Rates as of 05:00 GMT

(Note: the changes in the tables are from Thursday morning, as I took Friday off – as I assume many of my European readers did, too.)

Market Recap

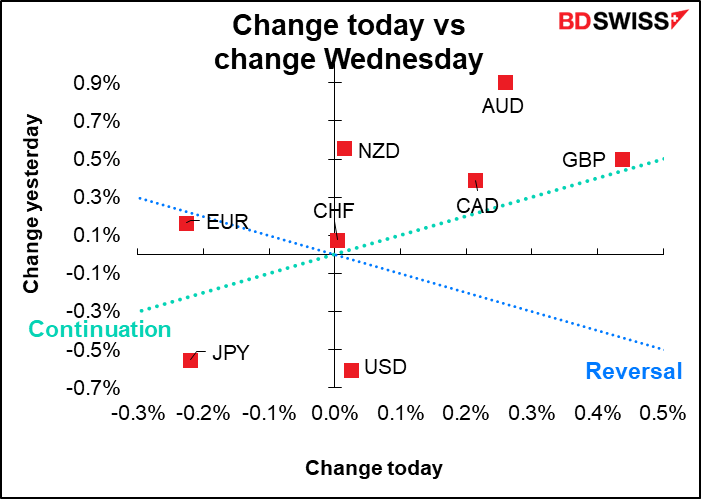

As expected, not much movement in the markets on Friday. (I was out trying to get my booster jab, but the hospital that said on its website it would be open actually wasn’t – so I have to try again.)

GBP was the center of attention. I wish I could say it was the wise leadership of their perspicacious Prime Minister that was reviving market confidence in the currency, but no such luck.

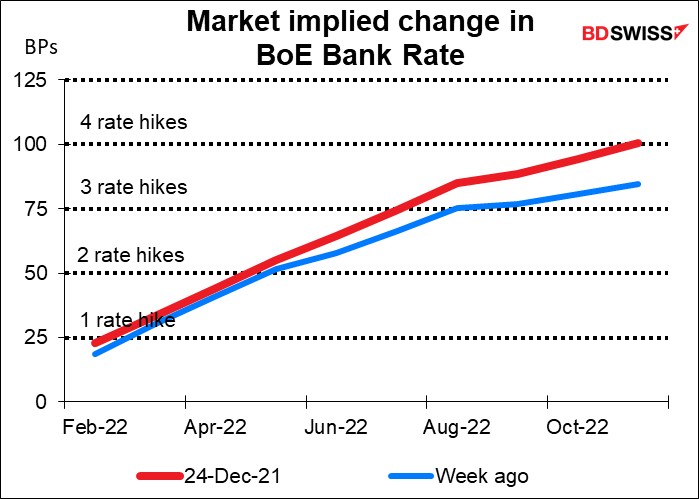

Bloomberg says it’s because of traders’ assumptions on higher interest rates in the UK during 2022 and also easing concerns about the impact of the omicron variant in global growth.

It’s true that the market’s estimate of the Bank of England’s Bank Rate has been creeping up over the last week.

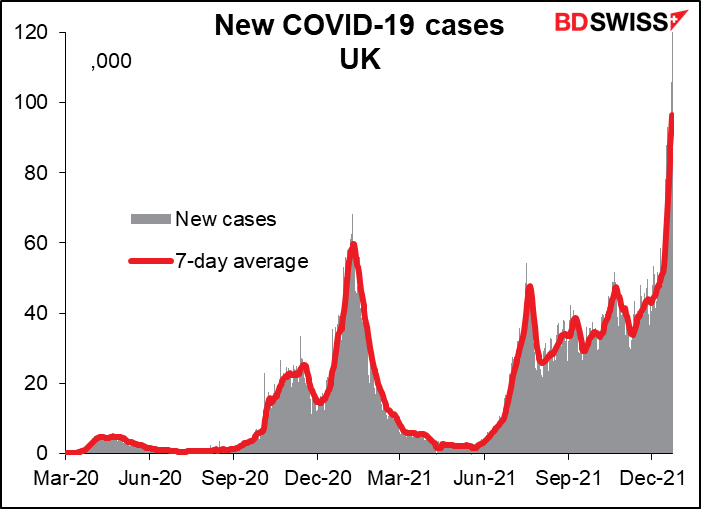

I should point out though that the graph of new virus cases in the UK is not only the highest it’s been during the whole pandemic but also shows no signs of slowing – it’s gone vertical. Meanwhile China reported the highest number of local cases since January. It looks pretty bad with regards to the number of infections.

