Rates as of 07:30 0 GMT

Friday’s US nonfarm payrolls

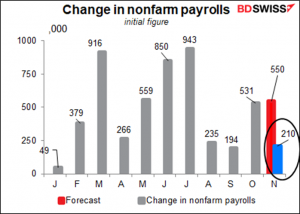

The nonfarm payrolls fell well short of expectations at +210k vs the market consensus forecast of +550k.

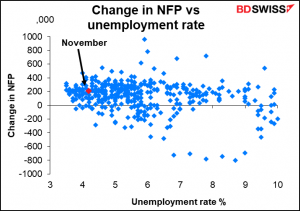

Many people complained that the rise in payrolls was disappointing. It was lower than market estimates, but it’s not unusually low given where the unemployment rate is (red dot is the November figure).

In fact, it’s higher than 60% of the NFP figures for the last 30 years.

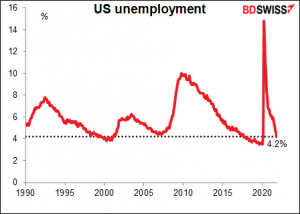

The key point in my mind though was the fall in the unemployment rate to 4.2%. That’s a historically low level that hasn’t been bettered very much. It’s only disappointing when compared to the 3.5% unemployment rate just before the pandemic hit.

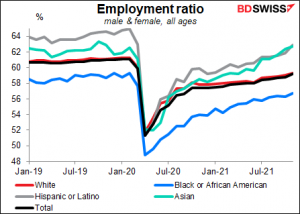

The participation rate rose to 61.8 from 61.6. And to eliminate all distortions, the employment ratio – the number of people working divided by the number of people – also rose for all groups. It’s now higher than before the pandemic for Asians. We’re seeing the “broad and inclusive” gains in employment that the Fed wants to see.

In short, this report was good enough to keep the Fed on track to accelerate its tapering at the December meeting, particularly if Friday’s US consumer price index goes as expected (a further rise to +6.7% yoy from +6.5%).

Market Recap

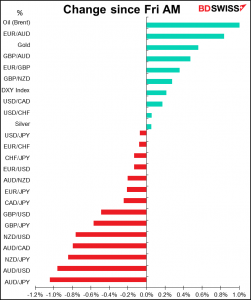

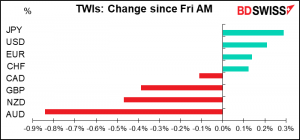

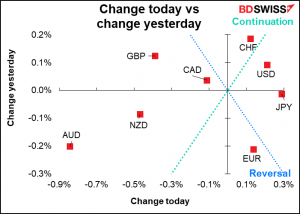

AUD and NZD led the losers, hitting their lowest levels for the year vs USD, on a “risk-off” sentiment as US stock markets slumped further. The outperformance of safe-haven JPY was the counterpart to this weakness.

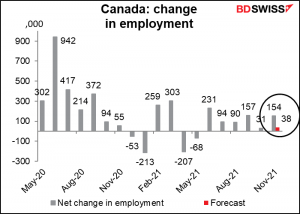

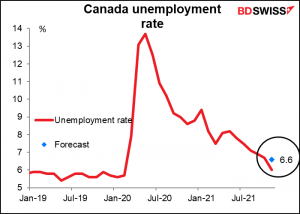

CAD weakened vs the strong dollar but held up well on much better-than-expected employment data on Friday. The number of new jobs was 4x as large as expected while the unemployment rate plunged to 6.0% from 6.7% (6.6% expected) with an unchanged participation rate. Excellent!

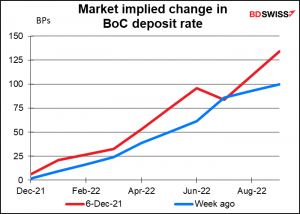

The market is now pricing in an 84% chance of a rate hike as early as January. This is more than double the odds of just a week ago (37%).

Also oil was up this morning after Saudi Arabia raised its official selling price for Asian customers. That should support CAD further.

In contrast, GBP fell to its lowest level in around a year after Monetary Policy Committee member Michael Saunders suggested that the MPC might wait to hike rates. With typical British understatement he said, “At present, given the new omicron Covid variant has only been detected quite recently, there could be particular advantages in waiting to see more evidence on its possible effects on public health outcomes and hence on the economy.”

In that respect, so far the signs are good. The chief US authority, Dr. Fauci, last night said on CNN that “We really have got to be careful before we make any determinations that it is less severe or really doesn’t cause any severe illness comparable to Delta, but this far the signals are a bit encouraging….. It does not look like there’s a great degree of severity to it.”

Commitments of Traders (CoT) report

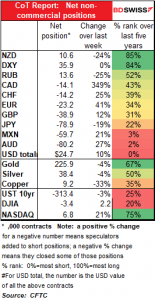

Speculators notably increased their long USD positions in the last week. They increased their shorts vs every currency except JPY and cut their long NZD positions. Bullish USD across the board!

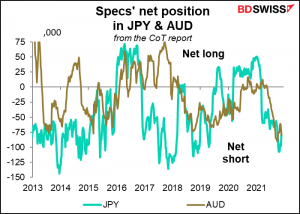

AUD is now their biggest short (barely), replacing the perennial favorite JPY. On the contrary, they cut their short JPY position by the most since the pandemic began.

It’s odd to see these two vying for the same position when they’re at opposite ends of the risk spectrum, with AUD being the quintessential “risk-positive” currency and JPY being the #1 “safe-haven” currency. Looking back however we can see that this situation isn’t so unusual.

