Usually in this weekly comment I start by discussing the factors that have been moving the market recently and how I think they are likely to develop, which forms the background for how I see the FX market developing. Nowadays though there are only two factors of interest: 1) the rate at which COVID-19 is spreading, and 2) the policy response by officialdom. Everything else is irrelevant. Since I have no special knowledge of epidemiology and no one knows what the politicians will come up with or when, I will refrain from talking about things I know nothing about and continue to focus on talking about things I know little about but just enough to sound good.

But first, I would like to take a moment to explain why I think the US is in serious, serious trouble in dealing with the coronavirus. The US has an exaggerated sense of the value of the individual that will make it difficult to enforce the kinds of restrictions necessary to stop the progress of the virus. US society puts priority on the rights of the individual over the individual’s responsibilities to the broader society. From the time of its founding, the “rugged individual” was the ideal in the US. Even now, so many people think that their rights are inviolable no matter how those rights impose on the group as a whole – just look at the opposition to getting rid of even AK-47s in America, much less other guns.

Look at the following tweet. I didn’t make this up. This is what I expect the typical response will be from many Americans, aided of course by the Tweeter-in-Chief, who until recently was pushing the line that the virus would “go away” and that the “fake news media” was blowing it out of proportion. Naturally, this lady is a Republican. No surprise then that she also has another tweet saying “The media wants you to freak out. Don’t let them dictate your life.”

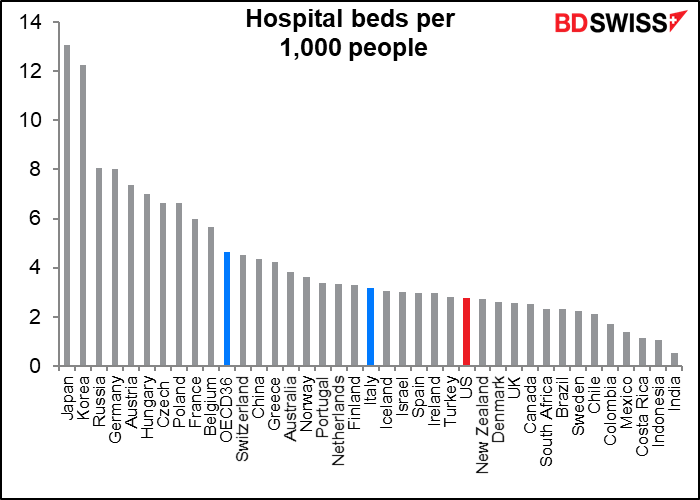

Added to this the fact that the US is woefully unprepared in terms of the availability of testing kits and hospital beds. Furthermore, the recently enacted fiscal package still leaves about 80% of the workforce potentially without sick leave. The country has a disaster in the making – in my view potentially the worst of any of the other G10 countries (except maybe the UK). Probably worse than China, which could quickly impose a draconian shut-down on its people. The EU response hasn’t been great but at least those countries have woken up to the problem and are taking steps. The US? Barely. It has totally squandered the head-start that it got. (If you want to see what the US reaction could’ve been, see How Taiwan and Singapore Have Contained the Coronavirus. Unfortunately Trump fired the people who would’ve been responsible for implementing such measures and disbanded that function.)

I think the US faces an unmitigated disaster that’s liable to send the dollar even lower.

My conclusions:

- The later they start, the harder it is to get the virus under control. You can see just what would have been possible by looking at Singapore and Taiwan’s response to the virus. Since the US started to deal with the problem so late, the end game is going to be more like Italy than Taiwan.

- It seems almost inevitable that the US will fall into recession.

- If the US – the biggest economy in the world – is in recession, can other countries grow?

