Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

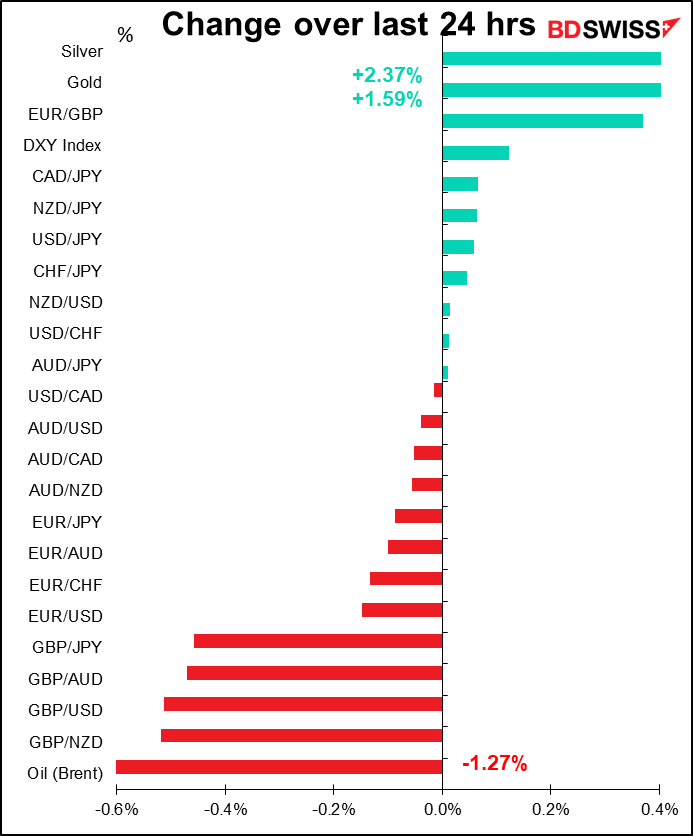

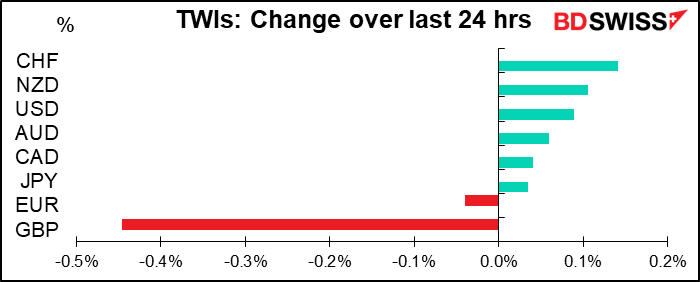

Attention yesterday was focused squarely on GBP. Movements in other currencies were minuscule. Just for two examples, yesterday when I ran my spreadsheet as always EUR/USD was 1.2133; this morning it’s 1.2115. USD/JPY went from 104.00 to 104.06.

GBP on the other hand…It’s all down to Brexit of course and I have to say that I have no particular inside line into what’s happening there. I have an opinion of course but I must warn you that my opinion is no better than anyone else’s. My guess is that the UK will fold before it’s too late and they will reach an agreement, although I must admit when I read about the stunt the UK side pulled with regards to fisheries on Sunday night, I started to wonder (see below).

UK PM Johnson talked with European Commission President von der Leyen yesterday, but in a joint statement the two “agreed that the conditions for finalizing an agreement were not there due to the remaining significant differences on three critical issues.” These are of course as always a) fair competition (the “level-playing field,”) b) EU access to British fishing waters, and c) a system of dispute resolution if the terms of the treaty are breached. Johnson will go to Brussels for emergency talks “in the coming days,” perhaps as early as Wednesday, ahead of Thursday’s EU summit there. That’s good, because EU Chief Negotiator Barnier said the talks will not go beyond Wednesday.

On the one hand it’s encouraging that not only are the two sides talking but they’re talking at the highest level and in person. On the other hand, a UK government source said to journalists that “Whilst we do not consider this process to be closed, things are looking very tricky and there’s every chance we are not going to get there.” That could be just positioning ahead of the talks, but it could also be their realistic assessment. The UK side presented some new conditions with regards to fishing just on Sunday night, which was a spectacularly stupid thing to do at this point in the negotiations if you’re interested in reaching an agreement.

Meanwhile, back at the ranch, UK MPs yesterday voted to reinsert the provisions in the Internal Market Bill that would allow the UK to break the Withdrawal Agreement under certain circumstances. The House of Lords had previously taken this perfidious clause out of the legislation in horror that it would legalize breaking an international treaty. The fact that MPs reinstated these clauses, which is totally unacceptable to the EU (and the US, I should add) should have been a deal-breaker right then and there. However, the UK government said it would be prepared to remove or deactivate the offending clauses if the solutions being considered are agreed upon and talks progress.

