PREVIOUS TRADING DAY EVENTS –31 Oct 2023

The BOJ watered down its 1% cap on the 10-year bond yield which it set just three months ago to allow long-term borrowing costs to rise more.

“We still haven’t seen enough evidence to feel confident that trend inflation will (sustainably hit 2%),” BOJ Governor Kazuo Ueda told a press briefing after the decision. “As such, we don’t see a big risk of being behind the curve.”

Ueda said the BOJ will no longer forcefully cap long-term rates at 1% but step in to avoid the 10-year yield from sharply moving above that level, adding that the tweak was aimed at making YCC more flexible.

“Through all the linguistic contortions, the fact is that they are dismantling YCC,” said Tom Nash, portfolio manager at UBS Asset Management in Sydney, who is positioned for a rise in Japanese yields. “A yield cap isn’t a yield cap if you change it every time the market gets close.”

This increase is a threat to the efforts of the Fed to bring inflation to its 2% target. It is expected that the Fed will leave interest rates unchanged, but maintain its hawkish bias.

“Those wage increases are likely to keep inflation running above target while higher house prices could lead to a pick-up in shelter inflation,” said Andrew Hollenhorst, chief U.S. economist at Citigroup in New York. “For now the Fed will remain on hold, but the evident upside risk to inflation means Chair (Jerome) Powell and the committee will keep potential further rate hikes on the table.”

In addition, the consumer confidence index dropped moderately to 102.6 this month from 104.3 in September.

“The U.S. consumer is in okay financial shape,” said Bill Adams, chief economist at Comerica Bank in Dallas. “For well-off Americans, inflation is a source of frustration but not enough to force cutbacks in overall spending.”

Source:

https://www.reuters.com/markets/us/us-labor-costs-growth-beat-expectations-third-quarter-2023-10-31

______________________________________________________________________

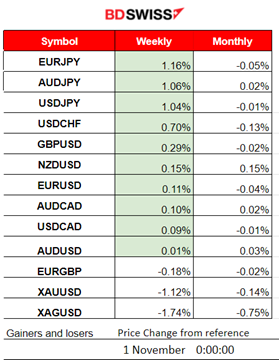

Winners and Losers

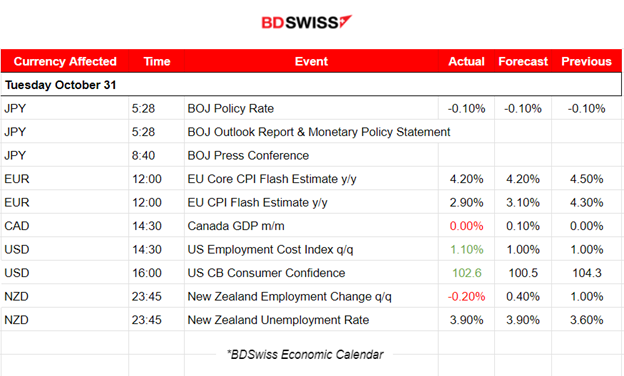

News Reports Monitor – Previous Trading Day (31 Oct 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Bank of Japan (BOJ) maintained its -0.1% target for short-term interest rates, as expected, and that for the 10-year government bond yield around 0% set under its yield curve control (YCC). The JPY was boosted yesterday by a report that the Bank of Japan (BOJ) could further tweak a key bond yield policy tool when announcing the monetary policy decision. Today the JPY is losing heavily against the dollar as the BOJ failed to appease some investors who had expected a bigger move toward ending years of massive monetary stimulus.

- Morning–Day Session (European and N. American Session)

Core CPI and CPI Flash Estimates figure releases showed that headline inflation dropped below 3%, but core inflation remains stubbornly high. The momentum is towards gradual slowing. The EURUSD was going upwards but upon release, it reversed to the downside. EUR was hit hard with a strong weakening. More push to the downside was attributed to the USD appreciation after the data releases.

Canada’s monthly GDP figure was reported unchanged. The higher interest rates, inflation, forest fires and drought conditions continued to deteriorate business and growth. The impact on the market upon release was minimal.

