PREVIOUS TRADING DAY EVENTS –01 Nov 2023

- U.S. job openings increased in September as per the figure to 9.55M, suggesting a persistent labour market tightness that is supporting the economy. The JOLTS job openings report from the Labor Department on Wednesday also showed layoffs dropping to a nine-month low.

The U.S. central bank left rates unchanged on Wednesday as expected. The USD weakened significantly after the news came out.

“Demand in the overall economy is not slowing down,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “The market has taken rate hikes down off the table for this year, but for how long if the labour market remains tight.”

The job openings rate was unchanged at 5.7%. Hiring increased 21,000 indicating that some companies continued to experience difficulties finding workers. The hire rate was unchanged at 3.7%.

Labour market resilience is driving economic growth.

While the JOLTS report suggested labour market conditions remained tight, the ISM said its measure of factory employment declined sharply in October. According to the ISM, responses from companies in the survey “indicate a slowdown in hiring,” and “an increase in staff reduction activity.” It also noted that “attrition, freezes and layoffs to reduce headcounts increased during the period, with layoffs the primary tool, indicating a more urgent need to reduce staffing.”

“The labour market has cooled off from its 2021 highs, but demand for workers is no longer dropping off,” said Nick Bunker, director of Economic Research at Indeed Hiring Lab. “The prospects for a ‘soft landing’ still look good.”

Source:

https://www.reuters.com/markets/us/us-private-payrolls-miss-expectations-october-adp-2023-11-01/

- The Federal Reserve held interest rates unchanged as expected. Policymakers struggled lately to determine whether the latest economic data are giving enough information regarding the effects of elevated interest rates on the economy.

Fed Chair Jerome Powell said the situation remained something of a riddle, with U.S. central bank officials willing to raise rates again if progress on inflation stalls. In the press conference, Powell said the better course of action for now, given the uncertainties, was to maintain the Fed’s benchmark overnight interest rate in the current 5.25%-5.50% range and see how job and price data evolve between now and the next policy meeting in December.

“We’re not confident that we haven’t, we’re not confident that we have” reached that sufficiently restrictive plateau, Powell told reporters. “Inflation has been coming down, but it’s still running well above our 2% target … A few months of good data are only the beginning of what it will take to build confidence.”

“These higher Treasury yields are showing through to higher borrowing costs for households and businesses. Those higher costs are going to weigh on economic activity to the extent this tightening persists,” Powell said, taking particular note of 30-year fixed-rate home mortgages that are nearing 8%, close to a 25-year high.

U.S. stocks rose in value after the release of the policy statement, while the U.S. dollar still weakens against a basket of currencies. U.S. Treasury yields fell and traders of short-term U.S. interest rates added to bets the Fed was done raising its policy rate.

“The statement leans to the dovish side,” said Peter Cardillo, chief market economist at Spartan Capital Securities. “The fact that they left rates unchanged for the second time in a row suggests the Fed might leave rates unchanged in December. And if they do, that means the Fed is done.”

______________________________________________________________________

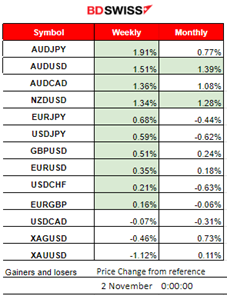

Winners and Losers

- The AUDJPY pair is leading as the AUD appreciates against other currencies quite significantly this week. Gains 1.91% so far.

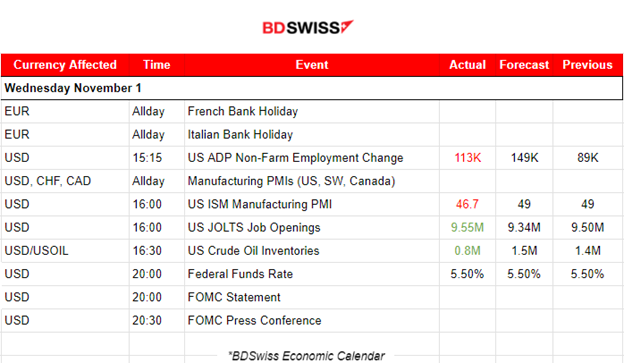

News Reports Monitor – Previous Trading Day (01 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

Manufacturing PMI releases:

Swiss

The Manufacturing sector remains in deterioration as the report shows the devastating figure of 40.6 points which is also way lower than the expected 45 points figure.

U.K.

A downturn in manufacturing continues at the start of the fourth quarter also for the U.K. The manufacturing PMI shows a 44.8 figure, lower than expected confirming that business conditions in that sector remain grim and in contraction. The BOE is deciding on rates today at 14:00.

