Rates as of 04:00 GMT

Market Recap

We had the first so-called Presidential “debate,” which apparently consisted of Trump yelling insults at VP Biden and the hapless, ineffectual moderator. While there wasn’t much debate or even discussion of policy, even Fox News had to admit that Biden’s performance “largely invalidated the president’s prior attacks on Biden’s mental acuity and cognitive abilities.” (Trump has been claiming that Biden is suffering from dementia, yet another incidence of Trump projection.)

According to a CNN poll, “the debate did not appear to dramatically move voters who watched in either vote preferences or their overall impressions of the two candidates.” But they added that “the minority who said they were moved were more apt to say they became more likely to vote Biden (32%) than Trump (11%).” Hence a Biden victory remains on the cards, which I believe is positive for risk sentiment and therefore positive for stocks. The impact on the dollar is debatable: a “risk-on” scenario suggests a weaker dollar, but a more stable, dependable government could boost sentiment towards the dollar.

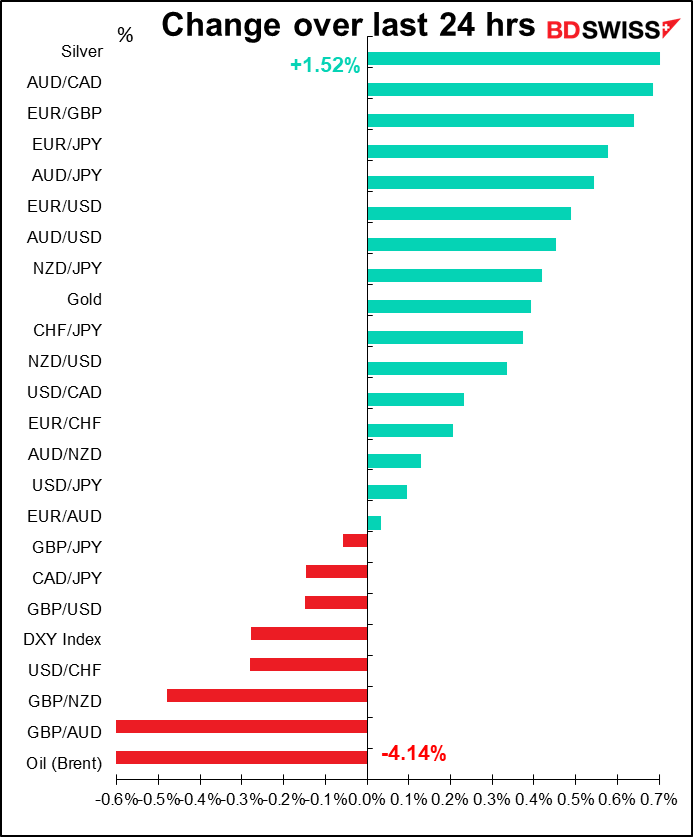

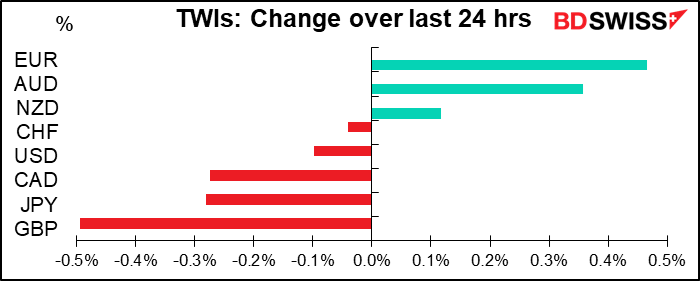

As for the markets, it was a day of modest reversals: European and US stocks edged lower (S&P 500 -0.48%) and the dollar remained under pressure in subdued trading as the market waited for the “debate” and any news on the US stimulus talks.

