Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

Market Recap

Another day of modest changes in the stock market and the FX market, with volumes depressed as the Lunar New Year began in Asia and Japan was closed for a national holiday. In the absence of any major economic indicators aside from the weekly US jobless claims there was little to spur trading, although the modest gains were enough to propel both the S&P 500 and NASDAQ to new record highs.

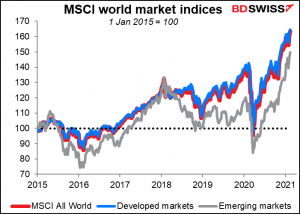

The rally wasn’t just in US stocks – the MSCI World Index rose for the ninth consecutive day, with both the developed & emerging indices moving further into record territory.

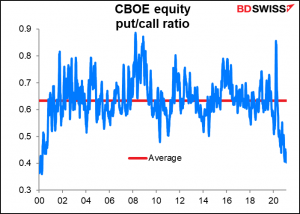

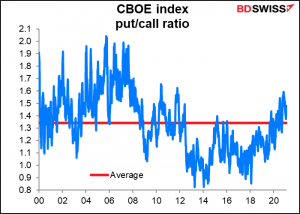

The CBOE put/call ratio for individual stocks, a measure of demand for insurance (puts) against a possible decline in stocks or looked at another way, a demand for bets against the price of stocks, has hit a low last seen in the dot-com bubble of 1999/00. This shows extreme optimism toward individual stocks.

The similar measure for puts & calls on stock indices however is at approximately its average level. This suggests investors are looking at individual company plays more than overall bullishness for the market.

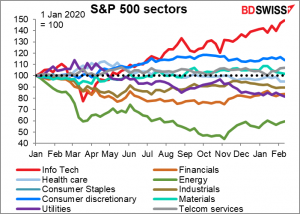

I’d guess a lot of the optimism is concentrated in the tech stocks that have been the darlings of investors recently.

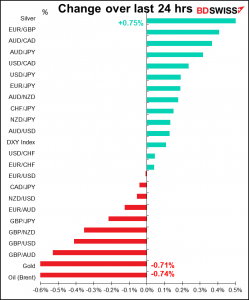

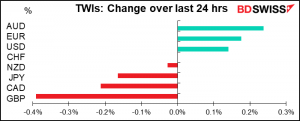

There doesn’t seem to have been any specific cause for the sell-off in GBP. The currency has had a good run recently thanks to the government’s surprisingly efficient vaccine program. It looks like that rally simply came in for some profit-taking after 1.3850 failed to hold.

Oil fell, dragging CAD down with it, after both the International Energy Agency (IEA) and OPEC cut their forecasts for oil demand this year.

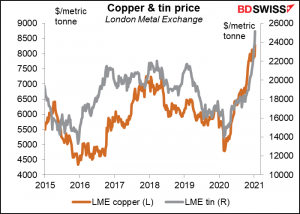

But the price of industrial metals keeps rising, signaling that the economic expansion remains intact.

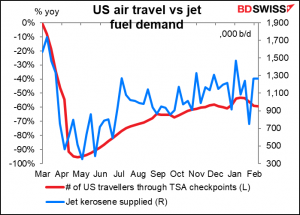

People just aren’t moving around as much as they used to, which is depressing demand for oil.

Today’s market

This has been a fairly dull week with regards to indicators, and we’re ending it with an especially dull day.

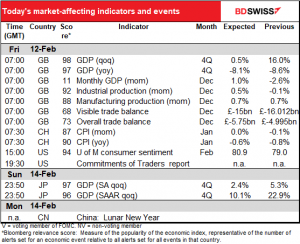

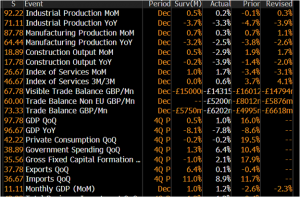

The major European data are already out – the UK short-term indicator day. The figures were generally better than expected, particularly Q4 GDP, which at +1.0% qoq was higher than both the market (+0.5% qoq) and the Bank of England (+0.6%) were expecting. Industrial and manufacturing production also beat forecasts. Note though that the trade deficit widened more than expected, and this was even before the Brexit changes took place.

So there’s nothing to do but make another cup of coffee, trade the technicals and wait for the US to open up. Even then, the one indicator coming out at the start of the US morning isn’t expected to be anything shocking.

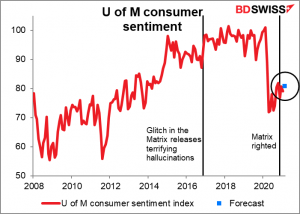

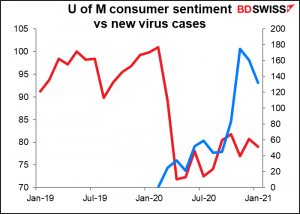

The University of Michigan consumer sentiment index is expected to be up a bit, but nothing significant. It’s still treading water in the same range it’s been in for the last few months.

Sentiment plunged when the virus first showed up but hasn’t gotten worse even as the pandemic spread. But nor has sentiment improved much as the pandemic turned down.

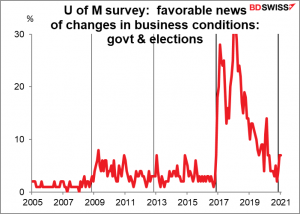

One reason may be that a lot of the people they’re polling apparently watch different news than I do. The U of M index for favorable news having to do with the government and elections skyrocketed after the 2016 election but has barely budged since last November. This strikes me as astonishing because I know I’ve heard a lot of favorable news about changes in the US government.

Then that’s it. Nothing else major on the schedule today until the Commitments of Traders report comes out.

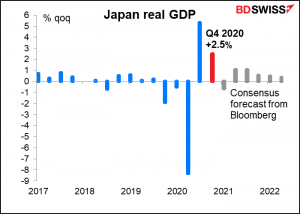

Then early Monday in Asia, while you’re probably still sound asleep. Japan will report its Q4 GDP. Japan’s GDP figures are notoriously unreliable and notoriously prone to revision, but the first one is important anyway. Although it’s expected to be fairly good, the forecast for Q1 this year is for a contraction, thanks to the state of emergency. In that case I don’t think the market will place that much weight on the Q4 figure as it’s of little help in forecasting what’s going to happen in Q1.