Lowe’s Companies, Inc. (NYSE: LOW) announced that it will hold its First Quarter 2024 Earnings Conference Call Today, May 21, at 9 a.m. Eastern time. A webcast of the call will be accessible via the Quarterly Earnings section of the Lowe’s Investor Relations website, ir.lowes.com, with supplemental materials available 15 minutes prior to the start.

As of May 2024, Lowe’s Companies, with a market cap of $131.12 billion, ranks as the 113th most valuable company globally, according to data from companiesmarketcap.com.

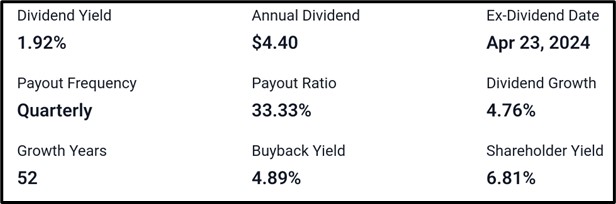

Dividend Information

Lowe’s Companies offers a dividend yield of 1.92%, with an annual dividend of $4.40. The ex-dividend date for the payout was April 23, 2024. The company distributes dividends quarterly, maintaining a payout ratio of 33.33%. Additionally, Lowe’s has shown steady dividend growth, with a rate of 4.76% over 52 years. In addition to dividends, the company’s buyback yield stands at 4.89%, contributing to a shareholder yield of 6.81%.

Recent Development At Lowe’s Companies

Here are some recent developments at Lowe’s Companies:

- NFL-bound quarterback Drake Maye joins Lowe’s Home Team.

- Lowe’s Foundation partners with SkillsUSA to celebrate ‘Trades Stars’ from the Toolbelt Generation on SkillsUSA National Signing Day.

- Lowe’s teams up with Lionel Messi, Inter Miami CF, and CONMEBOL Copa América 2024 USA™ to engage soccer fans.

- Lowe’s is helping homeowners save money on their spring home improvement projects.

- Lowe’s Foundation awards over $6 million to innovative community-based nonprofits to strengthen America’s skilled trades workforce.

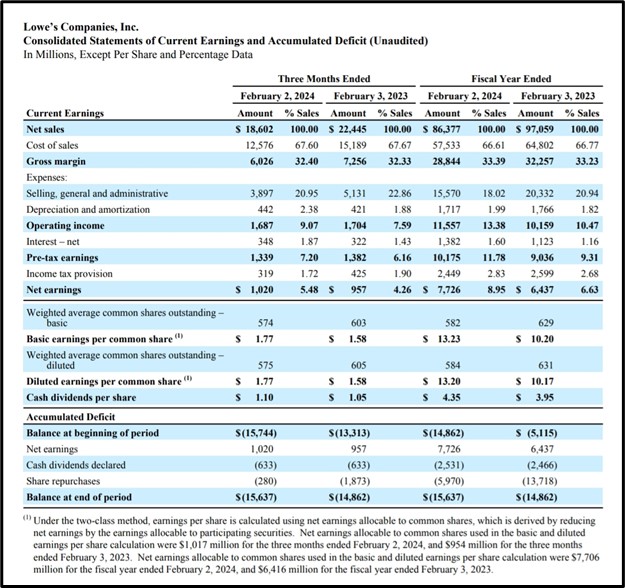

Q4 2023 Earnings Recap of Lowe’s Companies Inc

On February 27, 2024, Lowe’s Companies, Inc. (NYSE: LOW) reported net earnings of $1.0 billion and diluted EPS of $1.77 for the quarter ending February 2, 2024, up from $1.58 in the same quarter of 2022, which had included $441 million in pre-tax transaction costs related to the sale of its Canadian retail business. Excluding these costs, the adjusted diluted EPS for the fourth quarter of 2022 was $2.28. Total sales for the quarter were $18.6 billion, compared to $22.4 billion in the prior year, which had benefited from an additional 53rd week and $958 million from the Canadian business. Comparable sales dropped 6.2% due to a slowdown in DIY demand and unfavorable January weather, while Pro customer sales remained flat. Marvin R. Ellison, Lowe’s chairman, president, and CEO, noted the company’s strong operating profit and improved customer satisfaction despite reduced DIY spending and expressed confidence in the long-term strength of the home improvement market. He also highlighted the $140 million in discretionary bonuses awarded to frontline associates for their exceptional service in 2023. As of February 2, 2024, Lowe’s operated 1,746 stores, covering 194.9 million square feet of retail space.

