Rates as of 04:00 GMT

Market Recap

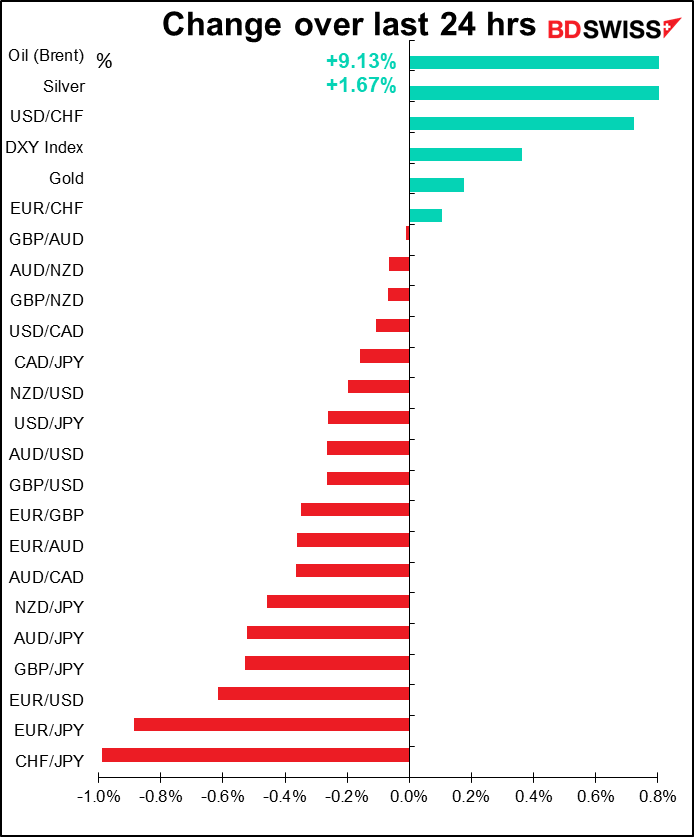

Another “risk on” day with US stocks up 0.9% and most Asian markets following suit today. Things were even better during most of the US day; at the peak, the S&P 500 was up nearly 2%. But Fed Vice Chair Clarida gave an unscheduled interview on CNBC. While he reiterated the usual talking points that the Fed is prepared to use its full range of tools to support the US economy and that there is no balance sheet constraint to what the Fed can do, he was also realistic – he not only didn’t say anything particularly optimistic, but also said that “unfortunately, the unemployment rate is going to surge to numbers that we’ve not seen probably since the 1940s.” I suspect he misspoke and that he really meant the 1930s, when unemployment hit the record high of 24.9%. Although maybe he meant “since the current data series began,” since it only starts in 1948. In any event, people are used to Fed officials being somewhat optimistic, and although he said he thought the economy could start to recover in the second half, he wasn’t particularly optimistic – which I think is in line with what Fed Chair Powell said in his press conference after the last FOMC meeting, but never mind, people can react a second time to the same thing.

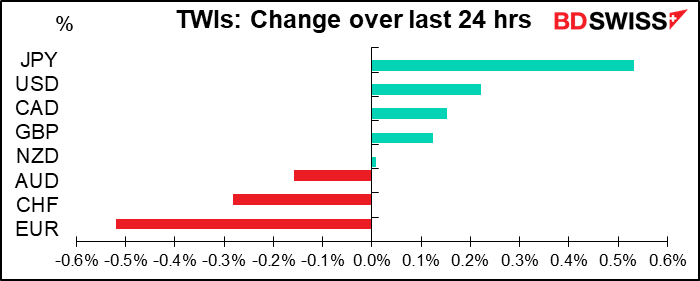

EUR was the weakest currency after the German Constitutional Court ruling went against the ECB. They rejected the European Court of Justice’s decision and ruled that the ECB’s Public Sector Purchase Programme (PSPP) is partly violating Germany’s constitution. They gave the ECB Governing Council three months to adopt “a new decision that demonstrates … that the monetary policy objectives pursued by the PSPP are not disproportionate to the economic and fiscal policy effects resulting from the programme.” If they fail to comply, then Germany’s Bundesbank would no longer be allowed to help carry out these purchases. On the other hand, the court didn’t find the ECB in violation of the prohibition on the monetary financing of member state budgets.

