PREVIOUS WEEK’S EVENTS (Week 24-28 July 2023)

Announcements:

Eurozone, U.S. and U.K. Economy

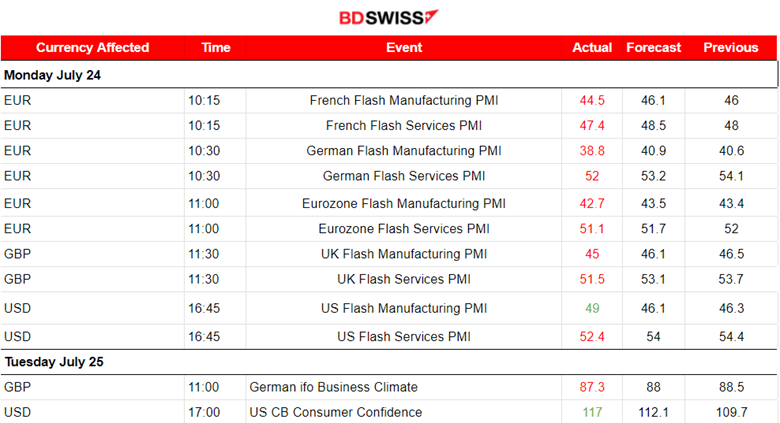

PMI releases last week: Eurozone and U.K. PMIs were all reported weak during the morning across Europe. German Manufacturing in particular was at 38.8, which is the worst figure since May 2020! U.K. Manufacturing remains firmly in contraction at 45.0 vs. 46.5 last time and Services at 51.5. The U.S. PMIs were also reported weak. The manufacturing sector beat expectations but remained in contraction.

The survey suggested that Eurozone business activity shrank in July as services demand declined while factory output fell at the fastest pace since COVID-19. Germany and France are both in contractionary territory and the figures raise recession fears. The figures for both countries were worse than predicted.

Activity in Germany especially, Europe’s largest economy, contracted in July, increasing the likelihood of a recession in the second half. The manufacturing sector is the most worrying. The data show apparent deterioration in macroeconomic conditions spreading from manufacturing to other sectors as well. The risk of a small contraction in eurozone GDP in Q3 rises.

U.S. Economy

This month, U.S. Consumer Confidence jumped to the highest level in two years as inflationary pressures eased. The American economy continued to show resilience in the face of an aggressive hike policy. A persistently tight labour market along with a significantly lower inflation rate.

Lower inflation explains mainly why confidence has surged.

The U.S. Unemployment Claims were reported lower than expected as a resilient labour market supported consumer spending. Durable goods orders figures were actually reported higher than expected.

Gross domestic product increased at a 2.4% annualised rate last quarter. The economy grew at a 2.0% pace in the January-March quarter.

German Economy

The ifo Business Climate Index fell to 87.3 points in July, down from 88.6 points in June showing that sentiment has worsened further. That’s the third consecutive fall. The drop was slightly bigger than forecast.

Germany’s economy was described as falling into a technical recession in early 2023, defined by two consecutive quarters of contraction.

_____________________________________________________________________________________________

Inflation

Australia: Inflation figures for Australia were reported lower than expected. Underlying inflation has slipped below 6%. Inflation slowed more than expected in the second quarter, suggesting less pressure for another hike. The CPI rose to 5.4% year-on-year, down from 5.5% in May. The trimmed mean rose by 0.9% in the June quarter, pushing the annual pace down to 5.9% and just under forecasts of 6.0%.

Some further tightening in Australia might take place. The RBA is expected to hike two more times honouring their statements that they are committed to bringing down inflation. Headline inflation remains far above the RBA’s target band of 2-3%, projected to return to the top of the bank’s target by mid-2025.

U.S.: Annual U.S. inflation is slowing further and could push the Federal Reserve to stop rate hikes for now. The personal consumption expenditures (PCE) showed a figure of 0.20%, lower than the previous 0.30%. The employment cost figure also showed a lower, 1% increase. The data show that labour costs posted their smallest increase in two years in the second quarter as wage growth cooled significantly. Together with labour market resilience pushed away and thinking of recession.

The U.S. central bank on Wednesday raised its policy rate by 25 basis points to the 5.25% – 5.50% range, a level last seen just prior to the 2007 housing market crash.

