Rates as of 05:00 GMT

Market Recap

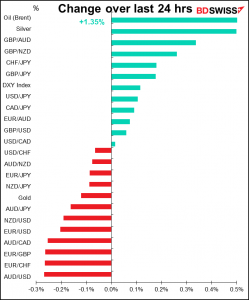

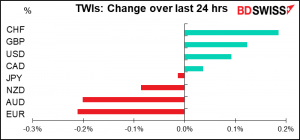

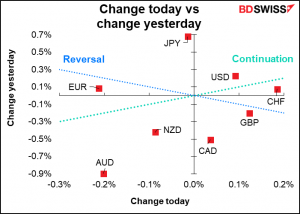

After days of some volatility, FX rates were little changed overnight.

I’m astonished to see oil up and CAD slightly higher even though OPEC+ decided to continue to increase production by 400k barrels a day (b/d) each month as scheduled. Most observers (aka me) had thought they would at least pare back the increase if not pause it entirely. The reason for the surprising response is that the alliance said it could revisit the decision at any moment due to high uncertainty in the market. The statement following the meeting said the group agreed “that the meeting shall remain in session pending further developments of the pandemic and continue to monitor the market closely and make immediate adjustments if required.”

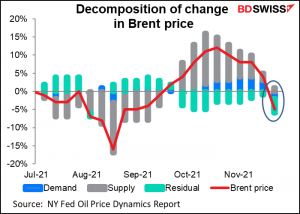

I have to admit, this was a brilliant way to finesse the current situation in the oil market now, where it’s largely anxiety pushing prices down not supply or demand. The New York Fed’s Oil Price Dynamics Report breaks down the causes of changes in the oil price into demand, supply, and “residual” factors. Recently it’s been “residual” that’s been responsible for the drop in the oil price. This is no doubt fear of the Omicron variant and its effect on mobility. Assuming no change in supply or demand then, the elimination of this fear might well bring oil prices back up.

With that in mind, here’s an entire article by Dr. Angelique Coetzee, Chair of the South African Medical Association. The salient points are where she says “No one here in South Africa is known to have been hospitalized with the Omicron variant, nor is anyone here believed to have fallen seriously ill with it…If, as some evidence suggests, Omicron turns out to be a fast-spreading virus with mostly mild symptoms for the majority of the people who catch it, that would be a useful step on the way to herd immunity.” She blasts the travel restrictions that the UK (and other countries since) have imposed in reaction to the discovery: “nothing I have seen about this new variant warrants the extreme reaction the UK government has taken in response to it.”

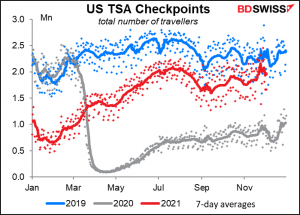

That’s important because it was the expected hit to travel that sent oil prices down sharply. For example in the US air travel was almost back to normal but has started to turn down again over the last several days. If the variant proves harmless, oil prices are likely to pop back up, but if it’s dangerous, OPEC+ stands ready to act quickly.

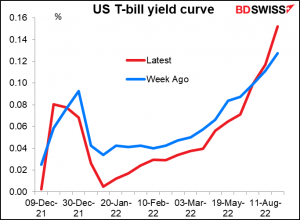

Elsewhere, the US managed to avert a shutdown by reaching an agreement to fund the government until February 18. So we now have another two months before the same ridiculous theater plays out all over again. I’m surprised that the near-term hump in yields didn’t go away, but on the other hand there’s no new hump in February so perhaps investors think the problem is finally solved.

Today’s market

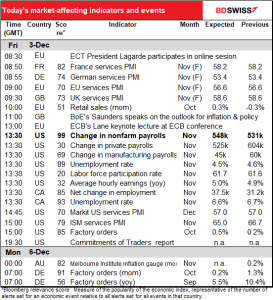

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

The day starts out with ECB President Lagarde speaking at a Reuters event, Reuters Next. This is “a free virtual global conference that brings together world leaders, big business and forward-thinking pioneers to inspire, drive action and accelerate innovation to tackle humanity’s greatest challenges,” according to their website. They have an astonishing lineup of some 150+ speakers over three days, including US Treasury Secretary Yellen, NZ PM Arden, the head of the World Trade Organization, the head of the Russian Central Bank, the World Health Organization (WHO) Chief Scientist, and the much-maligned US medical Bodhisatva Dr. Fauci. (In Buddhist thought, Bodhisattvas are enlightened beings who have put off entering paradise in order to help others attain enlightenment. I believe this accurately describes Dr. Fauci, who has persevered in his role as Chief Medical Advisor to the US President in the face of incredible hostility.)

