PREVIOUS TRADING DAY EVENTS – 31 July 2023

“The news in Europe is a bit more mixed (with) the preliminary data in Italy coming in much weaker than expected, although the eurozone is not doing too badly,” said Andrea Cicione, head of research at TS Lombard. “The picture is not as encouraging as the U.S. and so the markets are trying to figure out what matters most.”

Compared with the U.S.: Inflation in the United States has indeed succeeded in causing a significant drop but the economy, however, has shown resilience to the aggressive hike policy. The Eurozone struggles on the other hand since the economy is slowing down significantly, as the recent economic data suggest.

An index of Eurozone banks edged up 0.2% after the European Banking Authority’s (EBA) annual stress test results showed three of 70 banks from the European Union failed to meet binding capital requirements.

______________________________________________________________________

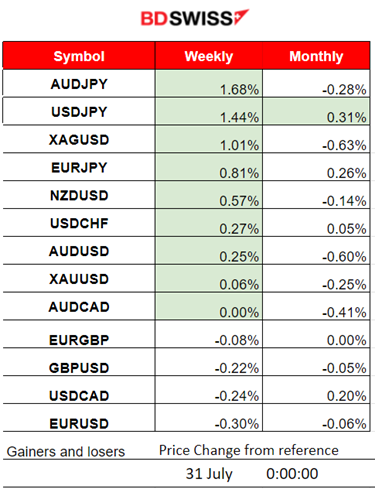

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (31 July 2023)

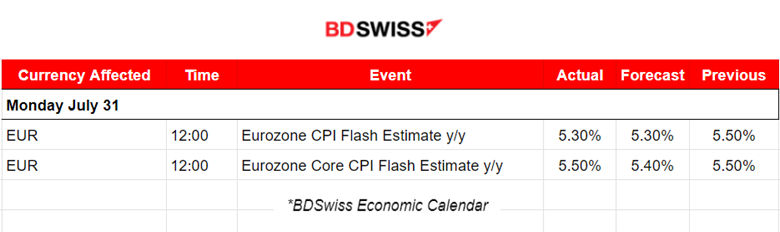

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

The CPI Flash estimate figures were released at 12:00 but had not too much impact. These figures showed that the Euro area annual inflation went down to 5.3% (core inflation remained at 5.5%) according to the flash estimates from Eurostat.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

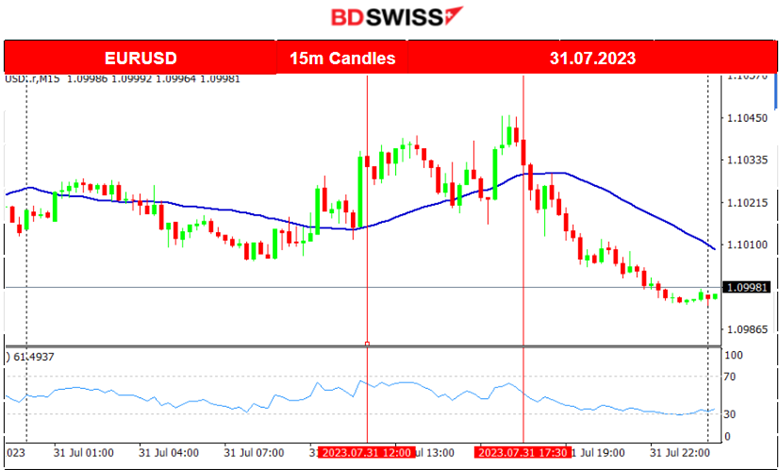

EURUSD (28.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was following a sideways path around the 30-period MA until the European session started. After 12:00 when the CPI Flash estimates for Eurozone were released, more volatility was observed. The pair further deviated from the mean to the upside before reversing again later on and crossing the MA on its way downwards with USD appreciation.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Triangle formation for NAS100 as the U.S. stock market starts to show lower activity. Since the large drop on the 27th after the rate releases, there is some kind of consolidation phase keeping the index on a sideways path, part of a triangle formation, but close to the resistance of 15815 USD. The RSI shows signs of bearish divergence with its lower highs. However, recent scheduled releases regarding the labour market could trigger volatility that might cause the index to jump breaking that resistance.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

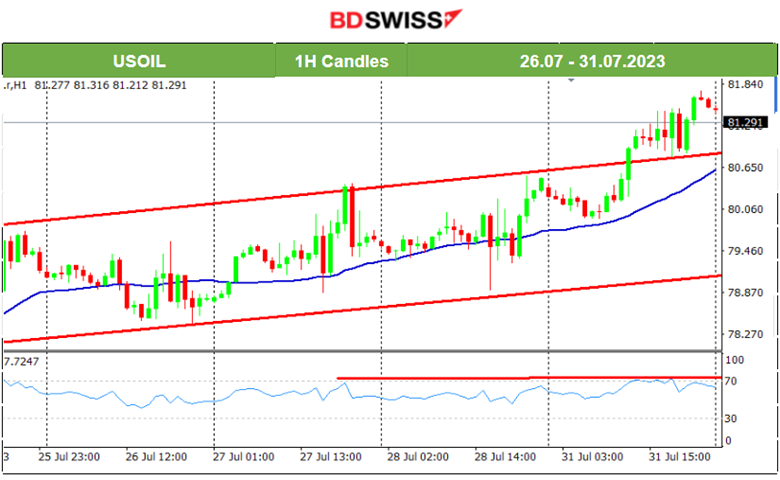

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude is moving steadily upwards with moderate volatility. It was moving within an upward channel but it has now broken as the price jumped even higher. It remarkably remains on the upside. This week OPEC-JMMC Meetings are taking place and are probably going to cause a distortion in Oil’s path. The RSI obviously remains over the 50 level for long as the trend is upwards, but shows signs of bearish divergence. The price could reach 80.70 USD/b upon short retracement.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The drop that happened on the 27th is attributed to the USD strengthening that took place after the ECB rate decision, causing the Gold price to drop since it is denominated in USD. Retracement followed after the price found strong support near 1942 USD/oz. The next day on the 28th of July, retracement followed and the price settled around the mean near 1955 USD/oz/. It later continued with an upward path but with no strong signal that an uptrend has started.

______________________________________________________________

News Reports Monitor – Today Trading Day (01 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The Reserve Bank of Australia (RBA) has decided to keep the Cash Rate Unchanged. It was a surprise for the market since it was expected that the decision would be an increase of 25 bp. The Board states that the higher interest rates are on levels that can keep a sustainable balance between supply and demand in the economy and that they will continue to do so. This belief, plus the uncertainty surrounding the economic outlook, the decision resulted in interest rates being kept steady this month. The market reacted with AUD depreciation at 7:30. About 40 pips drop for AUDUSD.

- Morning – Day Session (European)

PMIs for the Manufacturing sector are released today since the start of the European session for all regions. At the time of their release, a moderate intraday shock will probably occur especially for Germany, the U.K. and the U.S. More volatility is expected in general since PMIs will show the recent level of economic activity which is important to the decision and policymakers.

The US ISM Manufacturing PMI release is expected to cause an intraday shock for the USD pairs. It is released together with the JOLTS Job Openings figure which is expected to be lower. As the rate hikes are having more impact on the economy, the labour market is expected to further cool. Interest rate changes have proven to have a lasting impact on the U.S. economy but it continues to keep its resilience the truth is. Let’s see.

General Verdict:

______________________________________________________________