Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

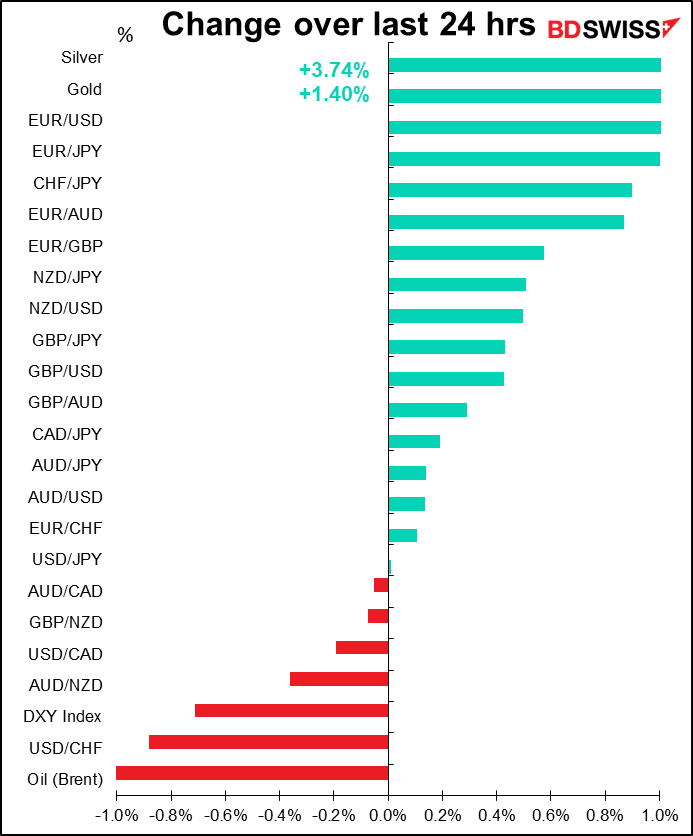

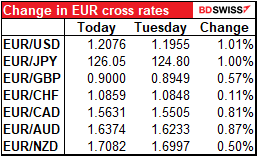

It was the day of the euro! Not only did EUR/USD break the notorious 1.20 barrier, but also EUR gained on all of the major cross rates as well.

There were a number of reasons behind the surge.

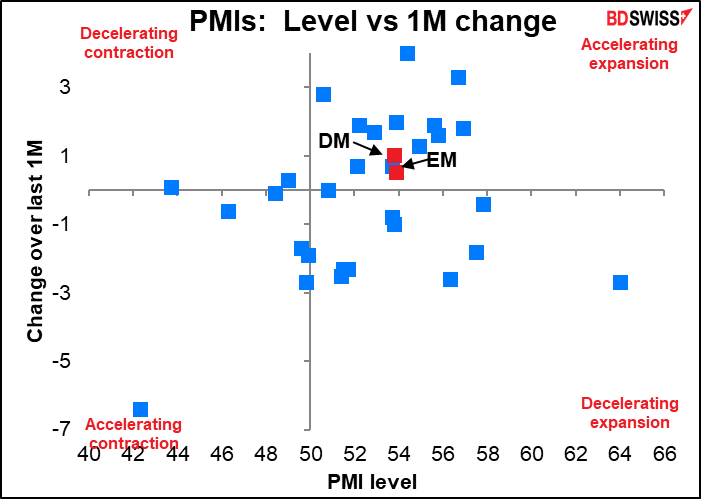

Although many of the manufacturing purchasing managers’ indices (PMIs) showed some deceleration, the majority were still in expansionary territory, suggesting that the global economy continues to recover. We have to wait to see Thursday’s service-sector PMIs before we can be fully confident however as the service sector was hit harder by the pandemic.

The Brexit talks seem to be making progress, or at least haven’t broken up yet. No news is good news as far as the “breakthrough or break up” talks are concerned. There were reports that the two sides had entered “tunnel” negotiations, in which the negotiators are insulated from leaks or media scrutiny, but neither side would confirm this.

