Previous Trading Day’s Events (15 Feb 2024)

The jobless rate rose to 4.1%, topping forecasts of 4.0% and the highest since January 2022.

Investors added to their bets on the Bank of England (BoE) cutting interest rates this year and businesses called for more help from the government in a budget plan due on March 6.

“The news that the UK slipped into technical recession in 2023 will be a blow for the prime minister on a day when he faces the prospect of losing two by-elections,” Gregory said.

Recent data showed that inflation held at a lower-than-expected 4.0% in January, reviving talk among investors about a BoE rate cut as soon as June.

Source: https://www.reuters.com/world/uk/uk-economy-entered-recession-second-half-2023-2024-02-15

“Retail sales in January declined sharply, however, revised seasonal factors and inclement weather exaggerated the degree of the slowing in spending following the holiday spending spree,” said Kathy Bostjancic, chief economist at Nationwide.

Economists had forecast 220K claims for the latest week, however the reported figure was lower, at 212K.

“Cutting through the noise in the data, we expect that consumer spending will rise at a solid pace this year,” said Michael Pearce, deputy chief U.S. economist at Oxford Economics in New York. “Real disposable incomes are growing at a decent pace, and we see little reason to expect a surge in household saving because balance sheets are solid and rising house prices and equity markets are adding to net wealth.”

“The consumption path in the fourth quarter to the first quarter now looks softer,” said Ellen Zentner, chief economist at Morgan Stanley in New York. “The report supports our view that the economy is strong but cooling. There is no reason for the Fed to rush the next move in rates.”

______________________________________________________________________

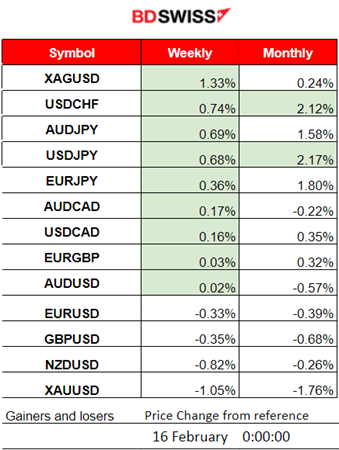

Winners vs Losers

Silver is on top of the winner’s list for the week with 1.33% gains. USDCHF and USDJPY lead with 2.12% and 2.17% gains respectively.

______________________________________________________________________

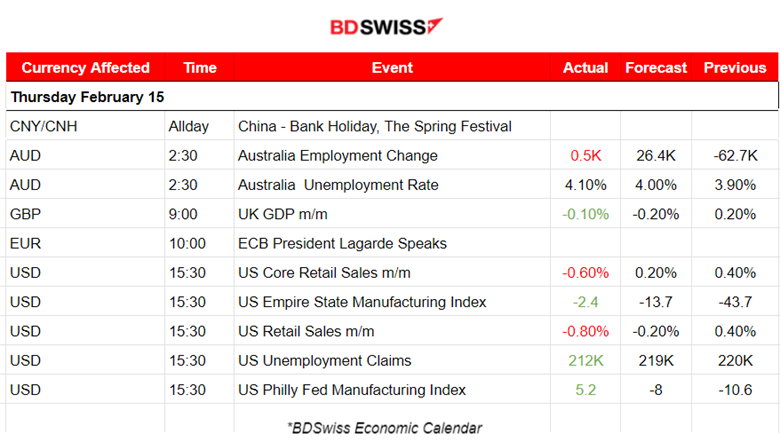

News Reports Monitor – Previous Trading Day (15 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Australia’s labour market data released at 2:30 showed that the unemployment rate jumped above 4% with January recording no significant increase in jobs. Quite weak data for labour. The market reacted with AUD depreciation, bringing down all AUD pairs (AUD as base). The AUDUSD suffered a near 20 pips drop before retracing soon after during the Asian session.

- Morning – Day Session (European and N. American Session)

In the U.K. real gross domestic product (GDP) is estimated to have fallen by 0.3% in the three months to December 2023, compared with the three months to September 2023. On a quarterly basis, this gives two consecutive falls in GDP, with a fall of 0.3% in Quarter 4 (Oct to Dec) 2023. The market reacted to this month’s decline with GBP depreciation. GBPUSD dropped more than 20 pips.

At 15:30, the U.S. retail sales reports were released along with the unemployment claims and Empire State and Philly manufacturing PMIs. The figures recorded a decline in retail sales for January beating expectations and casting an intraday shock for USD pairs. A weak start for consumer spending after a solid performance in the fourth quarter of 2024. These sales declines further support the idea that there will be no further delay eventually for interest rate cuts. Obviously, now expectations have gathered around this idea. This is the initial reaction to the figures at least. Without any Fed intervention so far commenting on the recent data the market reacted with USD depreciation. Gold up, over the 2K USD level, and U.S. indices remained high during that time.

