PREVIOUS WEEK’S EVENTS (Week 27 Nov – 01 Dec 2023)

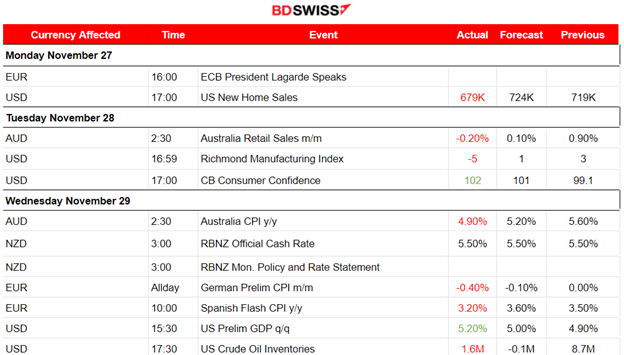

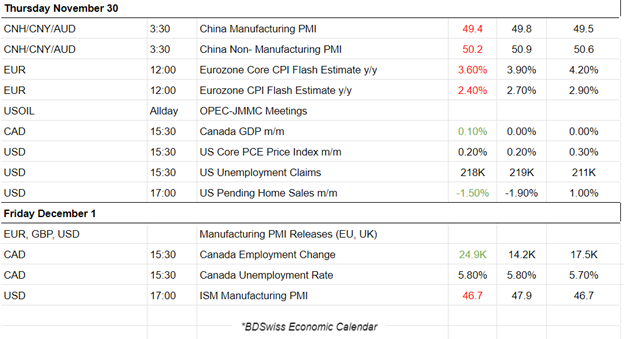

Announcements:

U.S. Economy

The CB consumer confidence report showed a higher-than-expected figure, at 102, indicating that the confidence level rose in November after three straight monthly declines, amid higher prices and interest rates.

About two-thirds of consumers surveyed this month still perceived a recession to be “somewhat” or “very likely” to happen over the next year with economists suggesting instead that a period of very slow growth is rather going to take place.

The improvement in confidence was concentrated mostly among households aged 55 and above. Consumers in the 35-54 age group were less optimistic about their prospects. The share of consumers in the Conference Board survey expecting higher interest rates was the smallest since April 2021, while the proportion anticipating lower borrowing costs was the largest in nearly three years.

Financial markets anticipate a rate cut from the Fed in mid-2024, according to CME Group’s FedWatch Tool due to the reports suggesting significant inflation cooling.

U.S. Inflation and Consumer Spending

The annual increase in inflation is the smallest in more than 2 and a half years and consumer spending levels get lower and lower all signalling cooling demand that boosts expectations the Federal Reserve’s interest rate hiking campaign is over.

The labour market is gradually easing. More Americans applied for unemployment benefits last week and the number on jobless rolls surged to a two-year high in mid-November. The data favour the Fed since they were looking at an extended hold for policy, rather than an additional rate hike to curb inflation pressures.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased 0.2% last month after an unrevised 0.7% gain in September. Inflation-adjusted consumer spending rose 0.2% last month according to the PCE report. The Inflation report as measured by the personal consumption expenditures (PCE) price index was unchanged in October after rising 0.4% in September. In the 12 months through October, the PCE price index increased 3.0%. That was the smallest year-on-year gain since March 2021 and followed a 3.4% advance in September.

Canada Economy and Inflation

The employment change report on Friday showed that the Canadian economy added more jobs than expected in November while the unemployment rate was reported slightly higher. 24,9K jobs were added in November, more than the 15K forecast.

Employment is rising and it is the last major economic data to be taken into account ahead of the next Bank of Canada (BoC) rate announcement on Wednesday. The market is expecting unchanged interest rates.

Economic growth has stumbled and inflation has eased to 3.1%, according to the latest data.

_____________________________________________________________________________________________

Interest Rates

RBNZ

The Reserve Bank of New Zealand (RBNZ) held the cash rate steady on Wednesday but noted inflation remained too high and that further policy tightening might be needed if price pressures do not ease. The official cash rate (OCR) was held at 5.5% as expected, but the hawkish tone of the statement surprised many in the market causing the NZD to appreciate.

