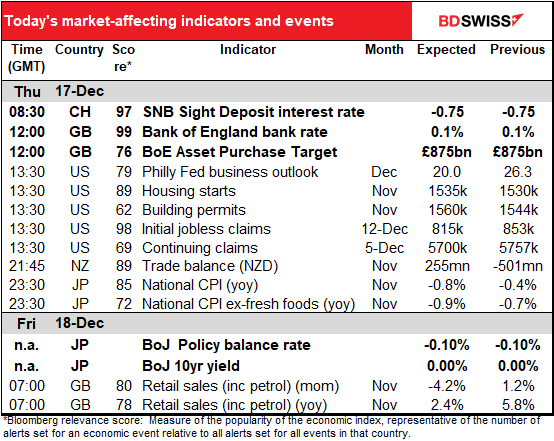

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

The results of the Federal Open Market Committee (FOMC) meeting were largely in line with expectations. They gave more specific guidance for their asset purchases but still left it vaguer than their guidance on interest rates. They also included some explanation of the reason for the asset purchases. They also left the amount of purchases and their composition unchanged, and Fed Chair Powell indicated in his press conference that these parameters are likely to remain unchanged, assuming the economy develops the way the Committee expects. (Specifically, he said switching to a weighted average maturity target for their bond purchases was “not something high on our list in terms of possibilities.”)

The statement following the meeting said “…the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions…” This compares with their pledge to keep rates unchanged “until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.” Note that while the guidance for interest rates has specific numerical targets attached to it, that for the asset purchases simply requires “substantial further progress” toward the Fed’s goals. This is more specific than before, but leaves them plenty of wiggle room to start tapering down their QE program before they even begin “thinking about thinking about” raising rates.

The decision was unanimous.

The Summary of Economic Projections upgraded the growth forecasts for this year, next and 2022, but downgraded that for 2023 slightly – i.e., they are now assuming a somewhat faster return to normality. They cut their unemployment forecasts and raised their inflation forecasts slightly, consistent with their improved growth outlook. But according to the “dot plot,” the Committee overall still sees rates staying unchanged until at least end-2023, the limit of the forecast horizon. Only one more person joined the dissenters to that conclusion (now it’s 12 to five).