Business activity edged slightly lower in New York State, according to firms responding to the February 2024 Empire State Manufacturing Survey. An improved figure, however at – 2.5 points. In the week ending February 10, the advance figure for seasonally adjusted initial claims was 212K, a decrease of 8K, adding to the data suggesting strong labour market conditions.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

AUDUSD (15.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moved downwards during the employment data release and suffered a near 20 pips drop before retracing soon after, back to the 30-period MA. While the dollar was suffering high depreciation, the pair moved upwards reaching resistance near 0.65300 which had tested twice with no breakout. It eventually retraced to the MA after the USD saw some appreciation, correcting from the jump.

EURUSD (15.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving sideways with low volatility and began to move upwards after the start of the European session. However, at 15:30 it accelerated after the U.S. retail sales report was released. The USD depreciation during that time was the cause of the jump. The pair reached the intraday resistance near 1.07830 before retracing eventually to the 30-period MA.

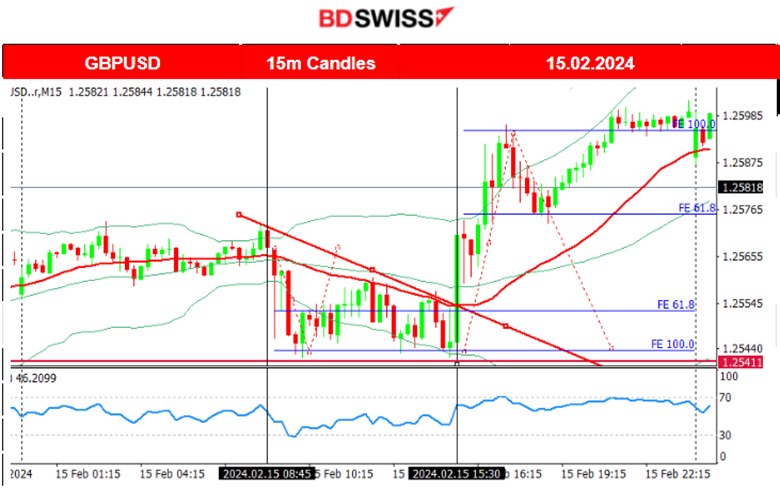

GBPUSD (15.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

It was a quite volatile trading day for the GBPUSD since the GBP was affected greatly early at 9:00 during the GDP news and later the USD was affected by the retail sales news at 15:30. The GDP figure suggested a decline in GDP and that caused the GBP to depreciate bringing the pair down by near 20 pips before it eventually reversed after finding support at near 1.25410. When the U.S. retail sales figures were released showing a decline, the USD depreciated greatly against other currencies causing the GBPUSD to jump, reaching a resistance near 1.25960 before retracing to the 61.8 Fibo level. Soon after, it continued with an upward path until the end of the trading day.

___________________________________________________________________

CRYPTO MARKETS MONITOR

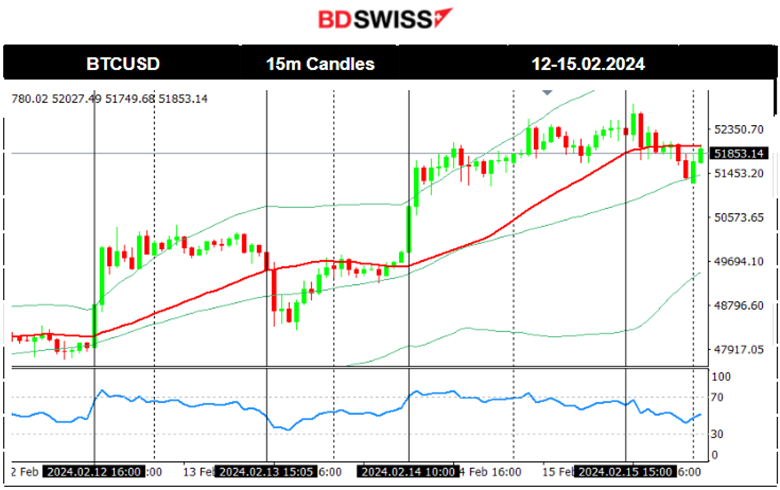

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin surged on the 12th Feb breaking the 49,000 USD resistance, reaching the resistance near the 50,000 USD. On the 13th Feb, the U.S. inflation figure released at 15:30 caused Bitcoin to fall until it found support near 48,300 USD. It soon reversed showing resilience and moved to the upside and back to the 30-period MA. Early on the 14th Feb, Bitcoin climbed again aggressively reaching up to 52,600 USD on the 14th and even reached 52.800 USD on the 15th Feb before retracing. Current headlines are such: “Bitcoin briefly climbs above $52K as ETF demand booms”.

