Previous Trading Day’s Events (28 Feb 2024)

The bank lowered its forecast cash rate peak to 5.6% from a previous projection of 5.7% – toning down its hawkish stance and effectively reducing the risk of further tightening.

“Core inflation and most measures of inflation expectations have declined, and the risks to the inflation outlook have become more balanced,” the RBNZ statement said.

The RBNZ’s statement reflected the need to keep policy restrictive for a while in order to bring inflation below the top-end of its 1% to 3% target band.

______________________________________________________________________

Winners vs Losers

USDCAD leads this week with 0.61% gains while the EURJPY remains on the top of the month’s gainers with 2.21% gains. The USD has been gaining ground significantly since yesterday.

______________________________________________________________________

______________________________________________________________________

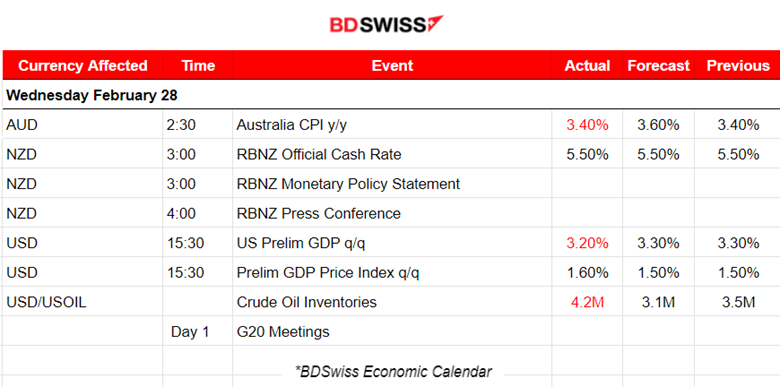

News Reports Monitor – Previous Trading Day (28 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Australia’s inflation remained steady in January according to the report at 2:30 today, below economist expectations of a bounce. The market reacted with AUD depreciation but experienced only a light shock at that time. The AUDUSD only dropped significantly soon after when the USD experienced heavy appreciation.

The Reserve Bank of New Zealand (RBNZ) left the official cash rate unchanged at 5.5% and says risks to the inflation outlook are now ‘more balanced’ but there is a limit to the ability to ‘tolerate upside inflation surprises’. The NZD depreciated heavily and the NZDUSD dropped more than 70 pips since the time of the decision release, reaching the support at 0.61.

- Morning – Day Session (European and N. American Session)

Canada’s preliminary GDP figure, for the last quarter, was reported lower beating expectations. Real gross domestic product (GDP) increased at an annual rate of 3.2% in the fourth quarter of 2023, a slight downgrade from the government’s initial estimate. However, growth is still on and high interest rates are not affecting the economy as much as most feared. The market did not react significantly at the time of the release but the USD weakened slightly after that.

General Verdict:

__________________________________________________________________

__________________________________________________________________

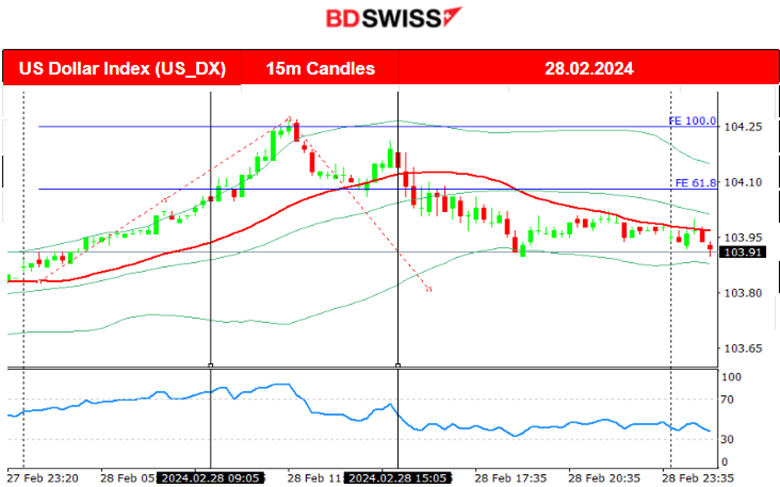

FOREX MARKETS MONITOR

EURUSD (28.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair started to move downwards exponentially due to dollar appreciation, quite early, during the Asian session. It eventually found support at near 1.07970 before retracing to the 30-period MA. The upward movement ended up being a full reversal to the upside, reaching the intraday resistance and eventually closing almost flat.

