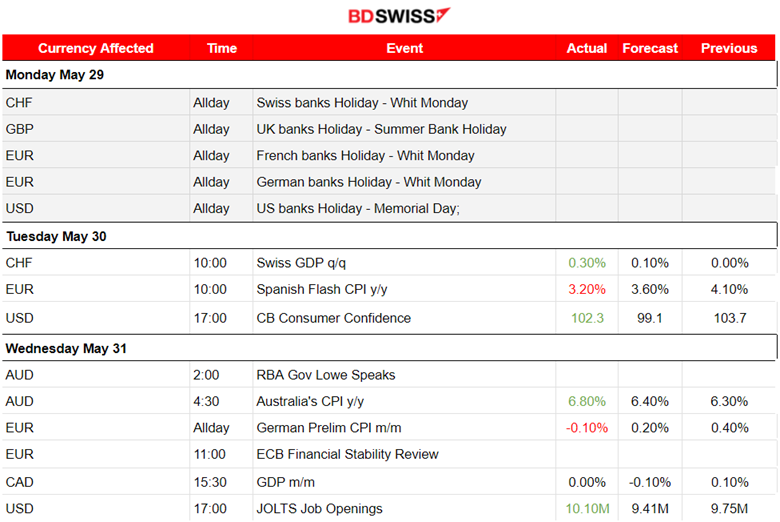

PREVIOUS WEEK’S EVENTS (Week 29 May – 02 June 2023)

Announcements:

U.S. Debt Ceiling

Early last week, the U.S. President, Joe Biden, was pushing for progress since the default deadline was approaching and showed extreme confidence that the deal was going to pass through the House. The U.S. Secretary of Treasury Jannet Yellen had announced previously that the U.S. debt default deadline has been extended until the 5th of June.

The U.S. House of Representatives eventually passed the bill to suspend the $31.4 trillion debt ceiling, until the first quarter of 2025, on Wednesday as time was running out. Biden proceeded in urging the Senate to act quickly so that he could sign it into law.

Finally, on the 1st June the majority of the U.S. Senate voted to pass the debt ceiling bill thus averting the debt default. Biden commented that this is a big win for the American Economy and pledged that he will sign it into law as soon as possible.

_____________________________________________________________________________________________

U.S. Economy

The U.S. Consumer Confidence report showed a lower index figure, 102.3 versus the previous 103.7, down to a six-month low in May. Consumers are expecting inflation to rise to higher levels over the next year.

The U.S. labour market remains tight but is slowing. Recent data showed its resilience and consumer expectations are slightly more favourable this time. 13.6% of consumers expect more jobs to be available, down from 14.3%. However, 20.2% anticipate fewer jobs, down from 21.3%.

The JOLTS Job Openings figure was reported higher, up to 10.1 million on the last business day of April, according to the U.S. Bureau of Labor Statistics. A higher-than-expected figure implies that the labour market continues to be strong.

This flow of strong Labor Market data forms new expectations that the Fed could revise decisions for a rate hike pause next month.

The advance figure for seasonally adjusted initial claims was 232,000 showing an increase of 2,000 from the previous week’s revised level. Private employers hired more workers than expected.

The U.S. Manufacturing PMI indicates a contraction in manufacturing activity that remains persistent, raising the risks of a recession. A stronger and sustained rate of slowdown is needed for the labour market to avoid rate hikes.

the U.S. Non-Farm payroll employment increased by 339K in May, way above expectations, and the U.S. Unemployment Rate rose to 3.7% versus the previous 3.4% figure. Thus, more data showing a strong labour market. The Fed’s most recent statements were about the need to take a pause, and then maybe look to hike in July. However, with this data, pause is maybe not an option. This is what the market is thinking at least. The DXY appreciated greatly after the figure release until the end of the trading day.

_____________________________________________________________________________________________

Inflation

Australia: Australia’s annual inflation figure was reported quite high, 6.8% in April, suggesting sticky inflation will likely keep pressure on the central bank since aggressive rate hikes seem to not have the desired impact.

The Reserve Bank of Australia (RBA) has to decide next week on the rates, taking this data into account. Policymakers are willing to continue rising interest rates in order to bring inflation back to target by mid-2025.

Germany: The Preliminary monthly Inflation figure for Germany was negative, -0.1%, indicating a sharp drop in prices. The European Central Bank’s (ECB) efforts in countering price growth seem to have an impact. Policy makers have raised rates by a record 375 basis points over the past year already committed to raise again in June.

Eurozone: The Euro area’s annual inflation is expected to be 6.1% in May 2023, down from 7.0% in April, according to the CPI Flash Estimate figure released last week.

