Rates as of 05:00 GMT

Market Recap

Stock markets gained some poise yesterday, with the S&P 500 down just a bit and the NASDAQ up slightly. Markets in Asia are responding well this morning as China comes back to work after the extra-long weekend. Amazingly, China stock prices are mixed this morning: the Shanghai Composite is actually +0.33% this morning while Shenzhen is -0.31%). The CSI 300 is -0.76% but the HS China Enterprise is +0.02%, just barely in the green.

Sentiment in China was helped by the decision of the People’s Bank of China (PBoC), the central bank, to add a net CNY 90bn into the banking system to help boost the economy. There has also been some good news about Evergrande: the company’s onshore property unit avoided default on a CNY 232mn interest payment tomorrow for one of its bonds. The filing said the coupon payment “has been resolved via negotiations off the clearinghouse,” leaving us none the wiser about how much they’re paying or when they’re going to pay it, but at least it doesn’t count as a default.

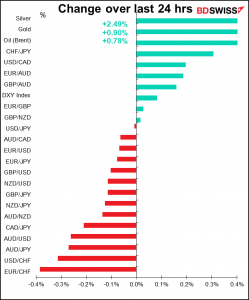

Despite the improving mood yesterday, the FX market continued to act in a “risk-on” mode.

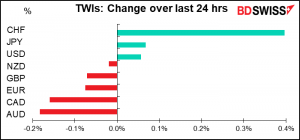

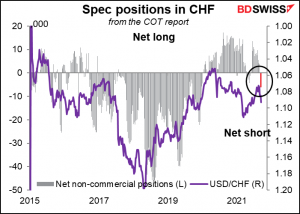

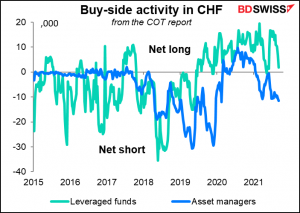

Of particular note was the further rally in CHF. EUR/CHF and CHF/JPY were the biggest movers of the currency pairs that I track, the former falling and the latter rising as CHF barreled ahead. I guess the closing out of short positions continued for longer than I had anticipated.

Hedge funds were long CHF going into the week, but asset managers were short- they may be closing out those positions.

The widening bond spread in favor of CHF bonds doesn’t help either.

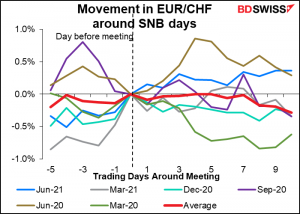

It could also be positioning ahead of tomorrow morning’s Swiss National Bank (SNB) meeting. As the graph shows, EUR/CHF has moved higher ahead of the previous three meetings (although it most distinctly did not two of the last six). Perhaps people are covering their positions in anticipation of some more strongly worded statement by the SNB?

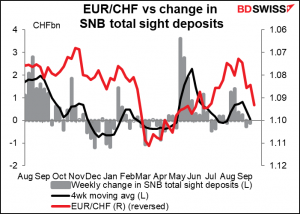

The SNB hasn’t been particularly active recently, although that’s probably because EUR/CHF has been moving higher under its own steam.

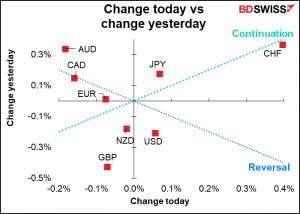

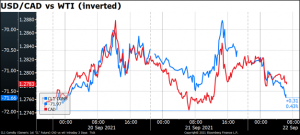

Movements in other currencies were muted. AUD and CAD lost ground despite the better risk environment. USD/CAD has moved pretty much in lockstep with oil this week, showing precious little reaction to the election (except today USD/CAD is failing to decline as much as oil is rising, perhaps because of the general risk aversion).

I was surprised that NZD outperformed AUD. Yesterday Reserve Bank of New Zealand (RBNZ) Assistant Governor Hawkesby made a relatively dovish speech about the RBNZ’s “least regrets” philosophy in which he emphasized that rate hikes are most likely to be limited to 25bp increments, countering speculation that they might move 50 bps at once. (He also suggested some native NZ birds to replace “hawks” and “doves” in the central bankers’ lexicon.) The speech initially boosted AUD/NZD but the impact faded.

I think with the mood in China improving this morning, we could have a “mean reversion” day today with the commodity currencies outperforming..

Today’s market

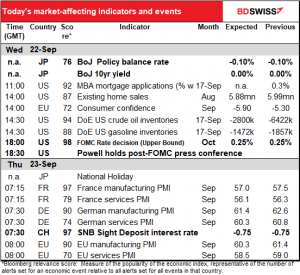

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

It’s FOMC day today! The Federal Open Market Committee (FOMC), the rate-setting body of the US central bank (the Federal Reserve System), meets. The main topic of discussion: what to do about its $120bn-a-month bond purchases ($80bn in Treasuries, $40bn in mortgage-backed securities). Do they announce that they’re going to start “tapering” down the purchases at some point in the future? And if so, when? Tune in to find out!

Remember that in his speech at the Jackson Hole Symposium last month, Fed Chair Powell said, “At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year.” I would expect to see this phrase incorporated into the statement following Wednesday’s meeting (e.g.., “if the economy evolves broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year” or something like that). That would still leave them the option of starting to taper in November or waiting until December. That would probably be positive for the dollar (except that it’s widely expected).