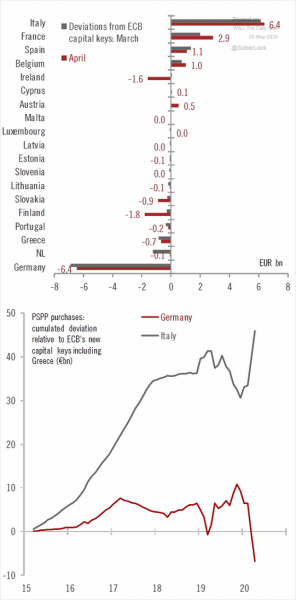

The idea of “disproportionate” refers to how much support the ECB gives to each government. The way it’s supposed to work in theory is that each government contributes to the ECB’s capital (their contributions are called the “capital keys” and are based on population and GDP) and then when the ECB buys bonds, it’s supposed to buy them in proportion to each country’s capital keys. However the countries that need the money aren’t necessarily the same ones that contribute it (graph from Banque Pictet). In short, Germany contributes the most money (26%) and Italy needs the most money.

While the ruling only pertained to the PSPP, it’s likely that someone will use the ruling to challenge the legality of the recently instituted Pandemic Emergency Purchase Programme (PEPP) as well, particularly because the PEPP is even more flexible regarding its proportionality.

It’s now up to the ECB and German government to explain the proportionality of the PSPP. The ruling makes it more difficult for the ECB to finance Italy and other troubled borrowers, such as Greece. Since the northern European countries remain resolutely opposed to joint financing (I’m talking to you, Netherlands), it presents a problem for the euro – the fundamental problem of having a joint monetary policy without having a joint fiscal policy.

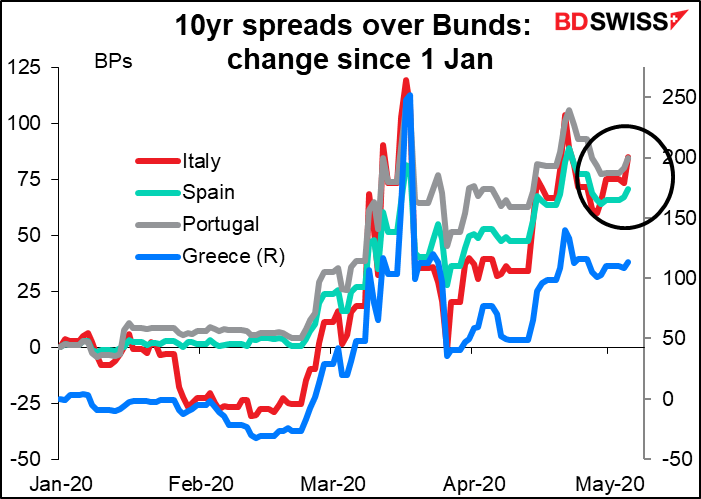

EUR weakened sharply on the news and peripheral bond spreads widened as once again the sustainability of the euro came under doubt. The spread of 10yr Italian BTPs over German Bunds rose by +12 bps to 244 bps, while the spread of Spanish bonds widened by 4 bps, Portugal 5 bps and Greece 5 bps, showing that the concerns are more widespread than just Italy, even if Italy is the biggest risk right now.

The German ruling is a big negative for the euro. While the euro has been looking much better than the US recently because of its faster action with regards to the virus, its better employment protection policies and its rising trade surplus, the news points out the euro’s main flaw – the lack of a central fiscal agency – which the US does have, even if the US government is really messed up at the moment and finds it difficult to agree on anything.

Taken to extreme, the German court’s ruling could mean that the court forces the Bundesbank out of the ECB Target 2 payment system and in effect pushes Germany out of the euro, although I sincerely doubt if it would go that far – and whether the German government would allow it to happen even if the court tried to force it. Nonetheless, questions about the euro are likely to remain at least until the next EU Council meeting in June. The ECB’s operations will have to become more opaque and probably less flexible, meaning less support for the third-largest economy – and the largest bond market – in the eurozone. The uncertainty is likely to weigh on the euro for some time.

