Previous Trading Day’s Events (01 Dec 2023)

24,9K jobs were added in November, more than the 15K forecast.

“Employment is still rising, but not fast enough anymore to absorb rapid labour force growth,” said Nathan Janzen, assistant chief economist at Royal Bank of Canada. “The Bank of Canada looks pretty firmly on hold for next week.”

The jobs report is the last major economic data to be released ahead of the next Bank of Canada (BoC) rate announcement on Wednesday and the market is expecting unchanged interest rates.

Economic growth has stumbled and inflation has eased to 3.1%, according to the latest data.

“If we look at the underlying details, they suggest that the Canadian job creation engine continued to decelerate and lose momentum,” said Karl Schamotta, chief market strategist at Cambridge Global Payments. “That is going to keep rate cut expectations firm for early next year and contributes to that picture of a slowing Canadian economy overall.”

Source: https://www.reuters.com/markets/canada-gains-24900-jobs-november-jobless-rate-rises-58-2023-12-01

______________________________________________________________________

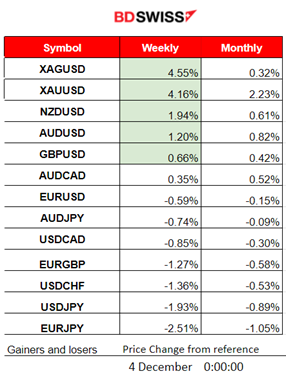

Winners vs Losers

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (01 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

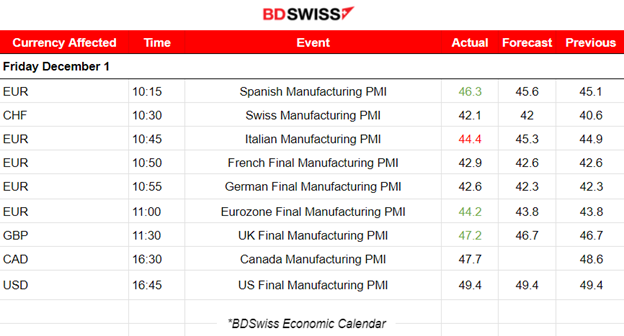

Manufacturing PMI Releases:

Eurozone Manufacturing Sector PMIs

Spanish PMI was reported 46.3 points again below 50 and in the contraction area for November suggesting that manufacturing operating conditions continue to deteriorate

Swiss PMI was reported at 42.1, just 1 point higher than forecast but still indicating significant deterioration in business in this sector.

Italy’s PMI was reported lower than expected. The November data showed that the manufacturers faced deteriorating demand conditions with notable contractions in both production and factory orders. Firms cut their payroll numbers to the largest extent since July 2020 as workload declined.

The French PMI showed a slightly higher figure but also quite low indicating further deterioration in business. The sector remained under intense pressure in November with a rapid deterioration in new orders that led production volumes to fall at the fastest rate since May 2020.

Germany’s PMI also showed a devastating figure of 42.6 points, in the deterioration area. However, the downturn experiences easing as the data suggest. Businesses reported the slowest declines in both output and new orders for six months. The main negative development in November was an accelerated drop in factory employment and a falling demand across the sector.

The Eurozone’s PMI was reported at 44.2 in contraction. The manufacturing sector in the Eurozone in general suffers from a downturn that remained strong in November, but at least the data suggest that reductions in output, new orders and inventories eased. Furthermore, business confidence edged up to a three-month high.

U.K. Manufacturing Sector PMI

The U.K.’s PMI figure was reported at 47.2 points, higher at least than the Eurozone’s figures but showing also a grim picture regarding factory business. Production contracted for the ninth consecutive month, however, the rate of decline eased sharply. In addition, the downturn in new orders slowed during the month.

Canada and U.S. Manufacturing Sector PMI

U.S. PMI was reported close to 50, at 49.4, higher than Canada’s PMI which was reported at 47.7. In Canada, the sector suffered once more during November with concurrent falls in output, new orders and purchasing activity. The U.S. manufacturers reported a renewed deterioration in operating conditions with lower new orders. The contraction in new sales led to a slower expansion in production and a further cut in headcounts.

The effects of higher borrowing costs, elevated interest rates and high uncertainty have had a large effect on both sectors and the economy as a whole. The manufacturing sector suffers in all regions, however, the U.S. is again in a better position than the other economies according to the recent PMI reports.

At 15:30, Canada’s employment data was released. The employment change was reported 24.9K, way higher than expected in November while the jobless rate was reported slightly higher, to 5.8% from 5.7%. The market reacted with CAD appreciation since the expectation of interest rates remaining high is in place. More pressure is needed for the economy to be affected, potentially causing the desirable cooling. USDCAD saw a moderate drop at that time.

U.S. ISM manufacturing PMI was recorded at 46.7 percent in November, unchanged from the 46.7 percent recorded in October, lower than expected. The sector’s economic activity contracted in November, for the 12th consecutive month. The release caused the USD to depreciate at that time but moderately.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

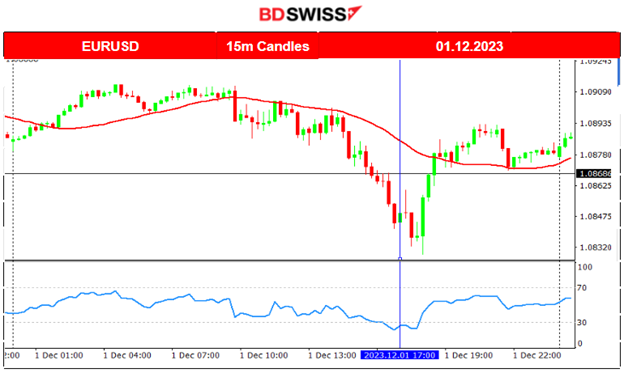

EURUSD (01.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair started to move downwards after the Manufacturing PMI releases for the Eurozone economies. The devastating PMI figures caused the EUR to depreciate heavily against the dollar thus the pair’s drop. After the release of the ISM Manufacturing PMI for the U.S. the USD depreciated heavily causing the pair to retrace back slightly. Further comments from Powell’s speech caused the USD to depreciate after 18:00 causing the pair to reverse fully back to the mean.