Canada

The Canadian manufacturing sector downturn was sustained as per the report showing a PMI of 48.6, below the 50 threshold that separates contraction from expansion. Output and orders both fell. Job cuts were sustained. Input price inflation jumped, and concerns that high prices would persist combined with the possibility of recession caused confidence to drop.

U.S.

We again see that the business conditions in the U.S. are in a better position. The U.S. manufacturing conditions look stabilised. The PMI for manufacturing was reported at 50. Businesses experienced a back-to-back expansion in output and a renewed rise in new orders. However, demand conditions were historically muted overall, with firms downwardly adjusting their output expectations.

The U.S. ADP Non-Farm Employment change figure was reported at 113K vs the expected 149K but higher than the previous figure. In any case, the figure is low. Annual Pay was Up 5.7%. This employment figure could serve as a potential sign that the employment picture could be worsening. No major impact was recorded at the time of the release but a low level of depreciation for the USD soon after the release at 15:15.

At 16:00 the U.S. ISM Manufacturing PMI reported at 46.7 points suggesting that economic activity in the manufacturing sector contracted in October for the 12th consecutive month following a 28-month period of growth. It was 2.3 percentage points lower than the 49 percent recorded in September. The overall economy dropped back into contraction after one month of weak expansion. At the same time, the JOLTS Job openings report showed 9.6M more jobs on the last business day of September. Just 22K more jobs than the expected figure. At the time of the release, no major impact was recorded. The dollar index remained close to the mean.

The Fed eventually met expectations by keeping the Fed Funds Rate at 5.5%. Policymakers stated that recent indicators suggest that economic activity expanded at a strong pace in the third quarter with still strong Job gains and with an unemployment rate remaining low. However, inflation remains elevated. The Committee remains highly attentive to inflation risks and aims to achieve maximum employment and inflation at the rate of 2%. The market does not expect a further rise in interest rates. Powell stated that it is now that we see the effects of the previous month’s hikes. The dollar index opened with a gap downwards today.

FED’S POWELL: THE BIGGER PICTURE IS WE ARE MAKING PROGRESS ON THE LABOUR MARKET, INFLATION, AND VERY FOCUSED ON GETTING POLICY SUFFICIENTLY RESTRICTIVE.

General Verdict:

- Increased volatility as we got more close to the Fed’s rate decision, FOMC report and press conference.

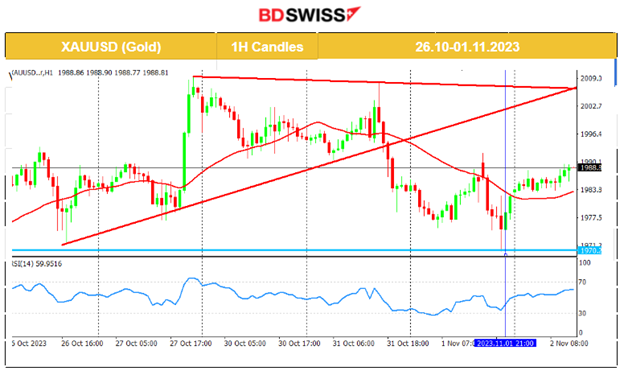

- Gold during the Fed News dropped near 5 USD to 1970 USD/oz and reversed back. Oil also dropped to 80.15 and reversed as well. The dollar weakened significantly as expected.

- S. benchmark Indices moved to the upside and reversed significantly after the press conference yesterday.

____________________________________________________________________

FOREX MARKETS MONITOR

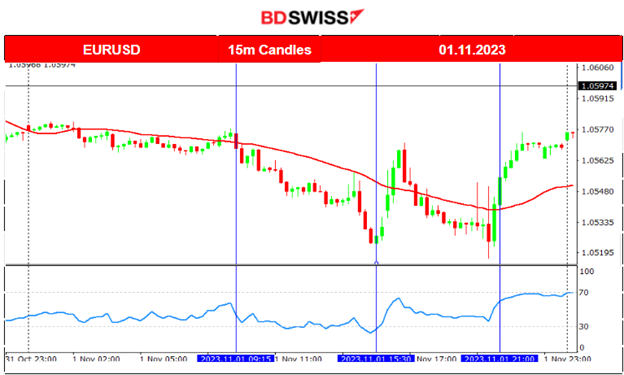

EURUSD (01.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair started to move to the downside at first rapidly after the European session started but at some point, it found support near 1.05240 and reversed to the upside when the employment-related data for the U.S. started to be reported. The impact of the releases was not great but only increased volatility levels moderately. After the Fed decision and press conference the pair moved eventually to the upside as the USD started to depreciate greatly.

