Rates as of 05:00 GMT

Market Recap

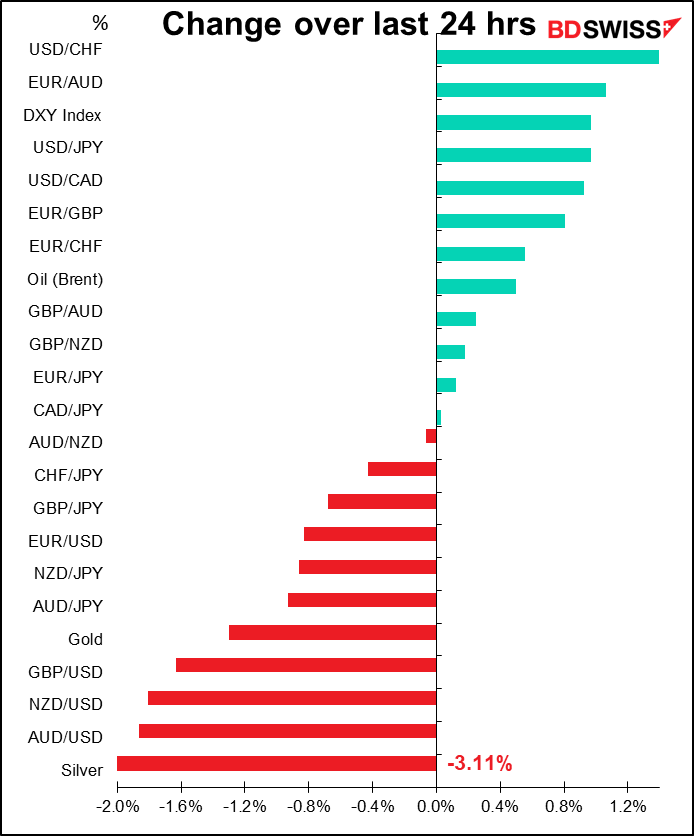

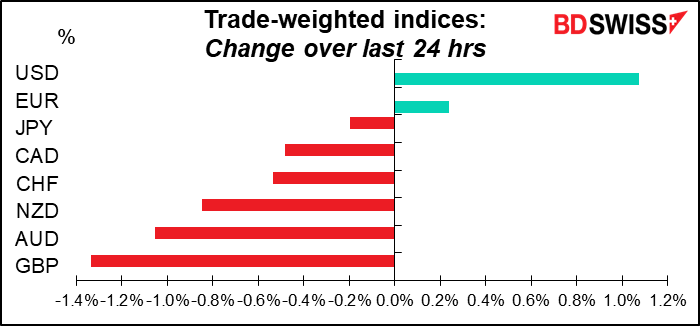

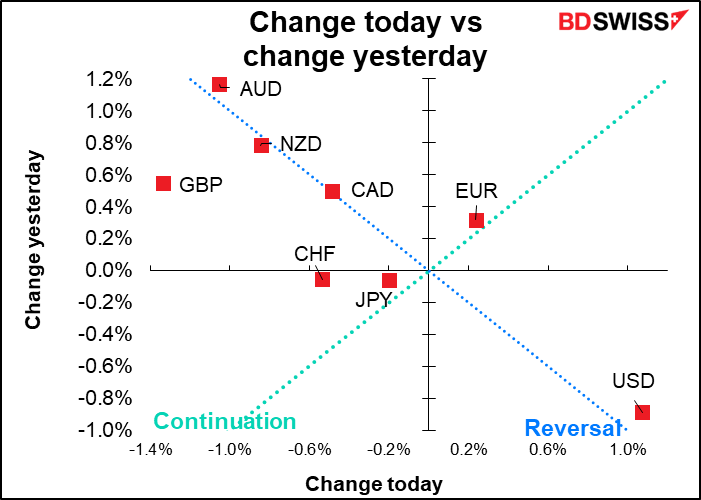

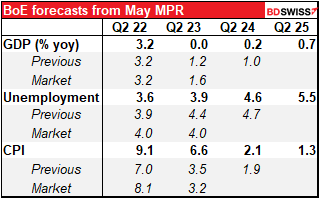

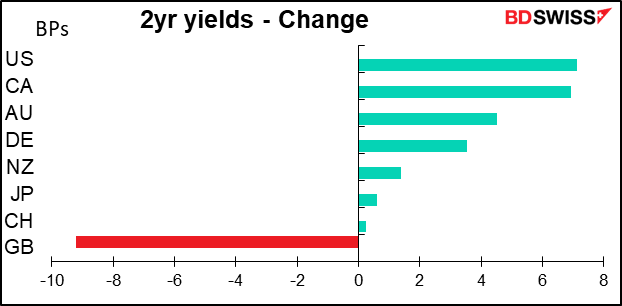

GBP was in the spotlight yesterday. The Bank of England hiked 25 bps to 1%, a 13-year high, as expected. It also confirmed that it will start selling some corporate bonds from September and “consider” selling gilts later in the year and thereby reducing its balance sheet. Furthermore, three of the nine members of the Monetary Policy Committee (MPC) dissented as they preferred a 50 bps hike. So why did GBP plunge?

Two reasons. One, while three members wanted to hike rates faster, apparently “some” members” (thought to be two) preferred a pause in hikes. This difference was reflected in a more hedged forward guidance. In March, the forward guidance read:

… the Committee judges that some further modest tightening in monetary policy may be appropriate in the coming months, but there are risks on both sides of that judgment depending on how medium-term prospects for inflation evolve.

This time however it reads:

…most members of the Committee judge that some degree of further tightening in monetary policy may still be appropriate in the coming months. There are risks on both sides of that judgement and a range of views among these members on the balance of risks (emphasis added).

