Rates as of 05:00 GMT

Market Recap

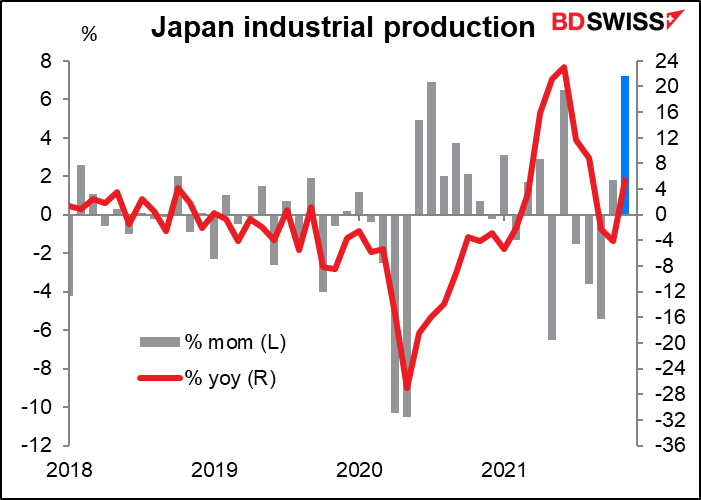

Yet more proof, as if we needed it, that JPY does not react to the economic fundamentals, or if it does, it reacts via the prism of the Tokyo Stock Exchange. Overnight, it was announced that Japan industrial production soared a record 7.2% mom in November vs expectations of a 4.8% mom rise (data back to 1978). Companies expect production to rise 1.6% mom in December and another unusually strong 5.0% mom in January (although they tend to be overly optimistic in their reported plans). This is one of the most widely watched economic statistics from Japan, with a Bloomberg relevance score of 98.9.