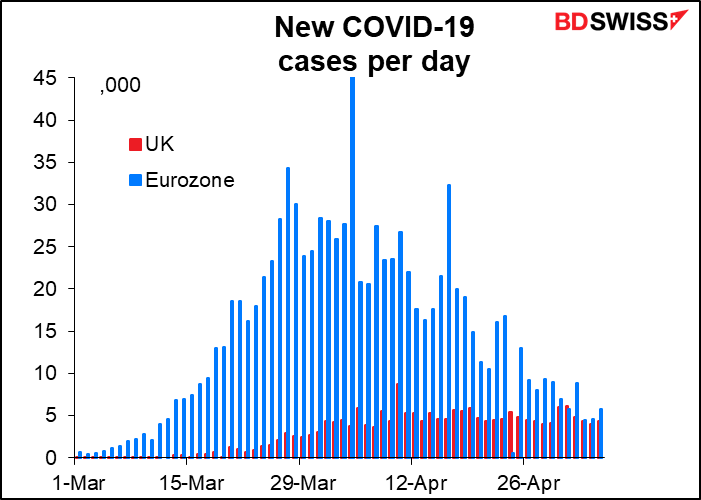

Britain is becoming the new epicenter of the virus (aside from the US, of course). Recently Britain (population 65.4mn) has had as many new cases each day as the Eurozone (342mn). I think this should start to weigh on the pound — the government’s incompetence in handling this crisis is a national scandal and may impair their ability to govern going forward.

Today’s market

The European Commission (EC) aims to present its proposal for a recovery fund by today. Media reports suggest that the Commission is likely to propose raising extra funds for the EU budget, maybe 1.2% to 2.0% of gross national income, temporarily to support grants and collateral for extra borrowing.

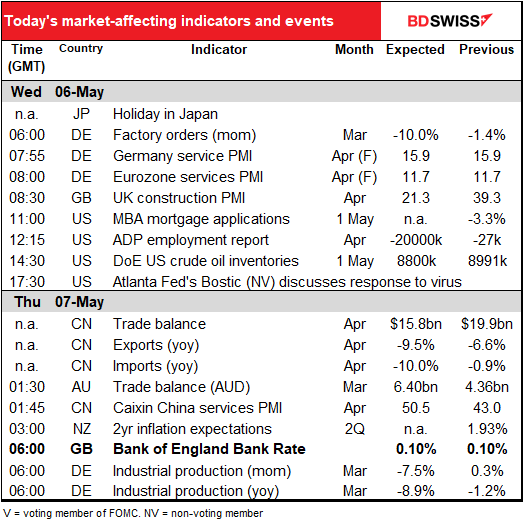

Otherwise, the main event over the next 24 hours is the results of the Bank of England meeting, which will be announced at the unusually early time of 0600 GMT on Thursday. That’s because they’re no longer having a press briefing and the Governor won’t have his usual press conference, so they’re going to release the statement before trading starts in London. This is a new – and one hopes temporary – arrangement that they’ve made with regards to market-affecting indicators and announcements since they can’t have the usual sealed-room sessions for reporters to prepare their stories ahead of time.

I wrote extensively about the Bank of England meeting in this week’s weekly, The Three Phases. If you’re really interested you can read the whole thing there, otherwise I’ll summarize it here.

At its special meeting on 19 March, the BoE cut Bank Rate by a further 15 bps to a record-low 10 bps and announced a quantitative easing program of GBP 200bn. It explained the moves as follows:

Over recent days, and in common with a number of other advanced economy bond markets, conditions in the UK gilt market have deteriorated… As a consequence, UK and global financial conditions have tightened…the MPC judged that a further package of measures was warranted to meet its statutory objectives. It therefore voted unanimously to increase the Bank of England’s holdings of UK government bonds and sterling non-financial investment-grade corporate bonds by £200 billion…and to reduce Bank Rate by 15 basis points to 0.1%.

