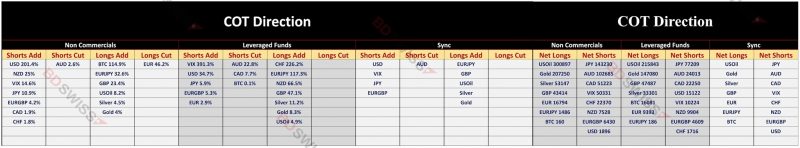

Latest Commitments of Traders (COT) report, April 2, 2024 (14th report of the year) the cut-off date.

COT direction table (Non Commercials and Leveraged Funds with Sync) The US Dollar (USD) experienced a notable increase in net short positions among non-commercials and leveraged funds by 201.4% and 34.7%, possibly influenced by expectations of a Federal Reserve rate cut. Short positions were also added in VIX, JPY, and EURGBP.

The US Dollar (USD) experienced a notable increase in net short positions among non-commercials and leveraged funds by 201.4% and 34.7%, possibly influenced by expectations of a Federal Reserve rate cut. Short positions were also added in VIX, JPY, and EURGBP.

Conversely, the Australian Dollar (AUD) saw a decrease in net short positions among non-commercials and leveraged funds by 2.6% and 22.8%, likely due to favorable recent data from China.

Aligned with other commodities such as USOil and Silver, Gold experienced a rise in bullish sentiment as non-commercials and leveraged funds augmented their net long positions by 4% and 8.3%, respectively.

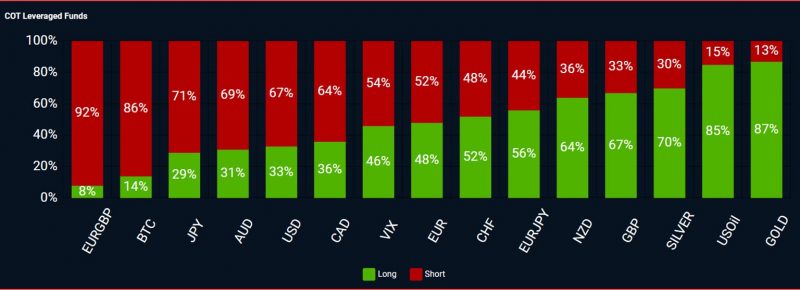

Below is the stacked barchart for the Leveraged Funds.

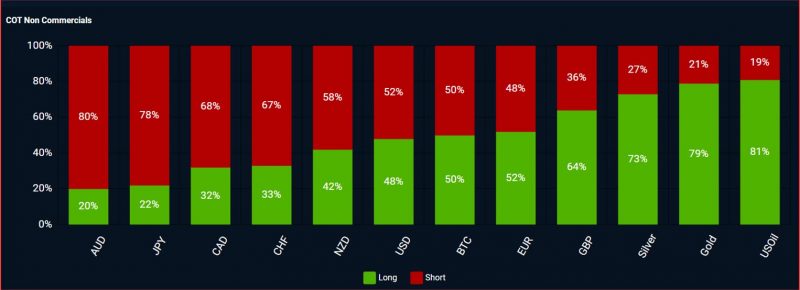

Below is the stacked barchart for the Non Commercials.

Below is the stacked barchart for the Non Commercials.

Below is the Heatmap of non commercials and leveraged funds.

Below is the Heatmap of non commercials and leveraged funds.

In conclusion, the latest COT report reflects dynamic shifts in market sentiments and positions, with notable changes in USD, AUD, EURJPY, and Gold. These adjustments appear to be influenced by factors such as rate cut expectations, positive data from China, and changes in bullish sentiment across various assets.

In conclusion, the latest COT report reflects dynamic shifts in market sentiments and positions, with notable changes in USD, AUD, EURJPY, and Gold. These adjustments appear to be influenced by factors such as rate cut expectations, positive data from China, and changes in bullish sentiment across various assets.

Source:

https://www.cftc.gov/MarketReports/CommitmentsofTraders/HistoricalCompressed/index.htm

Forex Source