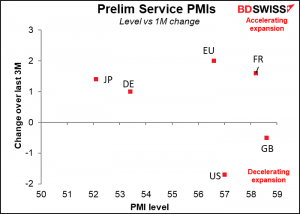

We then get the service sector purchasing managers’ indices (PMIs), once again the final ones for the major economies and the first and only versions for all the other countries. The preliminary ones were most better, much to the market’s surprise; only the US and UK fell, and they were quite high to begin with. If this good performance is replicated across the board it could help to bolster risk sentiment and be positive for AUD/JPY.

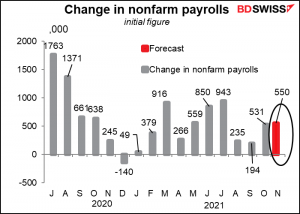

But you don’t really care about that, do you? What you’re waiting for is the US nonfarm payrolls. That’s the focus today, and with good reason. The Fed has certainly surpassed its goal of “inflation moderately above 2 percent for some time.” In fact, a convincing argument could be made that it’s no longer even “moderately above 2%.” So now what they’re waiting to see is “the shortfalls of employment from its maximum level.” If employment grows by another 550k or so, which is what’s expected this month, that would probably be enough for the Fed to accelerate its tapering. As Fed Chair Powell said at his press conference following the November FOMC meeting

…you don’t have to think back to the million job months of June and July, you can just think, okay, 550 to 600 (thousand), we should get back on that path, then we would be making good progress. And we’d like to see that of course.

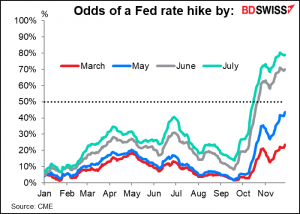

Based on that statement, I believe an NFP number like what’s expected would be enough to get the Federal Open Market Committee (FOMC) to vote at its Dec. 15th meeting to accelerate the pace at which it tapers down its bond purchases. Currently it’s planning on reducing them by $15bn a month, which would end the program by next June, but many members of the FOMC have said they’re open to accelerating that pace. Former NY Fed President William Dudley recently urged the FOMC to double the pace of tapering so as to enable the central bank to start raising rates by next March.

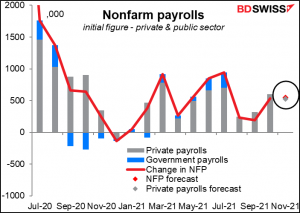

The forecast is for private-sector payrolls to rise by 525k and for government payrolls to rise by 25k. This would accord with the ADP Report of an increase in private-sector payrolls of 534k.

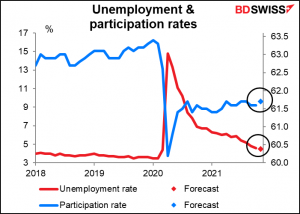

The unemployment rate is expected to creep down and the participation rate to creep up, both of which are going in the right direction although maybe not as quickly as many had hoped. It may look like we’re still far below “maximum employment” when we compare the current participation rate to where it was before the pandemic began, but this may be due to changes in society that the Fed will have to take into account. With the recent “take this job and shove it” mentality sweeping the US (indeed sweeping the globe), perhaps the participation rate isn’t going to get back to where it was before any time soon.

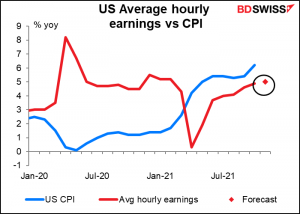

Average hourly earnings are forecast to continue to climb, but to climb by less than the consumer price index is climbing (but by exactly the same as the personal consumption expenditure deflator). The Fed is in somewhat of a dilemma here – they want to see wages rise, particularly for the lower-waged, but they don’t want to get a wage/price spiral started.

At the moment the odds of a rate hike in March is low – only 24% or so. I expect that to increase if the NFP figure comes in as expected or higher and for the dollar to gain as a result.

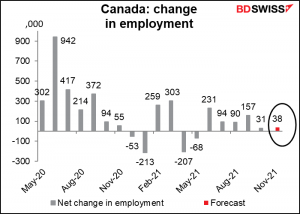

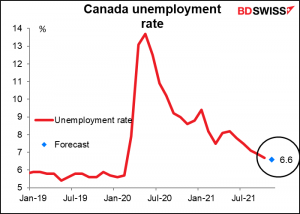

Meanwhile, Canada also reports its employment data. It’s expected to show continued improvement, which may be positive for CAD.