The title of my last weekly outlook was “Is the worst over?” This was referred to the economy, which was showing the proverbial “green shoots,” in this case defined as “indications that economic activity in May was slightly less horrible than in April.”

However, I’ve often quoted Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, who famously said, “You don’t make the timeline, the virus does.” So today I’d like to take a look at what’s happening with the virus.

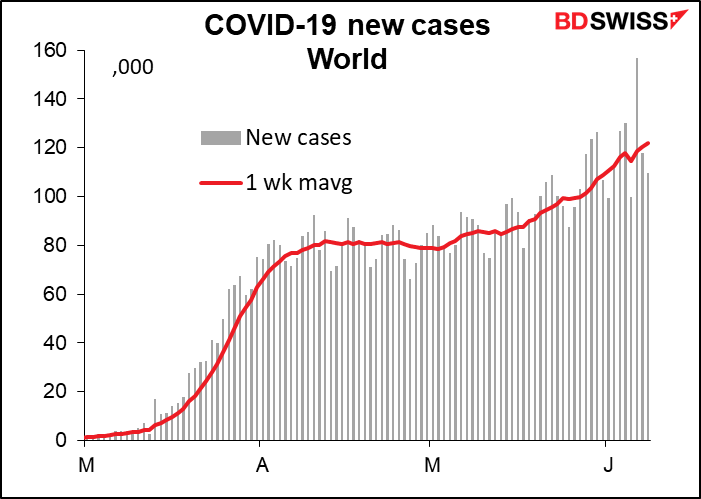

In a nutshell, it’s not great. In fact, it’s terrible. Dreadful. World Health Organization (WHO) Director-General Dr Tedros Adhanom Ghebreyesus observed this week that “Although the situation in Europe is improving, globally it is worsening.”

Indeed.

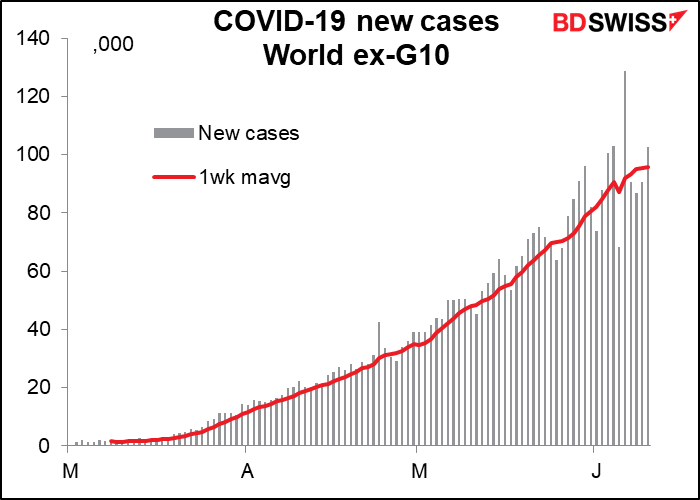

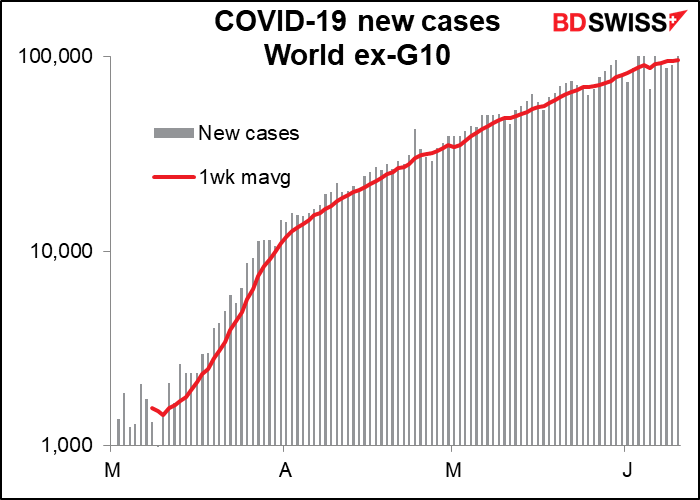

Most of the acceleration is coming from the developing world:

If we re-plot that graph in logarithmic scale, we get the tell-tale straight line that spells exponential growth. Exponential growth is great when we’re talking about the number of transistors on a chip, but disastrous in the case of a potentially deadly disease.