Fortunately, deaths in the UK don’t seem to be following infections proportionately, but still, the hospitals must be getting very crowded.

Oil was also up on hopes that the omicron variant would be less severe than previous waves even if more people were infected. That helped to support CAD.

AUD was buoyed by news that the People’s Bank of China (PBoC), China’s central bank, pledged greater support for the real economy and said it will make monetary policy more forward-looking and targeted. The PBoC in particular vowed to promote healthy development of the country’s real estate market, which as we all know is in kind of a shambles nowadays as several major real estate companies teeter on bankruptcy. The statement followed the PBoC’s Q4 monetary policy committee meeting.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

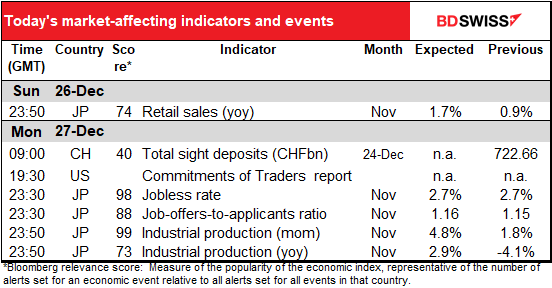

If every week of the year were like this week, it would be dreadfully boring. But once in a while it’s nice to have a week when the markets are open but there’s not that much going on. There are no indicators of any major importance whatsoever out this week, except maybe the Japanese indicators that are coming out overnight – but how important are any Japanese indicators nowadays? They have relatively little impact on the currency, which is swayed more by global risk sentiment.

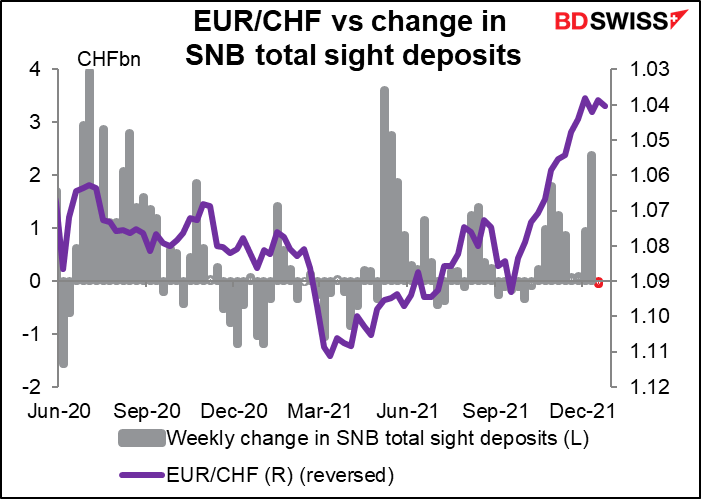

As usual, Monday morning is graced with the weekly Swiss sight deposits. I had thought the old Swiss National Bank was coming back after sight deposits increased by CHF 937mn one week and CHF 2.38bn the next, but in the most recent week deposits fell CHF 57mn even though EUR/CHF just held steady. So it looks like 1.04 for EUR/CHF is their “line in the sand,” bearing in mind of course that sand can be easily erased.

And that’s about it for the European and US day! The Dallas Fed manufacturing index comes out, but I don’t cover that as it doesn’t seem to be particularly relevant to the FX market. The weekly Commitments of Traders (CoT) report, which usually comes out on Friday, will come out today because the US was closed on Friday. It’s interesting and worth analyzing, which is why I do write about it every week, but it’s not market-moving.