___________________________________________________________________

___________________________________________________________________

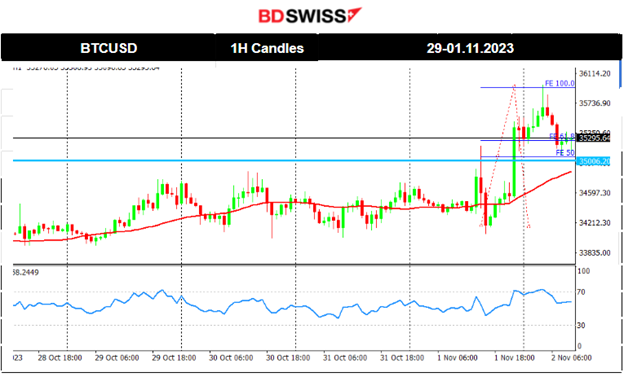

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin breaks the resistance of 35000 and moves further to the upside while the USD depreciates. On its way up it found strong resistance again at near 36000 before it retraced back to the 61.8% of the rapid move upwards.

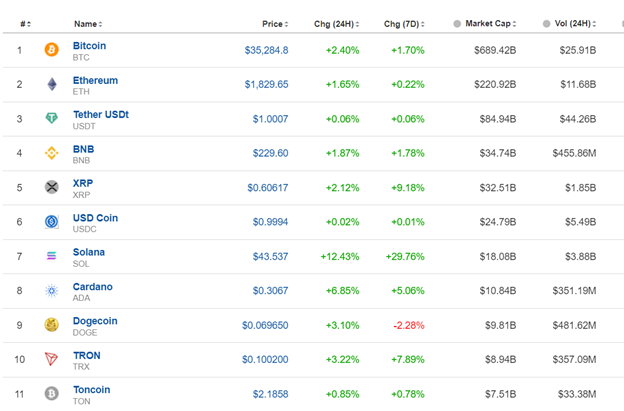

Crypto sorted by Highest Market Cap:

Volatility levels are higher for Crypto. We see that all experienced gains following Bitcoin’s rise in price. Risk-on mood as the dollar depreciates, gold falls, crypto and stocks gain.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

An upward movement as market participants change the risk mood to risk-on. After the Fed decision yesterday and the FOMC statement release the U.S. indices experienced an upward movement. We see that for NAS100 the channel was broken to the upside causing the index to move rapidly upwards. We could see a retracement as soon as an important resistance level is identified that could act as the turning point to the downside.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil has fallen significantly lately. It is currently following a downward trend but it is not expected that it will remain sustainable considering the fundamentals. Breakout of the channel to the upside will at least mean that it will head sideways for a short period of time at least. The RSI supports a sideways movement as it shows higher lows.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold reversed after testing the strong resistance at 2009 USD/oz. Yesterday it moved more to the downside, especially after the Fed decision on rates and FOMC statement release. The USD depreciated greatly after the news. Gold reached the support of 1970 USD/oz before eventually retracing back to the mean and continuing the path around it sideways. Could this be the start of an upward trend? We need more data to support that view.

______________________________________________________________

______________________________________________________________

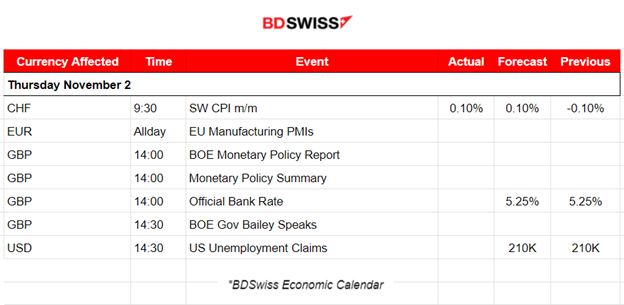

News Reports Monitor – Today Trading Day (02 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

Eurozone’s PMIs for Manufacturing were reported all in the contraction area showing a very grim picture of what is happening in business. The elevated borrowing costs are now presented to have affected the markets and the economy quite significantly causing further deterioration.

The BOE decides on the Official Bank Rate at 14:00. Probably we will see no shock but the market will potentially experience an intraday shock affecting the GBP pairs.

U.S. unemployment claims have been reported close to 200K recently. Any surprises might cause more volatility for the USD pairs. The labour market is still tight but the effects of higher interest rates are obvious. Further deterioration in business conditions affects the labour market and as a result, the numbers could change to higher levels soon.

General Verdict:

- Increased volatility due to PMI releases.

- BOE rate decision might cause intraday shock for GBP pairs.

- U.S. indices are on the uptrend currently.

- Gold seems to go sideways for now but with no major signals that the uptrend resumed.

- Crude Oil settled close to 83 USD/b.

______________________________________________________________