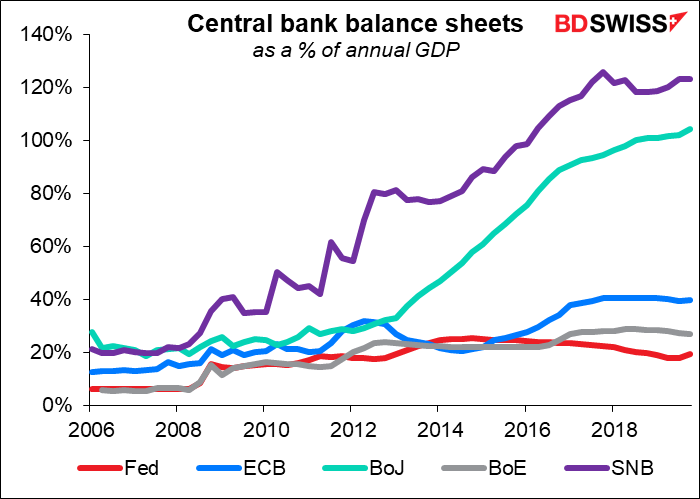

- Once again we will have a convergence of interest rates at the zero bound. Quantitative easing will be the norm as central banks will have to pick up the tab for the fiscal support that will be necessary to get economies over this period.

- In that case, what will differentiate markets? What will cause one currency to rise and another to fall? I believe it will be a FIFO market: first in, first out. The currencies of those countries that took the earliest steps to deal with the crisis, both financial and medical, will be the first to emerge, and their currencies are likely to do best.

- In that respect, I think the Eurozone, for all its problems, is coming to grips with the crisis better than the US. I would expect the EUR to gain further. JPY has done well and may continue to gain on “risk off” sentiment, but I’m not certain about Japan. We hear little about their medical problems, but that may just be the notoriously opaque government hiding everything. Australia and New Zealand were quick to institute solid health measures; with China starting up again, I think those currencies could rebound early as well. CAD too, although there I think the weak oil prices will continue to weigh on the currency. USD is likely to come in last as the US lags behind the rest of the world in dealing with COVID-19.

The main thing supporting the dollar though is the huge demand from borrowers, which could cause a dollar shortage that keeps the currency supported for some time.

Central bank meetings: FOMC, BoJ, SNB

Originally I had a big section here giving my expectations for this week’s FOMC, BoJ and SNB meetings. However the Fed and BoJ have already moved, making those sections irrelevant. So I’ve just cut out the sections on what I expect for the Fed and BoJ and left in some of the analysis.

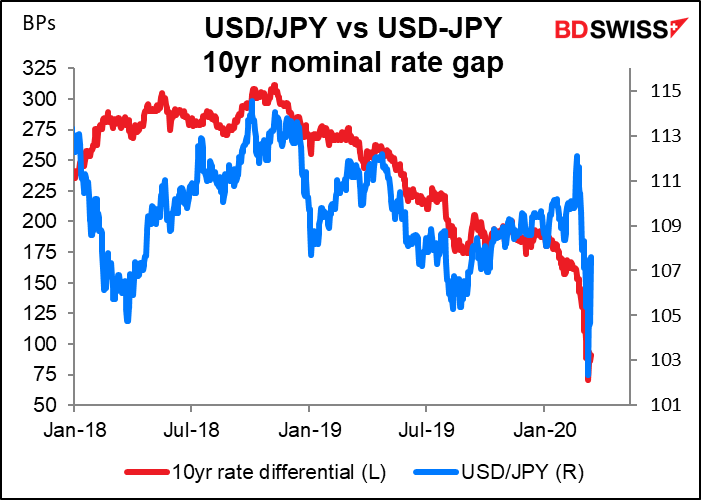

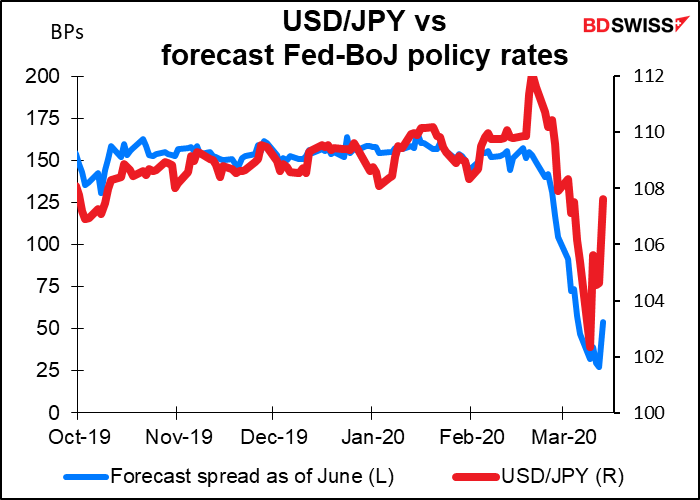

The BoJ is not well placed for an “easing contest.” They’ve already run into problems with their negative deposit rate – there’s a lot of concern that it’s already near the “reversal rate,” the rate at which lowering interest rates more causes banks to lose so much money that they pull back on their lending. That’s why at most two more cuts are priced in, bringing the balance rate down to around -0.30%, not as far as the ECB or SNB have gone. Furthermore, under the current yield-curve control (YCC) regime, the BoJ is committed to keeping the 10-year JGB yield around zero. As other central banks step up their asset purchases, spread vs JGBs are liable to narrow, thereby causing the yen to strength – just what they don’t want.

