Rates as of 05:00 GMT

Market Recap

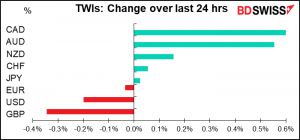

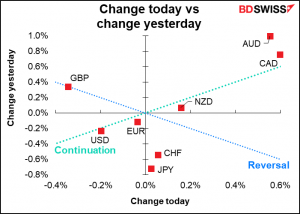

Monday was a reversal day, Tuesday was a continuation of that reversal, with the commodity currencies gaining particularly CAD and AUD. Unfortunately the corrolary of that didn’t happen – the safe-haven JPY and CHF didn’t weaken. So my daughter’s university in Kyoto still costs me the same.

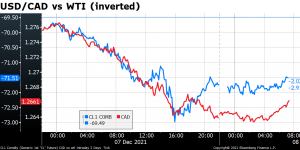

CAD followed oil higher (actually USD/CAD declined as oil rose, but I invert the oil price so you can see the correlation). CAD managed to keep its gains even as oil came off later in the US day, although USD/CAD has started to turn up a bit (i.e. CAD is weakening).

I think CAD (and AUD) are getting a boost from the general rise in industrial commodity prices. That could be because of the monetary loosening in China that I pointed out yesterday or just the general return of optimism to the markets as fear of Omicron fades. Every day that goes by without a disaster makes it seem more likely that the new variant won’t cause the end of civilization as we know it. A small study in South Africa gave some hope that “booster doses of the vaccine could help to fend off infection,” although there was mixed news in the study – which in any case only involved 12 people so it was hardly the last word.

The optimism infected stocks as well, with the Euro STOXX 50 up 3.4%, S&P 500 up 2.1%, and NASDAQ +3.0%. Most stock markets are higher in Asia this morning.

CAD may also be getting some boost ahead of today’s Bank of Canada meeting (see below).

The other question then must be, why did GBP underperform? What was it the laggard? No specific news out of the UK yesterday. I think it could be the continuing impact of Monetary Policy Committee member Michael Saunder’s recent comments casting some doubt on the likelihood of a near-term rate hike. Or perhaps questions about how fast and how far the Bank might be willing to go – the market has revised down its forecast for UK rates recently.

As I mentioned yesterday, today is German Chancellor Angela Merkel’s last day in office. I saw a tribute to her on US TV that referred to her as “Europe’s designated driver.” I’d say that during TFG’s time, she was maybe the world’s designated driver. Bye-bye, Angela and hello Chancellor Olaf Scholz. There will be seven ministers from the Social Democratic Party (SDP), five from the Greens, and four from the more right-wing Free Democratic Party (FDP). Among the new names we’ll be hearing are Green co-leaders Robert Habeck as Vice Chancellor and Annalena Baerbock as foreign minister, and FDP leader Christian Lindner as finance minister.

Today’s market

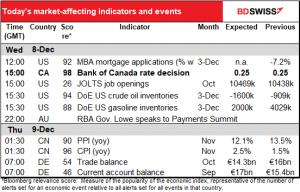

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Two major things on the schedule today: the Bank of Canada meeting and the Job Offers and Labor Turnover Survey (JOLTS) program.

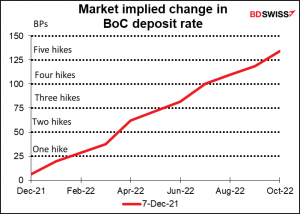

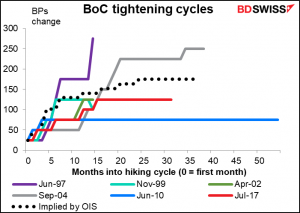

At its last meeting, the Bank of Canada (BoC) ended its quantitative easing program and moved up its expected date for “lift-off” to “the middle quarters of 2022” from “the second half of 2022.” The market already thinks a hike is probable by the March meeting and possible even at the January meeting.