The employment cost index and CB consumer confidence report caused much of the USD appreciation during the trading day. Both were reported higher than estimates.

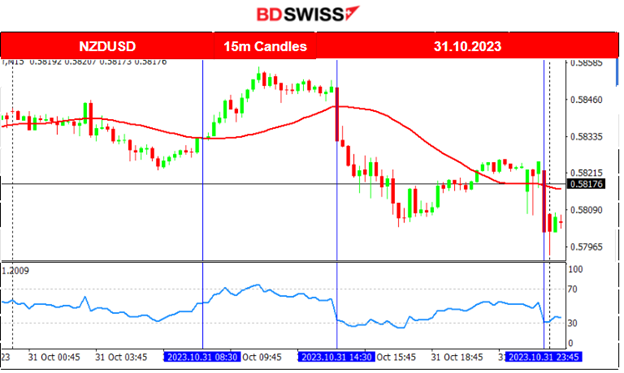

Late at 23:45, the New Zealand Labour data came out. Employment change was reported negative, way away from expectations while the unemployment rate was reported higher as expected. The NZD depreciated at the time of the release. Almost 30 pips dropped after the release for NZDUSD, moderate impact it seems.

General Verdict:

FOREX MARKETS MONITOR

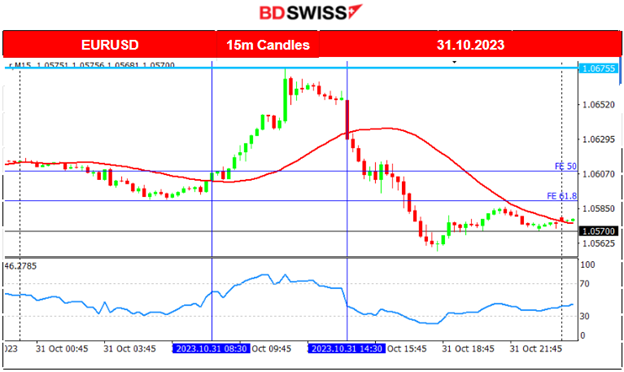

EURUSD (31.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved to the upside rapidly near the start of the European session finding resistance 1.06755 at near noon. The CPI estimates released at that time might have had some impact increasing volatility for EUR pairs and depreciation, however, it was the dollar that started to appreciate heavily as well after the news. With dollar appreciation also, the pair soon reversed heavily, crossing the 30-period MA on its way down finding support at near 1.05560, where it finally settled without the expected retracement, yet.

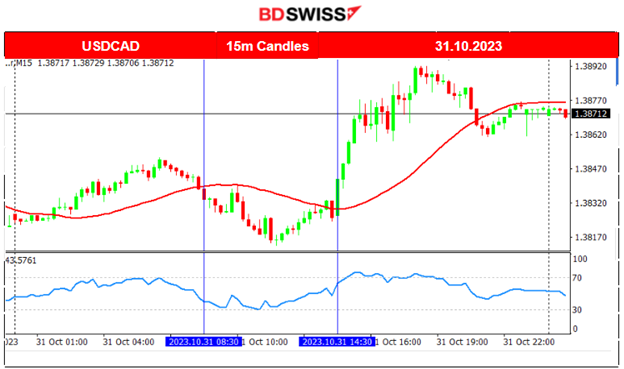

USDCAD (31.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved eventually to the upside following the market effects on the USD. The chart shows a path similar to the Dollar index chart. The CAD GDP news had no major impact on the path as the USD appreciated heavily eventually.

NZDUSD (31.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair movement was mirroring the Dollar index chart since the USD was the main driver until the news release at 23:45. At that time the release of the Labor market data for New Zealand the NZD depreciated from the huge drop in employment and the higher unemployment rate report, causing the NZDUSD to drop near 30 pips before settling lower eventually.

