Rates as of 06:30 GMT

Market Recap

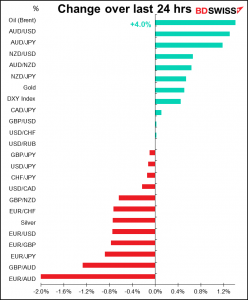

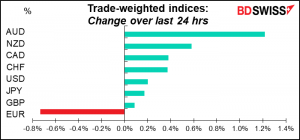

Some big moves in the FX rates today!

The stunning move was in AUD. It had been drifting higher ahead of the Reserve Bank of Australia (RBA) meeting this morning and then exploded higher once the statement was released. It wasn’t so much what Gov. Lowe said as what he didn’t say: he dropped the word “patient” from the forward guidance.

Previously, he said that “The Board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.” This time however he changed it to “Over coming months, important additional evidence will be available to the Board on both inflation and the evolution of labour costs. The Board will assess this and other incoming information as its sets policy to support full employment in Australia and inflation outcomes consistent with the target.”

Market Recap

Some big moves in the FX rates today!

The stunning move was in AUD. It had been drifting higher ahead of the Reserve Bank of Australia (RBA) meeting this morning and then exploded higher once the statement was released. It wasn’t so much what Gov. Lowe said as what he didn’t say: he dropped the word “patient” from the forward guidance.

Previously, he said that “The Board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.” This time however he changed it to “Over coming months, important additional evidence will be available to the Board on both inflation and the evolution of labour costs. The Board will assess this and other incoming information as its sets policy to support full employment in Australia and inflation outcomes consistent with the target.”

The RBA has been an outlier among major central banks in maintaining its “patience” in the face of rising global inflation even as most other central banks have abandoned the idea that higher inflation will just be “transitory” and started moving to rein in prices. As the RBA comes more into line with the prevailing international trend, AUD is likely to benefit. The Bank of Japan will then be left alone as the sole outlier (especially as core consumer prices in Japan are still in deflation!) and AUD/JPY could move significantly higher on monetary policy divergence rather than risk sentiment.

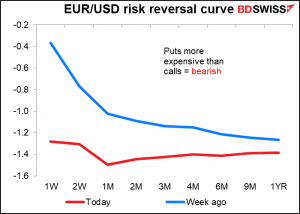

Before the RBA meeting the focus was on EUR and the increasing tensions in Europe, which have pushed EUR/USD back below 1.10. Reports of Russian atrocities in Ukrainian have increased calls for sanctions, including sanctions against Russia’s energy sector. That’s been largely exempted up to now in order to minimize the impact on Western Europe. French President Macron for example noted that the EU is set to discuss expanding sanctions to Russian oil and coal. That sent Brent up 4% on the day. Lithuania became the first EU country to stop importing Russian gas.

Meanwhile, Bloomberg reported that the US Treasury is preventing US banks from processing Russian sovereign debt coupon payments in dollars. The move is designed to force Russia to either drain the dollar reserves it holds domestically, spend new revenue, or default. A coupon payment was due yesterday.

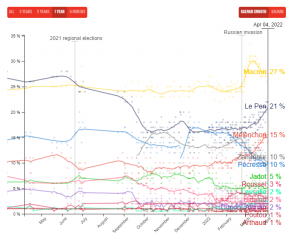

There’s also increasing uncertainty regarding Sunday’s French presidential elections, where incumbent President Macron’s lead in the polls has narrowed. He’s still expected to win in the run-off scheduled for April 24 but his lead in the polls over Marine Le Pen has narrowed to only six percentage points as she picks up supporters from rival Eric Zemmour, whose campaign looks to be faltering. That’s liable to be another source of risk for EUR.

Before the RBA meeting the focus was on EUR and the increasing tensions in Europe, which have pushed EUR/USD back below 1.10. Reports of Russian atrocities in Ukrainian have increased calls for sanctions, including sanctions against Russia’s energy sector. That’s been largely exempted up to now in order to minimize the impact on Western Europe. French President Macron for example noted that the EU is set to discuss expanding sanctions to Russian oil and coal. That sent Brent up 4% on the day. Lithuania became the first EU country to stop importing Russian gas.

