Rates as of 05:00 GMT

Market Recap

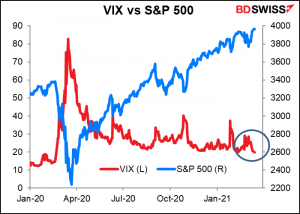

A relatively calm day ahead of today’s Federal Open Market Committee (FOMC) meeting. Stocks in the US were little changed and the VIX index of future volatility hit its lowest level in over a year.

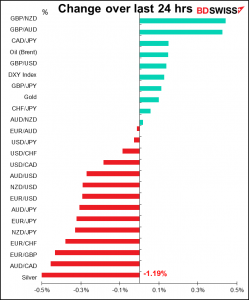

The focus seems to be on the problems with the vaccine rollout in Europe. How else to explain the utter underperformance of EUR despite a better-than-expected ZEW index (expectation 76.7 vs 74.0 expected, 71.2 previous) and much, much worse-than-expected US retail sales and industrial production (-3.0% mom vs -0.5% expected for sales, -2.2% mom vs +0.3% expected for IP)?

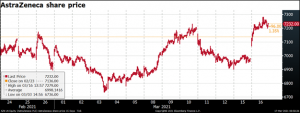

The European Medicines Agency (EMA) said there is “no indication” that AstraZeneca’s coronavirus vaccine is the cause of reported blood clots. The EMA is expected to conclude its investigation tomorrow. Nonetheless market participants worried about the implications of a slow vaccine rollout for growth in Europe. The pause amplified concerns in the face of rising virus cases that medical experts in Germany and French PM Casetx unambiguously characterized as “third waves” of the virus.

Those fears could dissipate soon if, as seems likely, the EMA does declare the vaccine safe. Italian PM Draghi (first time I’ve written that!) and French President Macron said their countries could resume using the O/AZ vaccine if the EMA declares it to be safe. The firm’s shares were up nicely yesterday, suggesting that someone thinks it’ll get the OK. I look for EUR to bounce back when the vaccine gets the all-clear.

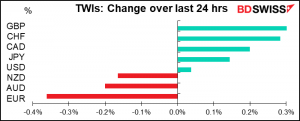

CHF gained as EUR/CHF moved lower along with German Bund yields for most of the day. The move developed a momentum of its own though as Bund yields later retraced their move, but EUR/CHF continued to weaken.

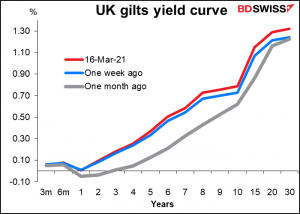

On the other hand, GBP was the best-performing currency – note that they too use the AstraZeneca vaccine, which they always call the Oxford/AstraZeneca vaccine to emphasize the fact that Oxford University had a hand in its invention (also AZ is the second-biggest listed company in Britain.) Bank of England Gov. Bailey yesterday said on BBC Radio Four that the recent rise in bond yields “is consistent with the change in the economic outlook.” This contrasts with the ECB’s shock/horror response and helped to push GBP higher. The big question is, can GBP/USD recover to the crucial 1.40 line? So far that seems difficult.

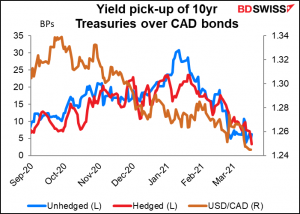

USD/CAD continued to move lower (i.e., CAD moved higher) as Canadian bond yields rose faster than US bond yields (Canada 10yr yields +3bps vs +1bp for UST). As the advantage for Canadians of investing in US bonds diminishes, CAD is likely to strengthen further, in my view.

Today’s market

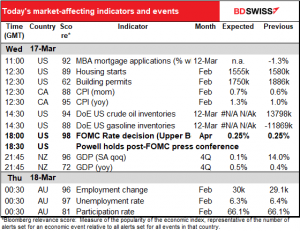

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

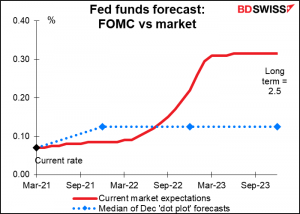

The feature on today’s schedule is of course the meeting of the rate-setting Federal Open Market Committee (FOMC). For those who are interested in the details, I’ve got a thorough discussion of it: FOMC Meeting: No Change in Policy, but Watch the Dots! Here I’ll only say that the focus will not be on what they do – they probably won’t do anything – but rather on the new forecasts, and in particular the “dot plot” — how many of the Committee members expect a rate hike in 2023? Previously it was five out of 17. This time? Will it be enough to pull the median up and confirm the market’s view that a rate hike is likely in 2023?

