PREVIOUS TRADING DAY EVENTS – 17 July 2023

This reading was higher than the expected negative figure, minus 3.5. The actual was above zero, signalling that the New York manufacturing sector is growing. The rebound is an encouraging sign for national manufacturing activity, which had been undermined by higher interest rates and the rotation of spending back to services from goods.

State manufacturers had diverging views of business conditions, with roughly 29% reporting an improvement and some 27% citing a deterioration.

The report showed manufacturers added workers after five months of paring payrolls.

Source: https://www.reuters.com/markets/us/new-york-factory-activity-rebounds-april-ny-fed-2023-04-17/

______________________________________________________________________

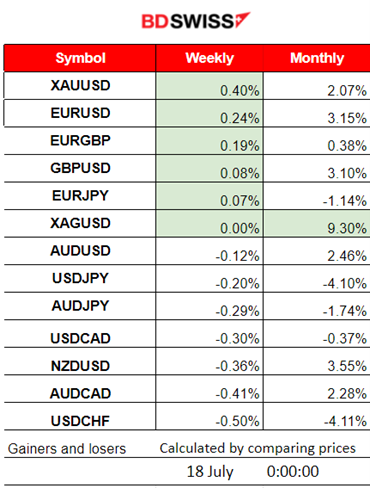

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (17 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, no special scheduled releases.

- Morning – Day Session (European)

At 15:30, the Empire State Manufacturing index recorded 1.1 points, higher than the expected figure but way lower than the previous one. A drop in the general business conditions seems that it didn’t have much impact on the dollar.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

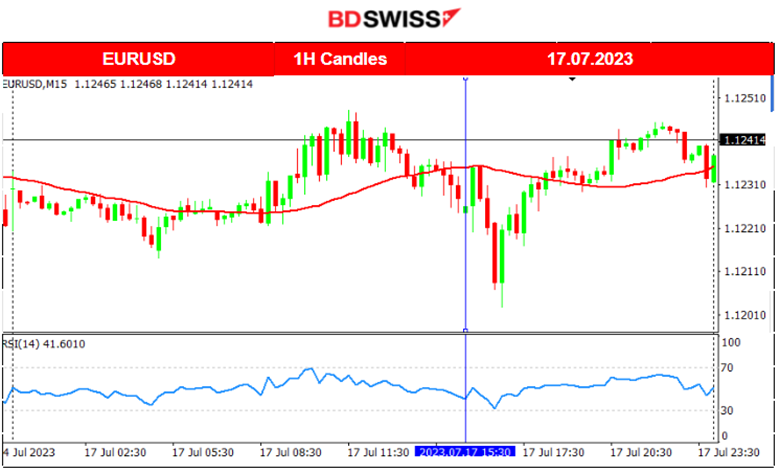

EURUSD (17.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced low volatility and was moving around the mean for the whole trading day, a typical Monday mood. The absence of major scheduled releases has left the path with no major intraday shocks. The Empire State Manufacturing Index improved suggesting that business activity held steady in New York State, according to firms responding to this July 2023 Survey. The dollar strengthened for a while after the release causing the pair to deviate on the downside but soon retraced back to the MA continuing the sideways path.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 moved significantly higher at a fast pace during the week but on Friday it finally showed signs of pausing the uptrend. On the 17th of July, it refused to move lower, starting the week with signs of stock market strength as the index moved rapidly upwards reaching higher levels than Friday’s peak. However, the RSI shows a price slowdown with lower highs. The U.S. labour market data together with the inflation-related data has caused an unusual uptrend for the benchmark indices lately and a market reaction that seems to keep indices high enough. Sideway volatile moves are more probable at the moment. Further uptrend is not impossible as Retails Sales figures are released today and volatility will probably be high after 16:30, NYSE opening.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Oil price followed an upward path formed by the OPEC meetings’ recent statements and other factors. The trend continued until the 14th of July when eventually the price reversed crossing the 30-period MA on its way down. On Monday, 17th of July the price continued the downward movement but with some retracements taking place back to the mean while following a downward path. The RSI shows higher lows while the important support is now at near 73.80 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was steady on the sideways until the bearish divergence was completed on the 14th of July when the price started to move on the downside. It looks like a downward channel is formed as Gold moves steadily on the downside with high volatility. A sideways path though remains more probable, unless important support or resistance levels break. Rapid moves are taking place usually when there are important scheduled releases during the busy trading days in the middle of the week.

______________________________________________________________

News Reports Monitor – Today Trading Day (18 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The release of the RBA Monetary Policy Meeting Minutes had a low impact on the AUD causing weakening. A small intraday shock was observed as the members discussed that the year-ended rate had declined and inflation remained quite above central banks’ targets in most advanced economies. Board agreed that some further tightening may be required as this would be reconsidered during the August meeting.

- Morning – Day Session (European)

Today’s important figures to be released at 15:30 are the Canada CPI data shedding some light on inflation direction, expected to lower significantly.

Retail sales data for the U.S. is scheduled to be released at the same time potentially causing an intraday shock to the USD pairs. These monthly changes are expected to be higher, however, considering the recent labour data results, surprises might take place.

General Verdict:

______________________________________________________________