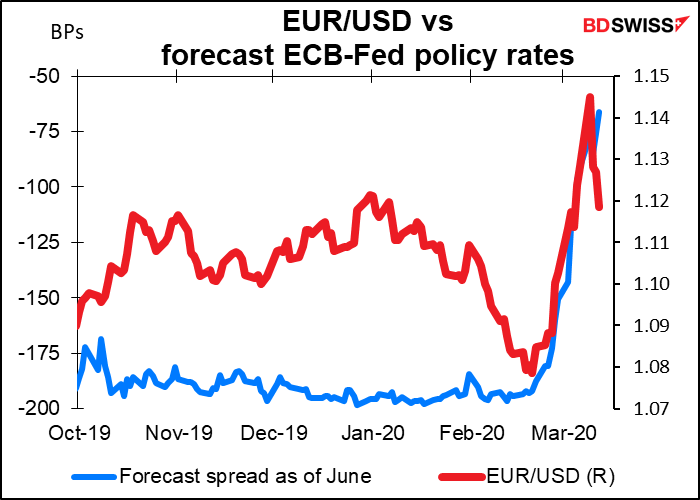

The expected spread in policy rates between the two currencies is one of the medium-term drivers of USD/JPY, although on a minute-to-minute basis, risk aversion and the ups and downs of the stock market are probably more important.

Same with EUR/USD, by the way, although not with AUD (see today’s daily).

The SNB is in a difficult position. They can’t lower rates further, and they’ve already blown their balance sheet up tremendously. Since they’re one of the few central banks that buy equities as well as bonds, they are now one of the major shareholders in many large companies (e.g. 30th largest shareholder of Apple, #38 in Microsoft, etc. You can see their shareholdings here.) It’s hard to think what else they might do now. Accordingly, I expect them once again to repeat their determination to hold the line on EUR/CHF and their willingness to intervene in the FX market if necessary, but I don’t expect them to lower rates or enact any new QE programs. The most I could see is some targeting lending programs, like other central banks have done.

This week’s indicators: does anyone really care?

There are a number of indicators coming out this week that would usually sway the markets, but for now, I’m not sure how much attention investors will pay to them. That’s because there’s likely to be a huge discontinuity between yesterday’s data and tomorrow’s data – a break in the data. People normally look at the past to extrapolate into the future, but we can’t do that now. Today is so different from yesterday and tomorrow will be so much more different that even recent data won’t give us much of an indication of where we’re headed. Because of this fact, it’s more important than ever to know exactly when the data were collected.

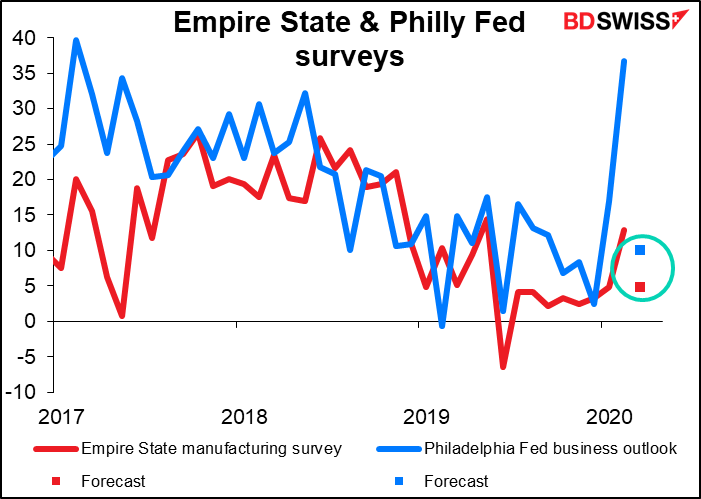

In that respect, I’d say the most important data coming out for the US economy are the first two of the Fed’s monthly surveys, that is, the Empire State manufacturing survey (Monday) and the Philadelphia Fed business survey. Both of these are at least for March. They are perhaps the most up-to-date information available. The NY Fed survey is mailed out on the first day of each month and most forms are returned by the 10th of the month, although they are accepted until the 15th. The Philly Fed survey, which is released later, begins earlier: surveys are mailed out near the end of each month, and are returned by the end of the first full week of the following month. So we can expect that they reflect the situation in those two districts in the first week of March, which is only a few days ago.

