PREVIOUS WEEK’S EVENTS (Week 08 – 12.04.2024)

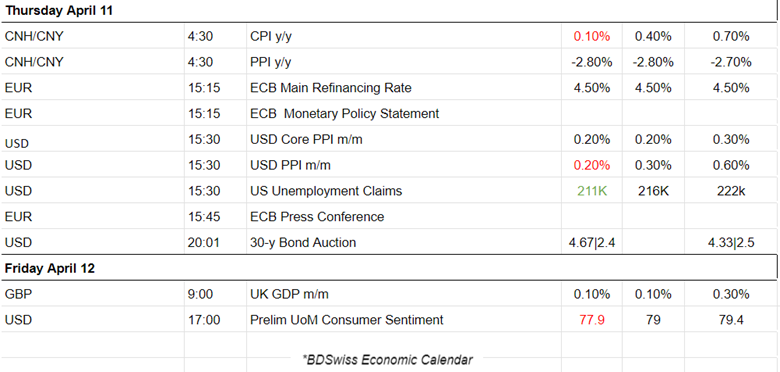

Announcements:

U.S. Economy

The University of Michigan’s preliminary reading on the overall Consumer Sentiment index was reported low, at 77.9 this month, compared to a final reading of 79.4 in March. Inflation expectations for the next 12 months and beyond increased as a survey showed on Friday.

One-year inflation expectations increased to 3.1% in April from 2.9% in March, rising just above the 2.3-3.0% range seen in the two years before the COVID-19 pandemic. The survey’s five-year inflation outlook rose to 3.0% from 2.8% in the prior month.

______________________________________________________________________

Inflation

United States

The U.S. inflation report last week shook the markets as it showed that U.S. consumer prices increased more than expected in March leading financial markets to anticipate that the Federal Reserve would delay cutting interest rates until September.

The latest labour market data showed that job growth accelerated in March, with the unemployment rate down to 3.8% from 3.9% in February. Financial markets now expect only two rate cuts instead of the three envisaged by Fed officials last month. A minority of economists see the window for rate cuts closing. The central bank has kept its policy rate in the 5.25%-5.50% range since July. It has raised the benchmark overnight interest rate by 525 basis points since March 2022.

According to the PPI data, U.S. producer prices increased moderately in March calming fears of a resurgence in inflation. Milder increases in the inflation measures are expected after this release. However, the recent CPI inflation report was quite strong.

______________________________________________________________________

Interest Rates

BOC

The Bank of Canada (BOC) kept its key interest rate unchanged at a near 23-year high of 5% on Wednesday but the bank’s head said a cut in June was possible if a recent cooling trend in inflation is sustained.

Inflation has been falling in recent months but at 2.8%, it is still above the bank’s 2% target.

“We just need to see it for longer to be confident that we are clearly on a path to 2% inflation and when we are at that point it will be appropriate to reduce our interest rate,” Governor Macklem told reporters.

ECB

The European Central Bank (ECB) kept interest rates steady at record highs but gave a clear signal that it may be preparing to proceed with cuts as inflation is heading towards the target level.

The central bank kept its deposit rate at 4.0%, where it has been since September. But, with inflation now close to the ECB’s 2% target, the ECB gave hints about a possible cut at its next meeting.

With Thursday’s decision, the ECB also left the interest rate on its daily and weekly loans for banks at 4.75% and 4.50% respectively.

______________________________________________________________________

Source:

https://www.reuters.com/markets/us/us-consumer-prices-rise-more-than-expected-march-2024-04-10/

https://www.reuters.com/markets/europe/ecb-holds-rates-record-highs-signals-upcoming-cut-2024-04-11/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 08 – 12.04.2024)

Server Time / Timezone EEST (UTC+02:00)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

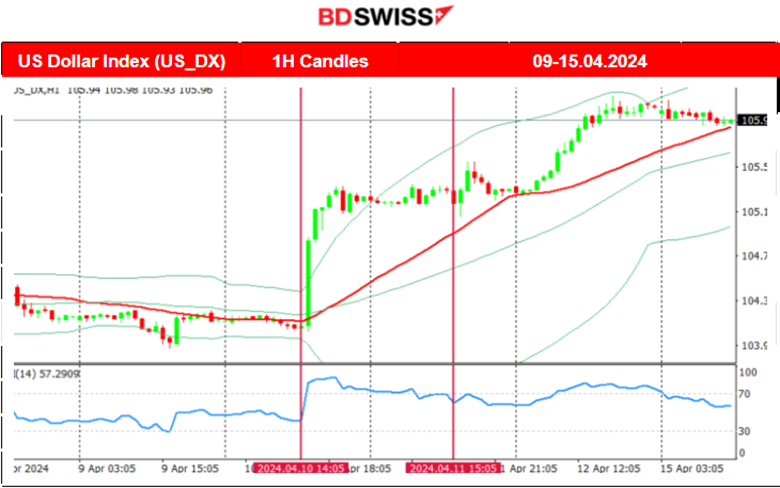

Dollar Index (US_DX)

It was an important week for the dollar and the Federal Reserve (Fed) as the inflation report had a major impact on the market and especially expectations for the future of the USD and inflation. It was on the 10th of April during the inflation report release for the U.S. that the dollar index jumped after the release of higher-than-expected inflation figures that shook the market. The PPI figures were having a similar effect as they were reported in line with expectations. The market reacted with dollar appreciation and a change in expectations of when the interest rate cuts will take place eventually. The market participants now anticipate that the Fed will delay cutting interest rates until September. This fact caused the dollar surge that lasted until even to this day.