The news with regards to the stimulus package is mixed. Speaker Pelosi and Treasury Secretary Mnuchin spoke for around 50 minutes yesterday and agreed to speak again today. It’s being reported that the Senate will vote on a relief package of some sort later this week, either the Democrat’s $2.2tn bill or a smaller, more bipartisan effort if it’s possible to agree on one. White House advisor Kudlow was on CNBC yesterday arguing that the US economy is already doing great and doesn’t need anything near what the Democrats want (a $2.2tn package). I think the two sides will not be able to agree on a package before the election and that the ensuing downturn in the US economy will be negative for the dollar.

Yesterday’s FX moves can’t necessarily be explained by the fundamentals. It appears that month- and quarter-end rebalancing flows were at work.

EUR was the clear winner on the day, with EUR/USD returning back above 1.17 despite German inflation falling to a five-year low and EU stocks, including bank stocks, weakening. The single currency also gained on the crosses, with EUR/JPY climbing back above 124.00 (although it’s fallen back below that now) as market participants unwound the short positions established over the last week. EUR/GBP moved back above 0.91 amidst GBP weakness (see below).

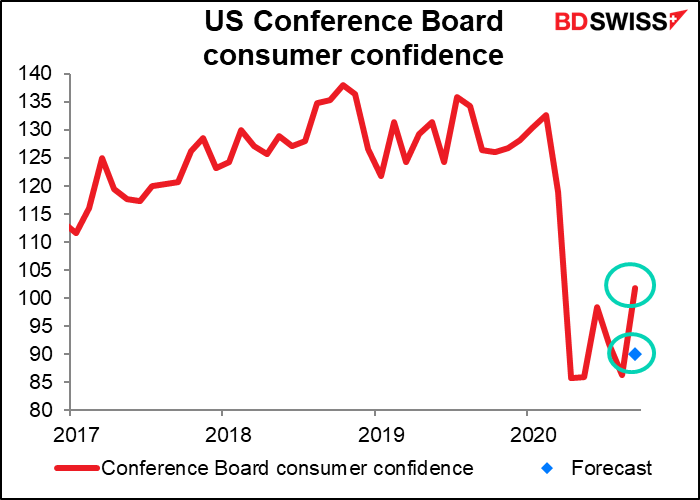

Despite the slight “risk-off” tone, an unexpected jump in the Conference Board consumer confidence index – the biggest monthly increase in 17 years, to the highest it’s been since the pandemic started — helped reassure the FX markets and pushed USD lower.

GBP was the big mystery – it fell despite positive news all around. My guess is that month-end rebalancing was the cause and we could see a rebound in GBP today. Brexit headlines suggested some rare progress – Bloomberg said the UK had sent five new “negotiating papers” to the EU on various points of difference, such as fisheries and the “level playing field” issue. Submitting these proposals was a necessary step to make any progress and so it was a positive, even if “EU sources” said that the proposals on state aid failed to meet the EU’s demands. The headline spurred a brief rally in GBP/USD rally up to 1.29, but it didn’t last as it became evident that there were still disagreements between the two sides.

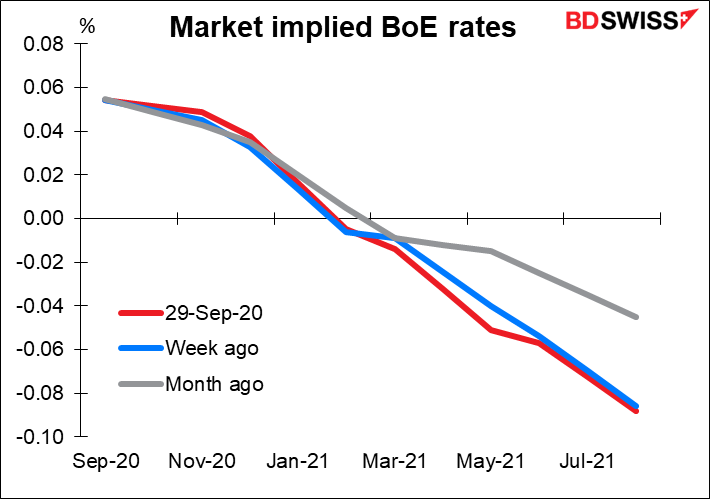

BoE Gov. Bailey, who’s been backpedaling on negative interest rates all week, said the Bank hadn’t reached a judgment on whether to introduce negative rates, but rather is just doing “all the groundwork” to make them available if necessary. He also said they “can’t easily put a date on the end of the negative rate review” and that “negative rates would require intensive communication.” In short, it doesn’t look at all like the Bank is going to institute negative rates any time soon. Nonetheless, the market is still forecasting negative rates in Britain by the middle of next year.