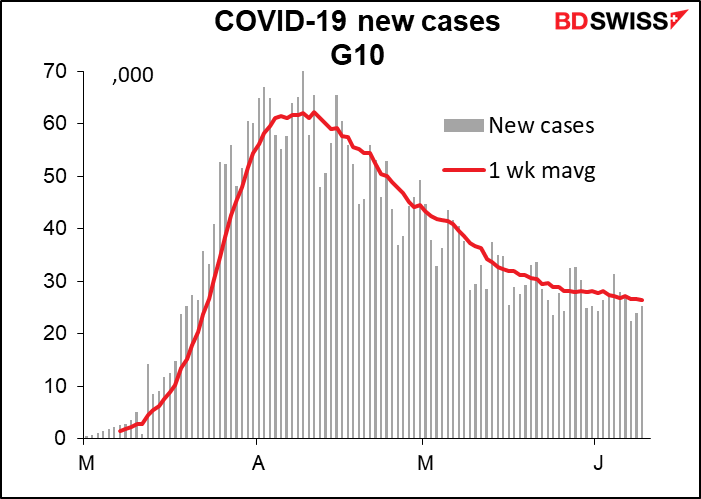

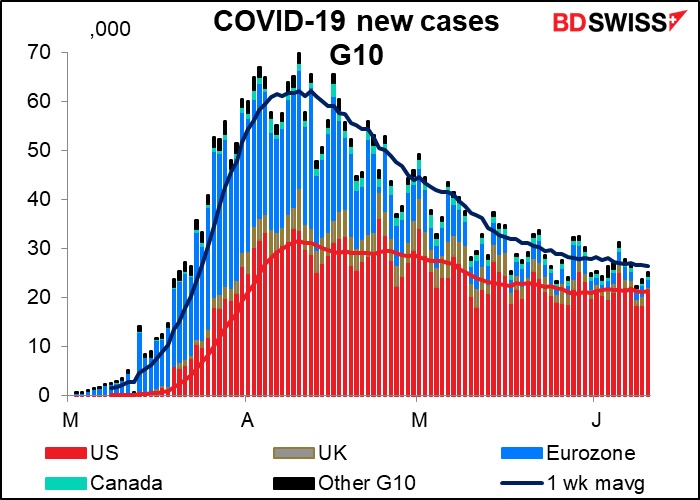

The G10 however is another story. There, new cases are falling, although the pace of decline has plateaued out recently.

I’m going to focus on the G10, because this is a foreign exchange column, not a medical column, and most of my readers are probably trading G10 FX not EM FX. Of course, the health and safety of the developing world is important for the global economy and therefore will have repercussions back to the G10. Moreover, a pandemic that’s raging in one part of the world will eventually be raging in all parts of the world. Nonetheless that’s some time down the road.

Within the G10, new cases continue to decline outside the US, but the US has stopped improving

Looking at that data another way, we can see that new cases are only a fraction of their peak level in six of the 10 countries/regions. Canada and Britain still have a relatively high burden, but at least they are headed in the right direction. They bear watching however.

There are two outliers: Sweden, where the pandemic is now at its peak, and the US, which has plateaued at a relatively high level.