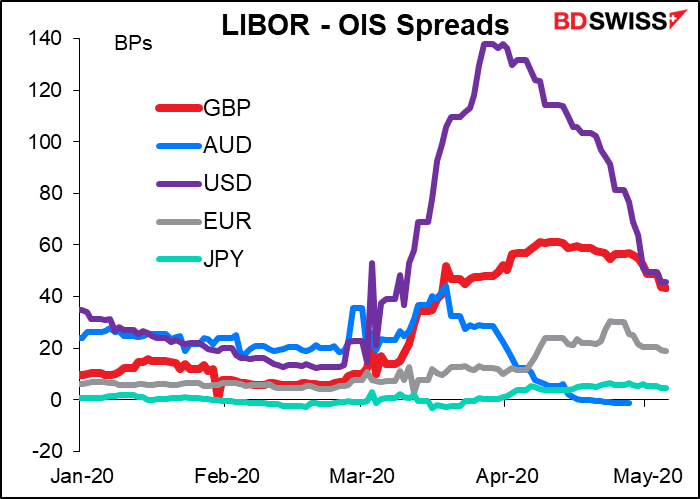

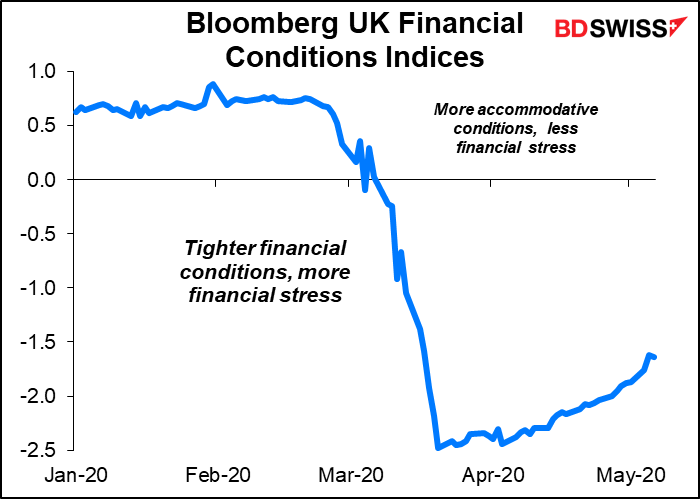

But financial conditions haven’t improved that much since then. The LIBOR-OIS spread, which was at 52 bps on 19 March, is currently at 43 – some improvement, but still far above what it was before the virus hit (it averaged 12 bps in January and 7 bps in February).

And the Bloomberg UK financial conditions index, which was in “loose” territory before the virus hit, has barely rebounded off its recent lows.

Meanwhile, the UK Debt Management Office (DMO) last week detailed its plans to issue GBP 180bn in gilts in the next three months. Given that the BoE has already bought GBP 80bn, that will exceed the Bank’s planned GBP 200bn purchases for its Asset Purchase Facility (APF). I therefore think it’s likely to announce an increase in the APF by at least GBP 100bn, rather than waiting until it has to.

Other possible actions: the BoE could also do some fine-tuning of its other policies, such as adjusting its eligibility criteria to include “fallen angels,” bonds that were investment grade before the virus struck but have since been downgraded (a move several other central banks have taken). It could similarly ease collateral requirements.

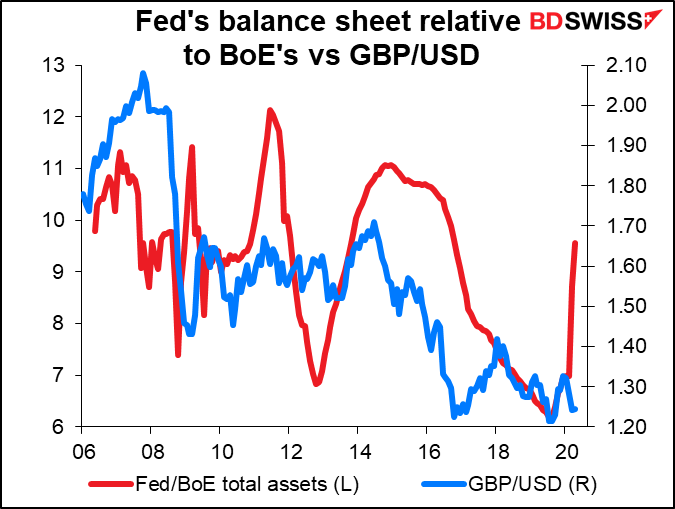

Market response: the relative size of balance sheets doesn’t seem to be a driver of either GBP/USD or EUR/GBP. Therefore, another GBP 100bn or so of gilt purchases shouldn’t have a major impact on the FX market.