These negotiations may be crucial for Britain, but they only seem to be bothering the foreign exchange market. GBP fell, but the weaker currency helped the multinational-dominated FTSE 100 to outperform other European bourses. It was up +0.08%, not much but other European markets were almost all down – the Euro Stoxx 50 was -0.26%, DAX -0.21% and CAC 40 -0.64%. The more domestic FTSE 250 though underperformed, falling 1.25%. (The F TSE 250 is the 250 highest-cap stocks after those in the FTSE 100.) Gilts also did well, with 10yr yields falling about 7 bps, their largest one-day decline since June.

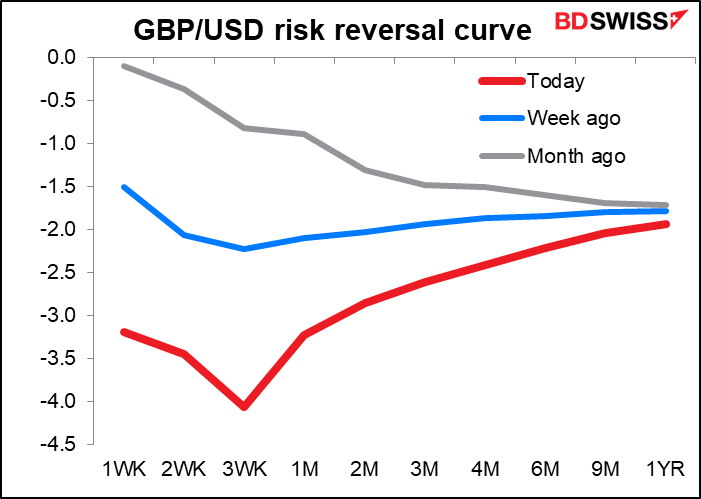

The market was taking a pretty sanguine view of Brexit before this week, but now that it looks like a “no-deal” is really a possibility, people are getting worried – and buying insurance.

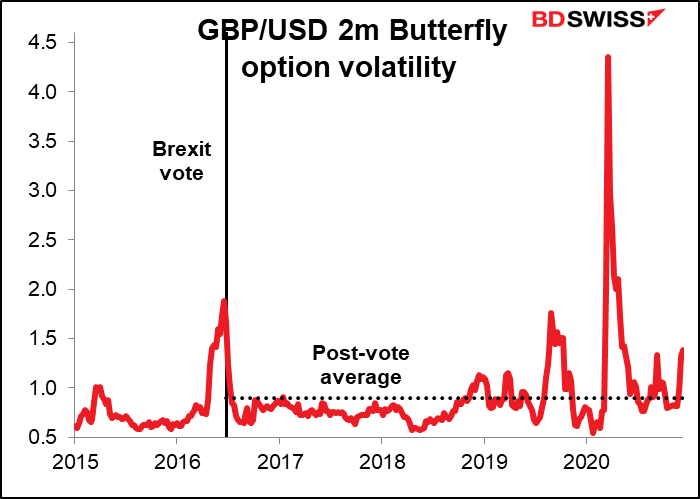

The two-month butterfly option volatility, which is a measure of the cost of insuring against a big move in either direction over the next two months, has risen suddenly. It’s nowhere near as high as it used to be, but it’s still a lot higher than it was just a week or two ago, even though it still covered the end of the transition period then.

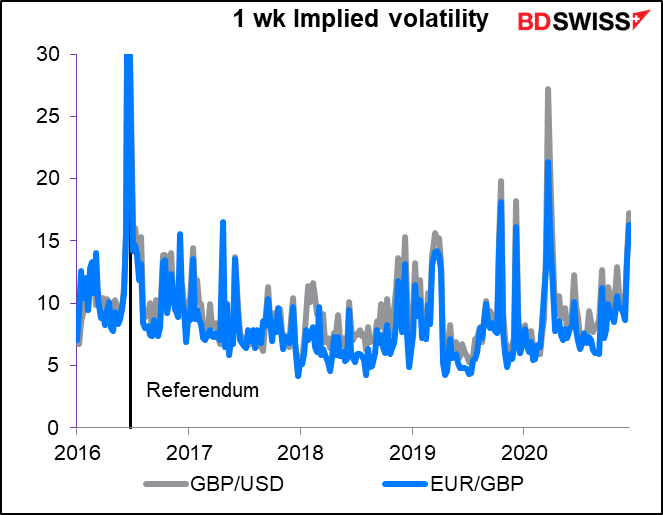

The one-week implied volatility has shot up too, although it’s still less than it has been at other times, implying that the market has to some degree digested the outlook for a “no-deal” Brexit.

