This last week we got more data that shows how Japan is lagging the recovery in the rest of the world.

The Tokyo consumer price index (CPI), out overnight, showed that Japan is a total outlier when it comes to one of the most crucial data points in the market’s focus right now: inflation. It showed that Japan, unique among the major countries of the world, has no inflation (prices were stable on a yoy basis).

Japan is the only one of the G20 countries that still has deflation at the national level (I didn’t include Argentina, with its 41% yoy inflation rate as it would distort the averages).

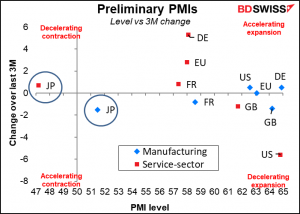

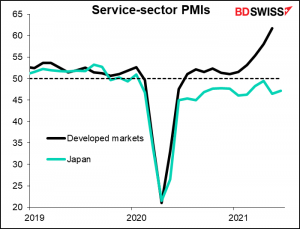

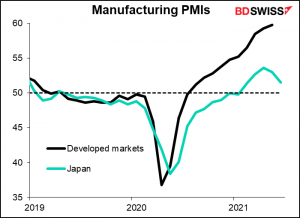

That’s not all. This past week’s preliminary purchasing managers’ indices (PMI) show that Japan remains a global outlier in the recovery from the pandemic as well. Alone among the major economies, Japan’s service sector hasn’t yet recovered to the 50 “boom-or-bust” line, and its manufacturing PMI is not only the lowest of these countries but to make matters worse, fell in June.

The service sector in Japan is clearly an international outlier.

Next week brings some important Japan statistics that may reinforce this view.

The most important of these is industrial production (Wednesday). It’s expected to be down 2.0% in the stop-and-go recovery for Japanese output.

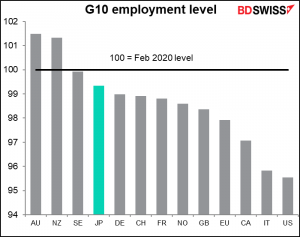

That would leave Japanese output almost 1% below pre-pandemic levels. Japan had been doing comparatively well in this one indicator, but the May figure is expected to put it back in with the rest of the pack.

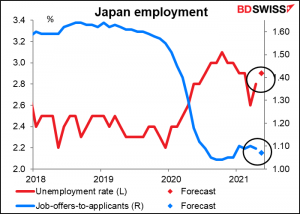

With much of the country remaining in a state of emergency, the unemployment rate (Tuesday) is expected to rise and the job-offers-to-applicants ratio to fall. This is the opposite of what’s been happening in most other countries as economies open up again.

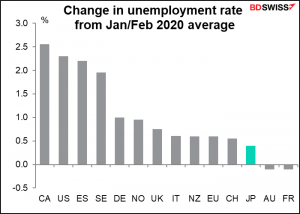

Having said that, Japan was one of the best-performing major countries with regard to employment. Its unemployment rate has risen relatively little since before the pandemic.

Unemployment figures can be fudged. Perhaps more importantly, its employment level has remained fairly high. So that’s one plus for the country, assuming that this solid performance is not undermined now.

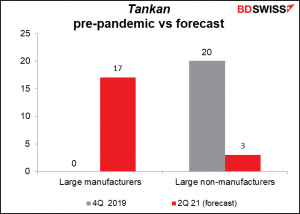

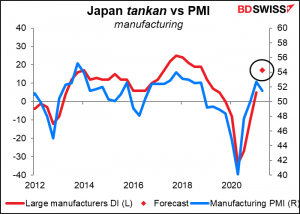

Thursday brings the most important indicator out of Japan: the Bank of Japan’s quarterly Short-Term Survey of Economic Conditions, universally known by its Japanese abbreviation, the tankan.

The tankan is expected to show conditions for manufacturers much better than before the pandemic began, but non-manufacturers are still far below where they were before.

Unfortunately, the PMIs suggest that perhaps the tankan forecasts are overly optimistic.

The relationship between the service-sector PMI and the tankan non-manufacturing DI is not that great which may be one reason why the PMIs don’t seem to carry the same weight in Japan as they do elsewhere. Nonetheless, this too isn’t promising.

Net net, the Japanese economy is an international laggard, still in deflation, with the service sector declining and manufacturing sputtering. Under these conditions, the Bank of Japan is likely to be the last central bank to normalize policy, if indeed it ever does. The market even expects Switzerland, which since 2015 has had the lowest rates in recorded history, to raise rates before Japan. That makes the yen the natural currency to fund carry trades as other countries begin to normalize policy. It should mean a generally weaker trend for the currency, in my view.