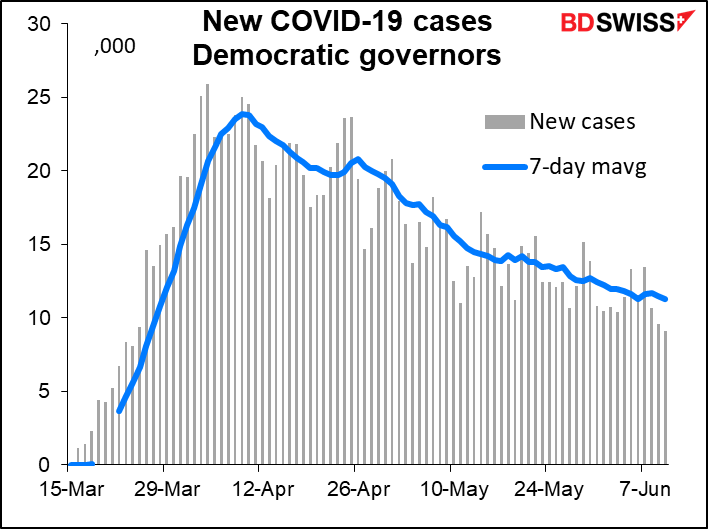

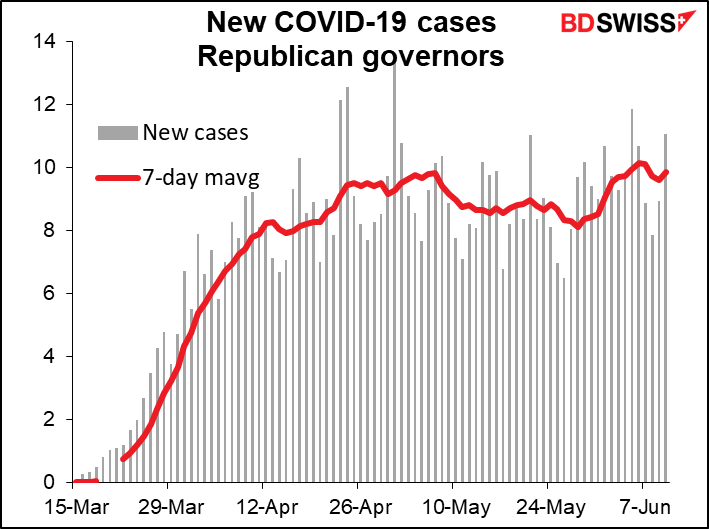

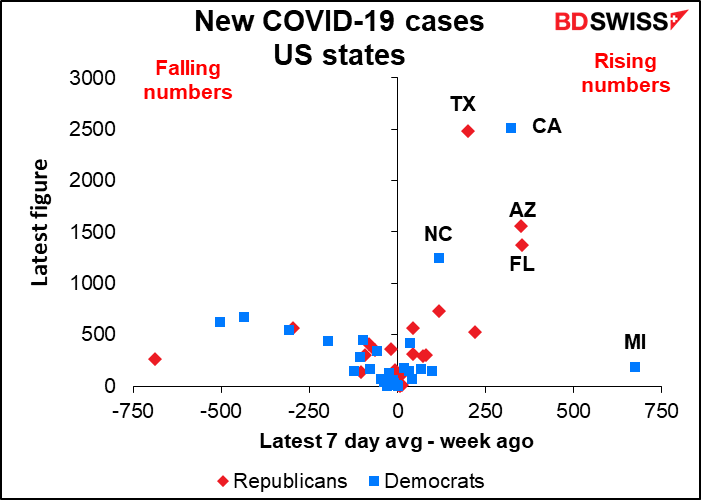

The US data shows some notable differences among the states, probably a reflection of a) the different degree of urbanization in each state, and b) the different approach each state took to lockdown. In general, states with governors from the Democratic Party tend to be more urban and went into lockdown earlier and more stringently. States with Republican governors tend to be more rural and have generally taken a looser attitude towards lockdown.

The result is easily visible in the data. The more urban Democratic states saw a much higher peak much earlier (mostly that was New York and New Jersey) but the numbers have been coming down steadily. (Blue is the color of the Democratic Party, red is the color of the Republican Party)

The Republican states got off to a slower start, but the numbers have been increasing recently.

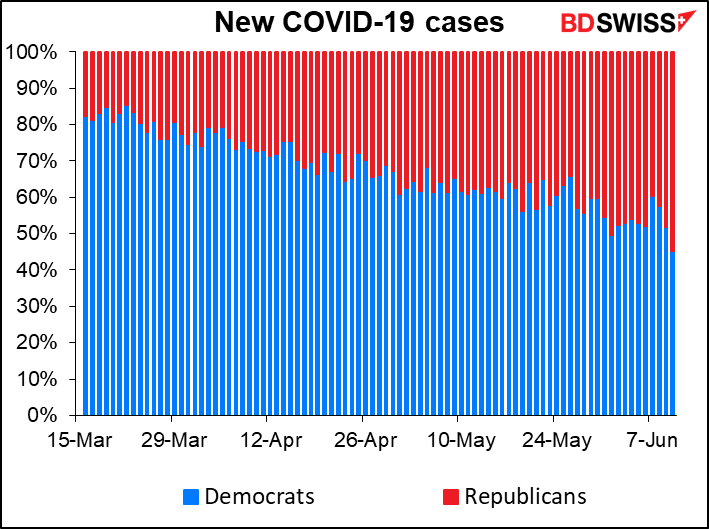

As a result the new cases are now divided fairly evenly between the two.

I looked at how the latest seven-day average of new cases compared with the average a week ago. On this basis, there are 28 states and territories where the number of cases is falling and 24 where it’s rising (I’m including Puerto Rico and Washington DC in my calculations and assigning both to the Democrats). It’s lower in 16 Democratic states and higher in 10; on the other hand, it’s lower in only 12 Republican states and higher in 14.

In this graph, the Y-axis (vertical) is the average number of new cases over the last week, while the X-axis (horizontal) is how this compares with a week earlier. You can easily see which states are the most troubled.