One bit of good news for the UK: the country will begin vaccinations today using the Pfizer/BioNTech shot that Britain approved last week. The first to get it will be people over 80 plus workers in care homes and front-line health services.

FYI, today is “safe harbor day” in the US. You probably haven’t heard of it before. It’s one of the obscure deadlines in the election process. Normally no one cares about these deadlines, but they do this year because of Trump’s plot to steal the election. Safe Harbor Day is the deadline by which all state election disputes, including court challenges and recounts, must be resolved. What it means concretely is that after today, even the Republicans have to acknowledge that President-elect Biden won the election, because there’s no way for Trump to overturn it. Although being able to ignore reality seems to be a prerequisite for membership in the Republican Party nowadays.

The next deadline is 14 December, when the electors meet and vote, and 6 January, when the new Congress meets and counts the votes. There is a process by which members of Congress can object to the electors, and several Republicans have said that they would do so, but without a majority in the House of Representatives they can’t do anything about it.

My guess is Trump never concedes and has to be dragged kicking and screaming out of the Oval Office, together with his tanning bed & golf simulator. Or maybe he’ll have resigned by then so that Pence can pardon him. Or maybe he’ll have already moved to Florida – or Russia. There’s talk of him organizing a rally in Florida to coincide with Biden’s inauguration. Real classy.

Today’s market

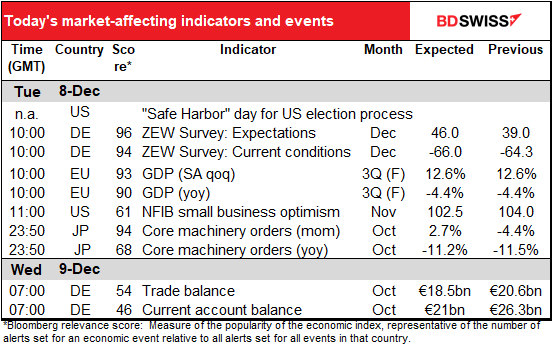

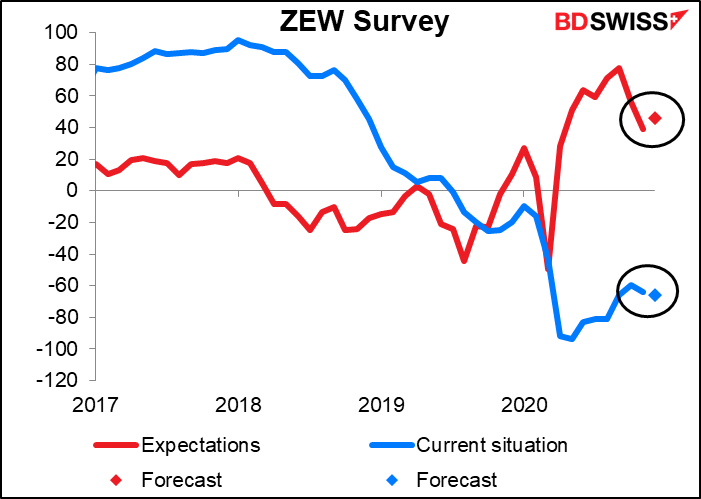

Today’s ZEW survey of analysts and economists is expected to show a slight decline in the current situation (naturally, with the country in partial lockdown) but a slight improvement in expectations. Since the market discounts the future, the rise in the expectations index could be good news for European stock markets and the euro.

The final estimate of Eurozone Q3 GDP is rarely if ever revised, so it’s not likely to be important.

