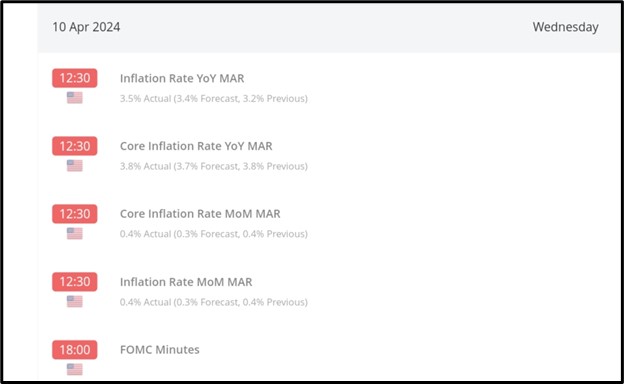

On Wednesday, April 10th, 2024, significant developments unfolded both in the European Union and the United States of America. In the EU, the European Parliament cleared a crucial milestone by approving reforms to address irregular migration, aiming to overhaul how the bloc handles large numbers of people, many fleeing conflict in their homelands. Meanwhile, in the USA, key economic indicators for March were released, revealing that the Inflation Rate Year on Year and Month on Month, as well as the Core Inflation Rate Year on Year and Month on Month, all surpassed earlier forecasts.

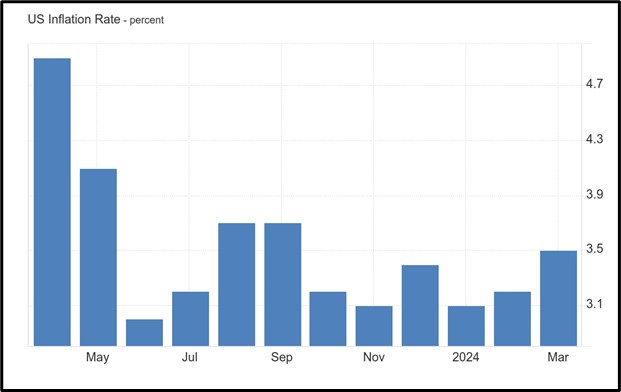

In March 2024, the yearly inflation rate in the US jumped to 3.5%, the highest since September. It was up from 3.2% in February and beat the expected 3.4%. Energy costs went up by 2.1%, with gasoline rising by 1.3%, while utility gas service and fuel oil dropped by less compared to February. Food and shelter prices stayed about the same, but transportation and apparel costs increased sharply. However, prices for new vehicles and used cars and trucks fell. The Consumer Price Index (CPI) rose by 0.4% from the previous month, similar to February but higher than the expected 0.3%. Shelter and gasoline contributed most to the monthly increase. Core inflation, which excludes food and energy, remained steady at 3.8% annually, surpassing the forecast of 3.7%. The monthly rate also remained at 0.4%, contrary to market expectations of a decrease to 0.3%.

Based on technical analysis using the 4-hour chart of EURUSD, the exchange rate has been trading within a range between 1.08849 as resistance and 1.07237 as support since April 4th, 2024. If the support level is breached, there is a strong likelihood of further downward movement in the exchange rate. Conversely, if the support level holds, there is a high probability of the exchange rate rebounding towards the resistance. If the resistance level rejects the exchange rate, there is a significant chance of it falling back towards the support. However, if the resistance level is surpassed, there is a high probability of the exchange rate rallying further.

Sources

https://edition.cnn.com/2024/04/10/europe/eu-parliament-reforms-migration-policy-intl/index.html

https://global.bdswiss.com/economic-calendar/

4HR Chart of EURUSD from Metatrader 4