During the BDSwiss global market outlook exclusive webinar on January 31, 2024, at both 11:00 GMT and 18:00 GMT, market analyst Assumang Da-Costa provided insights and forecasts for the crypto market. Da-Costa’s predictions, made during a presentation on crypto winter, suggested the end of crypto winter when the price of Bitcoin was $43,530.99. He indicated that if this price resistance was broken, there would be a high likelihood of the price surging to it’s all-time high of $69,030.75. As of now, the BTCUSD price stands around $63,559.84.

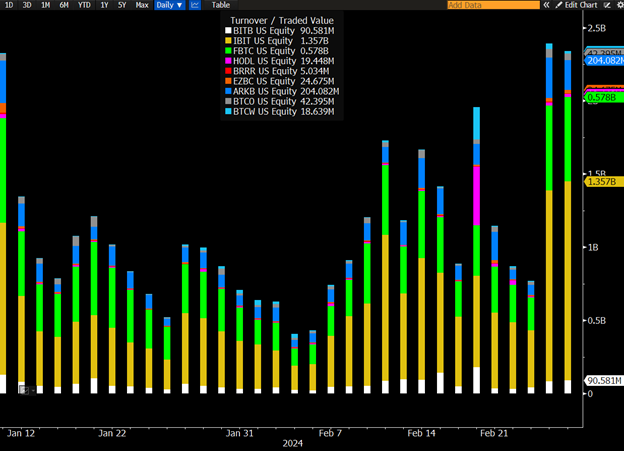

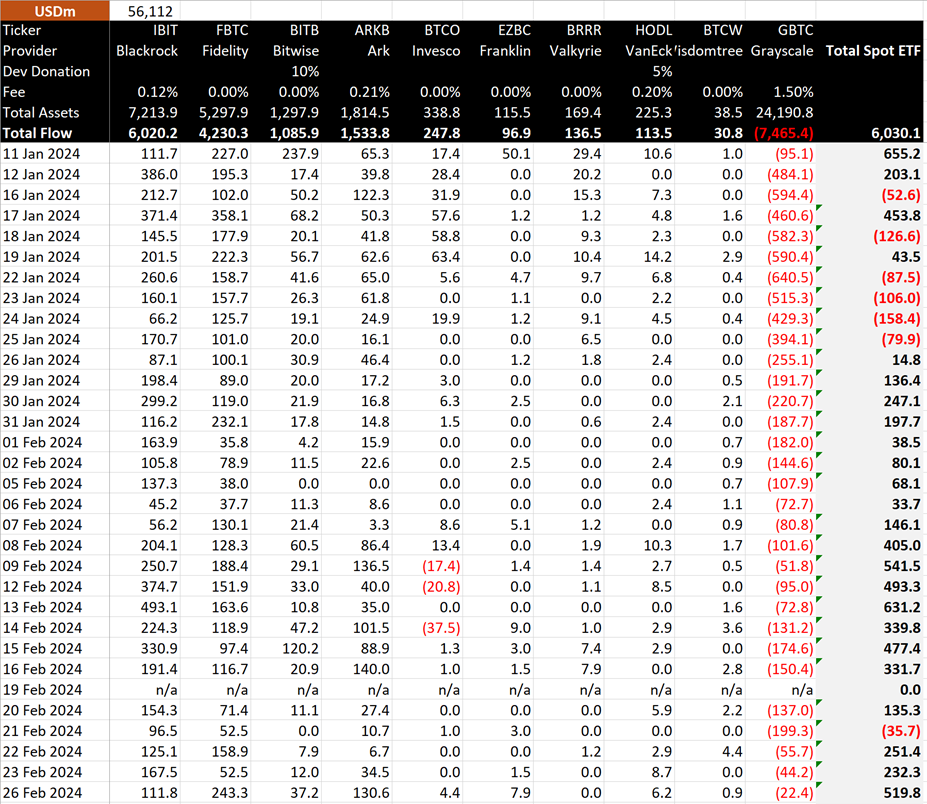

Furthermore, Da-Costa highlighted the significance of factors like the approval of the Bitcoin Spot ETF on January 10, 2024, which would attract non-expert investors to Bitcoin. This forecast materialized when BlackRock’s spot Bitcoin ETF, IBIT, recorded a trading volume of $1.357 billion on February 27, 2024, surpassing the previous day’s record of $1.3 billion. Additionally, BitMex Research reported a strong day on February 26, 2024, with a net inflow of $520 million into Bitcoin ETFs.

Da-Costa also forecasted that the adoption of Bitcoin by major financial institutions, such as JP Morgan and PayPal, would encourage other institutions to follow suit. This prediction came true on February 29, 2024, when Bloomberg reported that Bank of America Corp.’s Merrill arm and Wells Fargo & Co.’s brokerage unit had adopted Bitcoin and were offering access to ETFs directly investing in Bitcoin, signaling increased acceptance of such products by mainstream firms.

Based on the 1-hour chart analysis of BTCUSD, the price is currently consolidating within a range with $64,424.63 acting as resistance and $61,364.39 as support. A breakout above the resistance level could signal a bullish movement with higher potential for further upward momentum. Conversely, a breakdown below the support level could indicate a bearish trend with increased likelihood of further downward price movement.

Sources :

BDSwiss global market outlook exclusive webinar

https://youtu.be/_XeSddrUUSM?si=V5bgfVJRNndYLAEh