Previous Trading Day’s Events (25 Jan 2024)

The ECB mentioned that it is too soon to discuss a reversal in interest rates since price pressures persist.

“The consensus around the table was that it was premature to discuss rate cuts,” ECB President Christine Lagarde told her regular news conference following the decision, insisting that future decisions would depend on incoming data. “We need to be further along the disinflation process to be confident that inflation will be at target – sustainably so.”

While fighting inflation aggressively, economists worry about the economies in the Eurozone, since recent data show worsening business conditions.

“Germany is in an absolute hole with no prospect of getting out of it, and yet the ECB seem more worried about inflation than they are about a depression,” said Michael Hewson, chief market strategist at CMC Markets in London.

The ECB expects household and government spending to drive a recovery but data appear to be painting a bleaker picture, with manufacturing remaining in recession and services cooling.

Disruptions to trade from attacks by Yemen’s Houthi group on shipping in the Red Sea could add to inflation by pushing up energy and freight costs, she warned.

“We are observing it very carefully,” Lagarde said.

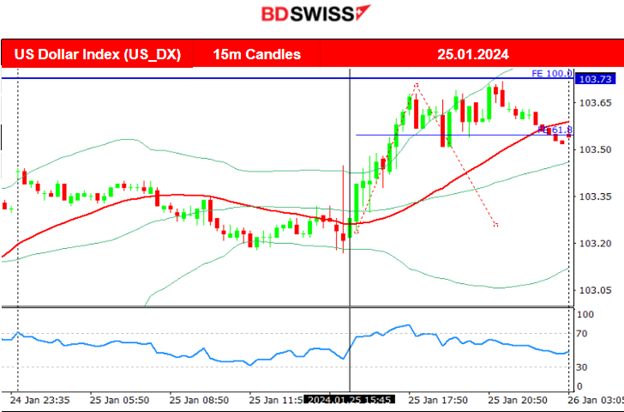

The Advance GDP estimate showed gross domestic product in the last quarter increased at a 3.3% annualised rate, compared with the consensus forecast of 2% growth rate.

“The dollar overall is stronger today, but given the scope and scale of the GDP beat, I would argue that it should be a lot higher,” said Eugene Epstein, head of structuring for North America at Moneycorp in New Jersey. “The market, even in the face of all this information that the economy is growing well, still does not buy the higher-for-longer premise that the Fed has given.”

Next week, Jan 31st, the Fed is widely expected to keep interest rates unchanged. Many economists expect that the Fed will likely wait until the second quarter before cutting interest rates.

Initial claims for state unemployment benefits increased 25K to a seasonally adjusted 214K for the week ended Jan 20th. This was a strong increase showing tighter labour market conditions.

______________________________________________________________________

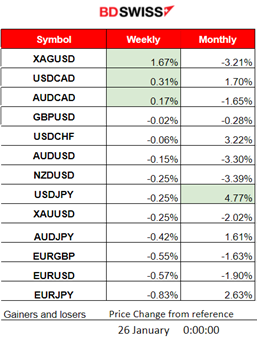

Winners vs Losers

Silver (XAGUSD) leads this week with 1.67% gains. USDJPY remains the top winner for the month with 4.77% gains.

______________________________________________________________________

______________________________________________________________________

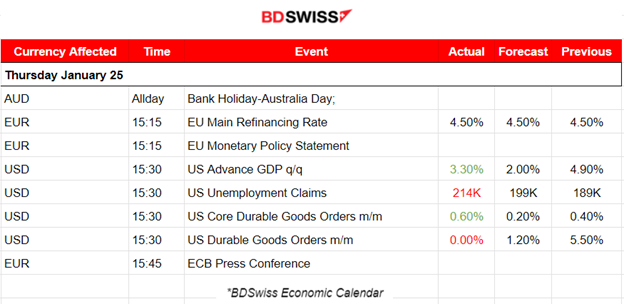

News Reports Monitor – Previous Trading Day (25 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no major scheduled figure releases.

- Morning–Day Session (European and N. American Session)

The European Central Bank (ECB) decided to keep the three key ECB interest rates unchanged. The declining trend in underlying inflation has continued with the current interest rate policy in place. Policymakers further stated that tight financing conditions are dampening demand, and this is helping to push down inflation more. They are determined to ensure that inflation returns to its 2% medium-term target. No talks for cuts yet, Lagarde said, however, that in summer there is a chance for them to take place. The market reacted with a low-level intraday shock at that time and the EUR started to depreciate more and more against the dollar as time passed and after the press conference took place.