Today’s market

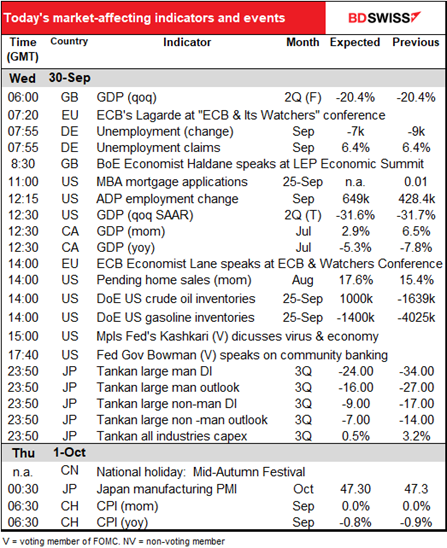

Today is one of my favorite conferences: the annual “ECB and its Watchers” conference. Every year I hope that a number of the Marvel extraterrestrials, The Watchers, will appear from their home in Watcherworld and give the ECB the benefit of their billions of years of experience, but alas every year they fail to show up. In their place all we get are “various monitoring groups, independent academics and market participants.” How disappointing.

In any case, “central bankers, financial market participants and academics will discuss current issues of monetary policy and financial stability at the conference.” You and I aren’t invited, not even to the livestream. You can see the agenda here if you’re interested to know what you’re missing.

The key speeches will be ECB President Lagarde at the beginning and ECB Chief Economist Lane at the end. The discussions will form part of the ECB’s strategic review of its monetary policy framework. Everyone’s waiting to hear what (if anything) they say about the exchange rate, particularly whether they “carefully assess” it or are “monitoring it very closely.”

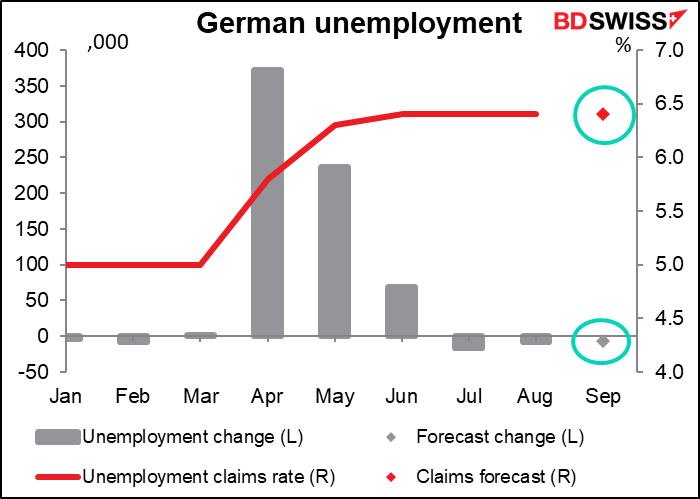

German unemployment is expected to fall slightly, while the unemployment claims rate – aka the unemployment rate – is forecast to be unchanged at 6.4% for the fourth consecutive month. This does not look like a naturally occurring figure. It shows the success of the German government’s efforts to keep people in their jobs rather than support them while they’re unemployed.

