting on 4 February they said “The outlook for the global economy remains reasonable” but that the coronavirus was a “source of uncertainty.” “It is too early to determine how long-lasting the impact will be,” they observed. My guess is that they might be a bit more definite about the impact, although of course they still don’t know whether this will blow over quickly or turn into a global pandemic.

They also implied that rates had perhaps hit bottom for now and they would wait to see what the effect is as the lower rates percolate through the economy: “With interest rates having already been reduced to a very low level and recognising the long and variable lags in the transmission of monetary policy, the Board decided to hold the cash rate steady at this meeting.” Since it can take up to three quarters for the impact of a rate cut to be fully felt throughout the economy, this statement to me portended a long period of no change in rates, assuming – as Fed Chair Powell would say – no “material reassessment” of the outlook.

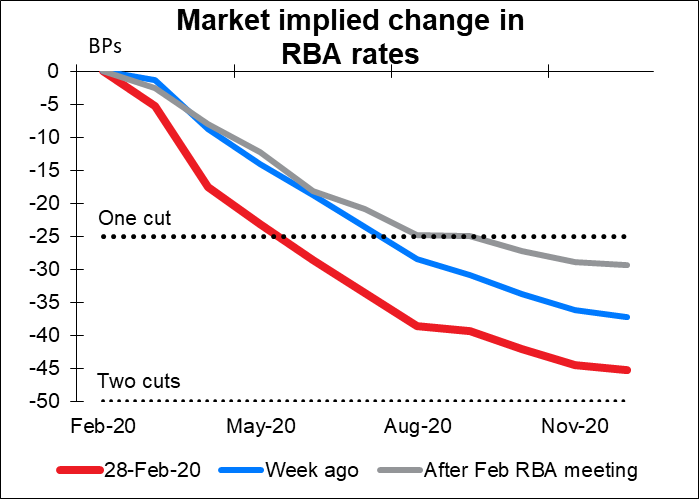

The virus has however changed the market’s view of what’s likely to happen. Right after the last meeting – and indeed, up to a week ago – the market wasn’t fully pricing in another rate cut until August or September. But just over the last week, that’s changed, Now the market is pricing in one cut by June and a pretty good chance of another cut by the end of the year.

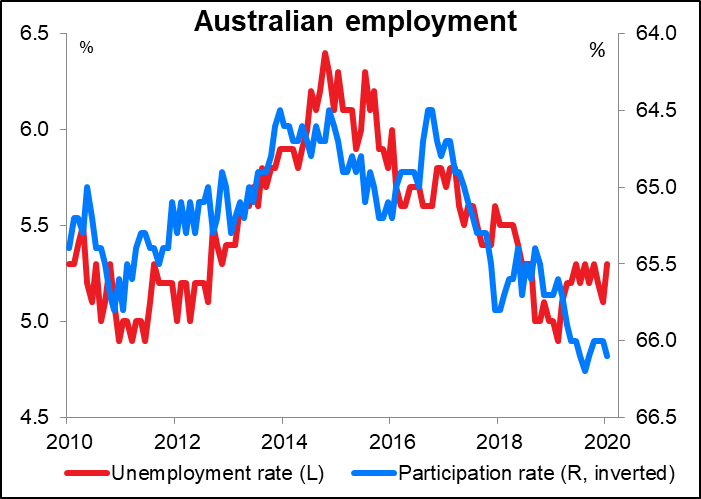

Meanwhile, the RBA itself has highlighted the labor market as the key variable that it’s watching. The unemployment rate (red line) has risen from the low of 4.9% hit a year ago to 5.3%, but at the same time the participation rate (blue line) has continued to rise – it’s now within a whisker of its record high of 66.2 set last August. In a case like this, the rising unemployment rate may be a sign of improvement in the labor market in that more opportunity is bringing discouraged workers back to work.

Employment is continuing to rise, although the pace of growth has slowed recently.

Net net, I expect the RBA will continue with its fairly optimistic tone. While it’s almost sure to be more concerned about the virus’ impact on the Australian economy, it remains focused on employment and employment is doing well. Unless and until the unemployment rate moves meaningfully higher (say, back to 5.5%) and the participation rate begins to trend lower, I wouldn’t expect them to start hinting at another rate cut. A result along those lines would probably be bullish for AUD.

The risk is if they think the fall in activity stemming from the virus could push inflation down further. It’s already below their target range. There’s a big debate among economists about whether the virus will inflict a demand shock (which is deflationary) because everyone is staying home and not buying anything, or a supply shock (which is inflationary) because no one is going to work and producing things. It’s pretty clearly a demand shock in the commodity currency countries. That’s what the RBA could be worried about.

The Bank of Canada (BoC) is thought to be in more of a rush. Until a week ago, the market was discounting one rate cut some time from now (some time from July to September). Now however people are looking for two cuts at least, with a good chance of a third – the first in April, the second in September and maybe a 50-50 chance of another one by the end of the year.

If you remember, the BoC surprised the market (well, surprised me at least) when it turned distinctly cautious at its meeting in January. “Growth in the near term will be weaker, and the output gap wider, than the Bank projected in October.” They said the economy “until recently, has been operating close to capacity,” meaning that it no longer is. The kicker is that they didn’t even mention the coronavirus specifically – they were focused on the US-Iranian tensions that were bubbling around then (22 January) and bemoaned the fact that “there remains a high degree of uncertainty and geopolitical tensions have re-emerged…”

What are they going to say now? Although the “geopolitical tensions” that they were worried about then have faded from view, the uncertainty in the world has increased sharply. Last time they said they would “be paying particular attention to developments in consumer spending, the housing market, and business investment.”