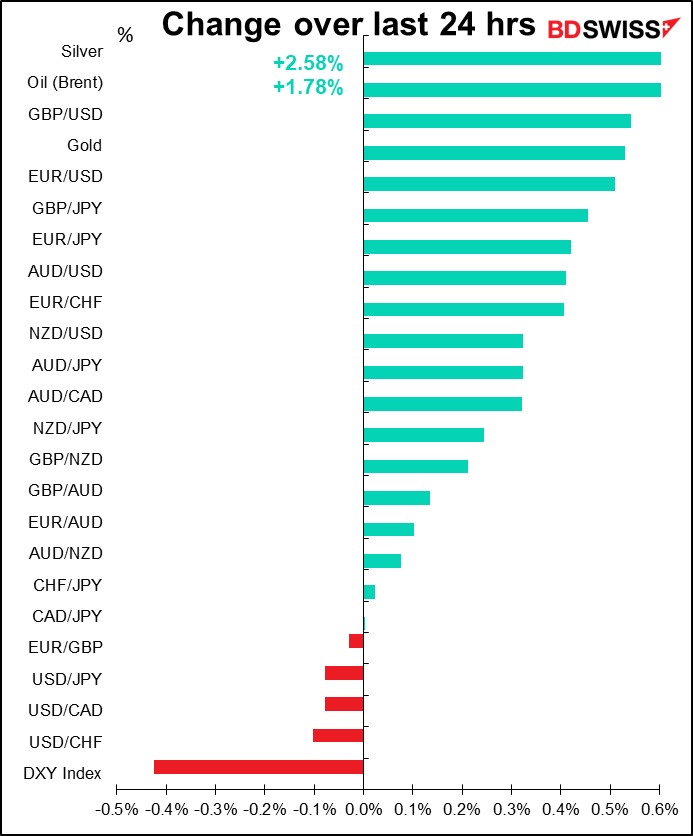

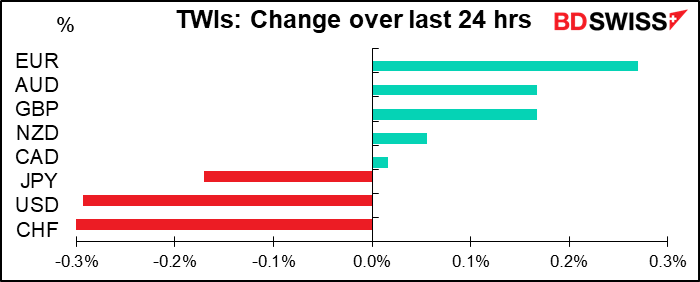

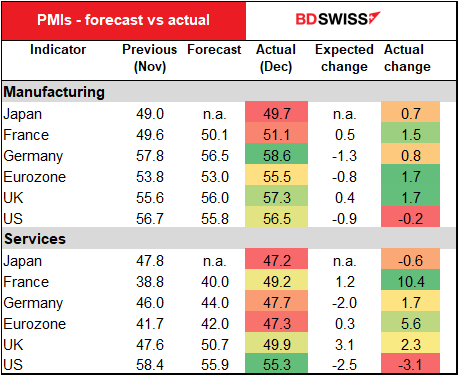

USD was lower on the day, but this wasn’t a result of the Fed. The big move came in reaction to the surprisingly strong set of preliminary purchasing managers’ indices (PMIs) for the Eurozone, which of course boosted EUR. The dollar did spike higher following the release of the Fed statement, but then lost the gains after Fed Chair Powell’s press conference.

CHF on the other hand was the worst-performing currency. The US Treasury Department labeled Switzerland and Vietnam as “currency manipulators” in its quarterly report on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States. “…(W)e continue to urge the SNB to limit foreign exchange intervention to lean against large appreciation surges and allow real appreciation in line with the long-term trend,” the report said. That would of course mean a stronger CHF and the currency initially gained following the release of the report, but a strong rebuttal by the Swiss National Bank (see below) sent it down again.

GBP rallied further on optimistic remarks from EC President von der Leyen, who said that “I can tell you that there is a path to an agreement now. The path may be very narrow but it is there and it is therefore our responsibility to continue trying.”

Today’s main events: three central bank meetings

We have two central bank meetings today and one overnight: the Swiss National Bank (SNB) and the Bank f England (BoE), plus the Bank of Japan (BoJ) overnight.

Swiss National Bank: nothing doing

The Swiss National Bank (SNB) meeting takes on new importance in light of yesterday’s decision by the US Treasury to label Switzerland and Vietnam currency manipulators.

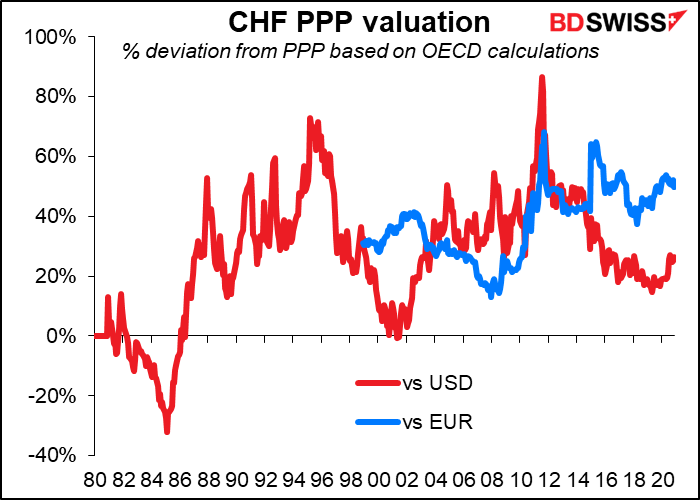

Does Switzerland manipulate its currency? Well, no one can deny that it tries. It has the third-largest stock of foreign reserves of any country in the world, and #1 and #2 are much bigger economies (China and Japan). However, if it is a currency manipulator, it’s not a very good one. The Swiss franc has been overvalued vs the dollar almost uninterruptedly since around 1987 and vs the euro since the single currency’s inception.