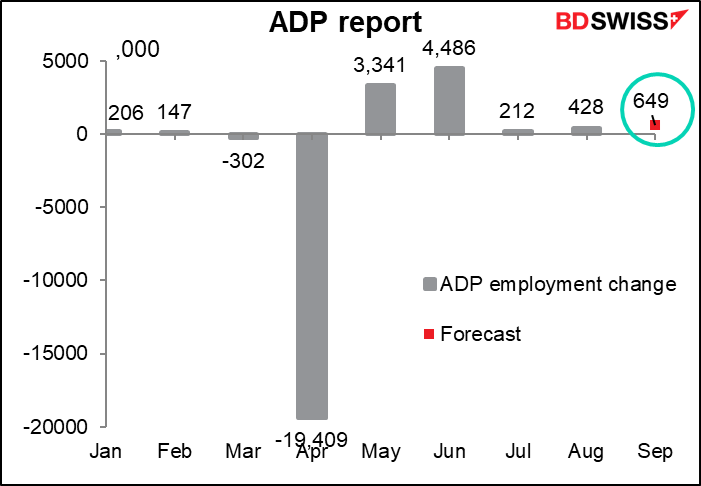

Then comes the big event of the day, the ADP employment report. Automated Data Processing Inc. (ADP) is an outsourcing company that handles about one-fifth of the private payrolls in the US, so its client base is a pretty sizeable sample of the US labor market as a whole. It’s therefore watched closely to get an idea of what Friday’s US nonfarm payrolls (NFP) figure might be, although in fact before this year there was only a 50% correlation between the two series, and it’s only gotten worse since we started getting these tremendous figures this year. This month the market is predicting +630k for the ADP report and +850k for the nonfarm payrolls.

Odd isn’t it that economists make a prediction for an indicator that they use to make a prediction for another indicator? I often wonder why the predictions for the two aren’t the same. Probably it’s because of different survey samples. Bloomberg has 28 estimates for the ADP and 62 for the NFP.

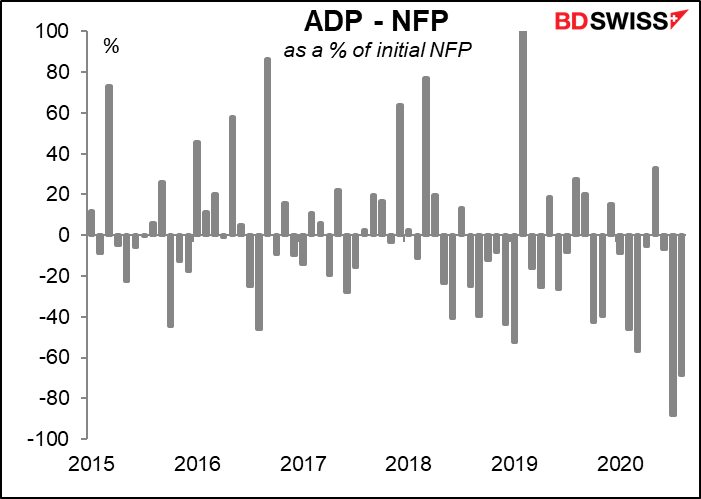

In any case, although the absolute value of the misses recently have been unusually large, that’s just because the numbers we’re talking about are unusually large. The discrepancy between the ADP and the NFP isn’t much different than usual when looked at in percentage terms (although in recent years, the biggest misses were when the ADP report was higher than the NFP, whereas this year it’s been lower).

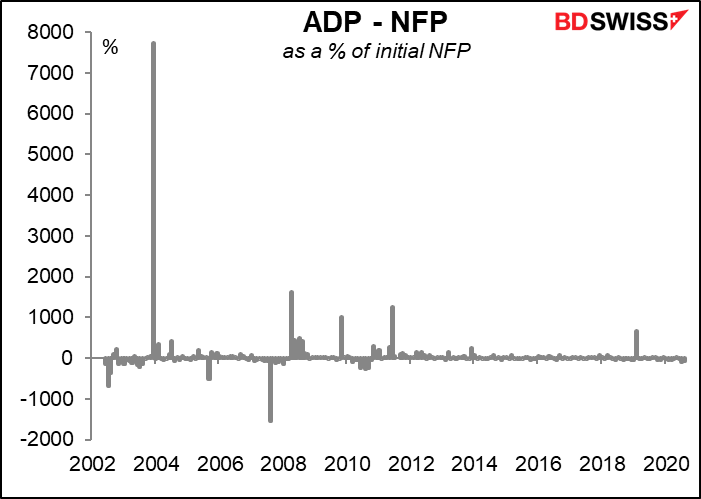

And it has been much, much worse in the distant past.