They added that “most members” think further tightening is necessary, implying that some members don’t. The fact that the word “modest” was taken out implies that these members don’t think any further tightening is warranted. Furthermore, the “range of views” among the members implies that some people think balance of risks are tilted toward recession.

Secondly, they downgraded their estimates for growth in the next two years. In his opening remarks, Gov. Bailey reiterated his recent comments that the MPC was now walking a “narrow” path in fighting inflation while avoiding a recession. If growth next year is expected to be zero, then tightening monetary policy further could easily tip the economy into recession.

In short, the MPC has mixed feelings about the trade-off involved in tightening policy when growth is expected to be near stall conditions anyway.

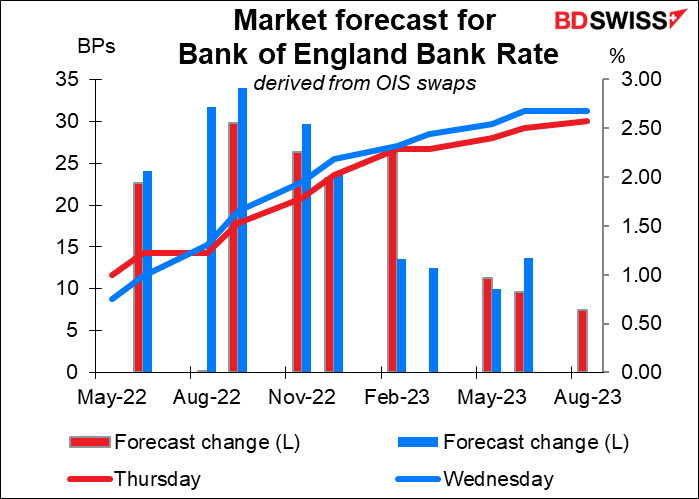

As a result, the market reduced its expectations for future rate hikes from the BoE and GBP fell.

We don’t yet know the results of the local council elections that took place across the UK yesterday, but the preliminary results haven’t been good for the ruling Conserviative Party. According to the FT they’ve “suffered significant defeats” across the UK, “including big losses in London.” However that doesn’t seem to be enough to push PM Johnson out of office. “The prime minister signalled in a WhatsApp message to colleagues on Thursday night that he was going nowhere, thanking them for their work in the local contests and declaring: “Onward!,” the FT reported. As the results of the election come it, it could pressure GBP further today.

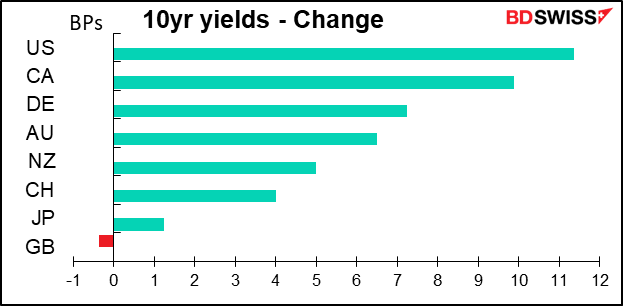

Meanwhile, USD gained as interest rates at both end of the US yield curve rose.