_____________________________________________________________________________________________

Interest Rates

U.S.: The Federal Reserve (Fed) hiked its policy interest rate range by 25 basis points, as expected, with the statement retaining the phrasing that further policy firming “may be appropriate”. The Fed has unanimously voted to raise the Fed funds target range to 5.25-5.5%, the highest level for 22 years.

The accompanying policy statement left the door open to another increase.

“The (Federal Open Market) Committee will continue to assess additional information and its implications for monetary policy,” the Fed said in a language that was a little different from its June statement and left the central bank’s policy options open as it is looking for a stopping point to the current tightening cycle.

Eurozone: The European Central Bank’s decision was to increase key interest rates by 25 basis points, as expected. It was the ninth consecutive rate increase as an effort to bring inflation down. The ECB said: “Inflation continues to decline but is still expected to remain too high for too long. They are determined to ensure that inflation returns to its 2% medium-term target in a timely manner.

They expect that inflation will drop further over the remainder of the year but will stay above target for an extended period as underlying inflation remains high overall. However, recent activity surveys (i.e. PMIs) suggest the economic slowdown is now significantly affecting both Eurozone manufacturing and services.

While the market expects no more hikes from the Fed and ECB as inflation reaches close to the targets, the Bank of England is still expected to have a few more rate hikes. Inflation in the U.K. remains higher than in the Eurozone or the U.S.

Japan: The Bank of Japan (BOJ) left rates unchanged again, BOJ Policy Rate remained at -0.10%. The Policy Board decided to conduct yield curve control with greater flexibility, surprising the market with a yield curve control tweak.

While the BOJ kept interest rates at ultra-low levels, it said the tweak to its bond yield curve control scheme (YCC) would allow it to respond “nimbly” to risks including rising price pressures.

BOJ maintained guidance allowing the 10-year yield to move 0.5% around the 0% target, but said those would now be “references” rather than “rigid limits”.

The BOJ said it would make an offer to buy 10-year Japanese government bonds at 1.0% in fixed-rate operations, instead of the previous rate of 0.5%, signalling that it would now tolerate a rise in the 10-year yield to as much as 1.0%.

_____________________________________________________________________________________________

https://www.reuters.com/markets/us/us-consumer-confidence-rises-two-year-high-july-2023-07-25

https://www.reuters.com/markets/europe/german-business-sentiment-worsens-further-july-ifo-2023-07-25/ https://www.reuters.com/markets/australia-inflation-slows-more-than-expected-q2-2023-07-26

https://www.reuters.com/world/us/us-annual-inflation-slows-june-consumer-spending-solid-2023-07-28/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (24-28 July 2023)

France: Business activity in France declines at the fastest rate since November 2020 as contractions worsen in the Services and Manufacturing sectors.

Germany: Lower than expected also PMIs for Germany pushing it into the contraction area in July. The Manufacturing figure is quite low, at 38.8.

Eurozone: PMI suggests worsening economic conditions. The survey suggests that demand in the Eurozone is falling for both goods and services.

U.K.: A slowdown in business activity growth across the U.K. private sector economy. The Manufacturing sector has 45 points and the Services sector just over 50, with 51.5 points.

U.S.: The Manufacturing sector improves but is still in contraction with 40 points while the Service sector growth slows in July. The Services sector is still in expansion with 52.4 points.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

DXY (US Dollar Index)

The Dollar experienced a lot of swings last week. During the middle of the week, the DXY was moving more to the downside at a steady pace. It crossed the 30-period moving average on the 26th of July and continued the downward movement until it found support eventually at 100.56. On the 27th of July, after the ECB announced its decision to hike rates the dollar started to strengthen greatly. The DXY reached higher levels near 101.80. The next day it moved even higher before eventually retracing back to the mean and the 61.8 Fibo level.