Nonetheless, the country still has a tremendous current account surplus (estimated at 9.7% of GDP this year), so it appears people are still willing to buy Toblerones and Rolexes despite the exchange rate.

The SNB was unmoved by the Treasury’s accusation. It denied “any form of currency manipulation” and said it “remains willing to intervene more strongly in the foreign exchange market.” “Foreign exchange market interventions are necessary in Switzerland’s monetary policy to ensure appropriate monetary conditions and therefore price stability,” it added.

Nonetheless, the market will be watching closely to see if they change their statement today. They usually say that “In view of the fact that the Swiss franc is still highly valued, the SNB remains willing to intervene more strongly in the foreign exchange market, while taking the overall exchange rate situation into consideration.” I expect them to stick to their guns and simply repeat it with no change, or indeed to double down on it. As for interest rates, the SNB hasn’t changed policy since January 2015, when they cut the interest rate on sight deposits from -0.25% to -0.75%, the lowest rate in history. Since then it’s been all FX intervention. I don’t think anyone expects the SNB to change any time soon.

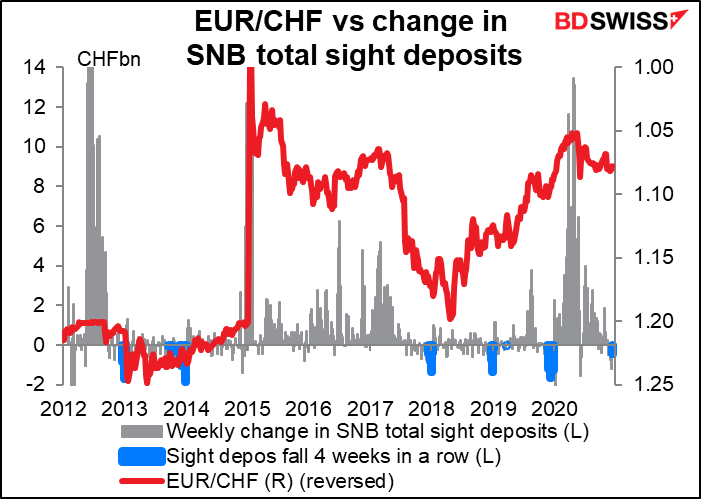

Swiss sight deposits, a commonly used proxy for intervention, have declined for the last four weeks in a row, but this seems to be a seasonal pattern as it’s almost always occurred only in December. I therefore don’t think it represents a change in policy.

Really, I don’t see why the US is bothering with this. Switzerland is a tiny country that accounts for only 5% or so of the enormous US trade deficit. It seems to me that the US should have bigger and more appropriate fish to fry.