We don’t yet know the results of the local council elections that took place across the UK yesterday, but the preliminary results haven’t been good for the ruling Conserviative Party. According to the FT they’ve “suffered significant defeats” across the UK, “including big losses in London.” However that doesn’t seem to be enough to push PM Johnson out of office. “The prime minister signalled in a WhatsApp message to colleagues on Thursday night that he was going nowhere, thanking them for their work in the local contests and declaring: “Onward!,” the FT reported. As the results of the election come it, it could pressure GBP further today.

Meanwhile, USD gained as interest rates at both end of the US yield curve rose.

On the other hand, what we’ve seen time after time is that the USD is the ultimate safe-haven currency. When things get really bad, USD tends to gain even if US markets are tanking along with everything else.

Separately, Norges bank kept rates on hold at 0.75%, as expected.

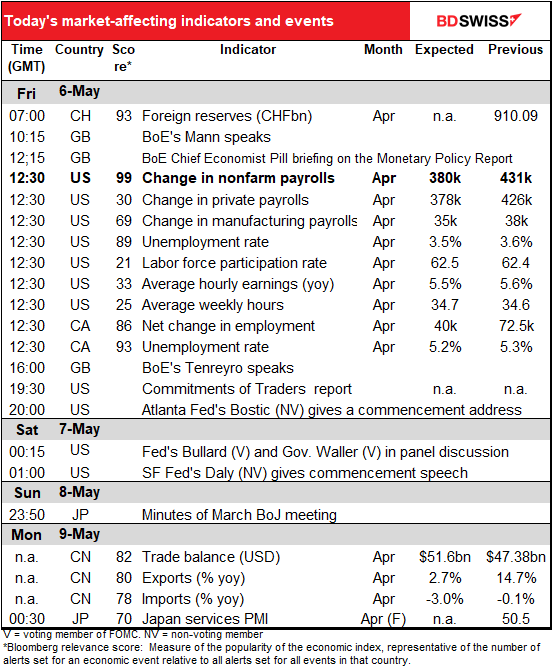

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

It’s the day you’ve all been waiting for: US nonfarm payrolls (NFP) day! The market is forecasting a fairly healthy 380k jobs, which although down from 431k in the previous month would still show strong job growth. With the Job Offers and Labor Turnover Survey (JOLTS) showing a record number of job openings, it’s clear that the only thing holding down growth in employment is peoples’ willingness to work, not the availability of jobs (well, maybe the availability of decent jobs that pay a living wage…perhaps people feel it’s not worth going to work when your job pays less than what you would have to pay in daycare & transportation).

I’m including two graphs: one shows the initial NFP series, the second shows the revised data. As you can see, 380k would be quite normal for the initial figure but would look a little low compared with the final, revised figures.

Some forecasters may have revised down their forecast after Wednesday’s slightly disappointing ADP report, which came in at 247k vs 383k expected, but the ADP report has virtually no correlation with the NFP so I’d just ignore it.

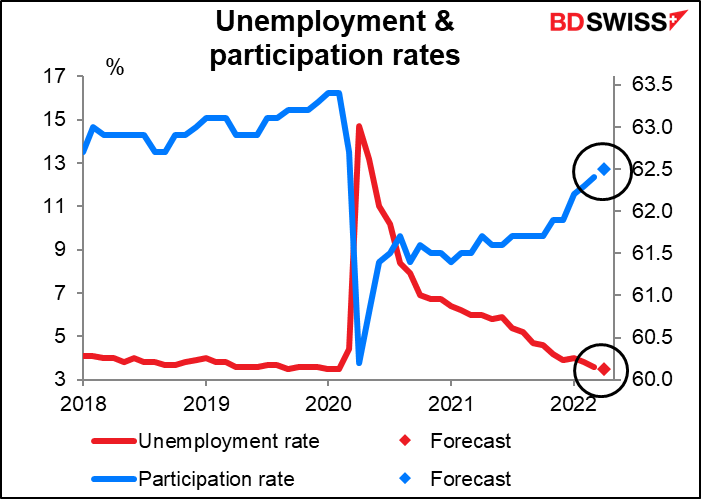

I think more important than the NFP figure itself will be the unemployment rate. It’s forecast to fall to 3.5%, tying the pre-pandemic low, which also happened to be the lowest figure in some 50 years. It’s hard to argue with that. The remaining mystery though is why the participation rate hasn’t recovered. It’s expected to inch up a bit but it’s still got a long way to go before it’s back to the pre-pandemic rate.