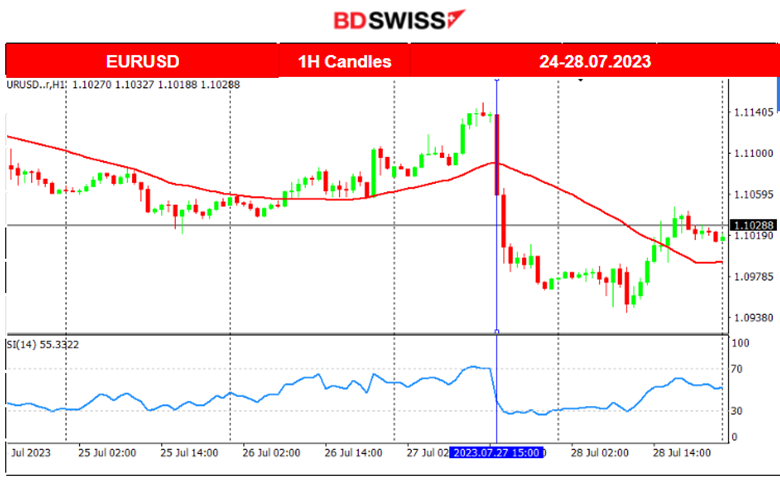

EURUSD

Obviously driven by the USD, the pair started to move above the 30-period MA on the 26th of July and found resistance on the 27th of July. Even though the ECB hiked rates, the EUR actually depreciated moderately and the USD started to strengthen too much against other major currencies. This caused the pair to drop heavily, finding strong resistance only on the 28th of July when it eventually retraced back to the 30-period MA.

AUDUSD

This pair was moving mostly sideways around the 30-period MA with high volatility at the start of the last week. On the 26th of July, the low CPI figures reported early during the Asian Session caused the pair to drop but the impact was not so high. The AUDUSD remained on the sideways path close to the MA. Volatility surged on the 27th of July after the ECB rate decision when it experienced a steady drop as the USD was gaining strength. This drop was relatively rapid and characterised as a reversal. The pair, after finding strong support at near 0.66220, it eventually retraced.

_____________________________________________________________________________________________

NEXT WEEK’S EVENTS (31 July – 04 Aug 2023)

This week the RBA is going to decide if they are going to increase the Cash Rate by 25 basis points. The BOE also is expected to hike by the same amount.

We also have the release of labour market data for many regions including the NF Payrolls.

OPEC-JMMC Meetings are taking place on August 3rd.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

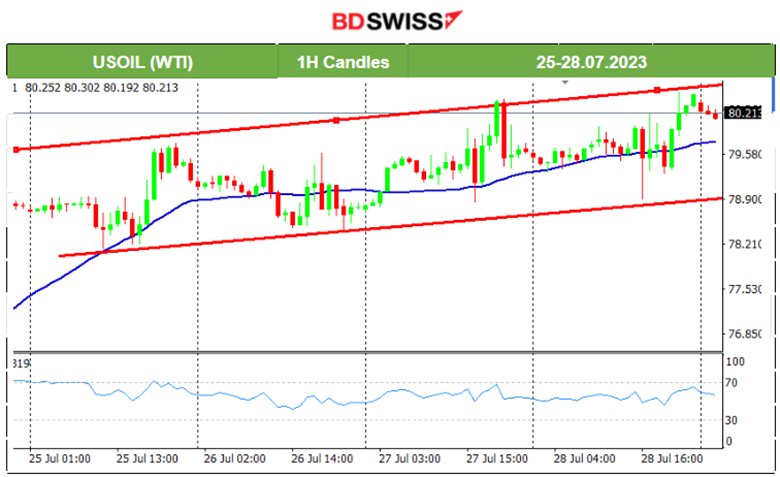

U.S. Crude Oil

Crude is moving steadily with moderate volatility within an upward channel as it seems. It remains on the trend and moves while being above the 30-period MA

Gold (XAUUSD)

The Gold price crossed the 30-period MA, on its way up and remained on the upside. It seemed to be in an upward channel with low volatility. The RSI indicated that there is a bearish divergence that would cause the end of this upward path. Apparently, it has. However, the drop that happened on the 27th is attributed to the USD strengthening that took place after the ECB rate decision, causing the Gold price to drop since it is denominated in USD. Retracement followed after the price found strong support near 1942 USD/oz. The next day on the 28th of July, retracement followed and the price settled around the mean near 1955 USD/oz/.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The long and recent upward movement of the NAS100 index was interrupted. In the last couple of days, the index moved sideways with high volatility around the mean. It showed actual signs of recovering from the previous downward movement as it was moving steadily to the upside breaking resistances. Yesterday, during the ECB press conference, the Dollar was gaining remarkable strength but the U.S. benchmark indices kept moving to the upside steadily. Only after the NYSE opening, the U.S. Stock market suffered an intraday crash, reversing heavily from the upside, crossing the MA and staying below the mean. The biggest drop was observed after 20:00. The next day, the 28th of July, the index reversed fully. A quite resilient market as it seems. An upcoming retracement after the rapid upward path is possible.

______________________________________________________________