PREVIOUS TRADING DAY EVENTS – 02 June 2023

Announcements:

The May’s non-farm payrolls report shows high employment numbers thus strong labour market making it difficult for the Fed to keep rates unchanged. This is at least what the market is thinking, since the market reaction was heavy USD appreciation after the news release.

“The Fed has painted themselves into a corner with these most recent statements about the need to take a pause, and then maybe look to hike in July, and I think they’re going to regret it after today’s non-farm payroll number,” said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi US.

“The challenge is that we’ve entered the Fed’s blackout period ahead of the (Federal Open Market Committee) meeting, which means it’s going to be hard to see a pushback from officials or any guidance from officials after this employment report,” said Marc Chandler, chief market strategist at Bannockburn Global Forex.

Source:

______________________________________________________________________

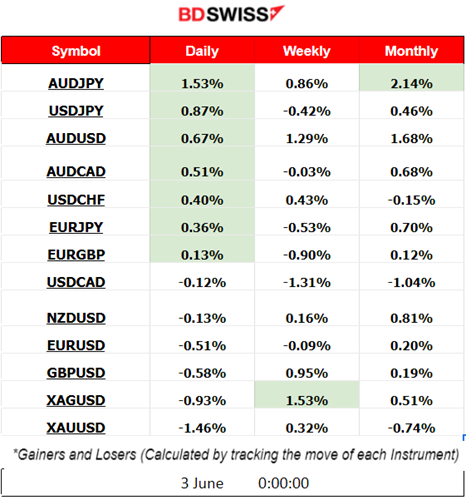

Summary Daily Moves – Winners vs Losers (02 June 2023)

- AUDJPY reached the top of the winners list on Friday with a 1.53% price change.

It also lies on the top for this month so far with 2.14% gains overall.

- Silver has gained enough to lead last week with 1.53% gain.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (02 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no significant scheduled releases.

- Morning – Day Session (European)

The U.S. Non-Farm Employment Change and Unemployment Rate figures were released on Friday. Total nonfarm payroll employment increased by 339,000 in May, way more than expected, and the unemployment rate rose by 0.3 percentage point to 3.7 percent. The Fed had its eyes on the Labour Market data and waited for weakness. However, now with this strong data it should be open to raising interest rates. USD strengthened greatly after the news indicating that expectations are in favour of a hike.

The U.S. Average Hourly Earnings figure was lower and as expected, down to 0.30%. This indicates lower costs for labour, thus presumably lower prices in the future. However, we know that in most economies prices are sticky in general, thus very hard to come down, even if costs for labour are reduced.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (01.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD experienced low volatility during the Asian Session and even at the beginning of the European session as the market was waiting for the U.S. Labor Data before taking any action. The Non-Farm Payrolls increased by 339K (Change in the number of employed people during the previous month, excluding the farming industry) while the unemployment rate increased by 0.3%. Excluding the Farming Industry gives a better indication of labour market strength and that is why the Fed looks at these data. The market participants eventually have formed expectations that the USD will appreciate in the future, perhaps because they expect that the Fed will eventually not pause rate hikes after observing this data. EURUSD continued with a downward movement after finding resistance. USD appreciated steadily later on after expectations settled, bringing the pair down, with no retracement taking place.

GBPUSD has a similar path since the USD was the main driver here. USDJPY had moved upwards overall and inline with USD appreciation.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index reversed on the 1st June crossing the 30-period MA and moving significantly upwards. The Senate voted on the debt ceiling bill that day and the outcome was released after the Stock exchange had opened. This caused stocks to experience a jump. The next day, NFP data pushed the stocks higher overall but not significantly. At the time of the release, volatility got high and the index had actually retraced to the 61.8 FE level.

This analysis though is technical, while fundamentals are really driving the market intraday. The figure releases caused “ups and downs” in price movement with support and resistance levels to form and the Fibo tool to identify them. However, forecasting with this tool during this news makes it quite difficult, since more uncertainty is involved during shocks.

The index eventually reversed and moved upwards after the stock market opened, at 16:30, but not significantly. Major reports saw an end for now and the RSI forms lower highs. This is a bearish divergence which signals a future price reversal to the downside. Due to the fact, though, that the 30-period MA is on an upward trend it kind of counters the idea of going short on this one.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude reversed on the 1st of June after testing the support levels near 67 USD/b, moving upwards jumping near 3 USD over the 30-period MA after the Senate passed the bill. It surprisingly showed low volatility and a steady movement upwards since then. NFP data had no special impact on its price.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold continued with the upward and volatile path above the 30-period MA since the 30th May. It moved further upwards on the 1st of june and found resistance at 1983 USD/oz that was tested several times before it eventually settled near 1978 USD/oz. On the 2nd June, it experienced low volatility, before the NFP data was released. At the time of the release though, at 15:30, it started a clear rapid movement downwards that resulted in a crash as USD was appreciating heavily. The USD related news had a great impact on Gold causing it to drop near 30 USD since the NFP figure release. No retracement yet took place and it is expected to happen next week since the MA is high enough. 1946 USD/oz is supposed to be the strong support that it is to be tested before price retraces. Let’s see.

______________________________________________________________

News Reports Monitor – Sunday (04 June 2023)

OPEC-JMMC meetings took place on Sunday.

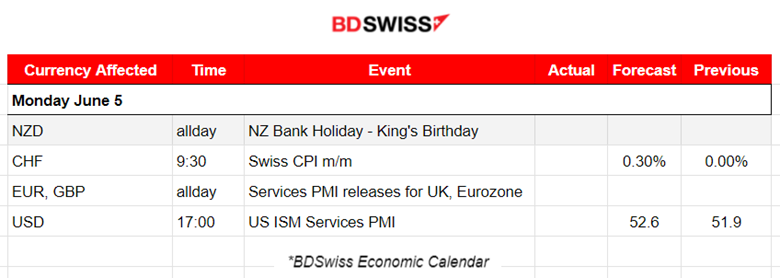

News Reports Monitor – Today Trading Day (05 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no significant scheduled releases.

- Morning – Day Session (European)

Inflation related data for Switzerland, the CPI monthly change will be released at 9:00. We expect to see an intraday impact on CHF pairs but not so great.

PMI data for the Services sector are released during the trading day and they might have an impact on Monday’s volatility. Higher than typical volatility might be observed as the figures are released on by one.

More probable to observe high volatility during the N.American session with the release of the ISM Services PMI figure for the U.S. That is considered a high impact release that usually has a significant effect on the USD pairs. We might experience an intraday shock at that time.

General Verdict:

______________________________________________________________