The Australian dollar slipped to a three-week low this morning as the RBA looks set to enhance monetary easing. Current consensus is that the additional stimulus is likely to be announced during the RBA’s Nov. 3 policy meeting. Specifically, the central bank is expected to cut the interest rate to a new record low of 0.1% from the current 0.25% and possibly boost bond purchases in the five to 10-year window.

As a major risk currency, the AUD tends to follow global stock markets trends and is generally seen as a leading indicator of risk appetite. A generally weak USD has helped the AUD higher recently but we see a major trend reversal today.

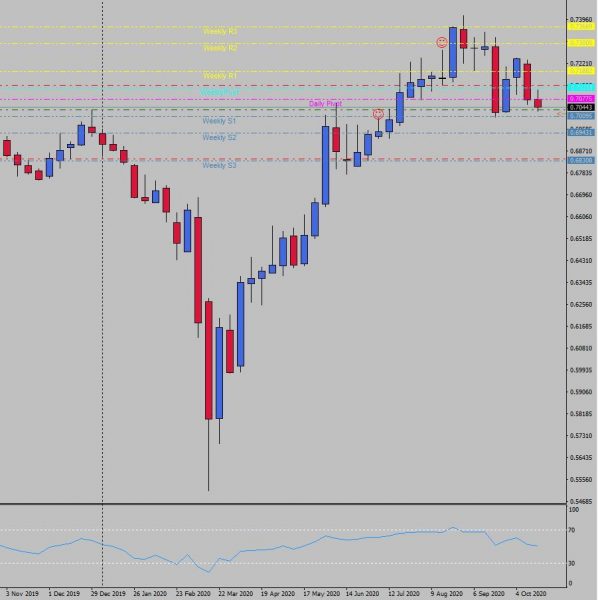

With growing uncertainty in the Covid-19 pandemic, the strength in the USD might return and we hence sold this pair at 0.7034 with SL at 0.7135 and TP at 0.6835.