Rather, the key will probably be on what they say. If instead of expanding purchases by GBP 100bn they say something like “buy as much as needed,” then we could see some temporary weakness in GBP, although since everyone else is buying as much as they can too, it won’t change the relative picture long term. If they say that they are open to cutting rates to negative, then that would probably be a big deal, because they’ve opposed the idea up to now. But as I discussed above, it’s clear that interest in negative rates as a policy tool has been waning among central banks recently.

Lastly, will they make any forecasts? The quarterly Monetary Policy Report, which is scheduled to be released at this meeting, usually contains the Bank’s forecasts for the economy. But how can they make any believable forecasts nowadays? The most likely solution will be a range of forecasts, which would allow them to put forward a variety of views without seeming to endorse a negative outlook. Again, the market could react to the forecasts, but then again, I’m not sure anyone believes any forecasts now.

Today’s indicators

We already covered the German factory orders yesterday. They’re expected to be a disaster, but so is everything else, too.

We get the service-sector purchasing managers’ indices (PMIs), including the final ones for those countries that have preliminary versions. Usually the revisions aren’t very big. They may be bigger this time because of the virus, but everyone expects bad figures so I doubt if it will have much effect.

The ADP employment report is the big indicator of the day. It’s never a particularly reliable indicator of Friday’s nonfarm payrolls, but it’s always watched as if it were. I’m not even going to include a graph of it today. Needless to say, there’s no precedence for it to show a decline of 20mn jobs in one month, which is the median of economists’ forecasts. The series only goes back to 2002 and the largest decline before now was -835k in February 2009. The graph would look basically like a straight line with one bar coming down at the end.

The range of forecasts is incredible, reflecting the uncertainty in today’s conditions: from -15k to -24mn. There are actually four people looking for around -25k, but most people are from -19mn to -24mn.

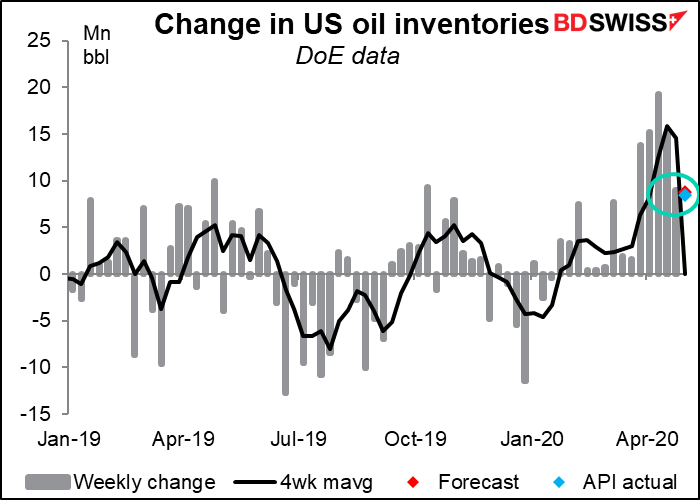

Crude oil inventories are always interesting nowadays. Gasoline inventories have een falling recently, much to everyone’s encouragement. Watch those as well, because they were what the market focused on last time more than the crude inventories.