RBNZ Governor Adrian Orr told a media conference on Wednesday he had met with Luxon and new finance minister Nicola Willis on Tuesday, describing talks as “incredibly constructive” and focused. “The number one job in hand for us is to reduce inflation,” he said. He added the bank had not been consulted on returning to a single mandate but expected it would be.

New Zealand’s annual inflation is currently 5.6%, with expectations that it will return to its target band by the second half of 2024.

_____________________________________________________________________________________________

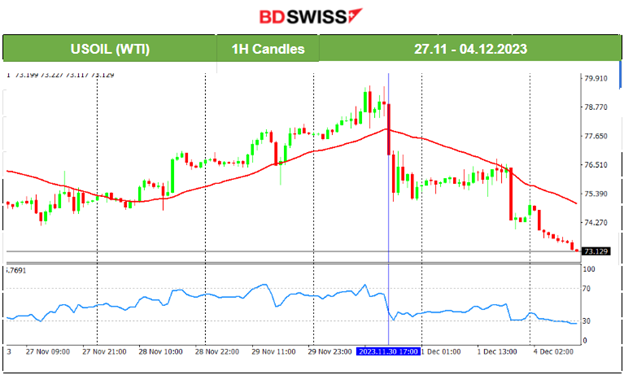

Crude Oil

Oil prices saw a big fall, by more than 2% on the 30th Nov, after OPEC+ producers agreed to voluntary oil output cuts for the first quarter of next year that fell short of market expectations. These producers involve Saudi Arabia, Russia and other members of OPEC+, who pump more than 40% of the world’s oil. They agreed to voluntary output cuts approaching 2M barrels per day (bpd) for the first quarter of 2024.

At least 1.3M bpd of those cuts, however, were an extension of voluntary curbs that Saudi Arabia and Russia already had in place.

OPEC+ also invited Brazil, a top 10 oil producer, to become a member of the group. The country’s energy minister said it hoped to join in January.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-consumer-confidence-rises-november-2023-11-28/

https://www.reuters.com/markets/canada-gains-24900-jobs-november-jobless-rate-rises-58-2023-12-01

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 27 Nov – 01 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD was roughly on the upside last week by moving over the 30-period MA and remaining sideways most of the time. However, that changed on the 30th Nov. The pair eventually in general reversed from the upside and dropped sharply creating a short-term downward trend. It lost ground when the USD experienced remarkable strength, early at the start of the European session after 9:00. The Inflation report as measured by the personal consumption expenditures (PCE) price index indicated figures as expected. It found strong support at 1.083, on the 1st Dec, before retracing back to the MA, where it currently settled.

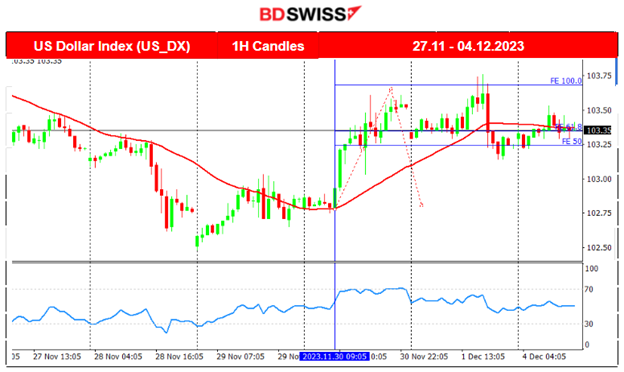

Dollar Index (US_DX)

The dollar index showed a strong downward path early last week with high volatility while it was moving below the 30-period MA. That changed on the 30th Nov when the USD started to experience strength. The index found resistance near 103.7 and retraced back to the mean near 103.50, where it currently settled. The recent U.S. inflation reports show that the elevated rates have caused significant cooling while consumer spending falls to lower levels. Interest rates though are expected to remain high still causing a rather sideways volatile path for the dollar index, for now.