Hedge funds also cut their short JPY positions while increasing their (small) shorts in GBP, CHF, CAD, and AUD. They increased their long MXN positions while keeping EUR shorts – their largest short positions – steady.

It’s interesting that they’re so long MXN while being short CAD – these are two currencies linked to oil. I don’t follow MXN so I don’t know why they might be positive on MXN and negative on CAD.

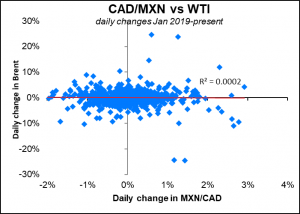

CAD/MXN doesn’t seem to be influenced by the oil price so it’s not that one is considered more “oily” than the other.

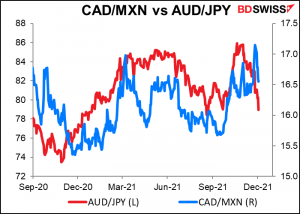

Rather, CAD/MXN seems to be more correlated with AUD/JPY – that is, it tends to fall (CAD weakens relative to MXN) when AUD/JPY falls (which is during “risk-off” periods). This puzzles me too, because why would an emerging-market currency outperform a G10 currency during risk-off periods? I guess after so many years in this industry I still have things to learn.

Retail traders trimmed their long CAD positions and flipped from a small long NZD to small short, while adding to their short GBP and AUD positions. But they cut their short JPY and CHF positions – a bit of risk aversion?

As for the precious metals, specs cut both their long gold and long silver.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

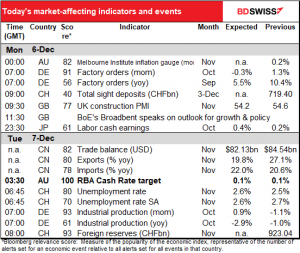

The European day starts off with German factory orders. They’re expected to be down from the previous month. That’s not great, but we have to keep this in perspective – even so, they’re expected to be 9% above the 2019 average. Probably this kind of elevated level can’t last forever. Still, people may notice the trend. EUR-

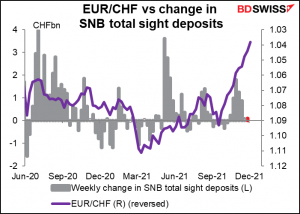

Swiss sight deposits recently just show that the Swiss National Bank (SNB) is largely absent from the market. Only token intervention as EUR/CHF goes down, down, down… (well, up, up, and away in this chart, where EUR/CHF is inverted).

Then that’s most of the excitement for today. Bank of England Deputy Gov. Broadbent speaks; he voted with the majority last month to hold rates steady. Does he still feel the same way? Tune in to find out!

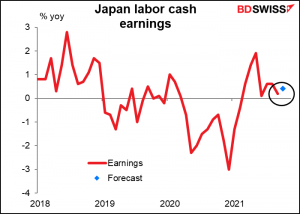

Overnight Japan releases labor cash earnings, which should be interesting but isn’t, except to people like me who a) like to keep up with what’s going on in Japan and b) have a daughter living there who’ll be entering the workforce eventually.

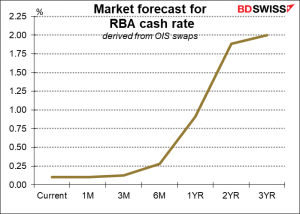

Then we get to the only big event over the next 24 hours, which is the Reserve Bank of Australia (RBA) meeting. As I said in my Weekly Outlook, it’s likely to prove uneventful. They said last month that they would “continue to purchase government securities at the rate of $4 billion a week until at least mid-February 2022,” which is the next meeting after this one. With no change in asset purchases likely and of course no change in rates, the focus will be on any change in their forward guidance, which currently hints at the possibility of a rate hike “at the end of 2023.”

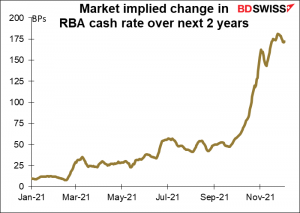

The market begs to differ, and not by a small amount; it sees 175 bps of tightening by end-2023.

The market expects the first rate hike in about six months, not two years.

In that respect, the main focus will be on what if any changes they make in their forward guidance and what hints they give about the likely decision on bond purchases in February. Given the increase in global inflation and the Fed’s capitulation with regards to “transitory,” I’d expect them to take a more hawkish view of things. Q3 GDP was better than expected, they may have an improved view of Q4. Accordingly, I’d expect them to build more optionality into their forward guidance, allowing for the possibility of an end to the bond purchases in February and an earlier hike in rates. That could prove positive for AUD.

Meanwhile, China’s trade surplus is forecast to decline a bit but not significantly as export growth is expected to slow while import growth is forecast to rise. That should be good for the commodity currencies, particularly as AUD.

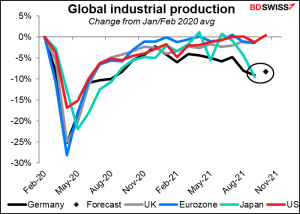

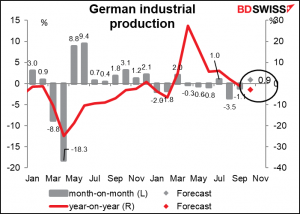

Then we come full circle with German industrial production. It’s expected to be up slightly after two months of significant declines – better than a third month of decline I guess but not a stunning performance by any means.

On the basis of this forecast, German IP would be down 8.3% from the pre-pandemic level, a performance on part with laggard Japan and well below the US, UK, and even the EU-wide performance. EUR-