The NY Fed surveys “about 200 manufacturing executives,” while the Philadelphia Fed surveys “about 250 large manufacturing firms.” The total of 450 companies is actually quite a large number for such a small region. By comparison, the HIS Markit purchasing managers’ index (PMI) and the widely watched Institute of Supply Management (ISM) PMI both cover around 800 companies, but that’s from across the entire country.

Both surveys are expected to be sharply lower, but to remain in positive territory. That would be great news, although I’m not sure how relevant it is for now – so much activity has shut down, at least in the service sector (both of these surveys are of manufacturing enterprises, which has been hit less than service-sector companies). I think any positive number would be positive for the dollar, if indeed the markets are responding to economic data.

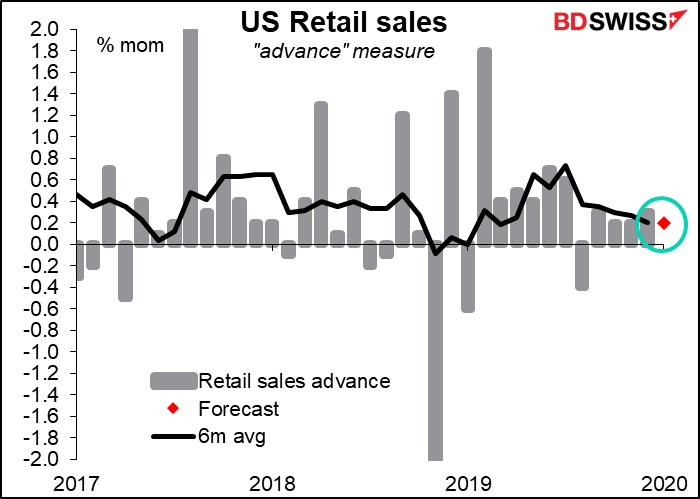

The other major US indicator out this week is US retail sales. This covers “activity taking place during the calendar month.” The Bureau of Economic Analysis (BEA) conducts follow-up telephone interviews “beginning on the third business day after the reference month.” “Data collection is completed by the sixth business day following the end of the reference month.” So this data too is relatively up-to-date. The question is, when did people in the US start panic buying toilet paper and hand sanitizer? I suspect that that was March activity, not February. We may therefore see an artificial boost to the March data that would be the harbinger of a collapse in April.

In any event, the February figure is forecast to be consistent with the recent trend, which could be positive for the dollar. The Fed is counting on consumer spending to support the US economy, and a figure like what the market expects would show that indeed that was happening up to the time the virus became an issue. People with disaster on their minds might find that reassuring.

Other noticeable US indicators out during the week include industrial production and the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday. There are also several housing-related indicators, including the National Association of Home Builders (NAHB) survey on Tuesday, housing starts & building permits on Wednesday, and existing home sales on Friday.

For the Eurozone, the main point of interest will be the Eurogroup/Ecofin meeting of the EU finance ministers today, followed by the Economic and Financial Affairs Council meeting tomorrow. The official agenda for today’s meeting says “Ministers will take stock of the economic situation and discuss responses to the economic policy challenges related to the COVID-19 outbreak.” Friday, the European Commission issued a statement saying it “will use all the instruments at its disposal to mitigate the consequences of the pandemic…” The statement then goes on to explain how under the current situation, spending limits are suspended and fiscal measures to deal with the crisis are encouraged. Measures will have to be taken at the national level though, so we should be looking for announcements from individual countries throughout the week on just what measures they plan to take to support their economies.