Another NFP comes along.

I’ve said it before, but I’ll say it again: I count my life off in terms of US nonfarm payrolls.

For I have known them all already, known them all:

Have known the evenings, mornings, high teas,

I have measured out my life with NFPs;

I know the voices dying with a dying fall

Beneath the music from a farther room.

So how should I presume?

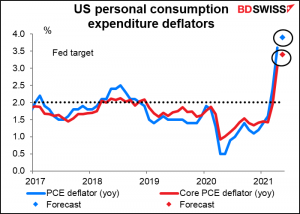

Every month we say “the NFP this month is really crucial,” and usually it is. This month it is, too. For example, on Thursday NY Fed President Williams (V) said about raising rates, “it is not the time now because the economy still is far from maximum employment.” Notice he didn’t say anything about inflation, the other part of the Fed’s dual mandate. Duh! Inflation is already around double their 2% target. (We’ll get an exact reading later today when the personal consumption expenditure deflators come out.)

Cleveland Fed President Mester (NV) Tuesday said, “I would like to see further progress on the employment part of our mandate and that’s what I’m really watching for over coming months.”

And in Tuesday’s testimony to the House Select Subcommittee on the Coronavirus Crisis, Fed Chair Powell (V) devoted three paragraphs to the labor market and only one to inflation. He was noticeably more optimistic about inflation than about the labor market. Concerning inflation, he said, “As these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal.” Contrast that with his outlook for the labor market: “Job gains should pick up in coming months as vaccinations rise, easing some of the pandemic-related factors currently weighing them down.” He didn’t say “some of” the transitory supply effects pushing inflation up would abate, nor did he say unemployment would “drop back toward our longer-run goal.”.

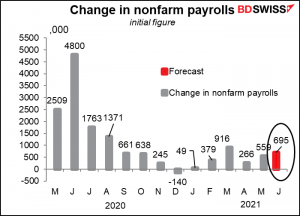

The market is looking for a higher figure than last month, although still not back to the nearly +1mn level of March. Fed officials are likely to consider this to be “progress” but not the “sufficient” progress that they’d want to see before changing policy.

The unemployment rate is expected to fall further, to 5.7% from 5.9%. However the participation rate (no forecast available yet) is probably as important.

Chair Powell said in his testimony,

The economic downturn has not fallen equally on all Americans, and those least able to shoulder the burden have been the hardest hit. In particular, despite progress, joblessness continues to fall disproportionately on lower-wage workers in the service sector and on African Americans and Hispanics.

Unemployment has worsened markedly for those with less education.

And, as the Chair said, the burden has fallen more on minority workers.

We’ll have to watch these details too as the summer goes on.

Many people expect some kind of big reveal at the annual Fed get-together at Jackson Hole. It will be held in person this year on Aug. 26-28. This conference has been used several times in the past to give the markets a “heads-up” about an impending change in policy, which was then enacted at the September FOMC meeting. Given Cleveland Fed President Mester’s comments above, I think a replay of that series is likely again this year too.

By the way, the Canadian employment data are not coming out this week. Usually they’re released along with the US employment data, but not this week.

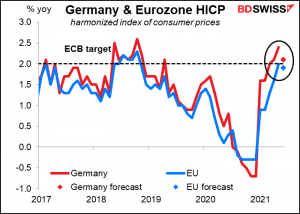

For the EU, the big thing will be the German CPI on Tuesday and EU-wide CPI on Wednesday. The year-on-year rate of both are expected to slow somewhat, which is likely to be a blow to the European Central Bank. That suggests they’ll have to keep policy looser for longer, which could be negative for the euro.

Other indicators coming out this week include the manufacturing PMIs (Thu), including the final ones for those countries that had preliminaries, and the Institute of Supply Management (ISM) version of the US manufacturing PMI, which is still closely watched.

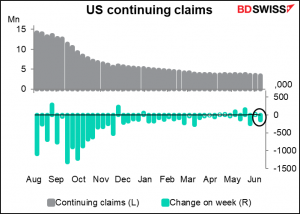

This week’s continuing jobless claims fell nicely. Was this the result of states stopping Federal unemployment benefits? Either more states will pull the same stunt in next week’s claims. Economists will get out their fine-tooth combs to examine the data to get an idea of how the expiry of these benefits might affect employment in September, when the extra benefits expire for everyone.