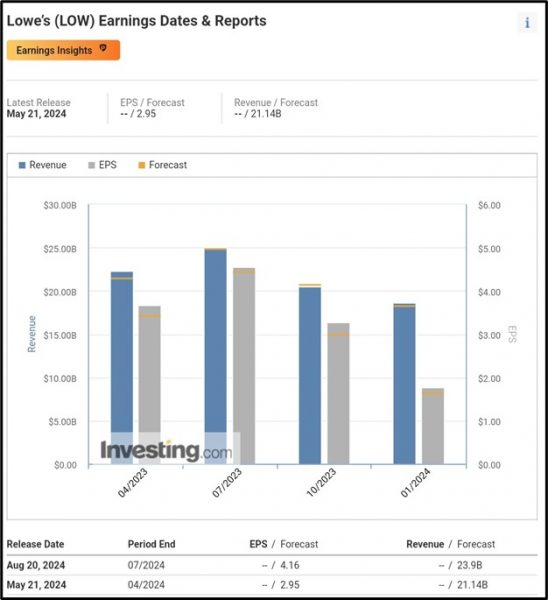

Q1 2024 Earnings Analyst Forecast

For the current quarter, sales estimates indicate a Zacks Consensus Estimate of $21.07 billion, with 11 estimates considered. The high estimate stands at $21.30 billion, while the low estimate is $20.89 billion, contrasting with last year’s sales of $22.35 billion, suggesting a year-over-year growth estimate of -5.70%.

On the earnings front, the Zacks Consensus Estimate for the current quarter is $2.94, based on 14 estimates, with the most recent consensus at $2.91. The high estimate is $3.02, and the low estimate is $2.87, compared to last year’s EPS of $3.67, reflecting a year-over-year growth estimate of -19.8%.

Investing.com forecasts that Lowe’s Companies Inc (NYSE: LOW) is expected to achieve an earnings per share (EPS) of $2.95, coupled with an anticipated revenue of $21.14 billion.

TradingView.com predicts that Lowe’s Companies Inc (NYSE: LOW) is projected to attain an earnings per share (EPS) of $2.95, along with an expected revenue of $21.14 billion.

TradingView.com predicts that Lowe’s Companies Inc (NYSE: LOW) is projected to attain an earnings per share (EPS) of $2.95, along with an expected revenue of $21.14 billion.

Technical Analysis

Analyzing the symmetrical triangle chart pattern of NYSE:LOW on TradingView, it’s evident that both uptrend and downtrend movements are losing momentum, suggesting the potential formation of a new trend in the near future, with the current price hovering around $229.17. If the downtrend line, which originated from $263.15 and rejected the price at $238.15 before descending to the current level of $229.17, is breached to the upside, there’s a strong likelihood of further upward movement. Conversely, if the uptrend line, stemming from $209.31 and rejecting the price at $225.09 before reaching the current level of $229.17, is broken to the downside, there’s a high probability of the price declining further.

Conclusion

In conclusion, Lowe’s Companies, Inc. (NYSE: LOW) is set to host its First Quarter 2024 Earnings Conference Call today, May 21, providing investors with insights into the company’s performance. With a market cap of $131.12 billion, Lowe’s ranks as the 113th most valuable company globally. Alongside its earnings call, Lowe’s also offers a dividend yield of 1.92% and has recently made significant strides in various areas, including partnerships with NFL-bound quarterback Drake Maye, SkillsUSA, and soccer icon Lionel Messi, among others. The company remains committed to enhancing customer satisfaction and making strategic investments for long-term growth, as evidenced by its strong operating profit and innovative initiatives. Looking ahead, analysts anticipate a challenging quarter, with a projected year-over-year decline in both sales and earnings. However, Investing.com and TradingView.com forecast that Lowe’s is poised to achieve an earnings per share (EPS) of $2.95 and an expected revenue of $21.14 billion, showcasing optimism amid market challenges.

Source:

https://corporate.lowes.com/investors/news-events/events-presentations

https://companiesmarketcap.com/lowes-companies/marketcap/#google_vignette

https://stockanalysis.com/stocks/low/dividend/

https://corporate.lowes.com/investors/stock-information/dividend-history

https://corporate.lowes.com/newsroom/press-releases

https://images.app.goo.gl/kyFP37ru2ye9x6bc9

https://corporate.lowes.com/investors/financial-information/quarterly-earnings/year/2023

https://www.zacks.com/stock/quote/LOW/detailed-earning-estimates

https://www.investing.com/equities/lowes-companies-financial-summary

https://www.tradingview.com/symbols/NYSE-LOW/forecast/

BDSwiss Academy on TradingView