USDCAD (01.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving on a downward trend intraday on Friday. This movement was further enhanced by the employment report for Canada. The higher employment change caused the CAD appreciation, thus the pair dropped further and continued with the path downwards, while being below the 30-period MA, for the rest of the trading day.

___________________________________________________________________

___________________________________________________________________

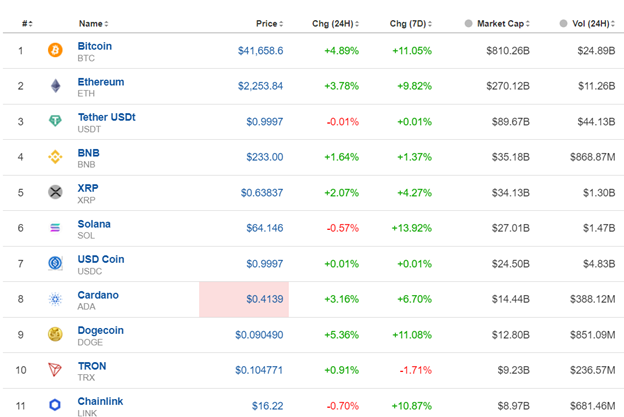

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin keeps on breaking all resistances this week progressing to the upside. It has broken above 40K USD for the first time this year gaining momentum from broad enthusiasm about possible U.S. interest rate cuts and the anticipated imminent approval of U.S.-stockmarket traded bitcoin funds.

Crypto sorted by Highest Market Cap:

Crypto performance has increased significantly as most break resistance and move to the upside. We see that in the last 24 hours, some Cryptos including Bitcoin gained over 3% for some crypto and in the last 7 days we have seen some with over 10% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

A period of consolidation followed after a high trend upward. The index started to move sideways but with high volatility last week. Even though it experienced some support breakouts we see resilience currently, pushing it to the upside and to remain in range. An apparent triangle formation is depicted on the chart below. Breakouts could push the index to one direction rapidly. Downward breakout could lead the index to reach the next support at near 15800. Breakout upwards could lead to the resistance near 16150.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

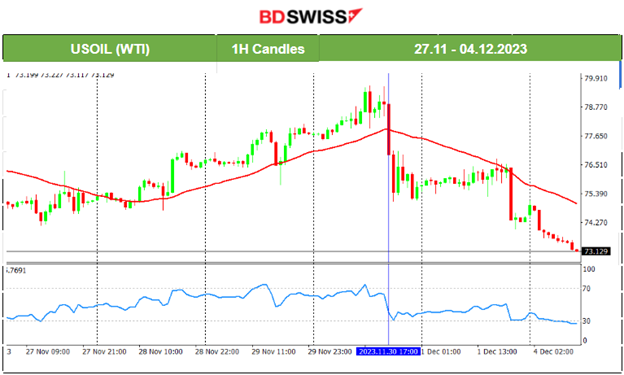

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude experienced a short uptrend from the 28th to the 30th of Nov. It reached the resistance near 79.5 USD/b and dropped suddenly after it was announced that the OPEC+ producers agreed to voluntary oil output cuts for the first quarter of next year that fell short of market expectations. Price dropped sharply on the 30th Nov reaching the support near 75 USD/b, where it stayed in consolidation until experiencing the retracement back to the mean. It later experienced another drop on the 1st Dec breaking the support and reaching the next at nearly 74 USD/b. It currently moves even further downwards.

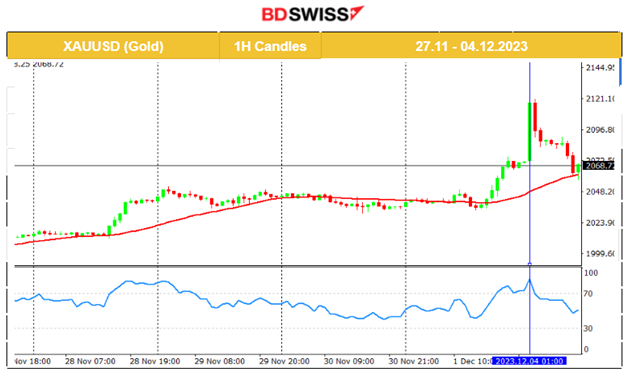

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold broke the range mentioned in our previous report and moved to the upside on Friday. The jump was reinforced with a sudden surge in price after the market opening today. A near 70-dollar move before reversing back to the mean. A record with a price above 2100 USD/oz, driven by a weaker U.S. dollar and the revising Federal Reserve interest rate expectations. The market is betting that the Federal Reserve will hold interest rates steady at next week’s policy meeting and consider cuts in the first half of next year.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (04 DEC 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

Swiss consumer prices fell by 0.2% in November according to the report released at 9:30. This fall is due to several factors including lower prices for hotels and international package holidays. Falling prices were recorded also for fuels, heating oil and fruiting vegetables. The market reacted with CHF depreciation causing some moderate moves for pairs.USDCHF jumped 40 near pips before reversing soon after.

General Verdict:

______________________________________________________________