Michigan is a statistical fluke – there was a huge increase of 5,888 cases on 7 June, vs an average of 272 cases a day in the week beforehand and 385 cases a day afterward. It looks like a testing program suddenly uncovered a lot of previously undiagnosed cases.

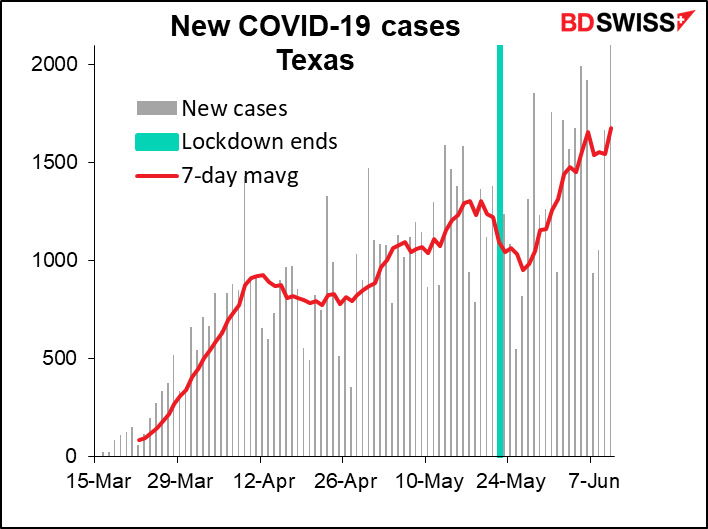

That leaves Texas and California as the biggest problem states. New cases in Texas bottomed five days after the lockdown effectively anded. They’ve since hit a record high. (Note: most states had a gradual relaxation of lockdown. If possible, I’m taking as the date the time when restaurants reopen.)

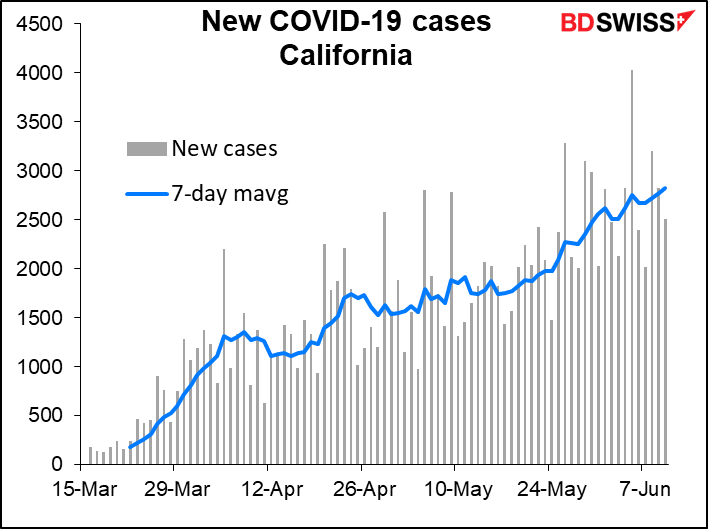

California is an odd situation. Roughly half the new cases are in the Los Angeles area.

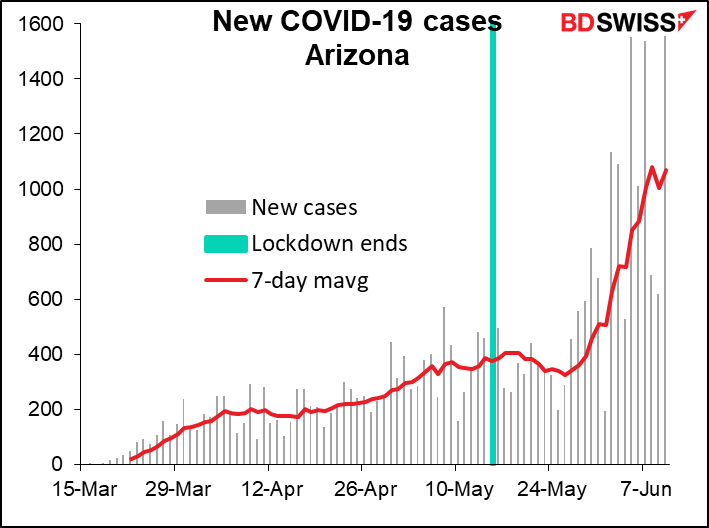

New cases took off in Arizona eleven days after lockdown ended there. (This is really bad; my sister lives in Arizona!)