The third and final estimate of US Q2 GDP…the figure was such an outlier, who knows how much it will be revised? And what does it matter, since it says nothing about the trend from here.

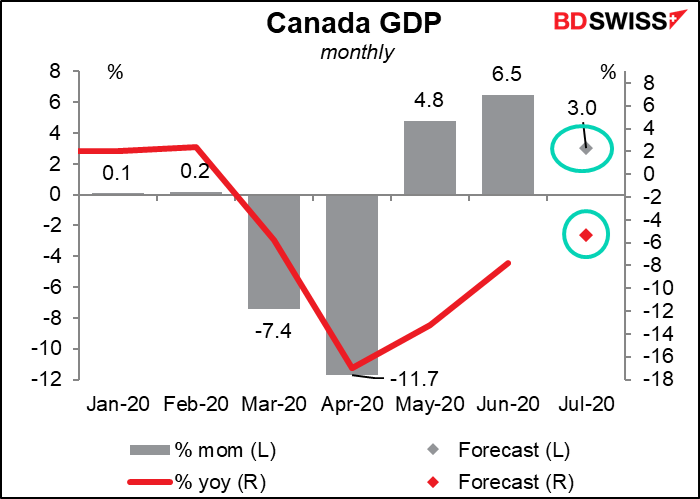

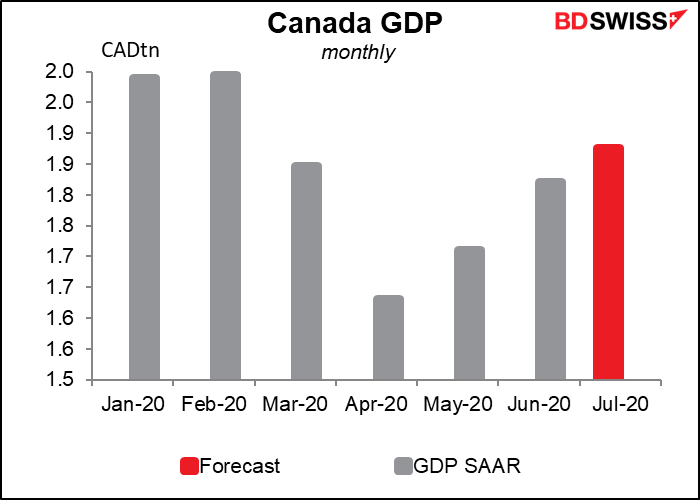

By contrast, there’s likely to be a lot of interest in Canada’s July GDP. As one of the few countries that produces a monthly GDP figure, it’s easy to see how Canada is rebounding. The recovery is apparently proceeding, but the pace of rebound has slowed a bit – perhaps only natural.

Where would that bring Canada’s GDP? Back slightly above the level of March, but not yet back to pre-pandemic levels by any means – 5.8% below the January/February average.