The pace of U.S. economic growth slowed in the last three months of 2023 but far less than had been expected. The U.S. gross domestic product (GDP) grew at an annualised rate of 3.3% in the final quarter of the year, down from 4.9%. However, it is still higher than the estimated 2% for the quarter. The Durable Goods Orders figure for the U.S. was reported higher than expected, a change of 0.6% against 0.2%. Unemployment claims were reported higher than expected showing a still-tight labour market when entering the new year. There was a slight reaction in the market with USD experiencing strength but the effect soon faded.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

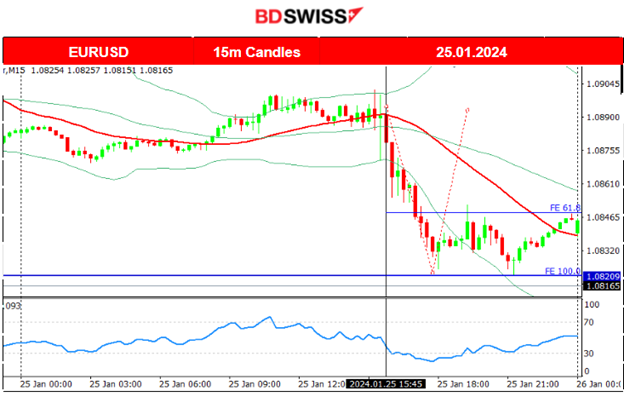

EURUSD (25.01.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving around the 30-period MA going sideways with volatility remaining low until the ECB news. At the time of the ECB’s reports and statement release the pair did not experience any particular movement. The market was almost certain about the outcome and since there were no surprises, no major shock took place affecting the EUR. At 15:30 the quarterly GDP figure for the U.S. was reported higher than expected causing some impact on the USD and its appreciation. During the ECB press conference that started after 15:45, the EUR started weakening, and in combination with the dollar strengthening, the EURUSD started to drop heavily, reaching support at 1.08200. Retracement followed to the 61.8 Fibo level and back to the MA.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

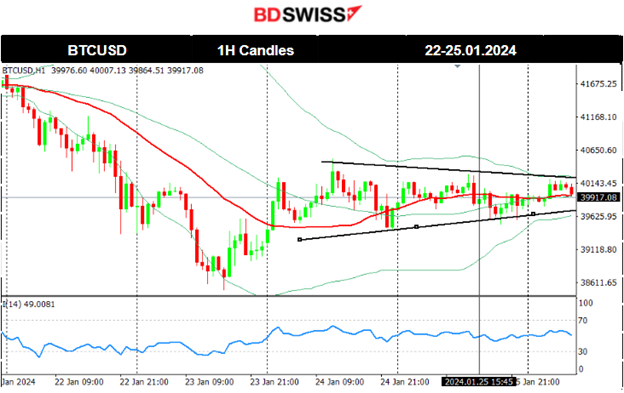

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After the Spot Bitcoin ETF approval from the SEC, Bitcoin saw an unusual fall in value. On the 18th Jan, it dropped heavily until the support near 40600 USD. Retracement followed but on the 19th it saw another drop to 40200 USD. On the same day, it recovered fully and on its way up it crossed the 30-period MA showing strength, settling at near 41600 USD. On the 22nd Jan, the price dropped heavily again reaching and testing the 40600 USD support once more, breaking that support and eventually falling further to 39400 USD. Bitcoin eventually reached near 38500 USD on the 23rd Jan before bouncing back. From the 22nd Jan, the drop was relatively rapid leaving room for retracement. This happened already since the price returned to the 30-period MA and further back to the 61.8 Fibo level. The market is in consolidation currently and the price remains near the 40000 USD level. Low volatility and a triangle formation are dominating the market currently as depicted on the chart.