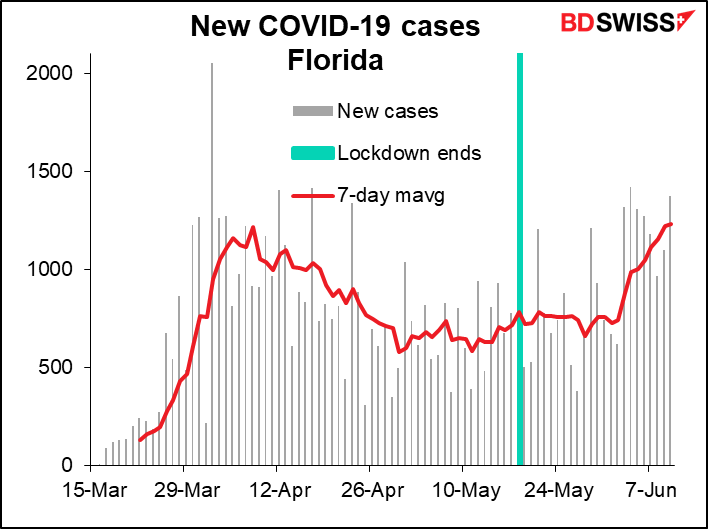

Florida was declining, but then two weeks after they relaxed the lockdown, new cases flared up again.

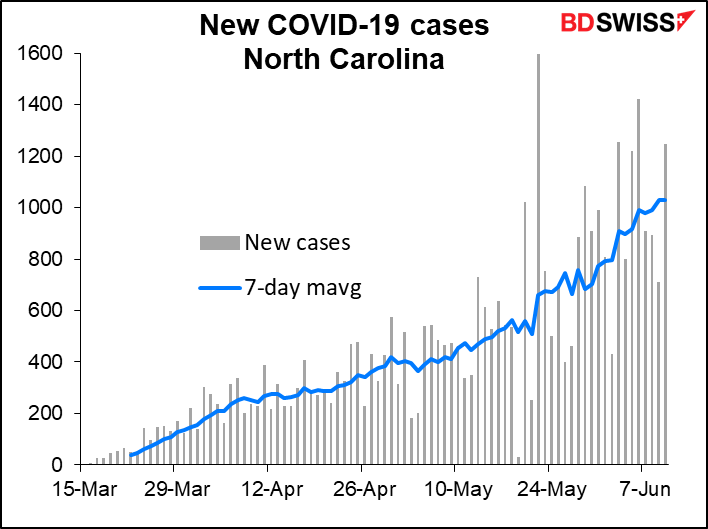

Note that California, Texas and Florida are the three most populous states, with a combined 90.5mn people. Arizona is smaller (7.3mn) but has the fastest growth rate in the last week. While these states haven’t seen the sort of case numbers that New York had (#4 in population and nearly 20,000 total cases per million), the four states are seeing 2,700-4,100 cases per million, similar to what Italy and France experienced and just below the UK. And unlike Europe and New York nowdays, the number of cases in these states is continuing to rise.

North Carolina has shown a steady rise.

This is all nice and good if you’re planning on travelling to the US, but why should a forex market participant be interested in all this? For three reasons:

1) The number of new cases is clearly increasing as states emerge from lockdown. To make matters worse, the massive demonstrations that the US has seen recently, while IMHO justified from a political point of view, may well exacerbate the problem. This suggests that the dreaded “second wave” of infections may well be starting.

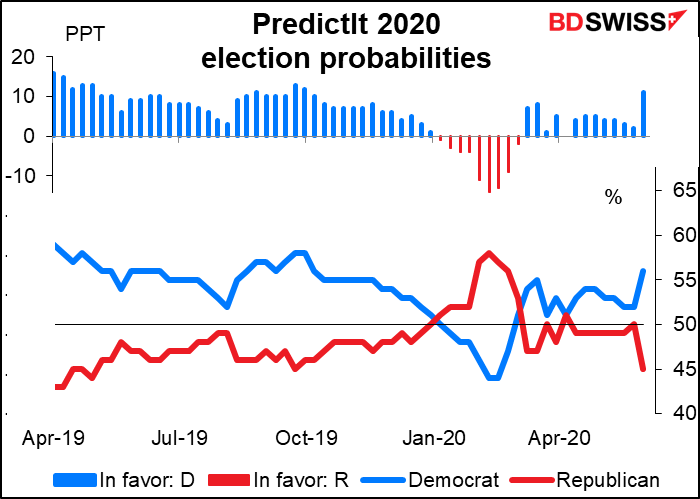

2) Trump won all the states mentioned above except for California. The fact that the virus is starting to become more virulent in Republican states is yet another threat to his reelection (did I hear someone mention something about clouds and linings?). It’s hard to vote for someone if you’re dead. Furthermore, voters may well hold it against the Very Stable Genius who told them the virus would disappear like magic in April, especially if their grandfather happens to die a few weeks before the election. Not to mention that older people, the most endangered by Trump’s bungling of this whole affair, have the highest voter turnout.

