1. Dollar Sags On Weak US yields, Investors Turn To Trade Talks

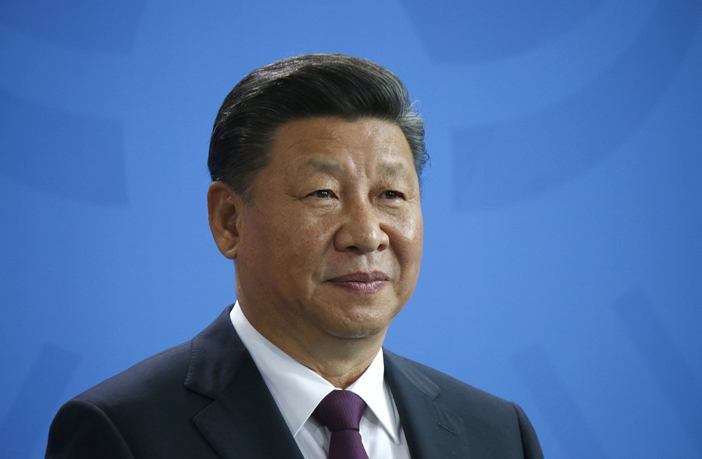

The dollar sagged against its peers on Wednesday in the wake of falling U.S. yields and as investors remained cautious ahead of the Federal Reserve’s policy meeting minutes due later in the session. The U.S. currency has also been weighed down as safe-haven demand for the liquid dollar has ebbed on optimism that a fresh round of talks between China and the United States would help resolve their trade conflict. The world’s two largest economies began their latest round of trade talks this week to resolve a bitter dispute in which each has levied tariffs on imports from the other. The United States has accused China of unfair trade practices, including forced technology transfers, charges it has denied.*

2. Canadian Dollar Gains As Oil Rallies, Investors Embrace Risk

The Canadian dollar strengthened against the greenback and the Wednesday, as oil prices climbed and as risk appetite was boosted by the potential de-escalation of the trade dispute between the United States and China as their meeting progresses. Oil prices were around 2019 highs on Wednesday, propped up by supply cuts led by producer club OPEC and by U.S. sanctions on Iran and Venezuela. However, it should be noted that soaring U.S. production and expectations of an economic slowdown look set to cap prices. U.S. West Texas Intermediate (USOIL) crude oil futures hit 2019 highs of $56.61 per barrel, up 17 cents, or 0.3 percent, as of 7:51 GMT. International Brent crude futures (CL_BRENT) were at $66.47 per barrel, up 2 cents from their last close and not far off their 2019 high of $66.83 per barrel from Monday.**

3. GBP/USD: Sterling Trades Flat As Investors Await May-Juncker Meeting

Sterling is trading little changed on the downside at 1.3054 as of 7:54 GMT after rising some 150 pips on Tuesday. The pair is struggling to extend previous gains as investors await details of the meeting between the UK Prime Minister Theresa May and the EU Commission chief Jean-Claude Juncker. The Brexit uncertainty remains the biggest challenge for UK. Sterling is expected to weaken at the beginning of 2019 and rebound sharply after the Brexit uncertainty fades away.***

You can find and trade all of the above mentioned assets on BDSwiss Forex/CFD platforms.

*Source: Investing Feb 20, 2019 2:48 AM ET

**Source: Reuters Feb 20, 2019 3:53 AM ET

***Source: Blokt Feb 20, 2019 03:07 AM ET