Bank of England: politics in the driving seat

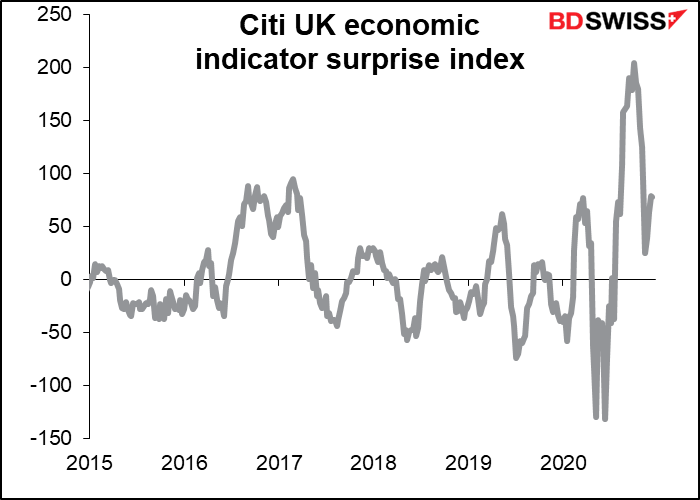

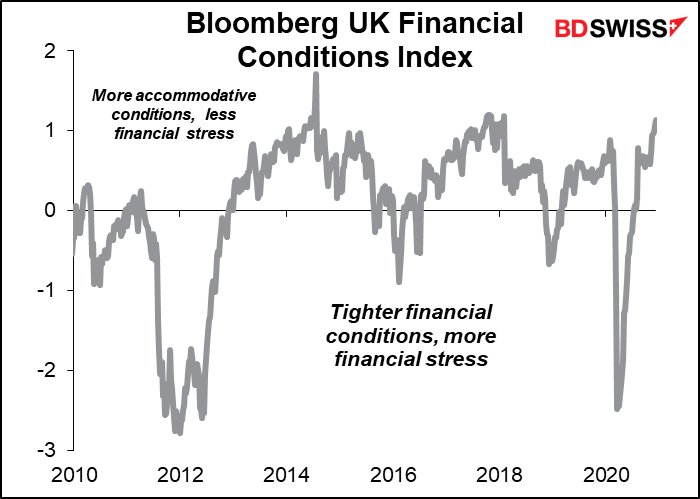

Now would be an inappropriate, if not bizarre, time for the Bank of England’s Monetary Policy Committee (MPC) to change its policy stance. On the one hand, the recent data have been better than expected. That doesn’t mean things are good, just that they aren’t as bad as people had expected (yet).

Furthermore, while the near-term outlook may be dim, the MPC said at its November meeting that it expects the economy to improve later on “as the direct impact of Covid on the economy was assumed to wane.”

So economically, things may indeed turn up, obviating the need for any further easing.

On the other hand…who knows what will happen over the next two or three weeks as we count down to Brexit. Assuming for a moment a successful conclusion to the talks (cue Andy Williams), the pound will rise, the economy will continue to the upside, and no need to loosen policy further for the time being. Assuming however an unsuccessful conclusion (cue Jim Morrison), the pound would probably fall, but It’s inconceivable that they would raise interest rates to support the currency just a few days before the economy is going to get an unprecedented kick in the pants. Either way, it makes much more sense for them to wait until the 4 February meeting so that they can see how Brexit has developed before taking any action. I would expect another 9-0 decision this time to keep everything – rates and the pace of asset purchases — on hold for the time being and wait to see (cue Kenny Rodgers) what condition the economy is in at the next meeting.

What it could do this time is signal how it might react to different scenarios. For example, the MPC expanded the scope of its government bond purchase program by GBP 150bn in November, which gives it additional firepower that it could use. It could indicate that stands ready to increase its QE program, or start up its commercial paper purchasing operations, or increase the corporate bond-buying program should conditions warrant it. They don’t at the moment however which is why I expect “watchful waiting.”