That may be one the reasons why the Democratic candidate has recently been surging as the likely winner in the 2020 Presidential election on Predictit.org, an academic betting website.

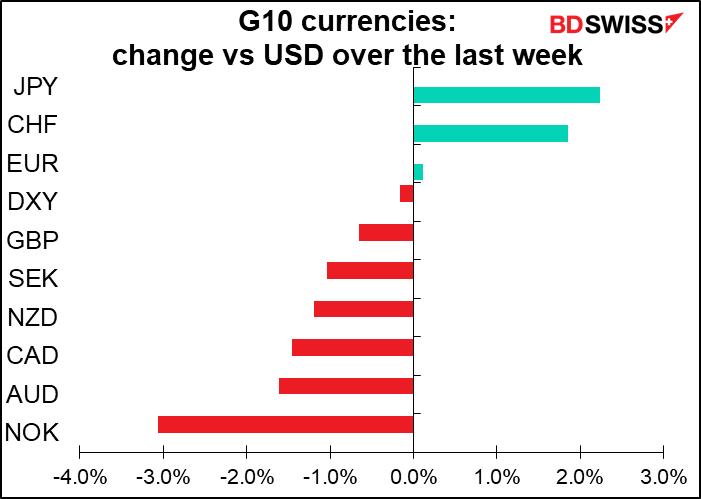

FX Market implications: USD-negative now, USD-positive later .In the immediate future, I expect that the eruption of a “second wave” of infections in the US would be negative for the dollar. It would at least cause another downturn in economic activity, at worst even another lockdown. If that were to happen as the rest of the industrial world was getting back to normal, the growth differential would explode. Furthermore, another leg down would force the Fed to take even more extreme loosening measures, such as yield curve control, which would diminish the attractiveness of Treasury bonds and thereby discourage inflows into the dollar. A researcher at the St. Louis Fed has already argued that negative interest rates will be necessary to achieve a V-shaped recovery.

As November approaches however any increase in the likelihood of Trump being evicted would be positive for the US currency, in my view. That’s because a) most people outside of the US dislike him intensely (he regularly polls outside the US as the least popular leader of any major country) and b) the end of the Trump regime could mean the end of the trade war with China, with beneficial effects on world growth.

The coming week: BoJ, SNB, BoE, and lots of CPIs. Plus some Fed speakers

There are three major central bank meetings in the coming week: the Bank of Japan (BoJ) on Tuesday and the Swiss National Bank (SNB) and Bank of England (BoE) on Thursday. The only one that presents much chance of news is the BoE. The other two are likely to just reiterate their current stance.

BoJ meeting: nothing happening

The BoJ stepped up its easing measures at the Monetary Policy Meetings (MPM) in March and April and the unscheduled May meeting. It’s likely to stand pat at this meeting.

In the absence of any policy moves, the market will be looking for any change in BoJ Gov. Kuroda’s view about the fiscal/monetary mix after the Cabinet approved the JPY 117tn second supplementary budget on 27 May, the largest-ever supplementary budget. Up to now Kuroda has been a willing partner in facilitating the government’s borrow & spend policies. He said in a speech on 14 May that the Bank “is determined to do whatever it takes as a central bank while firmly cooperating with the government and foreign authorities.” The market will want to see whether he’s still willing to cooperate with JPY 117tn worth of spending.

There has also been some talk about a “digital yen.” A “study group” was established last week with several major banks and companies “to examine and discuss challenges and solutions concerning digital currencies and digital settlement infrastructure, to find a consensus toward their realization, and to present a direction for standardizing services and infrastructure.” The BoJ and Ministry of Finance are both observers at this group. The market will want to hear what if anything Gov. Kuroda says about this, besides that he’s waiting for the group’s report, which is due out in September.

Finally, we will be interested to hear if anyone from the Fed has contacted the BoJ to ask them about their experience with yield-curve control, which seems to be the next step that the Fed would take if things get worse.

SNB: same old same old

The SNB hasn’t made any major changes in its policy stance for quite some time and, with rates currently at the lowest in recorded history, is unlikely to do so unless absolutely necessary. EUR/CHF, its main policy goal, was moving in the right direction until recently (= up, or a weaker CHF) and they were able to cut back their intervention in the latest week, so there’s not much reason for the SNB to change now. I’d expect Chairman Jordan simply to reiterate that the SBN will keep its negative rates and stands ready to intervene in the FX market and to “take additional steps to ensure liquidity as necessary.” I wouldn’t expect the announcement to have a major impact on CHF.

