Rates as of 05:00 GMT

Market Recap

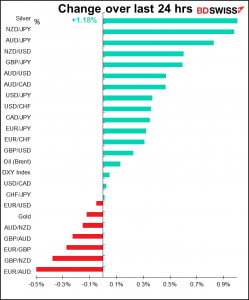

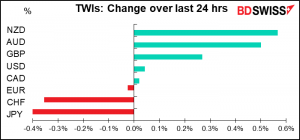

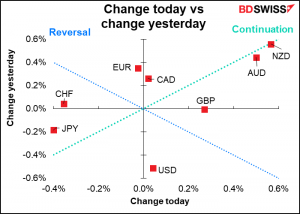

With stock markets in a happy mood thanks to better-than-expected earnings results (50 of the 57 US companies that have reported so far have beaten estimates), it was a pretty typical “risk-on” day in the Fx market. The commodity currencies rose and the safe-haven JPY and CHF fell.

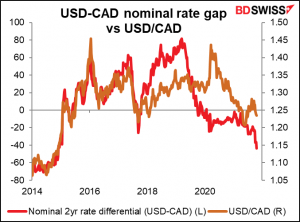

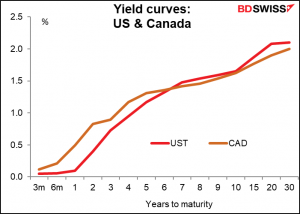

CAD underperformed the other commodity currencies even the gap between US and Canadian two-year yields widened in Canada’s favor by 3 bps to -44.3 bps, the widest since Jan. 2015.

Oil was slightly lower, at least in the US (Brent was a bit higher), but USD/CAD wasn’t moving along with oil during the US day. It looks to be perhaps some profit-taking or positioning ahead of today’s Canada CPI (see below).

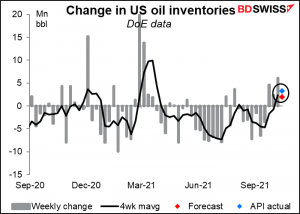

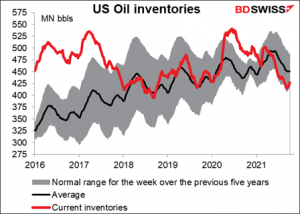

Oil prices fell in the US as the American Petroleum Institute (API) reported the fourth consecutive week of build-up in oil inventories. Watch for the official US Dept of Energy figures coming out later today (see table).

I’m not sure that’s such a disaster though because inventories are nonetheless flirting with the bottom of the usual range. They’re still exceptionally low. I think the upward pressure on oil prices from low inventories is still there.

GBP continued to gain as the market puts more weight on monetary policy than on any political problems there.

Today’s market

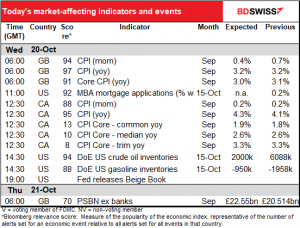

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

This morning we had the UK consumer price index (CPI). It was slightly below estimates at +3.1% yoy vs +3.2% yoy expected (3.2% previous). That somewhat reduces the pressure for the Bank of England to tighten rates ASAP. However, the Bank has steadily predicted that the peak for inflation would come in Q4 so the September figures are only the beginning for it. As energy prices and shortages feed through to the consumer, I’m sure the Monetary Policy Committee will find plenty to worry about.

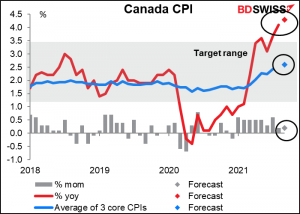

Next stop is the Canada CPI. Although the headline figure is expected to show a slightly faster rate of inflation, two of the three core measures are expected to be unchanged as is the month-on-month (mom) rate of change. That suggests inflation is peaking, at least until energy prices start to feed through.

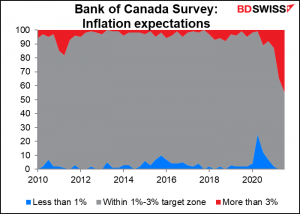

Nonetheless, the Bank of Canada is probably starting to think that the economy might not need so much help from monetary policy at this point anyway. Monday’s Bank of Canada survey showed that a record 45% of respondents expect inflation to be above their 1%-3% target range over the next year.

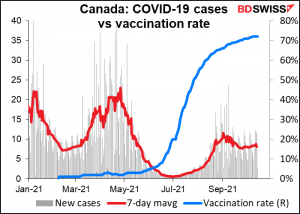

As inflation persists above their target range and the virus gets under control, the central bank is likely to start thinking about tightening policy. They could announce a further tapering of their quantitative easing (currently buying CAD 2bn a week) at their meeting next Wednesday, or even an end to it. A rise in the headline inflation rate today could be justification for such a move. In that respect it’s likely to prove positive for CAD.

Unhedged CAD bonds already yield more than US Treasuries out to six years at least. Expectations of even higher rates in the not-too-distant future may support CAD further.

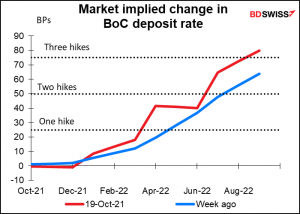

The market has moved up its expectations for Bank of Canada tightening recently. They could move them up further.

Later in the day, the Fed releases the “Summary of Commentary on Current Economic Conditions,” aka The Beige Book, as always two weeks before the next FOMC meeting. It’s significant for the market because the first paragraph of the statement following each FOMC meeting tends to mirror the tone of the Beige Book’s characterization of the economy. The book doesn’t have any number attached to it that quantifies its contents, but many research firms do calculate a “Beige Book index” by counting how many times various words appear, such as “uncertain,” or nowadays probably “supply chain,” “transitory,” and “labor shortage.” In any case, the book is largely anecdotal so you’ll just have to watch the headlines as they come out.