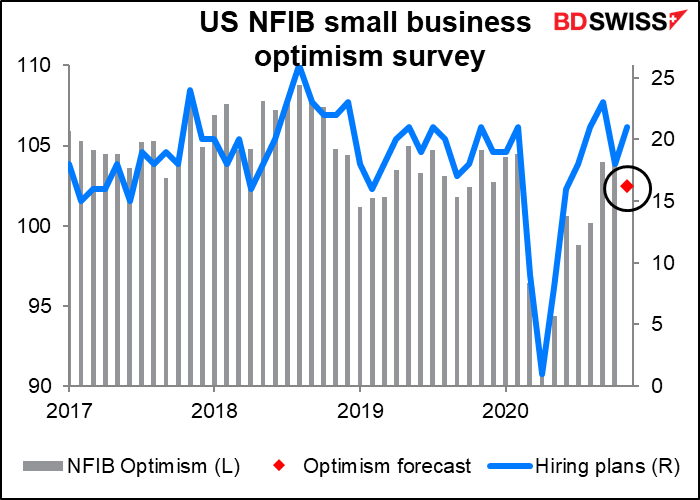

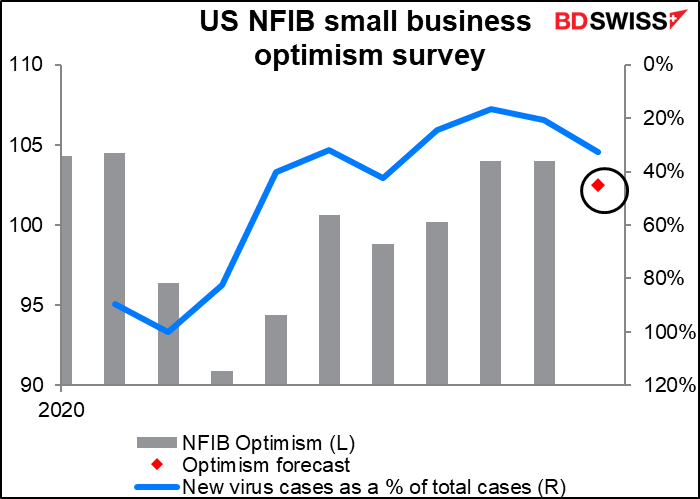

The US National Federation of Independent Businesses (NFIB) small-business optimism survey is expected to decline, although the “hiring plans” index, which comes out earlier, increased – a good sign.

The decline is probably due to the mounting (and spreading) problems with the virus. Optimism seems to fall as new cases increase. Makes sense. Although people may have hope for the vaccine, present-day reality must be rather depressing. Remember yesterday’s chart showing that just two tiny US states — North & South Dakota — combined (population 1.65mn) recently had more cases than Japan (population 126.5mn).

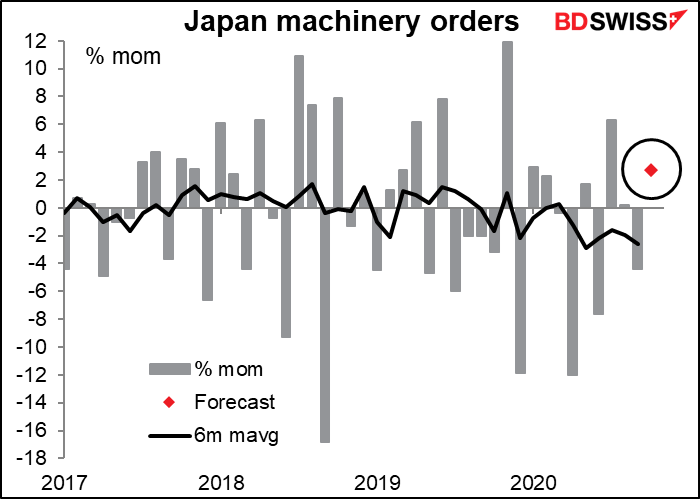

Speaking of Japan, there’s nothing else on the schedule until Japan comes in, at which point they release the closely-watched core machinery orders (excluding ships and electric power companies) figures. They’re expected to show a significant rise, although that wouldn’t be enough to drag the six-month moving average, much less the three-month, into positive territory.

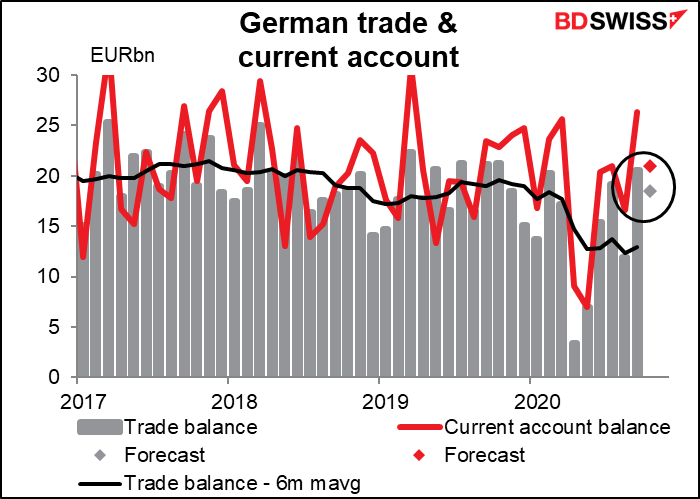

Then we can go back to sleep until Germany wakes up, and to be honest, even then we probably don’t have to be 100% awake as the German trade data aren’t particularly market-affecting. They’re expected to show a notable decline in both the trade surplus and current account surplus, which could be negative for the euro, but it could also be ignored, too.