https://finance.yahoo.com/video/bitcoin-briefly-climbs-above-52k-215744590.html

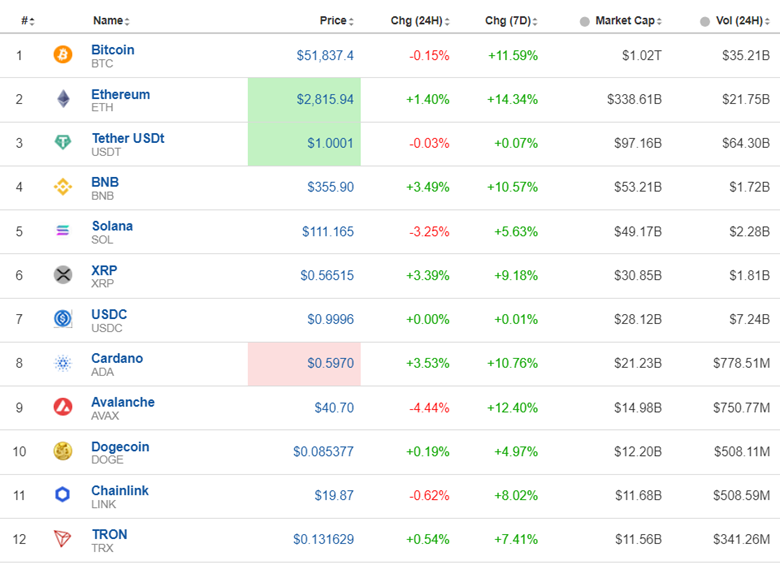

Crypto sorted by Highest Market Cap:

Cryptos continue to perform very well as the market participants switch their preferences. More demand is apparent. Bitcoin market cap crossed $1 trillion Reuters reported on the 14th Feb. Bitcoin gains 11.59% in the last 7 days.

https://www.reuters.com/technology/total-amount-invested-bitcoin-back-over-1-trillion-2024-02-14/

Source: https://www.investing.com/crypto/currencies

https://www.reuters.com/technology/total-amount-invested-bitcoin-back-over-1-trillion-2024-02-14/

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After 20:00, on the 12th Feb, the market started the downfall amid the important inflation news, risk-off mood. The index went all the way down as the market anticipated that the inflation figure was going to be reported higher than expected. It actually had. That is why after the release the index (and the other benchmark U.S. indices) plummeted. It eventually found support at nearly 17,500 USD before retracing back to the 30-period MA. On the 14th Feb and 15th Feb, the index climbed further. All three U.S. benchmark indices experienced the same path. It is currently on this upward channel that looks mostly like an upward wedge.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

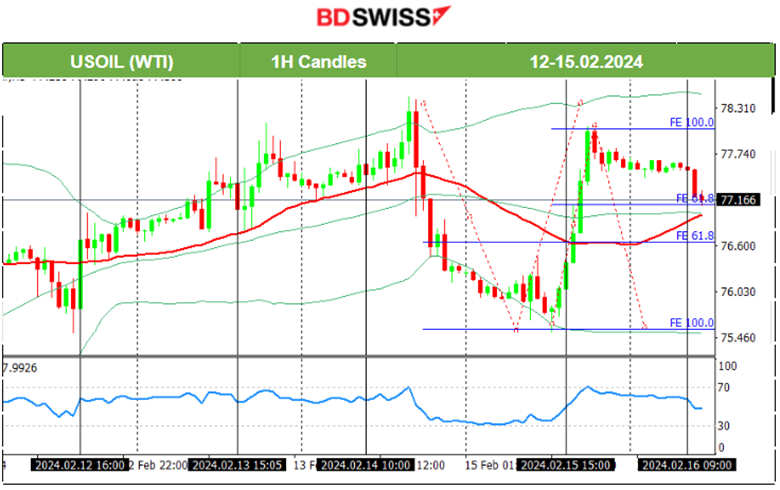

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 12th Feb Crude oil continued with the upward path. Despite the surprising inflation figure reported on the 13th Feb, Crude’s price did not experience major volatility but rather kept moving upwards within the channel as depicted on the chart. All changed on the 14th Feb with the release of the Crude oil inventories report released at 17:30. The market reacted heavily causing a price drop that extended until the end of the trading day, about 18 USD drop. The reported figure was indeed a high number, 12M barrels, a huge Crude build. U.S. production is back at record highs. More supply, (or less demand) expected is causing its price drop today.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 12th Feb Gold dropped further. On the 13th Feb, it finally experienced a rapid upward movement before the U.S. inflation report. After 15:30, the more-than-expected inflation figure caused USD heavy appreciation and a sharp drop for Gold, passing the support at 2000 USD/oz, moving further downwards until the next support near 1990 USD/oz. Surprisingly, on the 14th Feb, Gold remained in consolidation. Retracement eventually took place yesterday back to the upside, supported by the weak sales report for the U.S. and causing the price to reached just above the 2K USD level.

______________________________________________________________

News Reports Monitor – Today Trading Day (16 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

In the U.K. strong retail sales reported at 9:00. This was the largest monthly rise since April 2021 and returned volumes to November 2023 levels. The market reacted with a moderate shock, GBP appreciating momentarily but the effect faded soon.

The PPI data at 15:30 will probably affect the USD pairs greatly. The PPI data are expected to be reported higher, surprisingly. That is the expected opposite direction, compared to the CPI data. An intraday shock at that time cannot be excluded.

General Verdict:

______________________________________________________________