Bank of England: an APF top-up?

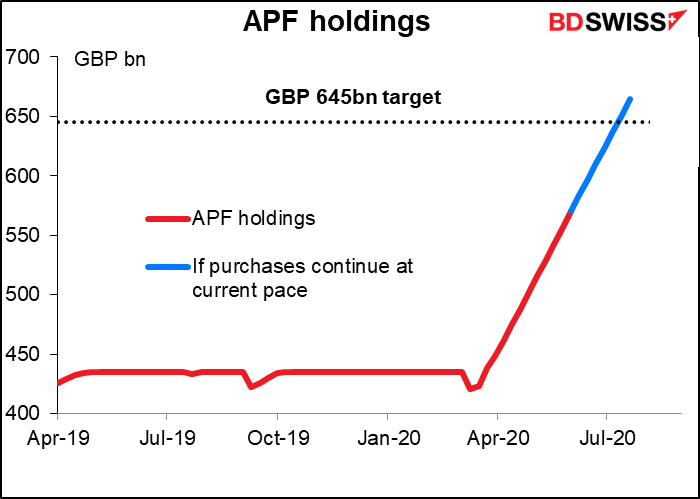

The BoE still has some policy options left. There has been some discussion about negative interest rates among the Monetary Policy Committee (MPC) members, although so far the balance of views seems to be against them. There is also some discussion about what to do with their Asset Purchase Facility (APF). This facility was to hold GBP 445bn worth of bonds; at the special MPC meeting on19 March, this was increased to GBP 645bn.

Since then, the BoE has been buying GBP 13.5bn a week. At that pace, the facility will be full and purchases will stop by 17 July.

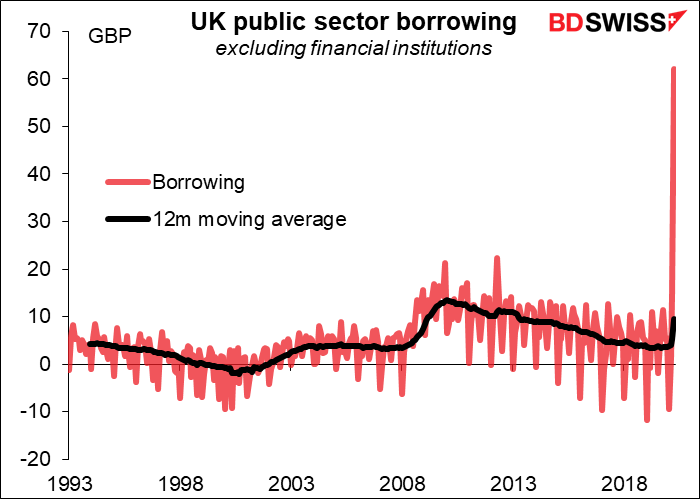

And at the last MPC meeting, on 7 May, two members proposed increasing the size of its by GBP 100bn. This proposal was voted down 7-2. The next MPC meeting after this one will be 6 August. The question is, will the BoE be content to let the APF stop purchases, will it hold an emergency meeting between now and 6 August, or will it increase the size of the APF at this meeting? Given the government’s unprecedented borrowing – the April figure was GBP 62bn, as much as the government had borrowed in the previous 12 months total – I think they will want to avoid any uncertainty and increase the target by at least GBP 100bn, the amount discussed last month. This would be similar to the European’ Central Bank’s pre-emptive top-up of its Pandemic Emergency Purchase Program (PEPP) at its last meeting.

I doubt if the increase would have much impact on the pound unless it were more substantial. After the move was foreshadowed in May, it wouldn’t be that big a surprise to the market. It might be different if they increased it by more however. The euro rallied when the ECB boosted the PEPP by more than expected. .

There are other measures the MPC could take as well. Aside from negative rates, as mentioned above, they could cut to zero, they could provide funding at a negative spread, or they could even add more than GBP 100bn to the APF. But it would be more natural for them to wait until the August meeting for such a move. That will allow them to see the government’s summer fiscal statement and updated forecasts in the quarterly Monetary Policy Report (MPR) to be published in August. Plus the August meeting will be followed by a press conference or at least a briefing by the Governor, as happened after the May meeting.

Powell testimony: what else is there to say?