I have to say though that the news from today’s Financial Times isn’t particularly optimistic. The FT says that chief EU negotiator “Michel Barnier will brief EU national governments on Brexit talks on Wednesday morning amid concerns in some capitals that the European Commission is poised to give away too much ground in the endgame of negotiations.” At the same time, “Britain is preparing further measures that would violate the divorce deal…The government is planning a new taxation bill containing clauses threatening to overwrite sections of the Northern Ireland protocol in the Brexit withdrawal agreement…” That doesn’t sound to me like two sides moving closer to an agreement. Beware of a reversal in GBP today!

Hopes for some stimulus package in the US increased as a bipartisan group of lawmakers introduced an aid proposal worth about $908bn, a compromise between the Democrats’ demand for a $2tn package and the Republicans’ $500bn response. While the group does not have unanimous backing from either side by any means, it at least represents some movement in the stalemate as aid to the unemployed and to cities & states approaches the end-year cliff when the current aid package ends. Of course the appalling Senate Majority Leader McConnell Y.S. rejected the idea, but he also said some relief measures would come together with the spending bill that has to be passed by 11 December to prevent the US government from shutting down.

Plus there’s now talk that the US may start to distribute a vaccine as early as mid-December.

All of this may have been among the reasons why there was a general risk-on tone in the market, which send USD & JPY down and stock markets up further, with the S&P 500 and the NASDAQ indices both moving further into record territory. The rally was broad-based, with 21 of the 24 major S&P 500 industry groups rising and both growth and cyclical companies generally gaining. European equities also did well, with the STOXX 600, DAX, and FTSE 100 all gaining on the day.

The EUR strength though was not solely a reflection of USD weakness, but rather also reflects progress on the EU budget front as well. German Finance Minister Scholz Tuesday said that he was “confident that we will soon be able to come to an agreement” about the EU’s “rule of law” mechanism, which would allow the bloc to pass its budget and the EUR 750bn pandemic recovery fund. “I am sure that no one will be so unwise as to prevent decisions from being made now,” Scholz said. His confidence may stem from knowledge that the EU can cut funding to Hungary and Poland if they don’t cooperate.

There were also some questions about whether next week’s European Central Bank (ECB) meeting would ease policy as much as is expected. Executive Board member Isabel Schnabel confirmed that the Bank was likely to ease further because the pandemic will be more protracted than expected, but suggested it was better just to continue the current state of affairs, with borrowing costs at a record low, rather than to ease further. “It is appropriate to focus on preserving these conditions rather than easing much further,” she said. “If it’s necessary to do something that doesn’t meet market expectations, we have to do that nevertheless.”

Schnabel’s comments make today’s “fireside chat” with ECB Chief Economist Lane at the online Thomson Reuters Global Investment Summit more important than usual. People will be watching to see if he agrees with Schnabel’s assessment. You can watch it yourself here (click on Day 0).

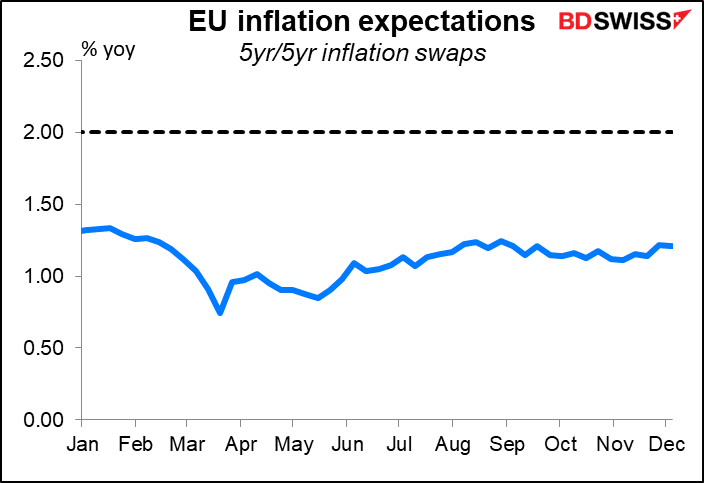

I think Lane could also warn against expecting too much next week. The ECB had been making a big deal about how the weakening euro affected their outlook for inflation, which indeed has been far below target (as we found out yesterday, when EU inflation rates remained unchanged in November from October) But inflation expectations have stopped falling recently as hopes for a vaccine and economic recovery have improved.