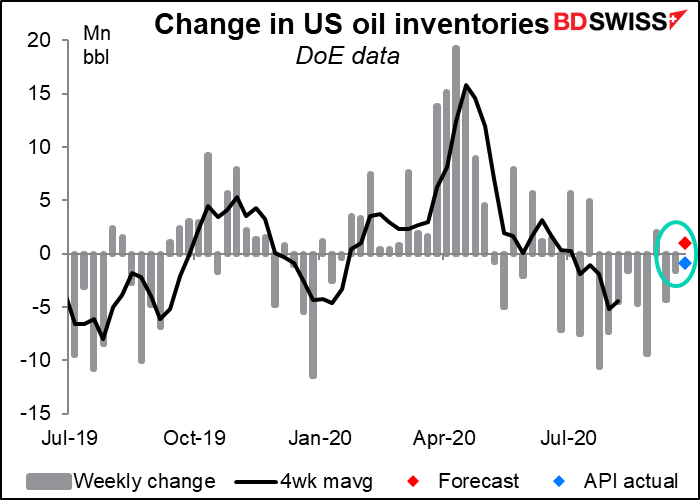

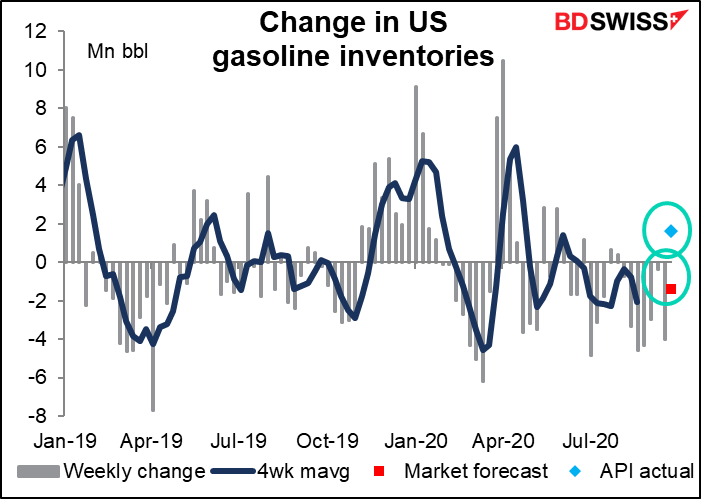

The US Department of Energy (DoE) weekly oil inventory data should be interesting. Last week the American Petroleum Institute (API) reported a small build in inventories (691k), but the DoE reported a large decline (-4.4mn). On the other hand, the API reported a large decline in gasoline inventories (-7.7mn) whereas the DoE reported only a tiny 381k decline. This week, the API reported a small 831k drawdown in crude oil inventories but a 1.6mn bbl increase in gasoline inventories. The market on the other hand was looking for a rise in crude inventories and a drawdown in gasoline inventories.

Fed Governor Michelle Bowman will speak on “Community Banks Rise to the Challenge” at the St. Louis Fed community banking conference. I only mention this because she doesn’t speak very often. In 2014, a law was passed reserving one of the seven Fed Board slots for someone with experience “working in or supervising community banks.” Bowman, a banker from the rural state of Kansas, is the first person to occupy that seat. Her views on community banks aren’t significant for the FX market, but she has one vote on the Federal Open Market Committee (FOMC) just like any other Governor, so what she says about monetary policy (if anything) is important. My guess is that given her “Main Street” credentials, she’s probably a dove.

She’s also speaking tomorrow. Remember what I said yesterday about how the ability of people to give virtual speeches rather than having to present in person is leading to an explosion of speaking engagements.

