Previous Trading Day’s Events (15.04.2024)

Strong retail sales prompted economists at Goldman Sachs to boost their gross domestic product (GDP) growth estimate for the first quarter to a 3.1% annualised rate from a 2.5% pace. The economy grew at a 3.4% rate in the fourth quarter.

“The stronger economic activity remains, the slower inflation declines and the later the Fed responds with rate cuts,” said Kathy Bostjancic, chief economist at Nationwide. “The lack of moderation in consumer spending and inflation … could push off rate reductions to next year.”

Despite higher inflation and borrowing costs, spending is continuing to hold up, thanks to the resilient labour market.

Financial markets and most economists have pushed back their expectations for the first rate cut to September from June, and anticipate two rate cuts instead of the three envisaged by policymakers.

Source: https://www.reuters.com/markets/us/us-retail-sales-beat-expectations-march-2024-04-15/

______________________________________________________________________

Winners vs Losers

Metals remain on the top with Silver gaining 2.21% and Gold gaining 1.04% so far. Silver has remarkably gained 14.03% for this month. The dollar continues with strengthening bringing the USDJPY and USDCAD to the upside.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (15.04.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

Retail Sales figures for the U.S. showed that sales jumped 0.7% in March, much higher than expected. American consumers continued with orders despite rising inflation. Core retail sales change jumped to 1.10% from 0.60%. The dollar gained after the release. EURUSD dropped near 20 pips at that time before experiencing retracement to the mean.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (15.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was moving steadily to the upside as the dollar was showing intraday weakness against the EUR. This trend lasted until the Retail sales news release. After the higher than expected Retail sales figures release, the USD experienced appreciation causing the EURUSD to drop nearly 20 pips before an immediate reversal to the 30-period MA. Later the dollar continued to strengthen and caused the EURUSD to drop further, closing lower for the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin saw a drop from 71K USD in the last few days and was moving below the 30-period MA. On Saturday, April 13th, Iran launched a drone attack on Israel and Bitcoin’s price dropped sharply reaching just below the 62K USD support. Volatility remained high and after Bitcoin’s price reversed to the upside passing the 30-period MA on its way up it signalled the end of the downside movement and the start of a sideways but volatile path. It currently trades around the MA and it tests the 62K USD support. 64,500 USD seems to be currently the mean level that the price settled at.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The market has not improved. Crypto assets still remain at lower levels and find it hard to recover. The current trend is downwards still with no signals of reversing.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A higher-than-expected inflation figure for the U.S. was released. This means that borrowing costs will remain high for a long time, causing a drop in U.S. indices on the 10th of April. The index found support near the 5,135 USD level before retracement took place. On the 11th of April, the index eventually saw a sharp movement upwards reaching the resistance at near 5,215 USD without retracement taking place. On the 12th of April, volatility continued being high and the index suffered a huge drop breaking the support at 5,135 USD, reaching the next level at 5,100 USD before eventually retracing to the 30-period MA. On the 15th of April, it was the situation when stocks plunged after the exchange opened and the index broke out from the channel as depicted on the chart.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

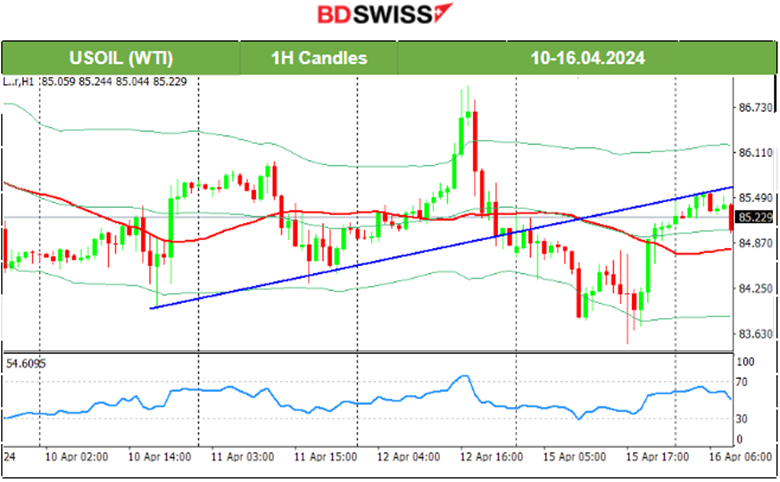

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Following Iran’s weekend attack on Israel, the price actually dropped, flirting with the 84.3 USD/b. Its breakout occurred on the 15th of April, and as mentioned in our previous analysis, the breakout caused a significant drop reaching the support of around 83.5 USD/b. The price recovered eventually with a full reversal, crossing the 30-period MA on the way up reaching 85.5 USD/b. It retraced from that level and currently remains close to the MA.

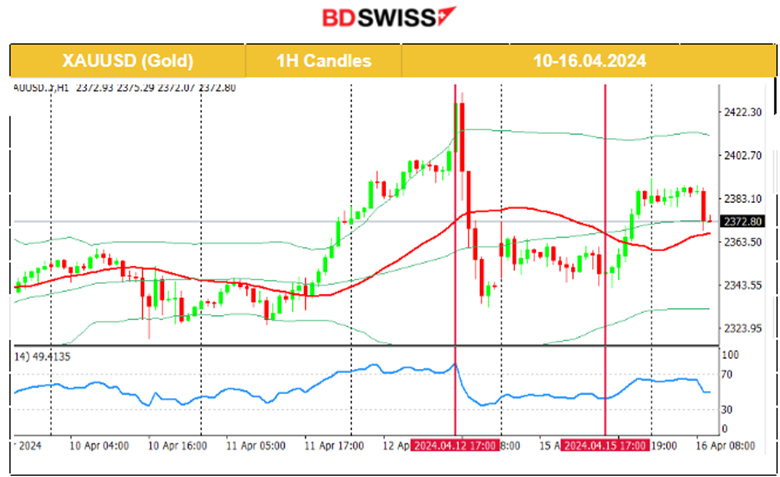

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 12th of April, Gold experienced a sudden drop after 18:00 and the start of the N.American session. It seems that positions on these commodities have been closed ahead of the weekend, perhaps due to increased uncertainty or information about the upcoming Iran attack on Israel during the weekend. On the 15th of April, the market opened with a gap to the upside. Despite the dollar strengthening due to better than expected retail sales data, Gold kept its resilience and picked up momentum, moving to the upside again. It currently remains close to the 30-period MA and the mean near 2,370 USD/oz.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (16 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

According to the GDP (q/y) figure China’s economic growth beat expectations in the first quarter, as factory output led the expansion bolstering expectations the government can hit its ambitious annual target. Gross domestic product increased 5.3% in the January-to-March period from a year earlier. Retail Sales annual change dropped to 3.10%

- Morning – Day Session (European and N. American Session)

At 9:00 the employment data ( Claimant Count change) and labour market report for the U.K. were released. Unemployment rate increased to 4.2% from the previous 3.9%. The Change in the number of people claiming unemployment-related benefits during the previous month (Claimant Count) was reported higher, near 11K. Payrolled employees in the UK fell by 18,000 (0.1%) between January and February 2024 but rose by 352,000 (1.2%) between February 2023 and February 2024. The GBP appreciated at first but the effect reversed soon. The GBPUSD overall fell to nearly 27 pips after the release.

At 15:30 the inflation report for Canada could cause intraday shock for the CAD pairs. The monthly figure is actually expected to be reported higher. In the case of a surprise to the upside, the CAD should see significant appreciation.

General Verdict:

______________________________________________________________