Former ECB Vice President Vitor Constâncio Monday tweeted, “Annoying to watch the media making a lot of the euro appreciating against the dollar (almost 1.20), as if this is a gauge of competitiveness. Nominal EUR USD since Q9/2019 ≈+8%, but the real effective exchange rate against 27 currencies (Bis data) only ≈+3% and 0% v. 2018.” Constâncio is no longer on the Executive Council, but it’s noticeable that ECB officials haven’t been talking about the exchange rate recently. Lane was the first ECB Board member to mention the exchange rate when it first touched 1.20 back in September. Listen closely today to hear if he mentions it again. If he doesn’t mention it today, then EUR/USD will most likely be free to move higher to 1.22 or so.

As I’ve said for some time, I think the diverging outlook for the virus – and therefore economic activity – in the US and Eurozone can continue to push EUR/USD higher.

Today’s market

We’ve already discussed the Swiss consumer price index in yesterday’s comment, and besides, it’s already out (-0.7% yoy, vs -0.6% yoy previously, -0.5% expected), and besides, it doesn’t matter anyway as the Swiss National Bank is on hold indefinitely. So let’s forget that.

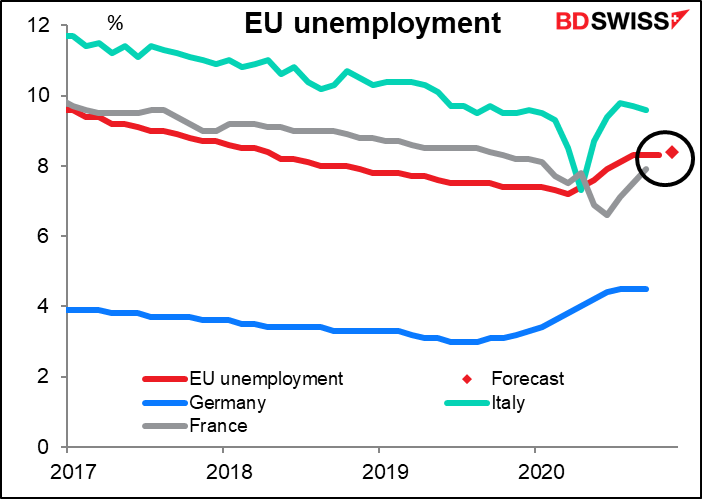

EU-wide unemployment is expected to tic up a bit in October, but nothing serious. Here’s a graph together with the EU standardized unemployment rates in the big three EU economies. Unemployment has not risen that much in the Eurozone as governments have emphasized keeping workers in their jobs. Longer-term I think this is going to prove a wise decision, as there will be more places of employment left in Europe than in the US when this is all over and economic activity will bounce back to normal faster. In the US, so many businesses have disappeared, even when people can move around freely once again they won’t have any jobs to go back to.

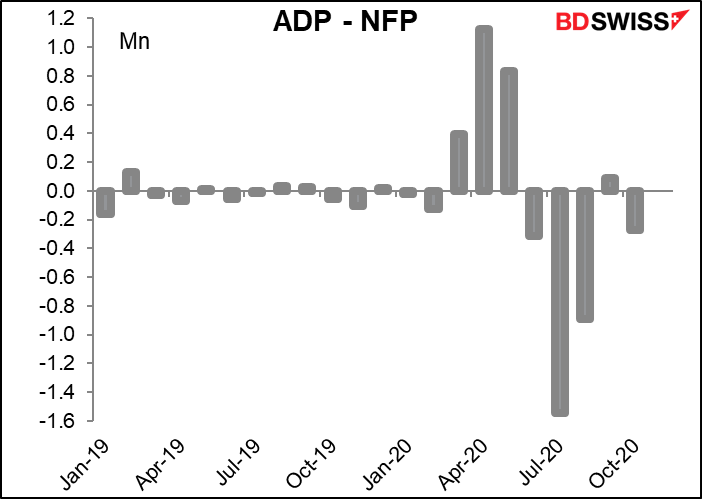

Automated Data Processing Inc. (ADP) reports its monthly estimate of the US nonfarm payrolls. ADP is an outsourcing company that handles about one-fifth of the private payrolls in the US, so its client base is a pretty sizeable sample of the US labor market as a whole and its figure is therefore looked at as a guide to Friday’s nonfarm payroll (NFP) figure. One point to note: it adjusts the figures in an attempt to match them to the final estimate of the NFP, not the initial estimate. So while they are one of the best guides to the NFP that we have, they aren’t perfect by any means – in fact, neither is the NFP figure itself, since it’s always revised.