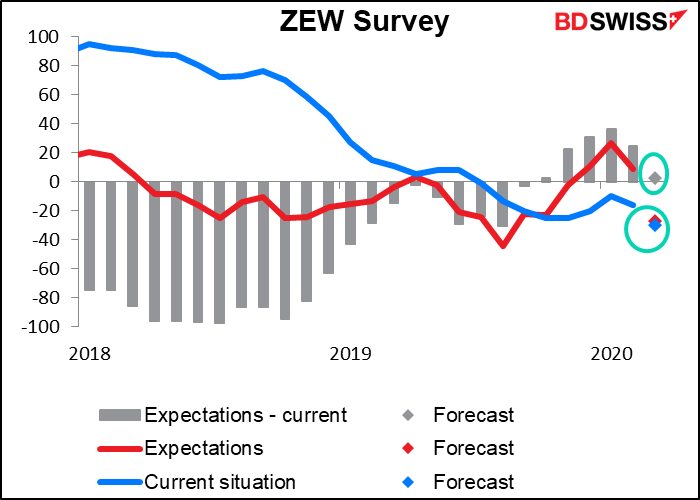

As for the EU indicators, the main one, such as it is, will be the ZEW survey of analysts and economists. This is expected to show a dramatic shift. Both indices are forecast to fall of course, but what’s striking is how the “expectations” index is expected to go from slightly positive to almost as negative as the expectations index. In other words, the improvement that analysts were expected – measurable by the positive “expectations minus current” figure – has now turned to zero, meaning people not only think things are bad now, but that they won’t get any better. Pretty grim! Ordinarily this might be negative for the euro, but I don’t think people anywhere else in the Western world are any more optimistic nowadays.

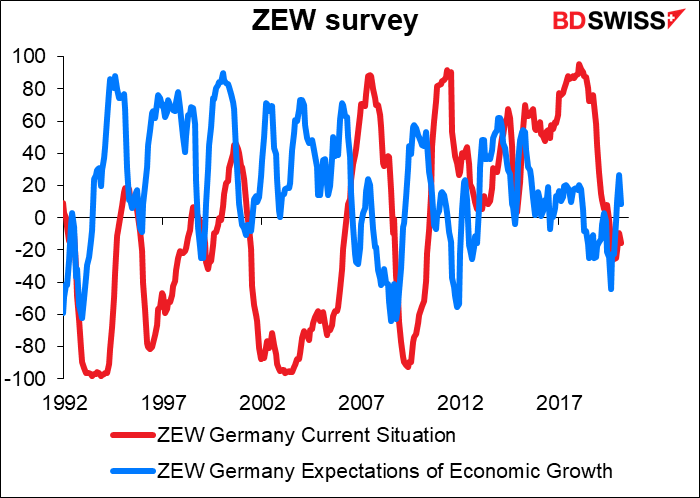

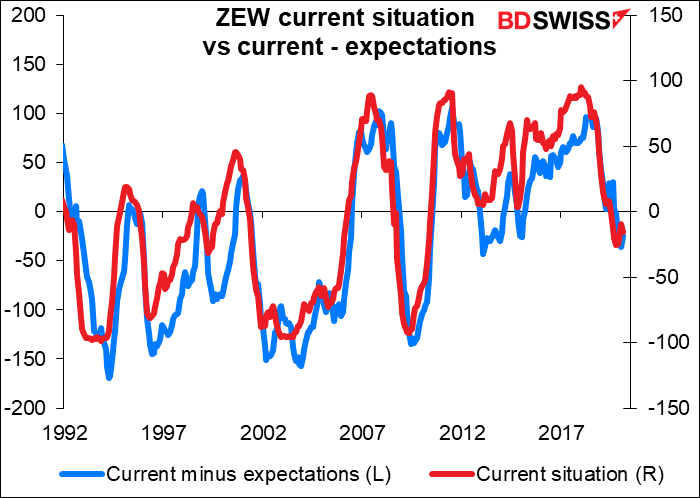

Usually the ZEW survey is mean-reverting; that is, when things are good, people think the future will be less good, and when things are bad, people think the future will be better.

We can see this better if we subtract the expectations index from the current index. That’s not the appropriate way to do it – for example, if the current situation is 10 and the expectations index is -10, meaning people expect things to get worse, subtracting the expectations from the current index would give a positive 20. Negative 20 would be more appropriate, indicating an expected deterioration. Nonetheless, doing it this way reveals the fact that the gap between the two basically follows the current index.