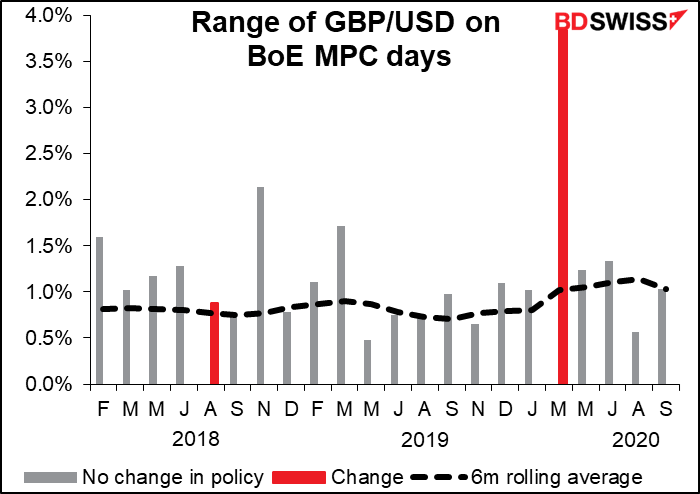

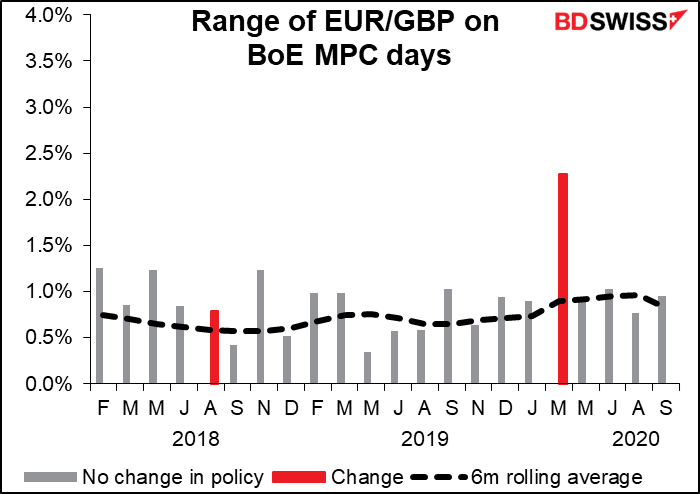

In that case, we can probably expect a pretty average day for the pound, or at least that the Bank of England’s decision won’t be the deciding factor for the currency.

Bank of Japan: extending lending

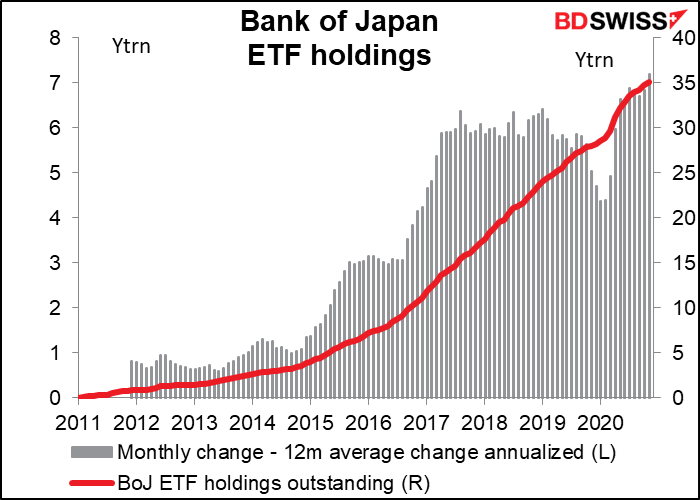

The Bank of Japan (BoJ) has had the peddle to the metal for several years now. Like other central banks, in the wake of the pandemic it instituted various special lending programs to target funds to specific classes of borrowers. However it hasn’t fundamentally changed its monetary stance, probably because there’s not much left that it can do.

The question the BoJ now faces is whether to extend its Special Funds-Supplying Operations to facilitate corporate finance in the wake of the pandemic. These operations, which were instituted in March 2020, are set to expire in March next year. Given that the government just approved its latest stimulus package last week, including extending its interest-free, collateral-free loans, it would be natural for the BoJ to move in line with the government and extend its operations as well. In addition, the government eased the conditions on its policy loans, so the BoJ may want to follow suit there too – perhaps by extending the periods of its loans. These would be ways for the Bank to show that it is coordinating with government policy. These decisions would not have any implications for monetary policy and probably would not affect the FX market significantly.