EURUSD

EURUSD

The pair was moving sideways until the inflation report release on the 10th of April when the volatility levels reached extremely high levels. The dollar experienced strong appreciation causing the EURUSD drop of near 130 pips that day. The ECB decided to keep rates steady on the 11th of April and according to their statements cuts should take place soon. This obviously causes the EUR’s weakening. In combination with the USD strengthening, the EURUSD inevitably continued with the downward movement, with the USD however, mostly driving the path.

USDJPY

USDJPY

Due to the dollar strengthening after the inflation news for the U.S., the USDJPY moved to the upside. The 11th – 12th of April was a period of low volatility and the price was actually moving within a channel but it was having an upward heading. However, the pair was moving around the 30-period MA when eventually on the 15th of April the USDJPY took a rapid move to the upside. Recent information shows that the Bank of Japan is shifting to a more discretionary approach in setting policy, with less emphasis on inflation according to sources, as the central bank maps its monetary path following the historic change in interest rate policy ending eight years of negative rates.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin is trading below 71K USD which was the peak last week on the 12th of April. Since then the price of bitcoin fell rapidly during the weekend reaching the lowest support near 60,280 USD level before retracing to the 30-period MA. Currently, the price crossed the 30-period MA suggesting the end of the short-term downtrend with hopes that volatility would turn to higher levels and potentially cause the price to reach the 71K USD level again soon.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

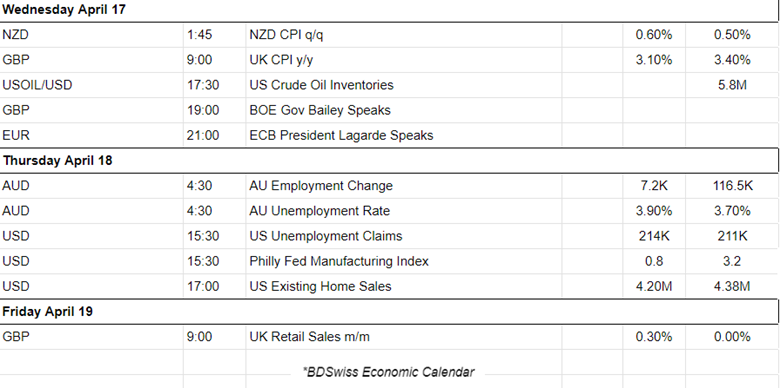

NEXT WEEK’S EVENTS (Week 15 – 19.04.2024)

Coming up:

Inflation reports for Canada, New Zealand and the U.K.

Retail Sales Reports for the U.S. the U.K. and China.

We have also the release of important employment data for the U.K. and Australia.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Following Iran’s weekend attack on Israel, the price actually dropped flirting with the 84.3 USD/b again. That seems a critical support and its breakout could cause a significant drop. On the 12th of April, Crude oil experienced a sudden drop after 18:00 and the start of the N. American session.

The alternative scenario will depend on the main fundamental factors such as Israel’s reaction to the attack which will be key to global markets in the days and weeks ahead. Significant and longer-lasting price effects for a price increase instead would require a material disruption to supply.

Gold (XAUUSD)

It has been a long time since Gold has been quite resilient to the downside, even when we have news releases that cause the dollar to strengthen. The NFP data release did not manage to bring it down. The U.S. inflation report caused a heavy dollar strengthening but again Gold was not affected by a heavy drop, but rather kept its resilience. Currently, the U.S. dollar strengthening is in place and metals see more demand kicking in causing prices to rally. However on the 12th of April, Gold experienced a sudden drop after 18:00 and the start of the N.American session just like the price of oil. It seems that positions on these commodities have been closed ahead of the weekend, perhaps due to increased uncertainty.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

A higher-than-expected inflation figure for the U.S. was released. This means that borrowing costs will remain high for a long time, causing a drop in U.S. indices on the 10th of April. The index found support near the 5,135 USD level before retracement took place. On the 11th of April, the index eventually saw a sharp movement upwards reaching the resistance at near 5,215 USD without retracement taking place. On the 12th of April, volatility continued being high and the index suffered a huge drop breaking the support at 5,135 USD, reaching the next level at 5,100 USD before eventually retracing to the 30-period MA. The RSI shows currently bullish signals even though it is not so clear.

______________________________________________________________