That’s why the current situation is relatively unusual. The ZEW survey started in 1991, meaning there have been 339 samples Of these, only 37 times (10.9%) have both indices been negative, as is forecast for March. Usually when things are bad, they’re expected to get better.

Note though that things could be worse. The March consensus forecast for the current situation is -30.0, which is still slightly higher than the forecast for the expectations index (-27.2). At least analysts don’t expect things to get much worse than they are today. There have been only 13 times (3.8%) when the current situation index been negative and the expectations index been even more negative. Three of those months were last year (July, August and September).

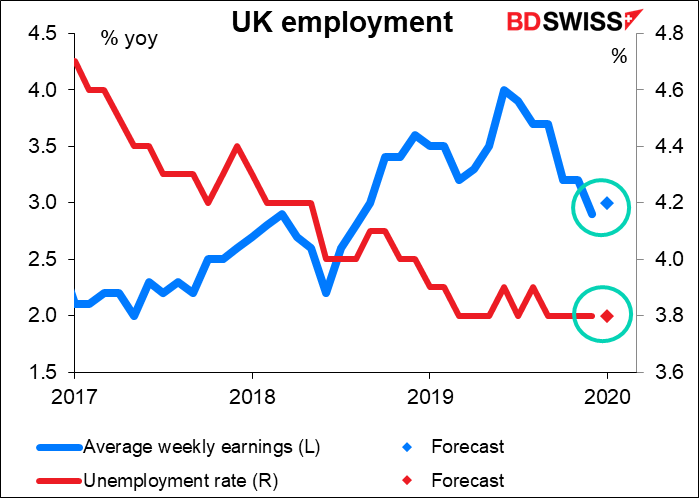

For Britain, the only major indicators out during the week are the employment data on Tuesday. These figures are for January and so of even less interest than the US and German data, especially now that the UK government has settled on a strategy of developing “herd immunity” – i.e., let everyone get infected and allow the weak to die off and the strong to recover, thereby leaving the “herd” immune to the disease in the future. Think of how much money that will save the National Health Service, not to mention rescuing many pension schemes!!! I’d be really excited if I were 10 years old and British – except I might be a bit worried about my Mum and Dad, not to mention Nana and Papa, who are probably doomed. But the reduced number of OAPs, as they’re called in Britain, will leave local authorities with more money to spend on children, so if I have to be taken into care I’ll probably be OK.

That is, if such a thing as “herd immunity” exists with this virus. The evidence is that it doesn’t, but that people who have had the virus once and recovered can get re-infected, as indeed happened to a man in Japan. In that case…well, maybe the EU won’t feel so bad about Brexit after all.

Anyway, the UK unemployment rate is expected to be unchanged at the recent rate of 3.8%, which is the lowest since 3.7% in December 1974. The change in average earnings is expected to tic up a bit to 3.0% from 2.9%. Overall, the figures are expected to show little change in the UK employment situation ahead of the crisis, which is encouraging – continuing with such good employment conditions could be positive for the pound, assuming that the news isn’t lost in news of virus-related deaths or some new idiotic comment on the UK-EU trade negotiations. That’s a big assumption.

Meanwhile, everyone will be waiting to see the Bank of England meeting the following week (26 March). Despite the unusual between-meeting 50 bps cut last week to coincide with the 2020 Budget, the market expects the Monetary Policy Committee to lower bank rate by another 10 bps or so to a record low 0.16% from the current 0.25%.