___________________________________________________________________

___________________________________________________________________

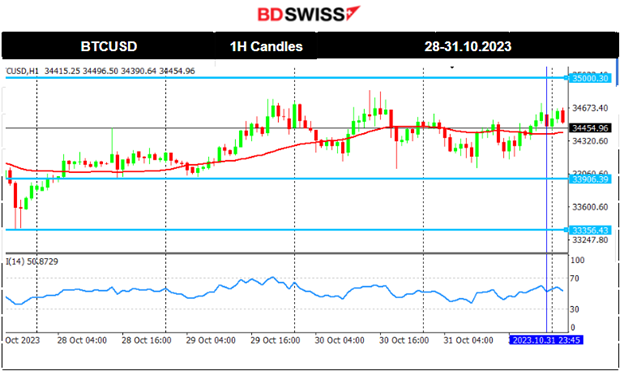

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin remains in consolidation and with low volatility levels, having 35000 USD as an important resistance level. Fundamentals remain the key factors that push the price to deviate significantly from the mean. Important resistance remains at the 35200 USD level.

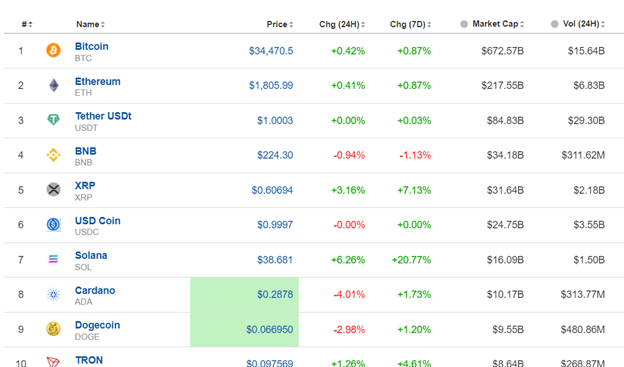

Crypto sorted by Highest Market Cap:

Volatility levels are lower and the markets for Crypto are not moving much. In the last 24 hours, we see some gains for Crypto. In general, not much is happening at the moment in regard to shocks or big moves. Only Solana seems to get much traction having 20% so far gains for the last 7 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

All benchmark U.S. indices are fighting for the upside. The downward trend is over. Currently, we see an upward movement as market participants change the risk mood to risk-on. Gold started to fall rapidly after reaching 2009 USD/oz. It might be the start of a long-awaited reversal in stock performance. However, the other U.S. benchmark indices have other more sideways paths. Let’s see.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil has fallen significantly lately. It is currently following a downward trend but it is not expected that it will remain sustainable considering the fundamentals. Breakout of the channel to the upside will at least mean that it will head sideways for a short period of time at least. The RSI supports a sideways movement as well with almost flat lows as depicted.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold experienced extreme volatility. It broke the triangle formation upwards testing again the 2009 USD resistance level before it finally reversed suddenly with a drop to 1975 USD/oz. This reversal could create an opportunity for a retracement as per the arrow and back to 61.8% of the downward move.

Analysis on TradingView:

https://www.tradingview.com/chart/XAUUSD/P0I0p4O2-Gold-Post-Reversal-01-11-2023/

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (01 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

The ADP Non-Farm Employment change figure is important for decision-makers and heavily taken into account by the market participants. As part of the labour data releases, it has a chance of causing volatility or even a moderate shock intraday, affecting the USD pairs. The same comment applies to the JOLTS Job openings report released at 16:00.

At 16:00 the ISM Manufacturing PMI could cause the USD pairs to move but the impact is not expected to be high. The picture regarding the business conditions in both sectors remains at the same levels in general and the market is focusing more on the Fed decision before taking action.

Major news at 20:00 (server time /GMT+2). The Federal Reserve decides on rates. Of course, the market expects unchanged interest rates. There is no reason for a surprise unless the Fed wants to create havoc. All indications in the economic analysis show deterioration in business conditions but a tight labour market. The elevated rates have a good impact on inflation, even though the recent crisis and wars create distortions in the analysis as it has increased energy costs/oil prices for some time. It is expected that the impact of high rates will continue to push inflation downwards to reach targets. The USD is expected to be affected upon release, especially at 20:30.

General Verdict:

______________________________________________________________