The folks at ADP had some pretty huge misses earlier this year, but they seem to be getting better at forecasting recently.

On a percentage basis though, the errors this year haven’t been that far out of the ordinary (although July was pretty bad). It’s just that the absolute value of the numbers has been so far out of the ordinary that the forecasting errors look extraordinary.

Fed Chair Powell and Treasury Secretary Mnuchin can repeat their punch-up from yesterday, this time at the House of Representatives. I still hold out hope that Powell will just go over to Mnuchin and kick him in the shins (since he’ll be sitting down).

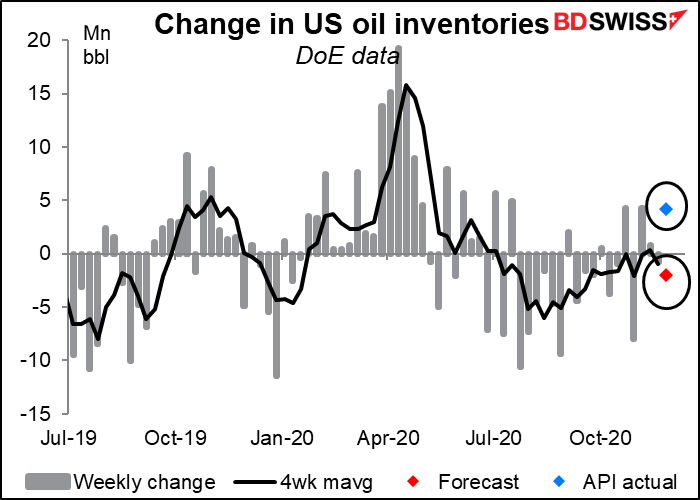

US oil inventories will be in focus after the American Petroleum Institute (API) yesterday reported a large build in crude oil inventories, instead of the modest decline that the market was expecting. The API also reported a higher-than-expected rise in gasoline inventories.

The Fed releases the Beige Book this evening, two weeks before its last Open Market Committee meeting of the year. While the Beige Book is entirely anecdotal, some people try to make a “Beige Book index” by counting how many times certain words appear. For example, check how many times the word “uncertain” occurs in it. That’s a good guide to the tone. It was 23 times in the last one (October) vs 27 in September, so maybe things are getting better. But then again the word appeared 24 times in April, and I’d say things were a lot more uncertain back in April.

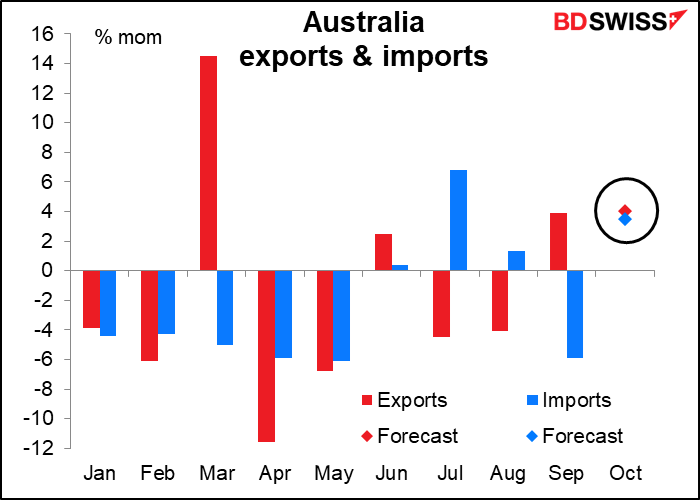

Overnight, Australia releases its trade balance. The trade surplus hit a record high of AUD 10.8bn in March as iron ore prices rose and imports fell. It then fell back in July and August as exports fell and imports rose. Now the country seems to be settling into a more normal pattern of both exports and imports rising, the former because the global economy is recovering and the latter as the domestic economy reopens. This normalization could keep the trade account in surplus going forward and might therefore be good news for the AUD.

What to give your FX friends for Christmas

By the way, if you’re looking for the perfect present for your FX-crazy friends, I have just the thing for you that you can make at home: an ECB-themed advent calendar. Just follow the link and make one for yourself and all your friends!