The BoJ may also want to adjust its guidance concerning its aggressive purchases of exchange-traded funds (ETFs). The BoJ says in its Statement on Monetary Policy following each meeting that it “will actively purchase exchange-traded funds (ETFs)” with an upper limit of “about 12 trillion yen” annually. However, the Tokyo stock market has been more buoyant than they had expected and they’re only buying at an annual pace of around ¥7trn. On the other hand, they don’t buy their full target of ¥80tn a year in Japanese government bonds either and that doesn’t seem to bother them, so maybe they’ll just leave the statement alone.

Today’s indicators

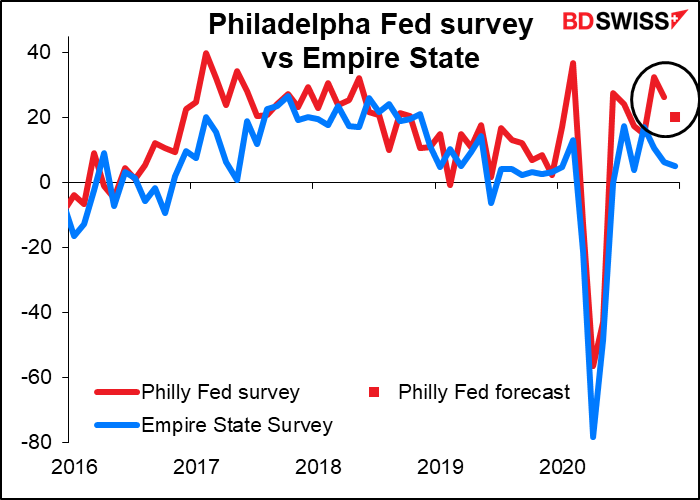

The Philly Fed index is expected to fall somewhat. That wouldn’t be surprising, considering that the Empire State manufacturing index fell and that the US manufacturing and service-sector PMIs fell. I wouldn’t expect a fall like that which is being forecast to have much of a market impact.

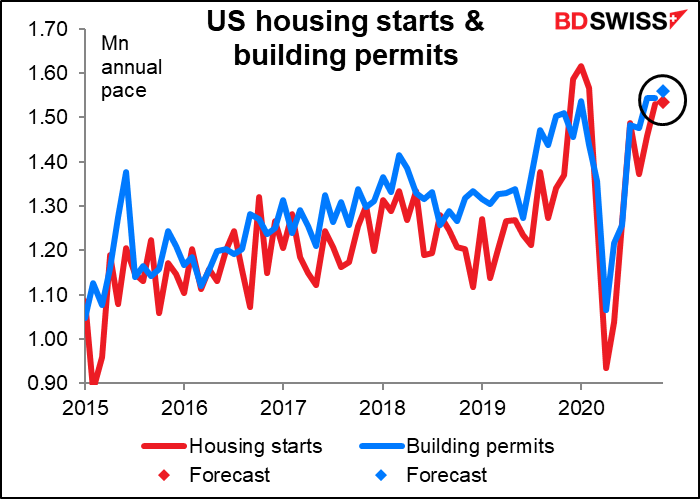

US housing starts and permits are both expected to be higher. Housing globally is one of the strongest sectors as people discover they can work from home and so flee the cities for more space in the suburbs and countryside.