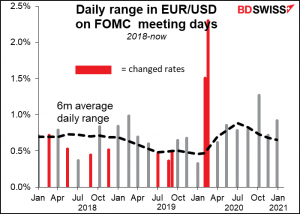

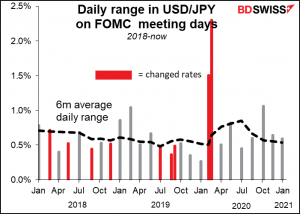

Meanwhile, although there can be extreme volatility on days when they change policy, other times the daily range is often nothing unusual. In USD/JPY it can even be narrower than usual.

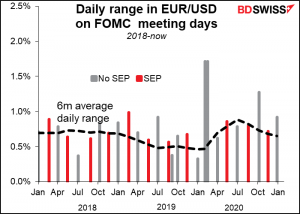

A new SEP doesn’t always mean a more volatile day, either.

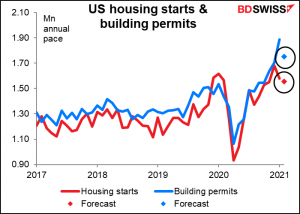

As for the data, US housing starts and building permits are both expected to fall substantially (-1.6% mom and -7.2% mom, respectively) thanks to the bad weather during the month, but nonetheless remain at historically high levels. December’s housing starts of 1.68mn annualized pace was the highest since the housing boom of the early 2000s, when starts hit a record high of 2.27mn (annualized pace) in January 2006.

There does seem to be some slowing in the housing market. Yesterday’s National Association of Home Builders (NAHB) index fell slightly to 82 from 84, which shows a loss of momentum. But that has to be seen in context – the record high for the index was 90, set in November, so it’s still very high.

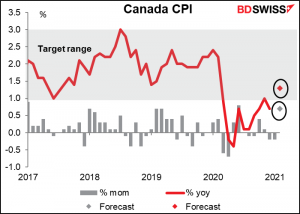

Canada’s consumer price index (CPI) is expected to jump, with the headline figure returning to the Bank of Canada’s target range for the first time since February 2020, thanks largely to higher energy prices in the first instance.

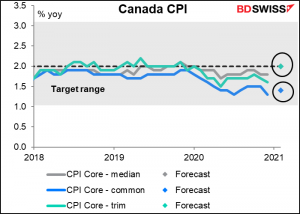

Of course, the three core measures of inflation – which are the ones that the Bank of Canada claims to pay attention to – never left the target range, and they’re expected to be barely changed. (Both the “median” and “trimmed” versions are forecast to be 2.0% yoy, hence only one visible dot.)

I should also mention that the return to within the Bank of Canada’s target range is expected by the Bank and will therefore make no difference to their policy. They said last week that

CPI inflation is near the bottom of the 1-3 percent target band but is likely to move temporarily to around the top of the band in the next few months. The expected rise in CPI inflation reflects base-year effects from deep price declines in some goods and services at the outset of the crisis a year ago, combined with higher gasoline prices pushed up by the recent run-up in oil prices. CPI inflation is then expected to moderate as base-year effects dissipate and excess capacity continues to exert downward pressure. (emphasis added)

Nonetheless, the market is likely to take a less informed view of the figure and we could have a knee-jerk strengthening of CAD as inflation rises.

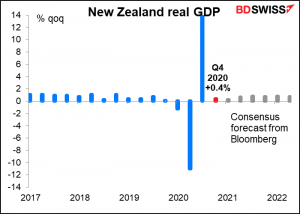

Overnight, New Zealand is I believe the last of the major industrial economies to release its Q4 GDP figure even as we enter Q2 of the following year. After two quarters of dramatic changes, Q4 is expected to show a boringly normal rate of increase of +0.4% qoq.

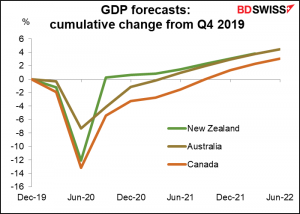

Looking at the three commodity currency countries, New Zealand has recovered faster than Australia, but Australia is expected to catch up by the end of the year. Meanwhile Canada, which has had much more of a problem with the virus than either of those two countries, has lagged behind.

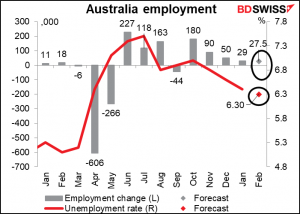

Then Australia releases its employment data on Thursday and retail sales on Friday. Like many central banks, the Reserve Bank of Australia (RBA) is probably putting more weight on employment nowadays than on inflation. Or perhaps more accurately, the high level of unemployment is considered the main barrier to achieving their inflation target. For example, the RBA said after its last meeting:

The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest.

The figures are expected to show another month of higher employment and a lower unemployment rate. Although nowhere near the RBA’s target, the direction is correct, which could help to boost AUD.