Even with this further increase, payrolls would not yet be back up to the pre-pandemic level.

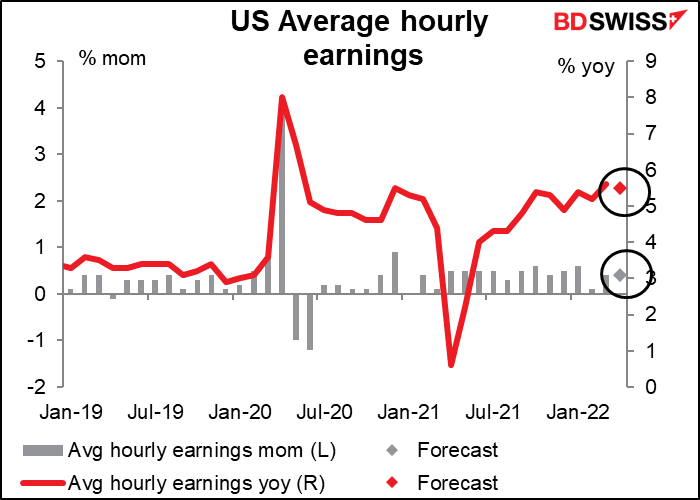

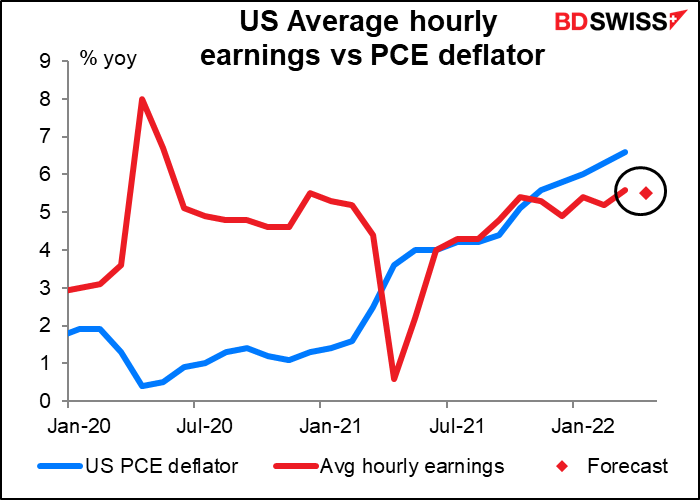

Average hourly earnings are expected to show the same mom change as in the month before with the yoy rate of change slipping slightly.

Notice though that earnings are growing more slowly than the cost of living. Does this mean we’ve avoided a wage/price spiral or that demands for higher wages will just keep coming?

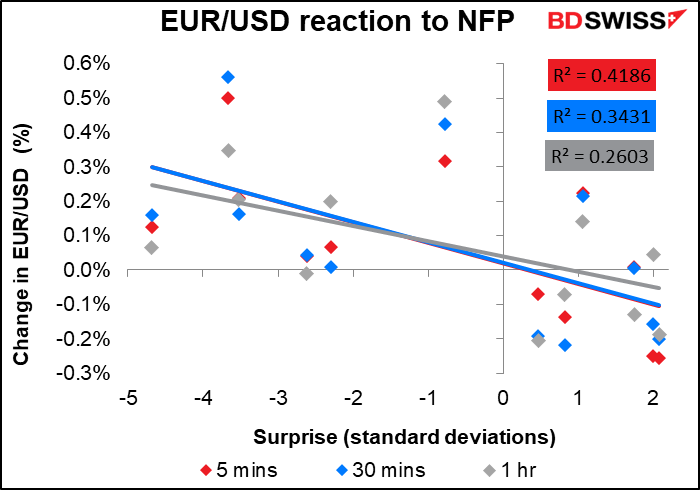

Market impact: For all the hoopla about the NFP ahead of time, it doesn’t seem to have that lasting an impact on the FX market. EUR/USD tends to be lower in the week following the figure when it misses estimates and tends to be unchanged when it beats estimates, which is of course ridiculous. It appears that the impact quickly fades and other factors must come to bear on the market.

Market impact: For all the hoopla about the NFP ahead of time, it doesn’t seem to have that lasting an impact on the FX market. EUR/USD tends to be lower in the week following the figure when it misses estimates and tends to be unchanged when it beats estimates, which is of course ridiculous. It appears that the impact quickly fades and other factors must come to bear on the market.