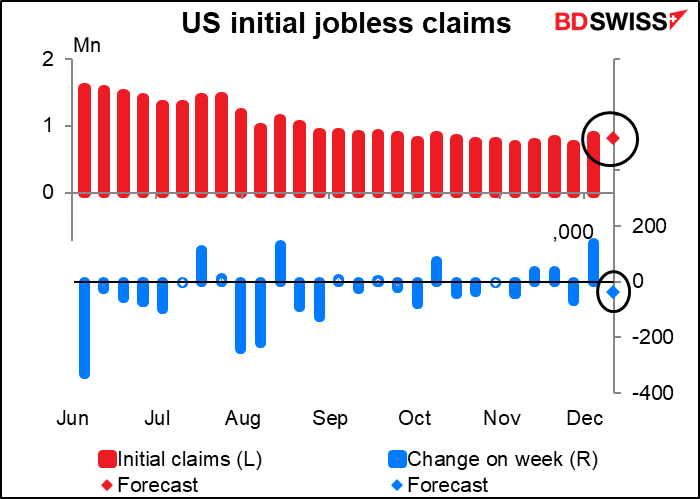

Jobless claims are expected to be better this week.After last week’s surprising 137k rise, initial jobless claims are forecast to have fallen by 38k.

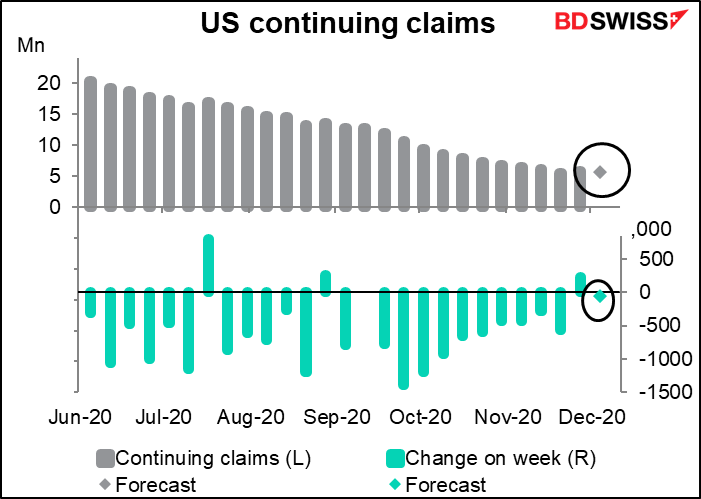

Continuing claims are forecast to have fallen 57k vs last week’s 230k rise.

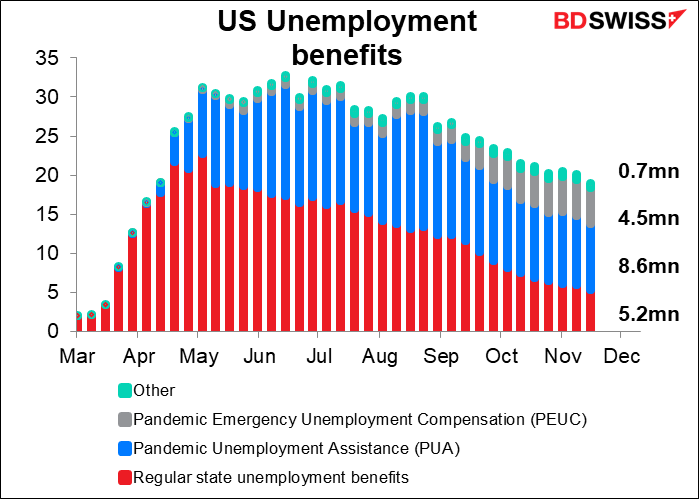

However, these figures are for regular state unemployment claims and therefore only a small part (27%) of the total number of people collecting some type of unemployment insurance in the country. So they don’t reflect how dire the situation really is.