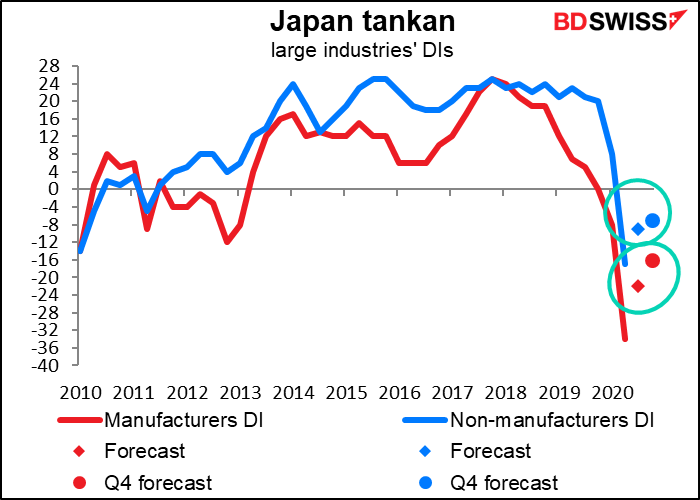

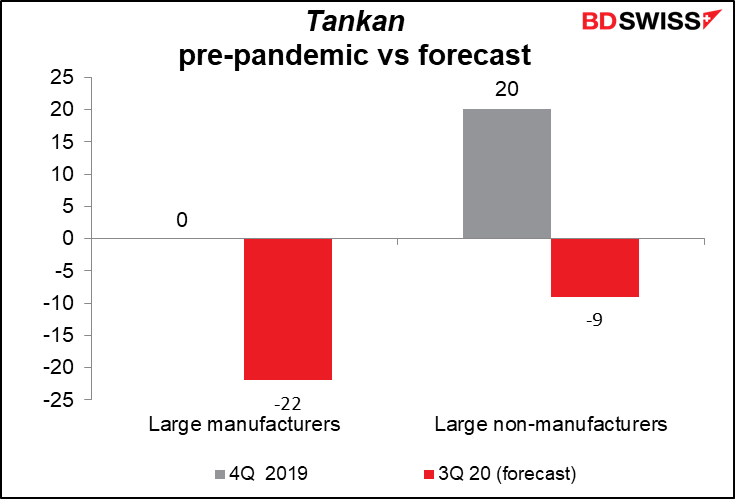

Overnight, we get the Bank of Japan’s quarterly short-term survey of economic conditions, universally known by its Japanese acronym, the tankan. This is the most widely watched indicator in Japan

Both the manufacturing and non-manufacturing diffusion indices (Dis) are expected to be higher, and the forecasts for Q4 are expected to be even higher still.

That’s fine, but they’re still nowhere near where they were before the pandemic. I think this will add to the indications that Japan’s recovery is painfully slow – the PMIs for example are still both below 50. Nonetheless, at least they are going in the right direction. Higher is higher and signs of improvement may boost sentiment in Tokyo a bit – which curiously enough would probably be negative for the yen, because it could spur a “risk-on” sentiment in Tokyo stock market.

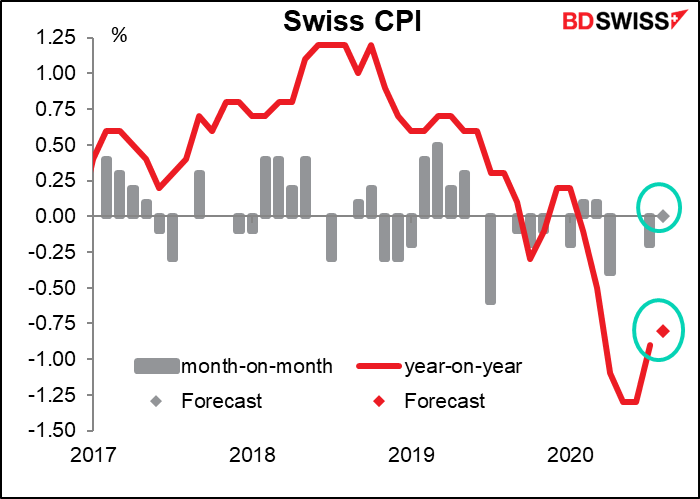

Then as dawn breaks over the Matterhorn, its red rays bringing a touch more color to the autumn leaves in the Alpine valleys, Switzerland announces its consumer price index (CPI), which probably no one cares about but I thought I’d start including it every month because it’s the #2 indicator out of Switzerland (#1 being the weekly sight deposit data). There’s virtually no chance that the Swiss National Bank (SNB) does anything in response to a change in the CPI – they haven’t changed rates since January 2015 – but it’s worth watching maybe to see how things are going.

The question for me is, does the SNB have an inflation target or a foreign exchange target? Probably a bit of both. So long as the CPI is moving in the right direction, it’ll probably focus on the currency.