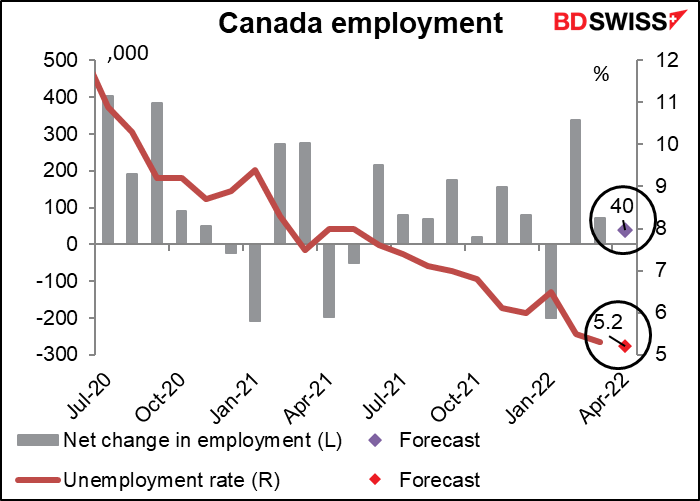

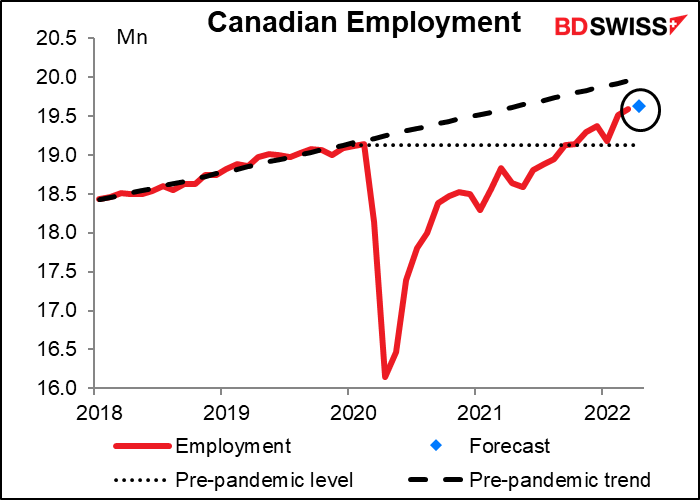

Canada also releases its employment data at the same time. It’s expected to show a further decline in the unemployment rate and a small rise in the number of jobs. I don’t think this will disappoint the Bank of Canada; on the contrary, after its April meeting the Bank said, “Labour markets are tight, and wage growth is back to its pre-pandemic pace and rising.”

So they’re probably happy to see some moderation in the pace of job gains. In any case, Canada some time ago regained its pre-pandemic level of jobs and is on its way to catching up with where the economy would be if job growth had continued at its pre-pandemic level. So as long as the number of jobs is increasing, I’d say this is CAD+.

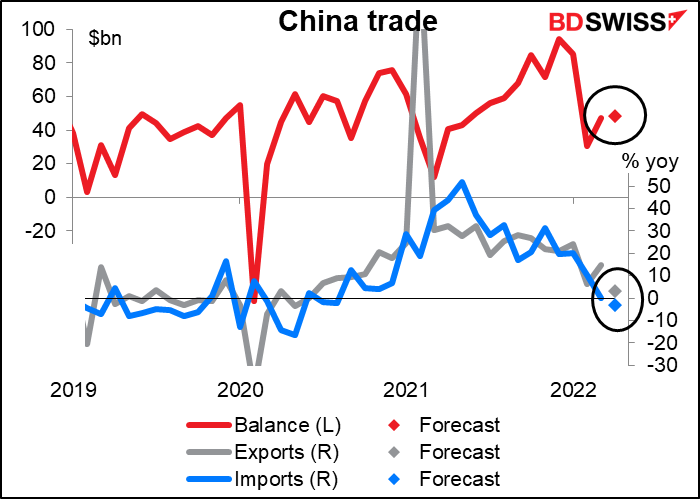

Then we can all put down our PCs or phones or whatever and head out for the weekend! But make sure to log in Sunday night (Monday morning in Asia) for the China trade figures.

The nation’s trade surplus is expected to rise slightly as exports rise a little bit and imports fall a little bit. It’s not clear to me whether the market just looks at the balance and says “oh, that must be good for AUD” or looks at the details, which in this case would be negative for AUD. I suspect that the headline figure is what dominates the market reaction and therefore the figure would be positive for AUD.