1. Forex Preview: TRY Down 2.1% After Erdogan Dismisses Central Bank Governor

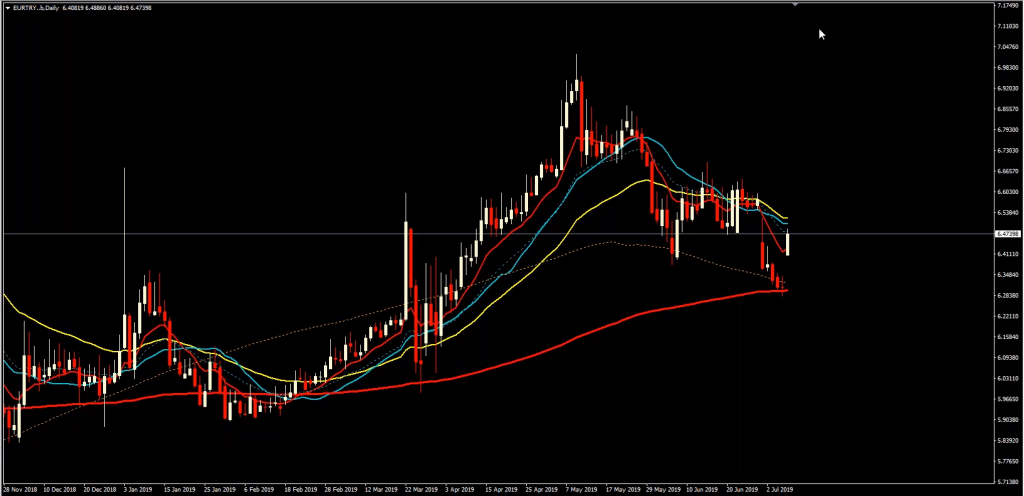

TRY lost heavily as the Turkish President Erdogan did what Trump would like to do with Powell. Erdogan sacked his present head central banker, most likely because he wanted to see rate cuts. The TRY lost as much as 2.1% against the dollar and 2.2% against the EUR this morning. Elsewhere, the USD held on to most of its Friday gains on Monday but might have a hard time to decide on either direction, until we get more clarity from the fed or the stock markets make a move. Meanwhile, the EUR remained under pressure on a set of disappointing Industrial data out of Germany and could extend declines later in the day.*

2. Strong NFP Dampens Rate Cut Expectations

Last Friday’s NFP’s were surprisingly strong and gave the USD an uplift; stock markets saw a bit of a dip, but later managed to recover. Global equities have generally been boosted on Friday by rising expectations that central banks will keep interest rates at or near record lows to boost economic growth; however, a stronger than expected NFP on Friday turned the tables and dampened expectations that the US Federal Reserve will slash interest rates at its upcoming meeting. Today, EU bourses edged lower while U.S. stock futures are also trading lower as markets remain uncertain over the course of the Fed’s future monetary policy.**

3. Gold Inches Higher, More Bulls Ahead?

Gold prices inched higher on Monday following a steep fall in the previous session, as a robust U.S. jobs report pushed the dollar higher, dampening demand for the dollar-denominated metal. Spot gold was last up 0.6% at $1,406.83 per ounce as of 7:55 GMT this morning. It should be noted that XAU/USD fell more than 1% on Friday, marking its first weekly decline in seven weeks. Spot gold could be en route to reclaiming recent highs if stock markets should get into trouble.***

You can find and trade CFDs on all of the above-mentioned assets on BDSwiss Forex/CFD platforms.

Sources:

*FXStreet Jul 8, 2019 03:07 AM ET

**Reuters Jul 8, 2019 3:53 AM ET

***CNBC Jul 8, 2019 2:48 AM ET