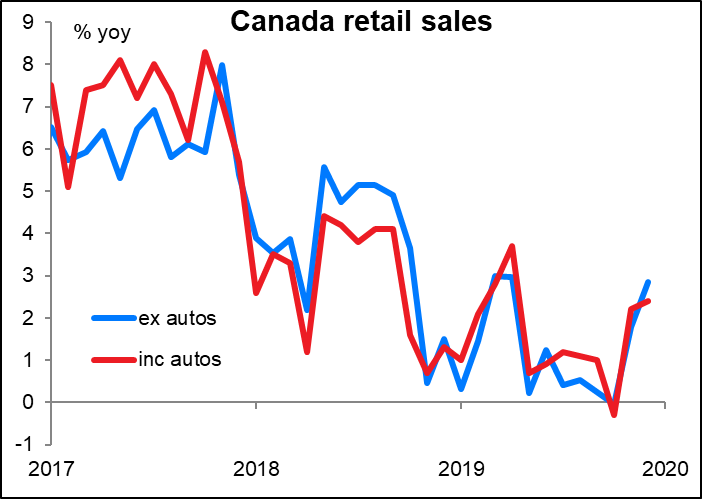

Consumer spending, as measured by retail sales, seems to have hit bottom and be rebounding a bit. The BoC expects to see that maintained thanks to growth in population and incomes, but worries that the consumers could start to save more of their incomes out of caution for the future.

The housing market is more or less neutral – house prices (red line) have gone nowhere for the last year or so, while housing starts are fairly steady although they may be starting to trend lower – we’ll have to see.

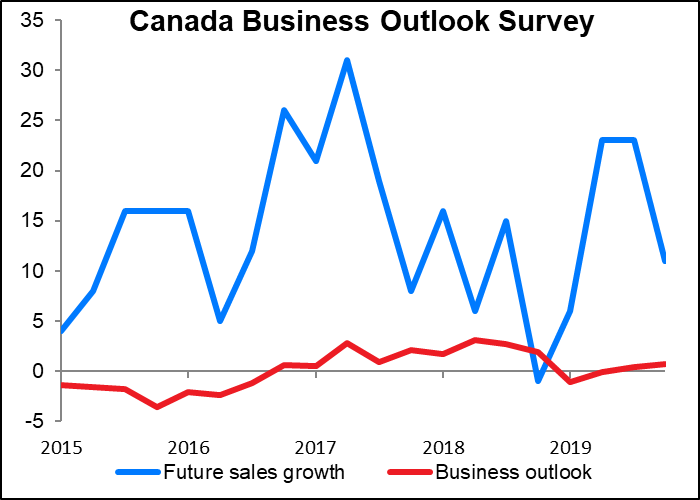

It’s hard to get an up-to-date reading on business investment (although we’ll know more later today when the Q4 GDP figures are released). The business outlook does not appear to be particularly rosy and expectations for sales growth are falling, so it’s likely that investment will be soft in Q1 this year.

The bottom line here is that although it hasn’t met the criteria it set for another rate cut, the BoC is likely to be even more worried at this meeting than it was at the last one. It could take a more dovish stance and drop a hint about a future rate cut. Last time it said it would be “watching closely to see if the recent slowdown in growth is more persistent than forecast.” This time it could say that yes indeed, it expects the slowdown to be more persistent. That would set the market up for a rate cut at the next meeting on 15 April. CAD-negative

OPEC+ meeting: once more into the fray.

The Organization of the Petroleum Exporting Countries (OPEC) meets Thursday and will be joined on Friday by a number of non-members that are co-operating with the cartel, most notably Russia. This group, called OPEC+, is caught between a rock (low prices as demand slips away) and a hard place (higher production by non-members, most notably the US). The conundrum faced by the group is only likely to get worse for the time being as much of the world’s shipping, air transport and industrial activity grinds to a halt because of the COVID-19 virus. For example, Chinese refinery runs are reportedly down by 3mn barrels a day (b/d). Italy is enforcing quarantines in the Lombardy and Veneto regions, which consume more than 25% of the petroleum products used in the country. Etc, etc.

The problem is, OPEC+ can’t agree to cut output fast enough to bring supply and demand back into balance, because governments are already suffering from lower income due to lower prices. They don’t want to compound their problems. Saudi Arabia initially proposed that the group should cut output by over 1mn b/d, but that was rejected. Russia rejected a later compromise of 600,00 b/d. The latest was a report in the Wall Street Journal (quickly denied) that Saudi Arabia, Kuwait, and the UAE were considering unilaterally cutting output by 300,000 b/d. Given that the Saudis originally thought a cut of more than 1mn b/d was necessary, the market would laugh at a 300k cut – and it looks like the group won’t be even able to reach consensus on that. I expect that the meeting will fail to come up with any convincing action to bring supply back into balance with demand. Oil prices are likely to fall further, dragging the currencies of oil-producing countries (CAD, NOK, MXN) down with them.

Finally, we may get some winnowing out of the Democratic candidates for president after “Super Tuesday,” when 14 of the 50 states hold their primary elections at the same time – the busiest day of the primary season. The big question is whether Bernie Sanders will remain in the lead or whether one of the other candidates will pull even with him, which would probably result in a “brokered convention” where delegates debate and vote and debate and vote until they can settle on a candidate.

Other important data out during the week include the US ISM manufacturing PMI on Monday and the EU-wide CPI on Tuesday (the last one before the 23 March ECB meeting).