ECB policymakers plan to extend their unprecedented tightening campaign. The European Central Bank President, Christine Lagarde made it clear that despite the drop, rate hikes will continue as it deems necessary for inflation to reach the target. Lagarde made clear that they still have ground to cover.

Sources:

https://www.reuters.com/world/us/us-debt-ceiling-bill-faces-narrow-path-passage-house-2023-05-31

https://www.cnbc.com/2023/06/01/debt-ceiling-bill-updates.html

https://www.reuters.com/markets/us/us-consumer-confidence-dips-may-survey-2023-05-30/

https://www.reuters.com/markets/us/us-job-openings-unexpectedly-rise-april-2023-05-31/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (29 May – 02 June 2023)

_____________________________________________________________________________________________

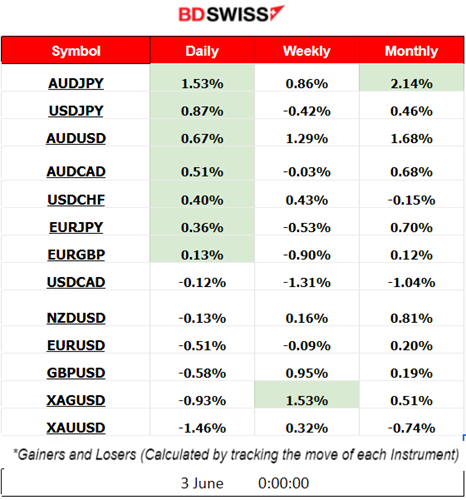

Summary Total Moves – Winners vs Losers (Week 29 May – 02 June 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD was moving around the mean with high volatility lately. On the 31st of May it reversed going upwards and crossing the 30-period MA eventually on the 1st June. The movement was mainly driven by the USD. On that day, the debt ceiling deal was approved, the USD depreciated greatly pushing the EURUSD to climb further. With the release of the NFP data on Friday 2nd the USD appreciated greatly causing the pair to drop and reverse.

DXY (US Dollar Index)

The U.S. dollar was affected continuously by many factors this week that caused the DXY index to move sideways with high volatility. There was no clear direction since market participants’ expectations about its future value were mixed. On the 1st June, though, the U.S. Unemployment Claims figures were released indicating a not so much increase from the previous figure. The market reacted with USD depreciation causing the DXY to drop rapidly. In addition, the debt-ceiling bill was approved by the Senate after 17:30 that day causing the USD to depreciate against other currencies even further until the end of the trading day, with DXY to not show any reversal. Reversal took place on the 2nd June after the NFP data release, which caused the USD to appreciate significantly.

_____________________________________________________________________________________________

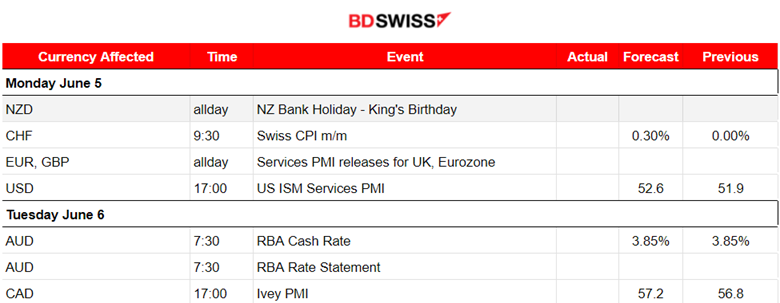

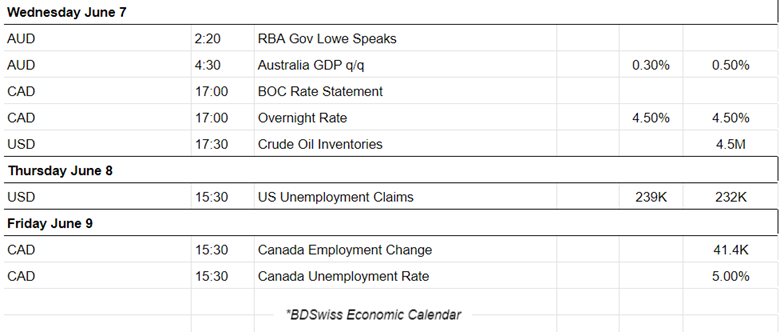

NEXT WEEK’S EVENTS (05 June – 09 June 2023)

Rate decisions ahead this week. The Reserve bank of Australia and Bank of Canada are going to decide if they will eventually leave the rates unchanged.

We are also waiting to see the employment data for the U.S. and Canada. U.S. insurance claims are expected to be reported higher. Canada’s unemployment rate lies at 5% while employment change was previously reported positive and figures grow since March’s reported figure.

