Last month was the big month for the RBA. They had to decide whether to roll over their market intervention from the April 2024 bond into the November bond. They decided not to, which was a modest tightening of policy. They also decided to continue purchasing government bonds after the completion of the current bond purchase program in early September, although they would reduce the amount to AUD 4bn a week from the current rate of AUD 5bn.

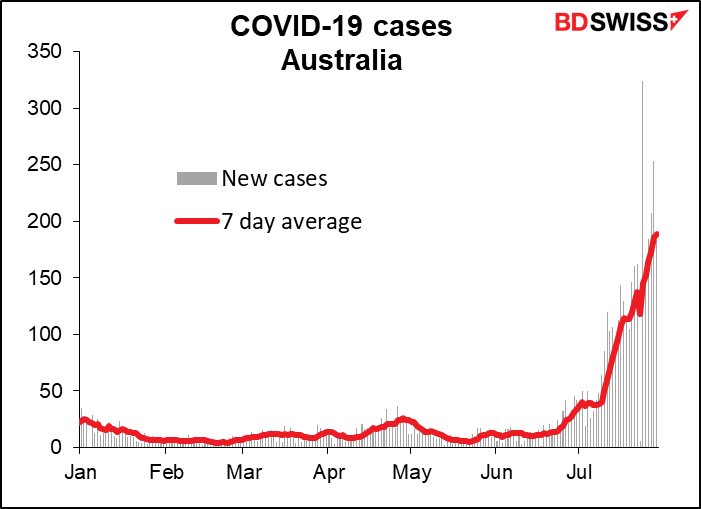

This month, the main topic of discussion will be the implications of the rise in COVID-19 cases and the extended lockdown in Greater Sydney. The lockdown was just extended to Aug. 28th and could be extended further. The area accounts for at least 21% of Australia’s population and so this is truly a Big Deal for the country. It’s likely to cause the economy to contract in Q3, although there would then be a stronger rebound in Q4 when Sydney reopens.

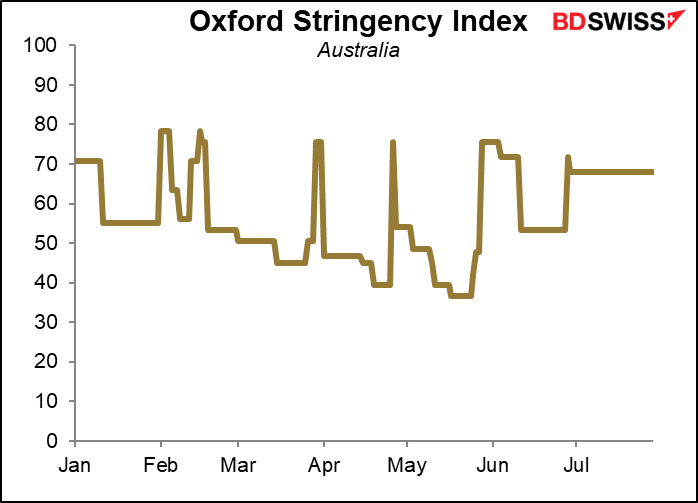

Previously the country has had a series of short sharp localized lockdowns, but recently they have been more widespread and longer-lasting. PM Morrison has promised lockdowns would be “less likely” once 70% of the adult population has been fully vaccinated, but that’s a long way off (currently only about 20% are vaccinated). and strikes people as more like a threat than a promise. The market fears that this is likely to impinge on growth.

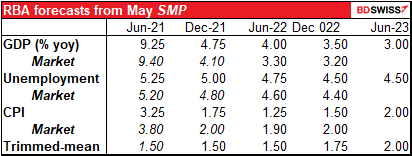

This makes it likely that they’ll revise down their forecast for 2021 growth in the updated Statement on Monetary Policy (SMP), which will be released on Friday. The main points of that are usually included in the statement following the meeting. Comparing their forecasts from the May SMP with the market’s current forecasts, they might revise down their growth forecasts but revise up their inflation forecasts – a difficult situation on the surface, except that with the trimmed mean inflation forecast not even expected to hit the bottom of their 2%-3% target range until mid-2023, they have no particular need to start tightening policy any time soon.

Rate expectations for Australia have come down substantially since the last RBA meeting on July 6th, probably as a result of the lockdown.

The question is, will they take any action to offset the lower growth? In the minutes to the July meeting, they said, “Given the high degree of uncertainty about the economic outlook, members agreed that there should be flexibility to increase or reduce weekly bond purchases in the future, as warranted by the state of the economy at the time, rather than a commitment to a specific rate of purchases over an extended period.” They could for example decide to increase the weekly bond purchases immediately.

Or they could rescind last month’s decision to cut the pace of purchases after September. That decision seemed to attract some discussion, but the hawks won out based on the brighter prospects for the Australian economy. “Members acknowledged that an argument could be made to retain the pace of bond purchases at $5 billion per week, given that economic outcomes were still well short of the Bank’s goals for inflation and employment. However, the economic outcomes had been materially better than earlier expected and the outlook had improved.” What if the outlook has now worsened?

Given the possibility of action, no change in policy would probably result in a stronger AUD, while an adjustment to the bond purchases would be likely to cause AUD to weaken.