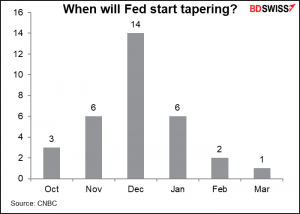

According to a survey by CNBC, market participants believe the Fed will announce tapering in November. A Reuters poll agreed – 73% said they would announce tapering in November, while only 12% said September and 15% December. I don’t think the statement I mentioned above would be tantamount to “announcing tapering,” because it just says that if things work out as expected. Then maybe at the next meeting they announce that yes, things have indeed worked out as expected, and we will start tapering next month, or some such.

The question of when tapering will actually start has more disagreement. The CNBC poll showed participants think the Fed will start in December by reducing their bond purchases by $15bn a month. The first rate hike will be Dec 2022.

Another poll I saw, by the economic research firm Cornerstone Macro, showed that 36% of their clients thought tapering would be announced in September (i.e., today!) and 45% in November, with a few stragglers voting for December or later. The big difference with CNBC though was when their clients thought tapering would actually start. Whereas 72% of the CNBC poll respondents thought it would start in Q4 this year, only 39% of the Cornerstone Macro respondents did – 52% thought Q1 next year (vs 28% for CNBC) and 9% thought even later. So there’s still some difference in opinion among market participants that’s liable to lead to volatility if and when it ever does start.

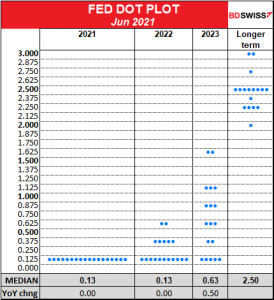

The other thing to watch out for of course is the dot plot, in which each Committee member gives his or her forecast for where they see the fed funds rate at the end of each year. Eleven members see rates unchanged next year while seven see them rising; will that change? It would only take two people to change their view from 0.125% (unchanged) to 0.375% for the median to rise to 0.25%. So it’s quite possible that they go from forecasting no rate rises next year to at least one. Similarly, they are now forecasting two hikes in 2023 – that could easily go to three as well. And then how many hikes do they expect for 2024?

You can read more about the meeting, such as my expectations for Fed Chair Powell’s press conference, in my Weekly Outlook.

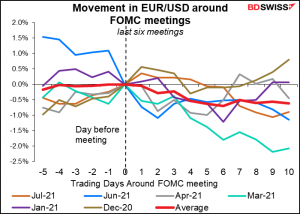

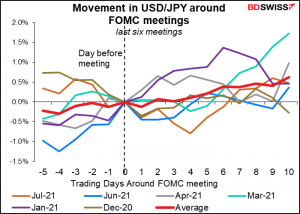

How does the dollar usually fare after FOMC meetings? In general, the dollar has tended to strengthen vs EUR after the last six FOMC meetings, although of course as is the case with everything in finance, past performance is no guarantee of future performance.

Same behavior with USD/JPY.

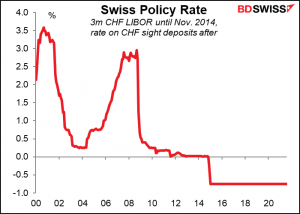

The Swiss National Bank (SNB) is also on the schedule, but I don’t think anyone expects much out of that meeting. They meet four times a year and basically just change the date on the press release they issue afterward. They’ve kept the interest rate on sight deposits –their effective policy rate – at -0.75% since January 2015. That must be a record for the post-Bretton Woods era among major central banks for the longest period without a change.

We can be pretty sure that the SNB will once again say something along the lines of “It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The Swiss franc remains highly valued.”

I would say the usual “look at my Weekly Outlook for more details” except there aren’t any.

Today’s indicators

Existing home sales are forecast to be down 1.8% mom. Meanwhile new home sales, due out Friday, are forecast to be up 0.6%. Why one up and the other down? Who knows? Over the length of the existing home sales series (back to Jan. 1999), the two have moved in opposite directions exactly half the time (135 months out of 270)! So clearly it’s just a coin toss whether they move in the same direction. It could be a sign that the housing market is starting to cool off, though.

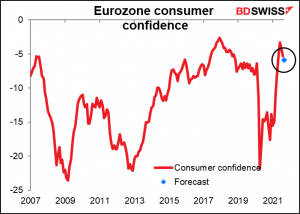

Eurozone consumer confidence started to turn down last month and is expected to fall further this month.

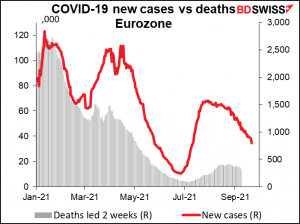

Although the virus situation in the Eurozone is gradually improving and deaths are much lower for this level of new cases than they were earlier in the year. Maybe they’ve all bought Everegrande wealth management products? (that’s a joke.)

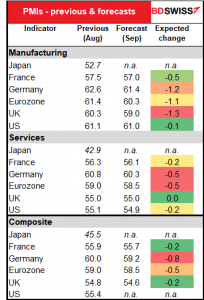

Then early tomorrow morning we get the start of the preliminary purchasing managers’ indices (PMIs) for the major industrial countries. (Japan is on holiday Thursday so we don’t get theirs until Friday.) Overall, the market expects both manufacturing and service-sector PMIs to decline but only slightly. This could add to the recent concerns about “stagflation” and hurt sentiment toward the commodity currencies, although the absolute level of the PMIs is expected to remain relatively high – well in expansionary territory (outside from Japan, that is).

Still, most of the declines in the COVID-19-sensitive service sector are expected to be relatively minor – perhaps people will get the opposite view and see the muted decline as a sign of the resilience of the global economy. It depends on whether markets are in a “glass-half-full” or “glass-half-empty” mood. I suspect though that given the pernicious influence of Evergrande, it’s the latter and people will take whatever negative impression they can out of these ambiguous figures.