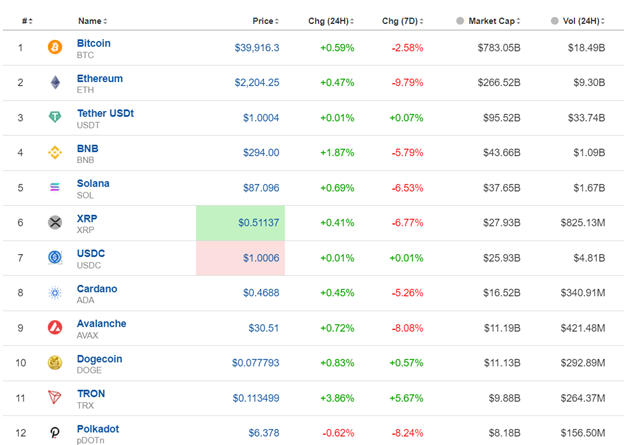

Crypto sorted by Highest Market Cap:

Nothing changed much for the last 7 days. The Crypto market is suffering after the spot Bitcoin ETF approval from the regulatory authorities. In the last 24 hours, we have had some gains signalling that the market might be on the turning point to the upside.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

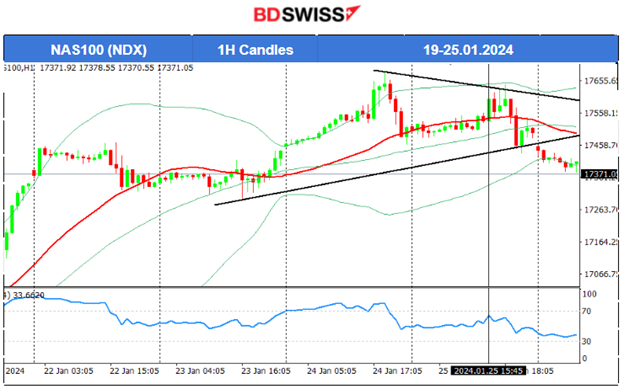

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

It is obvious that the market conditions are starting to change again. The U.S. Stock market seems to stabilise with less performance taking place the past few days. Indices are leaning more toward a sideways movement. This is obvious when looking at Dow Jones, showing high volatility and sideways 30-period MA. The NAS100 index was performing better but on the 24th Jan, it experienced strong resistance that persisted also in the 25th Jan. What seems to have formed is a triangle that today has been broken, giving a strong signal that the uptrend is over and a more sideways movement is following, with a possibility of a turning point to the downside soon.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

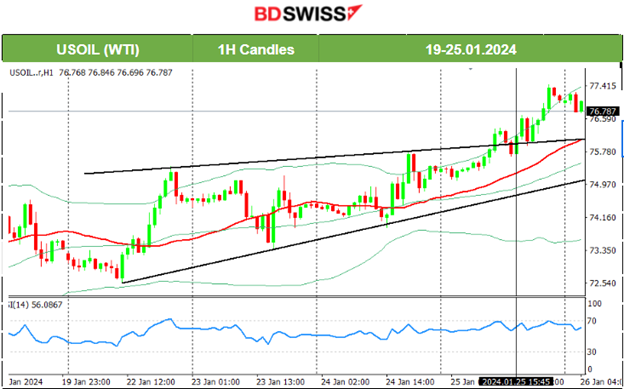

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil seems to give signals for moving higher in the future as it breaks the upward wedge on the upside. Looking at things from afar, using a daily chart we see that the support at 70 USD/b is quite strong and served as a turning point to the upside. On the 25th it moved upwards steadily, reaching the resistance near 77.5 USD/b after breaking the upward wedge, and retracement started to take place late.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold found support on the 22nd Jan and the 23rd it jumped higher finding resistance at near 2035 USD/oz. It seems that the recent path for Gold was sideways with significantly higher volatility levels. A triangle formation was apparent and on the 24th Jan, the price dropped heavily breaking the triangle formation and moving to the 2010 USD/oz support level. Retracement followed back to 2020 USD/oz and the 61.8 Fibo level. On the 25th, gold experienced high volatility but the path remained sideways overall. That day it reached the resistance of 2025 USD/oz when it jumped after the ECB news, and reversal followed soon after back to the lows. It finally retraced back to 2020 USD/oz.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (26 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

According to the report at 1:30, Tokyo inflation was reported lower than expected at 1.6%. The figure was the weakest since March 2022 resulting from falls in the cost of energy and from less gains in the prices of accommodation and processed food. At the time of the release, the market reacted with JPY depreciation. The USDJPY jumped near 30 pips before retracement followed.

- Morning–Day Session (European and N. American Session)

The U.S. Core PCE Price Index figure will be released affecting the USD. An inflation-related report that usually causes volatility. The change is expected to be reported higher, thus coinciding with the previous inflation data supporting evidence of rising prices in December.

______________________________________________________________________

General Verdict:

______________________________________________________________