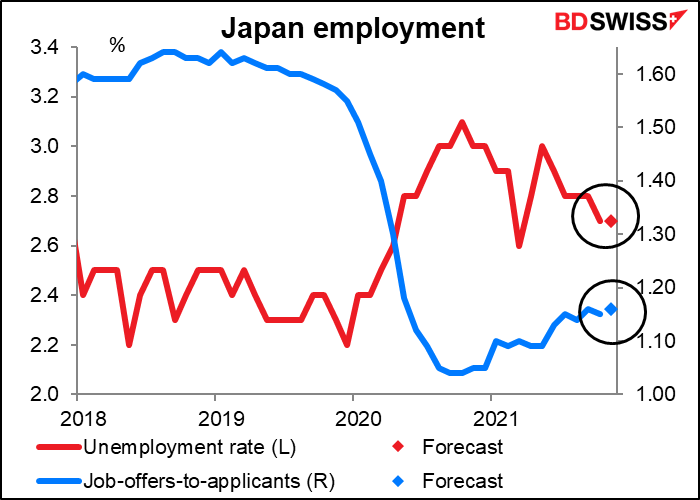

So then we go for a walk, watch some TV (I finally finished Game of Thrones — what a disappointment that ending was!) and wait for the Japan employment data. This is of some interest to me as my daughter in Japan will be entering the job market in a year, so I keenly watch the job-offers-to-applicants ratio. This is quite a good indicator of the state of the labor market and one that’s been getting some attention in the US even though it isn’t reported directly – people calculate it from the job openings reported in the Job Offers and Labor Turnover Survey (JOLTS) data. The job-offers-to-applicants ratio is particularly important in Japan because the unemployment rate is preternaturally stable because Japanese companies are reluctant to fire people (instead they now hire a lot of temporary workers, who now amount to an astonishing 30% or so of the workforce. These folks can be hired & let go on short notice.)

This month the unemployment rate is expected to be unchanged and the J-O-A ratio up one tick. I don’t think this is going to cause many people to rush out of their “year-forgetting party,” as end-year parties are called in Japan, and start trading frantically.

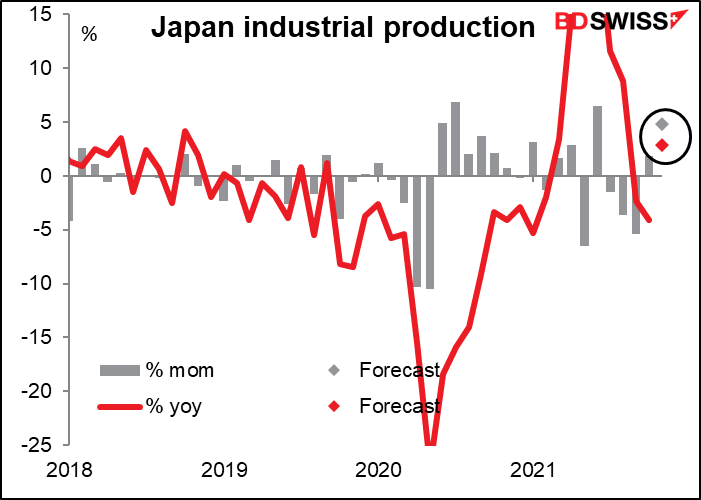

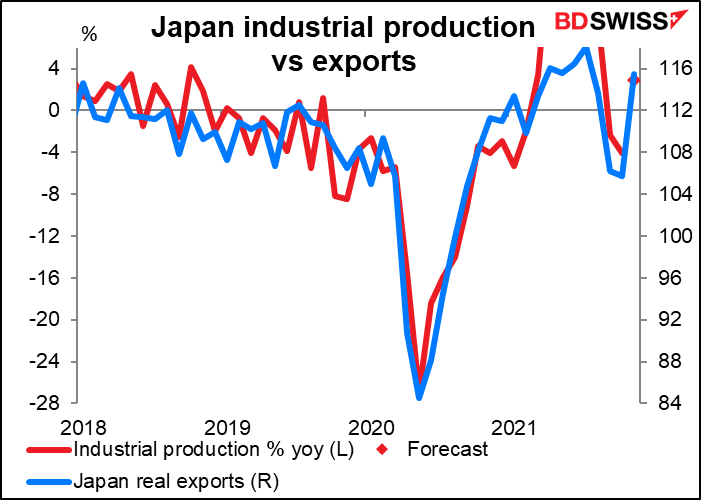

Japan industrial production is forecast to be up a lot

That goes along with the rebound in exports. Also the manufacturing purchasing managers’ index (PMI) rose to a post-pandemic high of 54.5 during the month.

With this figure, Japan should climb the global league tables a bit. Its production would be about 3.5% below its pre-pandemic level, which would still be below the Eurozone and UK level but above that of Germany, which is even more dependent on exports than Japan.