Meanwhile, Bloomberg reported that the US Treasury is preventing US banks from processing Russian sovereign debt coupon payments in dollars. The move is designed to force Russia to either drain the dollar reserves it holds domestically, spend new revenue, or default. A coupon payment was due yesterday.

There’s also increasing uncertainty regarding Sunday’s French presidential elections, where incumbent President Macron’s lead in the polls has narrowed. He’s still expected to win in the run-off scheduled for April 24 but his lead in the polls over Marine Le Pen has narrowed to only six percentage points as she picks up supporters from rival Eric Zemmour, whose campaign looks to be faltering. That’s liable to be another source of risk for EUR.

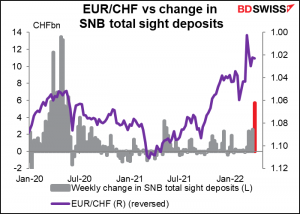

We asked yesterday whether the stability in EUR/CHF was natural or due to “supernatural forces” acting in the market. It appears to be the latter as Swiss National Bank (SNB) total sight deposits rose by CHF 5.7bn in the latest week, more than double the previous week and the largest weekly increase in sight deposits since May 2020. It looks like the SNB has indeed drawn its “line in the sand” with regards to EUR/CHF.

Today’s market

Not that much on the schedule today, as is often the case in the second week of the month –even if the first week is rather short.

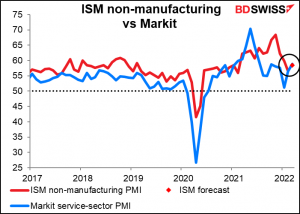

We already discussed the final service-sector purchasing managers’ indices (PMIs) yesterday. As last week’s final manufacturing PMIs were generally revised down, it wouldn’t be a big shock if the service-sector PMIs were too.

The Institute of Supply Management (ISM) version of the service-sector PMI is expected to rise slightly to be almost the same as the Markit version of this indicator, which does happen occasionally although not that often.

The US trade balance (which should actually be called the US trade deficit, since the US hasn’t had a trade surplus on an annual basis since 1975) has a much higher Bloomberg relevance score than the advance trade balance, but that’s silly because the advance balance – which is merchandise trade – pretty much defines the trade balance, as services don’t seem to change that much month-to-month. In any event it’s expected to narrow a bit from January’s record-wide trade deficit, which is no surprise since the advance trade deficit sorry balance narrowed from the record deficit on that measure.

Fed Gov. Brainard – note that she is still Governor, not yet Vice Chair as she hasn’t yet been confirmed – will speak on the impact of inflation at a Minneapolis Fed event. Since she’s still awaiting confirmation, she’s likely to emphasize the Fed’s price stability mandate in order to win brownie points with the “hard money” Republicans on the Senate committee that has to approve her. This may take the form of echoing Fed Chair Powell’s squaring the circle by saying “maximum employment can only be sustained with price stability,” making it so that there’s no conflict between the two goals – even though everyone knows that they have to dampen economic activity in order to ensure price stability and that will inevitably mean less employment. She may also emphasize that the Fed has not only reached “maximum employment” but also “broad-based and inclusive” employment.

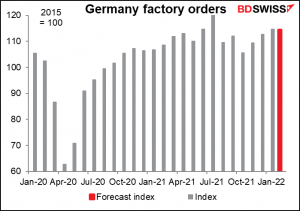

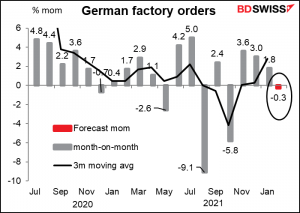

Then tomorrow morning bright and early Germany announces its factory orders. They’re expected to be down slightly after three months of fairly solid growth.

A fall wouldn’t be surprising – orders are still expected to be 10% higher than before the pandemic and 12.5% above the 2019 average. A pretty robust order book still.

A fall wouldn’t be surprising – orders are still expected to be 10% higher than before the pandemic and 12.5% above the 2019 average. A pretty robust order book still.