NZDUSD (28.02.2024) 15m Chart Summary

NZDUSD (28.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair dropped sharply after the RBNZ decision on interest rates release at 3:00. The unchanged policy caused the NZD to depreciate heavily during that time but it kept falling because of the USD appreciation as well. Volatility levels started to get lower and lower as time passed with the pair reaching the support near 1.0608. Retracement to the 61.8 Fibo level did not take place during the day as the momentum was high enough. Will the pair eventually reverse? There is a high possibility that it will, if we see more intraday resistance breakouts today.

___________________________________________________________________

___________________________________________________________________

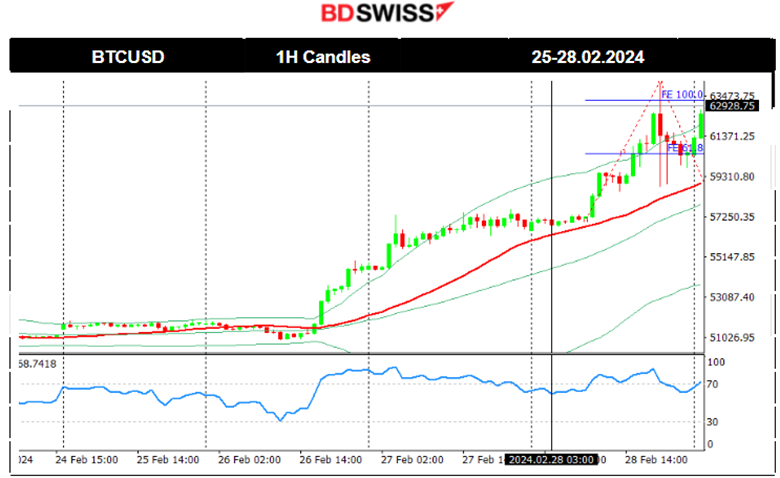

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The Bitcoin surge this week started on the 26th Feb. BlackRock Bitcoin ETF hit a record volume of over 1.3B USD for the second consecutive day. On the 28th Feb, another surprise surge took place having changed hands at as high as 63,933 USD overnight. Its monthly gain is more than 44%, the largest since December 2020.

Related article:

https://finance.yahoo.com/news/1-soaring-bitcoin-set-biggest-024417986.html

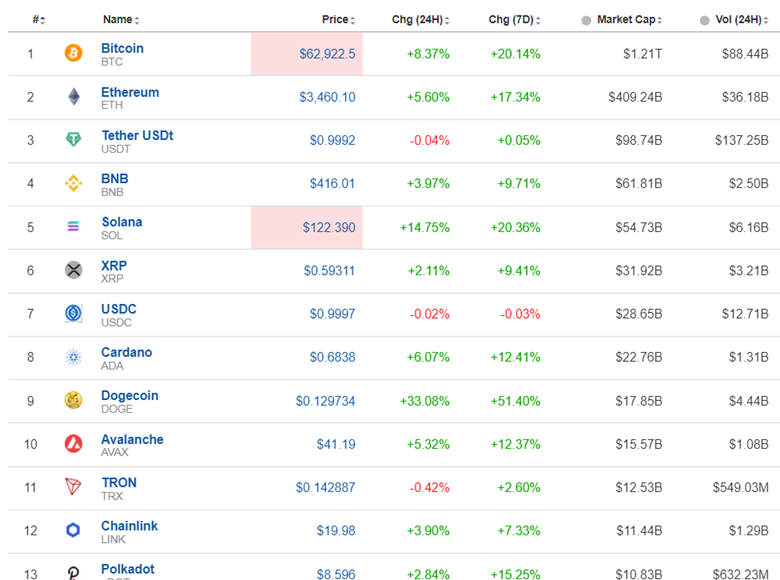

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

A clear high performance in the Crypto market due to risk-on mood and high investment amounts. LSEG data showed flows into the 10 largest spot bitcoin ETFs brought in $420 million on Tuesday alone.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Global stocks rallied on the 21st Feb and after 22:00. All U.S. indices experienced a big jump to the upside. The tech-heavy Nasdaq 100 index jumped over 1.8%. The boss of Nvidia said artificial intelligence (AI) is at a “tipping point” as it announced record sales. It reported that revenues surged by 265% in the three months to 28th January, compared to a year earlier. On the 23rd Feb, the index moved to the upside further, breaking the 18,000 USD resistance level and reaching the one near the 18,100 USD before retracement took place. The index was facing consolidation for days, calming down after the surge. The retracement to the 61.8 Fibo level was nearly completed on the 28th Feb.