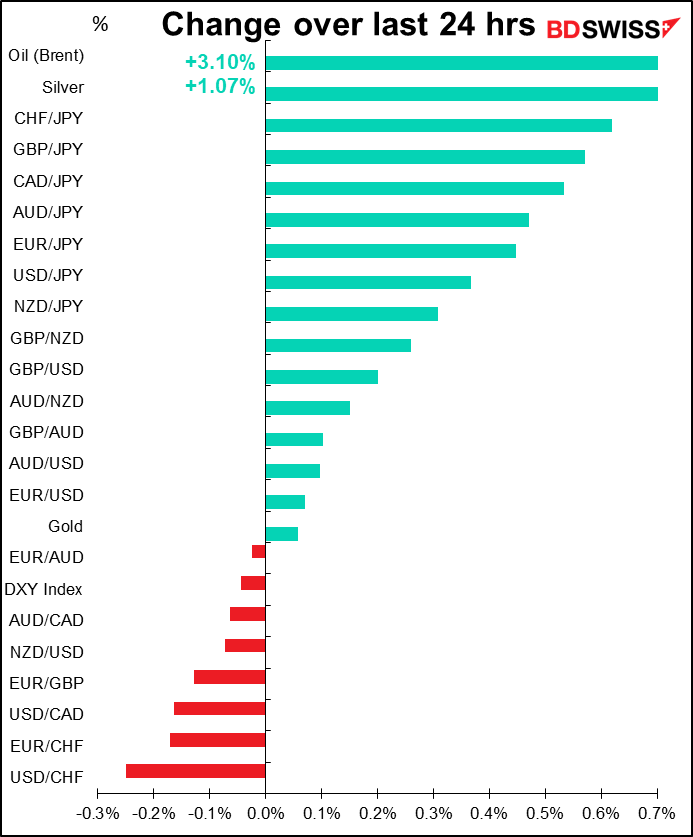

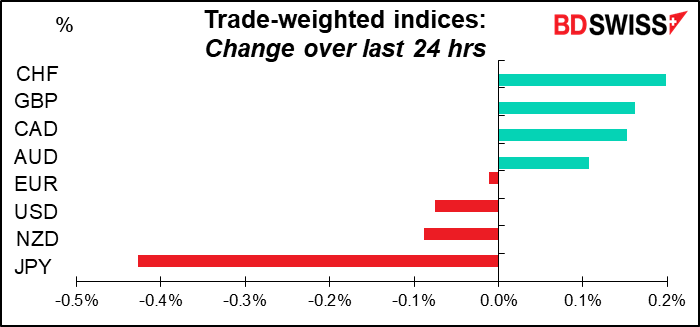

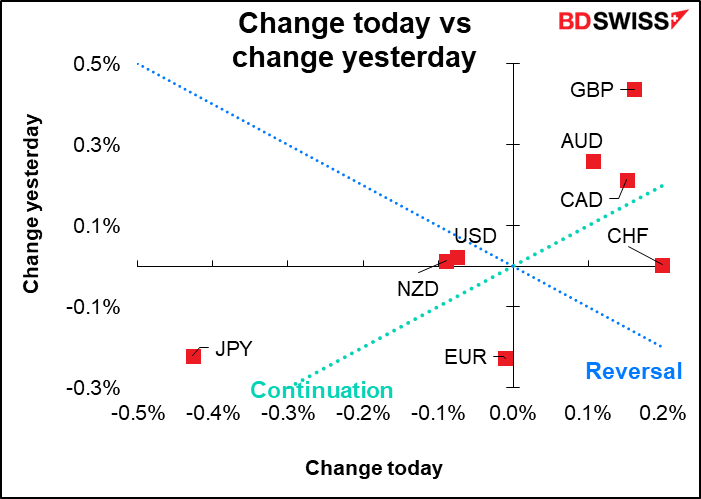

As a result (and following a 1.4% rise in the S&P 500 to a fresh record high) the Nikkei stock index was up 1.1%. Yet JPY was the main loser on the day. It no doubt reflects improving risk sentiment, not the strength of the Japanese economy.

(Admittedly there was also the countervailing factor of bad news on the employment front: the unemployment rate ticked up to 2.8% instead of remaining steady at 2.7% as expected, while the job-offers-to-applicants ratio stayed steady at 1.15 instead of ticking up to 1.16 as expected. But I don’t think that would outweigh the recovery in the auto industry that was apparent in the IP data.)

The improvement in stock markets reflects the growing confidence that the world can weather the omicron variant successfully. Oil surged on such expectations even as more countries moved toward more work-from-home arrangements, such as France, and case numbers continued to rise. Look at what’s happening in the UK! And the Eurozone overall continues to rise even though Germany is turning down. As for the US, the worst is yet to come, I’m sure.

Unlikely events in 2022

My last weekly (Some “unknown unknowns”) gave eight ideas for events that aren’t on our radar right now but would be big for the markets if indeed they were to occur. #1, the implosion of North Korea, looks surprisingly possible if indeed Kim Jong-Un is dying, as this North Korean escapee claims (but alas, if he does die, it looks like his sister would just take over and she might be even worse. Still, one can always hope…)

But now there’s an even bigger “unknown unknown” that I didn’t have on my radar. The Paper of Record, that Repository of Truth, The Daily Mail, is reporting that NASA has hired 24 theologians to assess how the world would react to the discovery of alien life. Now, there’s nothing to say that this portends anything imminent. The new hires will work at the Center for Theological Inquiry (CTI) at Princeton University, which NASA gave a $1.1mn grant to in 2014, so apparently NASA has been thinking about this issue for a long time. But coming after the US government’s admission last June that it has no explanation for dozens of UFOs seen by military pilots…maybe, just maybe, they’re getting ready to spill the beans on the biggest secret in town.

I’m not sure how that revelation would affect financial markets unless there were some spectacular new technology revealed at the same time, e.g. a new transport system that could put the airlines out of business or a new inexhaustible energy source that would fit in a lunchbox. But still, it would be pretty cool, no?

There’s also a new not-so-cool possibility. The New Yorker has an article discussing The Looming Threat of a Nuclear Crisis with Iran. “The Biden Administration faces a potential confrontation with a longtime rival that is better armed and more hard-line than at any time in its modern history,” it argues. That would be positive for oil and CAD but negative for humanity.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

If you thought yesterday was quiet, you should see today.

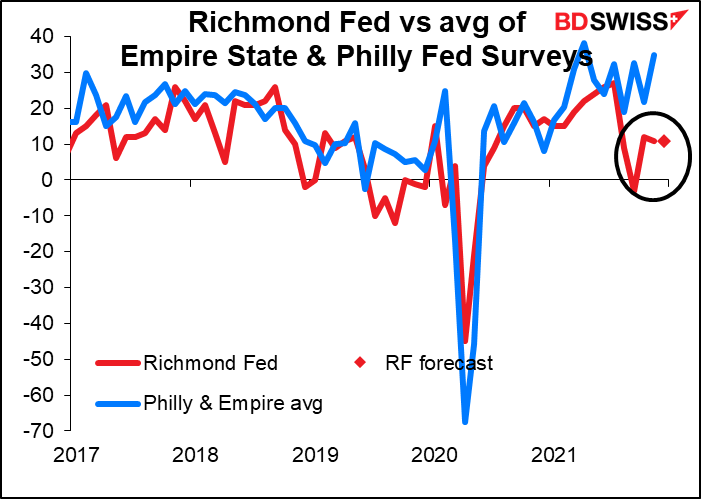

The only indicator on the schedule is the Richmond Fed manufacturing survey. The Bloomberg relevance score (69) shows that the market doesn’t watch it as closely as it does the Empire State (83) or Philly Fed (78) indices, but investors certainly should, IMHO. My research shows that among the five regional Fed surveys, it’s the best correlated with the Institute of Supply Management (ISM) manufacturing survey, which is what people are trying to forecast. (It doesn’t have much power at explaining the Markit manufacturing PMI however – the only one that’s good at that is the Empire State survey.)

It’s expected to be unchanged, which would be a bit surprising as the average of the Empire State & Philly Fed surveys was up sharply during the month. But there isn’t any guarantee that all three will move in the same direction – that only happens 24% of the time.

And that’s it! Have a nice day!