The year’s first inflation report from Canada is out today. According to the forecast, the YoY inflation rate is expected to decline from 3.4% to 3.3%, indicating a mere decline.

Sticky Inflation

The annual rate of CPI is expected to have slowed to 3.3% year on year in January after rising to 3.4% in December. It’s important to note that gasoline prices are lower than in January 2023, and food price growth has declined year-on-year.

So, the CPI’s components will be watched closely as the Bank of Canada looks to tame inflation and bring it back to its 2% target.

A hotter labour and housing market

Despite last month’s dovish stance, the January labor market was stronger than expected. Average hourly wages rose 5.3% yearly in January versus 5.7% in December.

Also, a rebound in house sales has fueled concerns that the Bank of Canada would need to keep interest rates higher for longer to bring inflation back to goal.

Governor Tiff Macklem said in January, “What I’ve emphasized is underlying inflation is more of a concept than a measure. We’re looking for continued evidence that inflationary pressures are easing, and we’re looking for clear downward momentum.”

What to Expect?

Despite hotter US CPI, strong dollar seasonality, strong labour market in Canada, and the dovish turn in January’s meeting by BoC, the loonie hasn’t depreciated much.

Recent inflation figures for Canada have indicated an increase in inflation rates. The Bank of Canada has expressed its concerns about the persistent inflation trend and has advised against premature rate cuts. Therefore, the most favourable scenario at present would be a surprise decrease in Canadian inflation figures. Hence, the optimal outcome would be a scenario where the Bank of Canada unexpectedly manages to control inflation effectively.

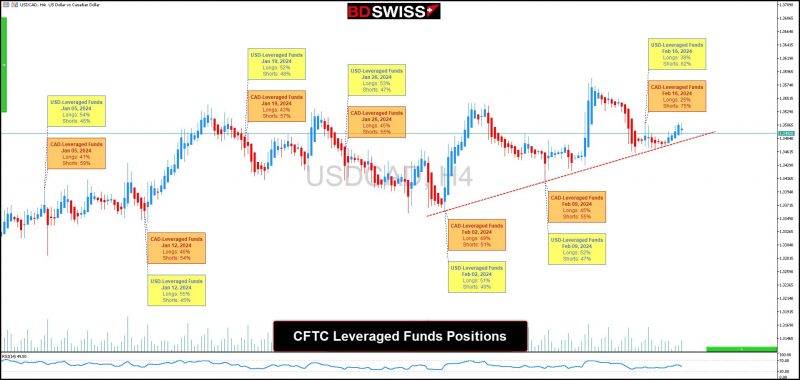

USDCAD Technical Forecast: Trading in a Tight Range

USDCAD has been trading upwards since the start of the week, mainly due to the dollar’s seasonality. The pair is trading just above its 200-day MA and approaching the next resistance level of 1.3541. If it can break this level, it can go towards 1.3581.

On the downside, the next support lies at 1.3440. A path below can bring the pair towards 1.3400.

Charts

Source: https://www.fxstreet.com/news/canadian-dollar-churns-on-quiet-monday-as-investors-await-canadian-cpi-202402191622