Fed Chair Powell Tuesday delivers the semi-annual policy report to the Senate Banking Committee. After his extensive press conference this week, I doubt if there’s anything new he can say. Nonetheless it’s possible that the market reacts all over again to something he’s already said. It happens sometimes.

We also hear from Dallas Fed President Kaplan (voter) on Monday, Cleveland Fed President Mester (voter) on Wednesday and Thursday, and Boston Fed President Rosengren on Friday. Also Friday, Powell and Mester appear together in a video conference. Mester is one of the more hawkish FOMC members; I wonder if she was one of the two who predicted a higher Fed funds rate in 2022.

The week’s indicators: US retail sales, UK employment, inflation data from Britain, Canada and Japan

We’re starting to get more and more data for May, and some for June as well. Market participants will want to see a decent rebound in May, which would confirm that April was indeed the bottom of this briefest-ever economic cycle (assuming countries don’t have to go into lockdown again).

The most important bit of data coming out during the week is likely to be the US retail sales for May on Tuesday. April was down a record 16.4% mom; for May, the market is expected a 7.2% leap upwards. Of course that would still leave sales well below the March level, but at least they’d be going in the right direction.

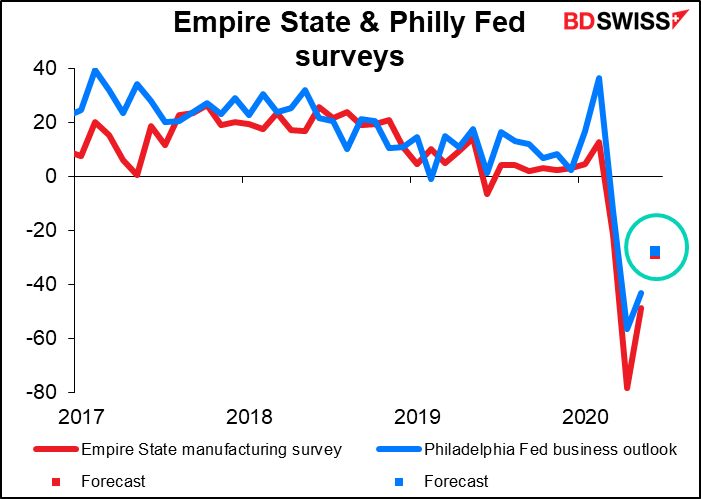

The Empire State manufacturing survey (Monday) and Philadelphia business outlook survey (Thursday) will give us an up-to-date view on how things are shaping up in June. The consensus view? Better than April, better even than May, but still not good.

Of course the weekly jobless claims and continuing claims will continue to be of interest, especially if continuing claims continue to fall.

Britain releases its unemployment data for April on Tuesday. Since it’s for April, the market is likely to ignore it. Furthermore, the UK employment data uses a rolling average and so is slow to respond to sudden shocks. Nonetheless, the small expected rise could be positive for the pound as it would show relatively little impact from the crisis.

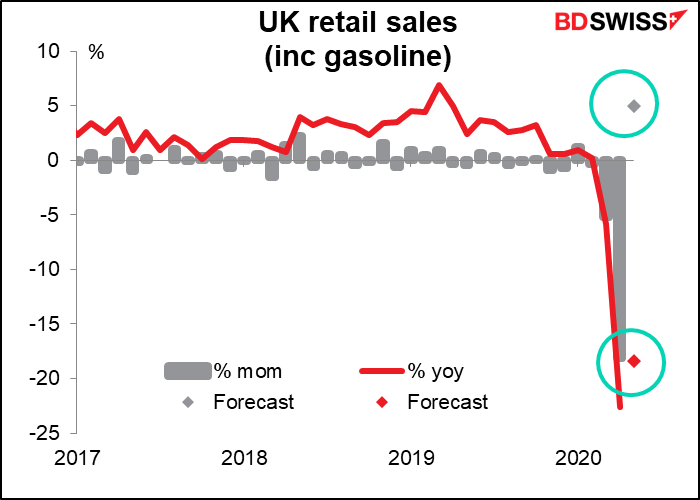

Britain also announces its retail sales for May on Friday. While sales are expected to be down sharply from a year earlier (-18.4% vs -22.6% in April) they’re expected to be up on a month-on-month basis (+5.0% mom vs -18.1% mom). This would be yet another indication that April was the bottom.

Inflation data is due from Britain (Wednesday), Canada (Thursday) and Japan (Friday). The UK data is expected to show continued downward pressure on prices. The Japan data is expected to show little change from the previous month. No consensus forecast is available yet for Canada, but I wouldn’t be sureprised if it showed lower headline inflation too.