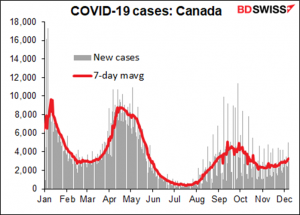

The BoC could in theory say something to increase the likelihood (already pretty high) of a January hike, but why would they with the Omicron variant just getting established and the virus count starting to turn up? Why would they want to limit their freedom of operation?

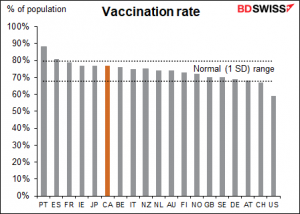

(Canada is pretty well vaccinated, but still, no one knows what’s going to happen.)

The market is already looking for a fairly steep tightening cycle (dotted line) by historical standards. I can’t see this being revised higher any time soon, given the uncertainties in the global economy (read: virus). Accordingly, I expect little impact on CAD from today’s meeting.

The risk though is that they decide to leave themselves more wiggle room because of the Omicron variant and become less certain about the dates for possible “lift-off.” That could cause CAD to weaken. But I don’t think that’s likely. Instead, I would just expect some vague comments expressing some concern about the virus and noting that they can change plans if necessary.

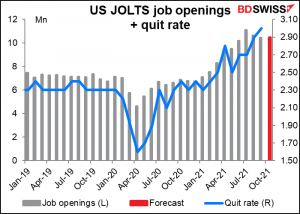

Meanwhile, back in the USA, the JOLTS report is the last word on the labor market before next week’s meeting of the rate-setting Federal Open Market Committee (FOMC). This report shows how many job openings there are. Openings hit a record high in July and have come down somewhat since then, but not as fast as the number of unemployed persons has declined. The forecast for October is for openings to be more or less unchanged from September, not too far off their record high. This suggests that a sluggish rate of new job creation is because people don’t want to work, not because there aren’t any jobs for them. (Or at least, they don’t want to work given the pay & conditions that are available.)

The market also pays attention to the quit rate, the percentage of people who voluntarily leave their job every month (the “take this job and shove it” rate, one might say). (No forecast available.) That was at a record high last month, indicating a lot of people were confident that they could get another job if they quit, or indeed indicating that people were quitting their jobs to get another one.

That might explain why average wages are rising – people rarely voluntarily quit a job for a less highly paid one. If this rate rises further or even just stays the same, it’ll be further proof that the labor market is quite healthy and provide more ammunition for those people on the FOMC who want to accelerate the tapering down of their bond purchases. That would be positive for the dollar.

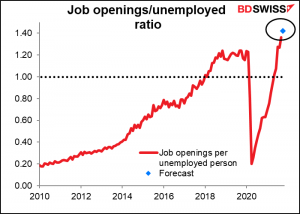

With the number of job openings expected to remain the same but the number of unemployed persons falling, the ratio of jobs to unemployed persons – similar to what they call in Japan the “job-offers-to-applicants ratio” – is expected to move even higher than last month’s record high. Many officials use this ratio as a measure of how tight the job market is. What this ratio suggests is that there is either a huge gap between the skills on offer and the jobs available, or between where the unemployed are vs where the jobs are, or that many people have changed their minds about working. Probably the latter. This kind of change in the desire to work changes how the Fed will view metrics like the participation rate when it tries to measure whether the economy is near “full employment.” It lowers the threshold for “full employment,” making it easier for the Fed to begin tightening.

Overnight China announces its inflation data. Producer prices are expected to rise at a slower pace, while consumer prices rise at a faster pace. For the rest of the world it’s China’s producer prices that matter because those become other countries’ import prices. Slowing producer prices in China may be yet another indication that global inflation is peaking.

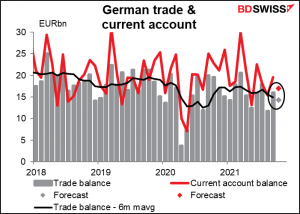

Then early in the European day, Germany announces its trade and current account data, which nobody cares about but I’m going to present a graph of anyway because Germany’s current account surplus is the EU’s current account surplus. The gradual decline at a time when European interest rates are much lower than US rates is a worrisome sign for EUR>