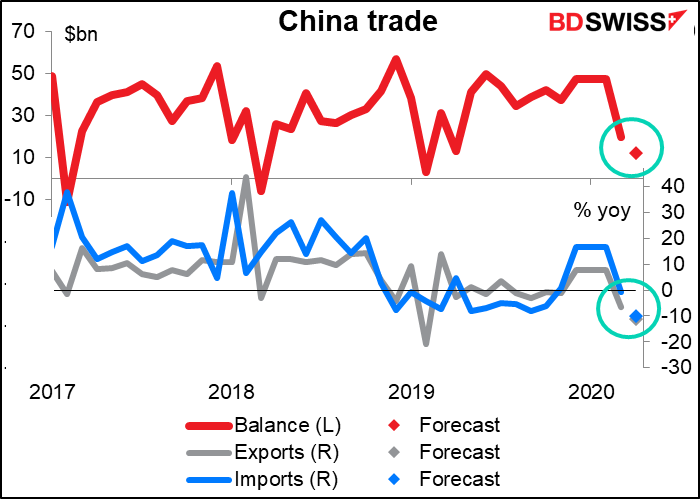

Overnight, China announces its trade figures. The trade surplus is forecast to decline further as exports fall a bit faster than imports. The forecast decline (-11.1% vs -10.0%) is nothing like South Korea however (-24.3% vs -15.9%) for the same month. This suggests China is recovering somewhat.

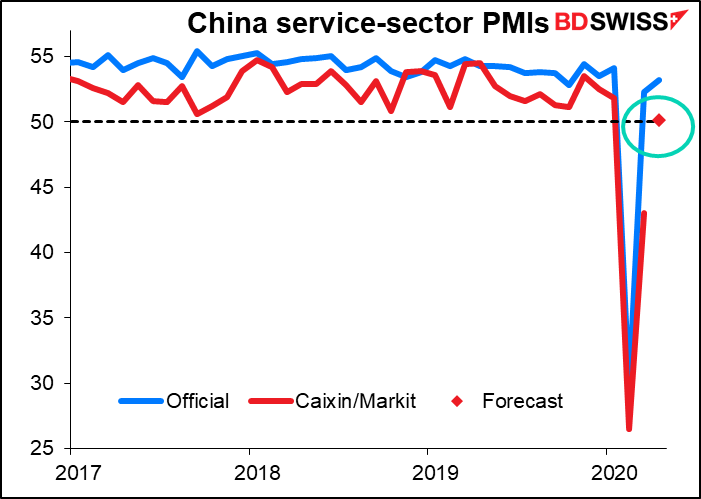

A few minutes later, the Caixin/Markit service-sector purchasing managers’ index (PMI) for China comes out. It’s expected to just poke its nose over the 50 “boom-or-bust” line. Amazing rebound from such a deep plunge. But remember that the PMIs are diffusion indices calculated by taking the number of people saying things are getting “better” and subtracting the number who say things are getting “worse.” It probably would be hard to get worse than things were back in February. So just because things are generally getting better in China doesn’t necessarily mean they’re good or even back to normal. It just means they’re better than the disastrous state that they were in when the government was welding people’s doors shut, which probably wasn’t hard.

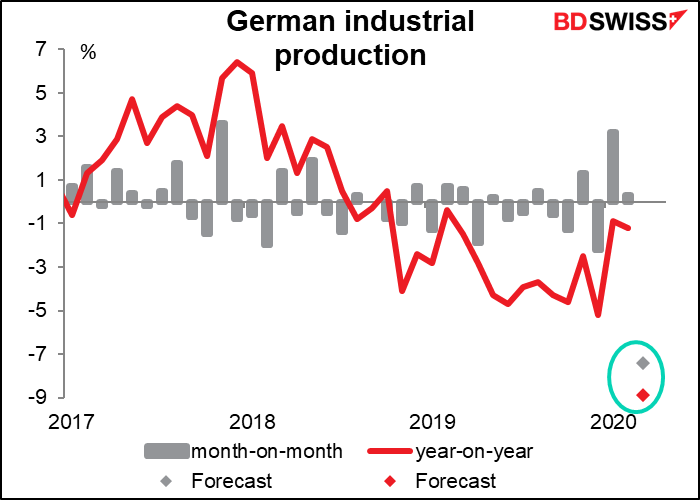

Finally, at the same time tomorrow morning that we get the Bank of England decision, Germany announces its industrial production figures. The forecast mom decline of -7.4% is far from a record – back in January 1991 it fell an astonishing 13.0% mom, and in January 2009 it was down 7.5% mom after being down 6.8% mom the previous month and 7.3% mom the month before that. Year-on-year too this is far from the 36.4% yoy decline in February 2009. Still, just because this isn’t the worst figure ever doesn’t mean it’s good. And this is for March – April will probably be worse.