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin keeps on breaking all resistances this week progressing to the upside. It has broken above 40K USD for the first time this year gaining momentum from broad enthusiasm about possible U.S. interest rate cuts and the anticipated imminent approval of U.S.-stockmarket traded bitcoin funds.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

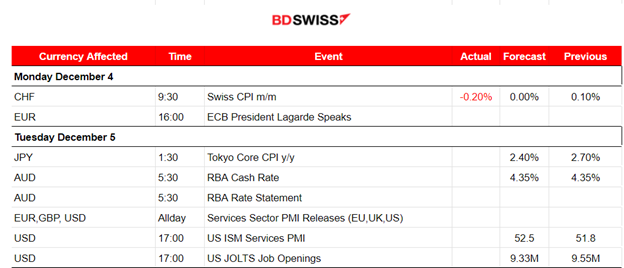

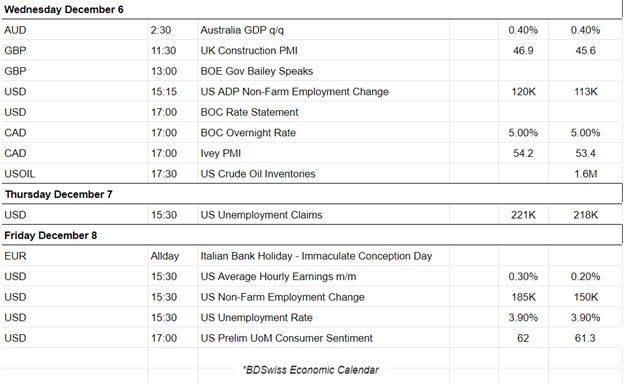

NEXT WEEK’S EVENTS (04-08.12.2023)

Important releases this week include the RBA and BOC interest rate decisions.

Other notable events related to the employment data releases for the U.S. are the ADP, JOLTS and NFP reports.

We have also the releases of the Services PMIs for the major regions.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude experienced a short uptrend from the 28th to the 30th of Nov. It reached the resistance near 79.5 USD/b and dropped suddenly after it was announced that the OPEC+ producers agreed to voluntary oil output cuts for the first quarter of next year that fell short of market expectations. Price dropped sharply on the 30th Nov reaching the support near 75 USD/b, where it stayed in consolidation until experiencing the retracement back to the mean. It later experienced another drop on the 1st Dec breaking the support and reaching the next at nearly 74 USD/b. It currently moves even further downwards.

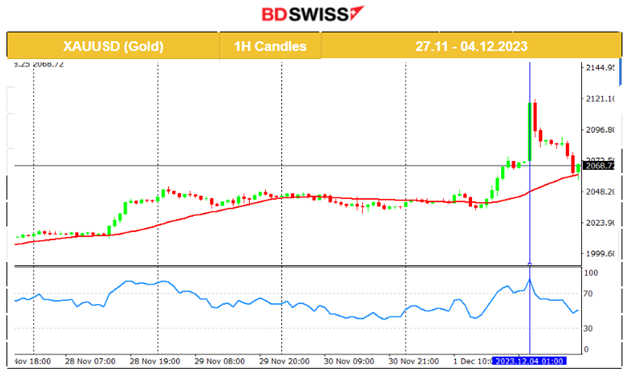

Gold (XAUUSD)

Gold broke the range mentioned in our previous report and moved to the upside on Friday. The jump was reinforced with a sudden surge in price after the market opening today. A near 70-dollar move before reversing back to the mean. A record with a price above 2100 USD/oz, driven by a weaker U.S. dollar and the revising Federal Reserve interest rate expectations. The market is betting that the Federal Reserve will hold interest rates steady at next week’s policy meeting and consider cuts in the first half of next year.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

A period of consolidation followed after a high trend upward. The index started to move sideways but with high volatility last week. Even though it experienced some support breakouts we see resilience currently, pushing it to the upside and to remain in range. An apparent triangle formation is depicted on the chart below. Breakouts could push the index in one direction rapidly. A downward breakout could lead the index to reach the next support at near 15800. Breakout upwards could lead to the resistance near 16150.

______________________________________________________________