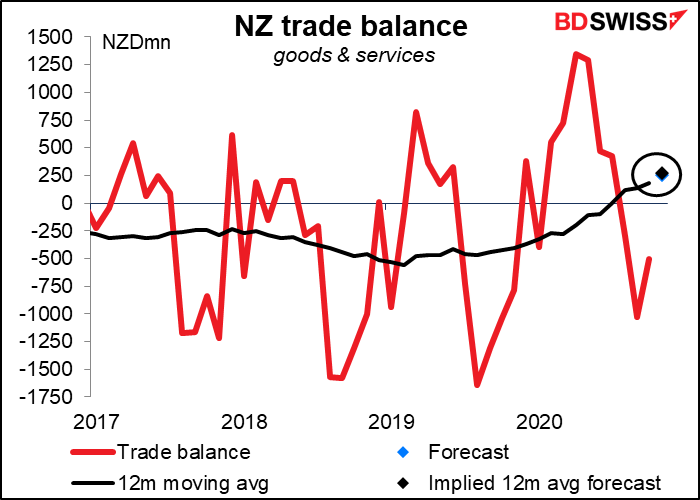

Overnight, New Zealand’s trade balance is expected to swing into surplus. The data aren’t seasonally adjusted so I find it more meaningful to calculate a 12-month moving average based on the forecast. In that case, it’s expected to be up too. This could be positive for NZD.

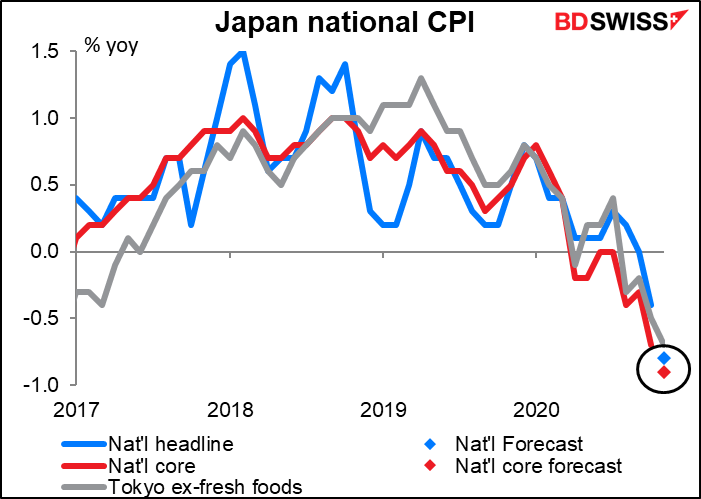

Japan announces the Queen of Useless Statistics, the national consumer price index (CPI). Useless because it largely follows the Tokyo CPI, which comes out three weeks earlier, and anyway the Bank of Japan is just going to watch helplessly as the country falls further and further into deflation despite some 25 years of near-, at- or below-zero interest rates and inventing a whole new toolbox of extraordinary monetary policies. Tomorrow morning’s figure should be no exception as the national CPI is forecast to follow the Tokyo CPI deeper into deflation. C’est la vie, or as they say in Japan, “shikata ga nai.”

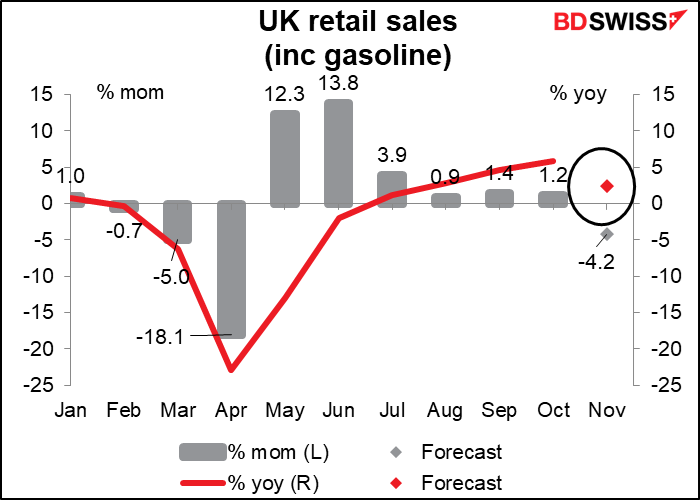

Finally, as dawn breaks over Clapham Commons, Britain announces its retail sales data. It’s expected to be poor: the first mom decline since the big collapse in April, and a fairly substantial collapse at that. I doubt if it will have much effect though as everyone will be poised for either a Brexit triumph or tragedy ahead of the weekend.