Tradingview Analysis:

https://www.tradingview.com/chart/NAS100/CmDSTZHY-NAS100-Shock-Retreat-23-02-2024/

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

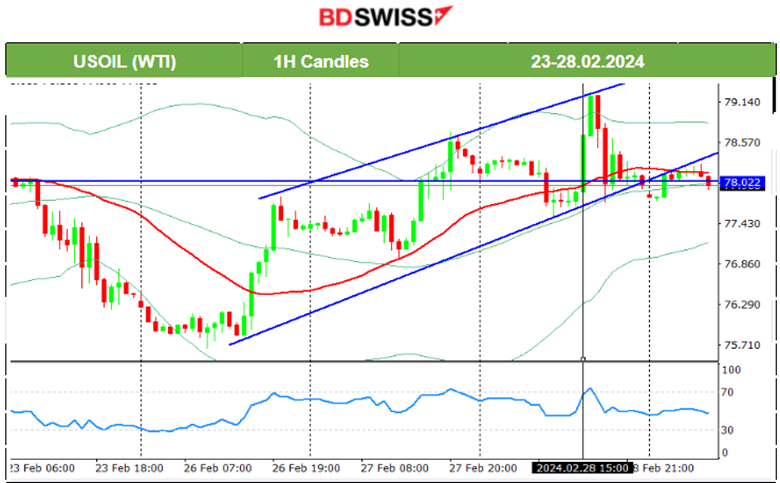

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 26th Feb Crude oil experienced a full reversal to the upside. The price reached the resistance 77.80 USD/b and retraced to the 61.8 Fibo level on the 27th Feb. The price continued with an upward movement reaching the next resistance at 78.75 USD/b before retracing again to the MA. On the 28th Feb, the pattern continued as the price was clearly on a short-term uptrend, however, after finding important resistance near 79.20 USD/b it reversed to the mean level at 78 USD/b. Since the price is now settling under the 30-period MA, considering the volatility of Crude, a sideways movement is now more probable, or even the start of a downtrend.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 23rd Feb, Gold moved to the downside, finding support at 2016 USD/oz and in a short period of time reversed significantly to the upside crossing the 30-period MA on its way up reaching the resistance at 2041 USD/oz. Since then, it moved sideways around the MA, with volatility levels getting lower and lower forming a triangle. That triangle has broken to the downside on the 28th Feb as the USD is gaining strength. On the same day, it reversed highly after reaching support and eventually came to test again the highs. A clear channel is now visible as depicted on the chart. A sideways volatile movement for Gold with a potential upside breakout soon, potentially reaching again the 2040 USD/oz or beyond.

______________________________________________________________

______________________________________________________________

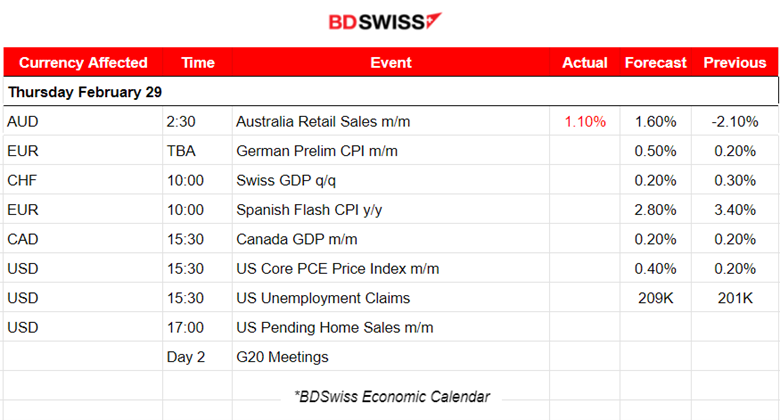

News Reports Monitor – Today Trading Day (29 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Australia’s Retail Sales report release at 2:30 showed growth of 1.10% but less than expected. No major impact was recorded at the time of the release, however the AUD surprisingly appreciated against the USD and other currencies, soon after the release.

- Morning – Day Session (European and N. American Session)

Canada’s GDP figure is going to be released at 15:30, expected to have grown at a steady pace of 0.20% monthly. The CAD pairs during that time could see some more than usual moderate volatility.

The U.S. core PCE price index, a measure of inflation, is highly taken into account by the Fed and is going to be released at 15:30. This figure is expected to be reported higher justifying the analyst expectations that there will be no cuts in March and even at May’s meeting. If inflation is not showing strong evidence of a downtrend rates will be kept elevated as per the Fed’s recent statements.

A surprise to the downside will probably cause the USD to be affected greatly causing weakness at the time of the release. U.S. unemployment claims are expected to remain close to 200K but slightly higher than the previous figure having some effect on the USD pairs during the release.

General Verdict:

______________________________________________________________