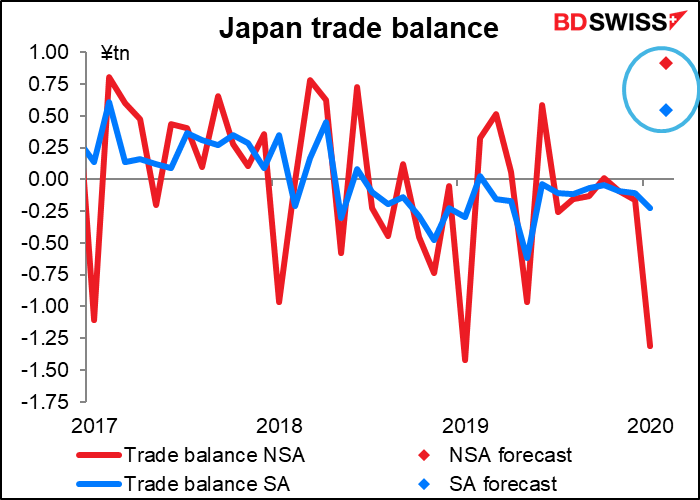

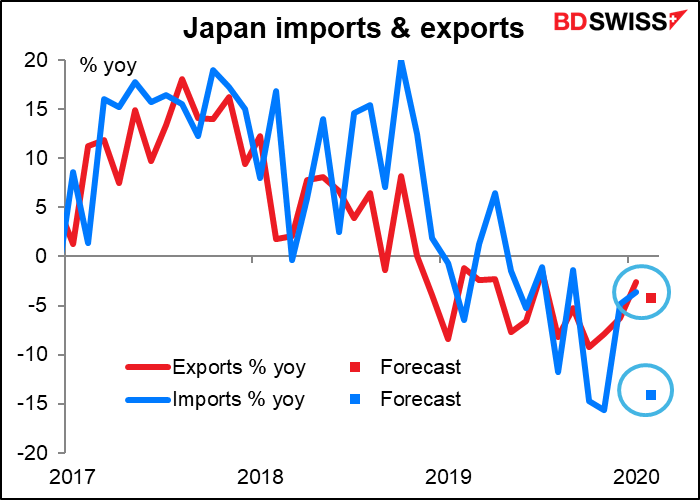

For Japan, The Land Where Economic Indicators Don’t Matter, we get the trade balance on Wednesday morning and the national CPI on Thursday morning (along with the Bank of Japan meeting). There’s also a national holiday on Friday. The national CPI is usually an afterthought after the Tokyo CPI and will be even more irrelevant a few hours before the BoJ meeting. The trade data on the other hand is a worthwhile indication of the global impact of China’s travails. In this case though Japan’s trade deficit is forecast to switch to a sizeable surplus on both an adjusted and unadjusted basis.

I’m not sure whether that’s good news though because it’s predicated on a collapse in imports, which are forecast to be down 14.1% yoy (vs a 4.2% yoy fall in exports). A collapse in imports that’s attributable to a slowdown in economic activity isn’t usually good for a currency. However, if it’s due to a fall in oil prices, then it’s good news. In this case it does correspond almost exactly with the 14.0% yoy fall in the average price of Brent crude during the month. It could just be that the lower oil price is reducing Japan’s import bill and sending the trade account back into surplus. That would be good for the yen even if demand from China weakens. On the other hand, if it’s because of falling domestic demand, then the market impact may be muted.

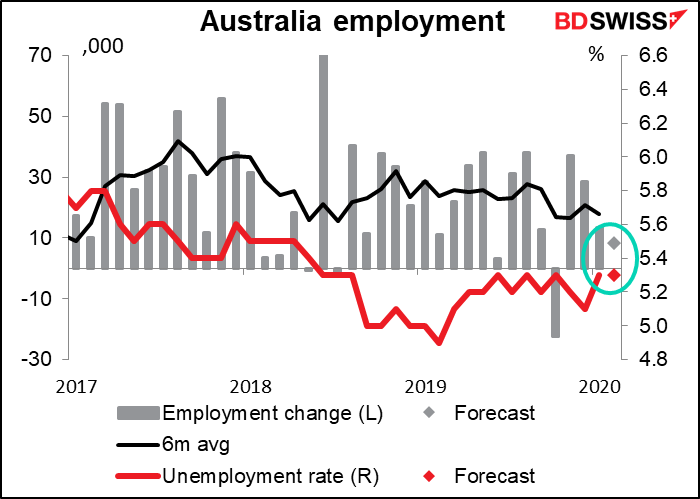

Finally, I should mention that Australia announces its February labor market data on Thursday. I mention this because the Reserve Bank of Australia (RBA) has singled out the labor market as the key indicator for its monetary policy. That view may be old though as the pandemic has taken precedence; we can learn more about that question on Tuesday, when the minutes of the 3 March RBA meeting will be released. In any event, for those who are still watching the indicators, the unemployment rate is expected to remain unchanged while the change in employment is expected to be somewhat less than the previous month but still positive. I think the figures don’t show any major change in the trend from the previous month and therefore should be neutral for AUD.