Currency Markets Impact:

_____________________________________________________________________________________________

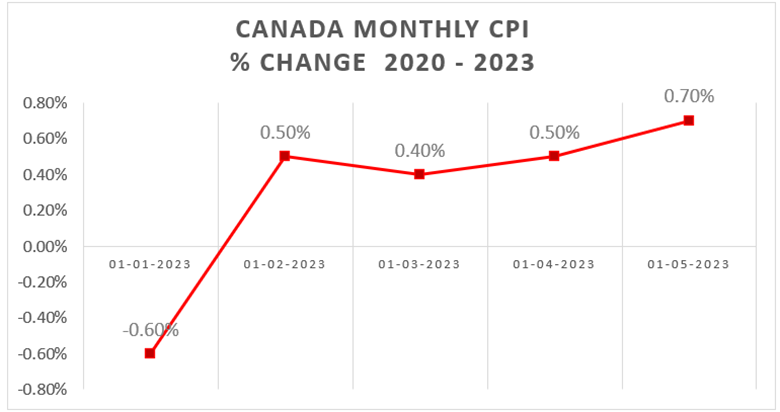

Canada’s Monthly CPI % Change

On a monthly basis, the Canadian CPI advanced by 0.7%, the most in six months. The annual inflation rate in Canada rose to 4.4% in April of 2023 from the 19-month low of 4.3% in the previous month. Consensus remains at “unchanged rate”, however recent reported data, showing prices rising rapidly, may change that.

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude reversed on the 1st of June after testing the support levels near 67 USD/b, moving upwards jumping near 3 USD over the 30-period MA after the Senate passed the bill. It surprisingly showed low volatility and a steady movement upwards since then. NFP data had no special impact on its price.

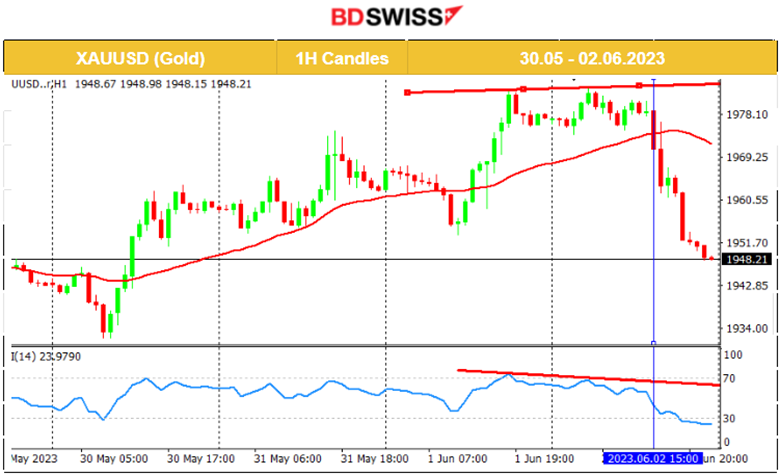

Gold (XAUUSD)

Gold continued with the upward and volatile path above the 30-period MA since the 30th May. It moved further upwards on the 1st of june and found resistance at 1983 USD/oz that was tested several times before it eventually settled near 1978 USD/oz. On the 2nd June, it experienced low volatility, before the NFP data was released. At the time of the release though, at 15:30, it started a clear rapid movement downwards that resulted in a crash as USD was appreciating heavily. The USD related news had a great impact on Gold causing it to drop near 30 USD since the NFP figure release. No retracement yet took place and it is expected to happen next week since the MA is high enough. 1946 USD/oz is supposed to be the strong support that it is to be tested before price retraces. Let’s see.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The index reversed on the 1st June crossing the 30-period MA and moving significantly upwards. The Senate voted on the debt ceiling bill that day and the outcome was released after the Stock exchange had opened. This caused stocks to experience a jump. The next day, NFP data pushed the stocks higher overall but not significantly. At the time of the release, volatility got high and the index had actually retraced to the 61.8 FE level.

This analysis though is technical, while fundamentals are really driving the market intraday. The figure releases caused “ups and downs” in price movement with support and resistance levels to form and the Fibo tool to identify them. However, forecasting with this tool during this news makes it quite difficult, since more uncertainty is involved during shocks.

The index eventually reversed and moved upwards after the stock market opened, at 16:30, but not significantly. Major reports saw an end for now and the RSI forms lower highs. This is a bearish divergence which signals a future price reversal to the downside. Due to the fact, though, that the 30-period MA is on an upward trend it kind of counters the idea of going short on this one.

______________________________________________________________