The Fed is widely – if not unanimously – expected to begin tapering down its $120bn-a-month bond purchases this week, aiming to end them by next June. This could be a crucial event for the markets. After all, one of the first truisms one learns in investing is “don’t fight the Fed.” As the Fed withdraws its support from the bond market, is that going to mean higher bond yields? And will higher rates mean a weaker stock market?

If the past is any guide to the future, then the answer is: no. If we look at what happened the last time the Fed withdrew its support from the markets, the result was remarkably benign. The fear of tightening was much worse than the reality.

The previous round of Fed intervention in the bond market was in response to the 2008 Global Financial Crisis. The Fed began buying Treasuries and mortgage-backed securities in 2009, proceeding through Quantitive Easing (QE1), QE2, and QE 3. The last, launched in September 2012, was an open-ended program to buy about $85bn in bonds a month “until the outlook for the labor market has improved substantially.”

Then-Fed Chair Bernanke, testifying to the Joint Economic Committee on May 21, 2013, shocked the market by hinting that the Fed could start backing off these purchases. His prepared statement was fairly pessimistic, but when asked when he expected the exit process to begin, he said, “If we see continued improvement and we have confidence that that is going to be sustained, then we could in the next few meetings, take a step down in our pace of purchases.”

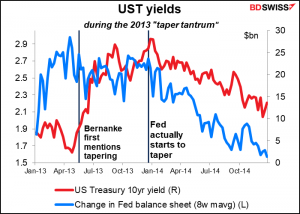

This statement set off what became known as the “taper tantrum” as bond market investors began selling bonds in anticipation of the Fed’s exit from the market.

In the event they didn’t start tapering until its Dec. 18th meeting that year, so the “taper tantrum” proved premature. In fact, it proved to be the ultimate in “sell the rumor, buy the fact” episodes as the peak in 10-year Treasury yields came about two weeks later. The day before the meeting, the 10-year was trading at 2.84%; it peaked on Dec. 31st at 3.03%. A little less than a year after the meeting (Dec. 16, 2014) it hit a low of 2.06%.

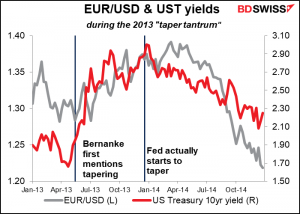

The lower yields were no obstacle to a stronger dollar, either.

There was only a momentary “taper tantrum” in the stock market, which continued to rally.

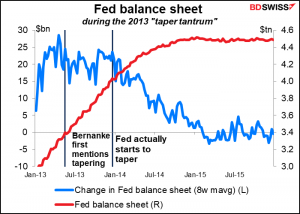

How could this be? One thing to remember: tapering down bond purchases only means a slower pace of growth in the Fed’s balance sheet, not shrinking it. The Fed’s balance sheet continued to expand during this time, just at a slower pace. It didn’t peak until Jan. 2015, and after that it was relatively stable – it ended 2015 down a mere 0.7% from the peak.

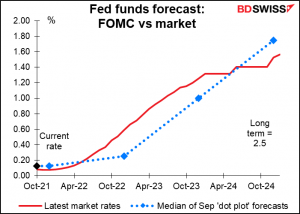

One difference between then and now may be that then, the time between beginning tapering and raising rates was quite long – two years (they started tapering at the Dec 2013 meeting and they hiked rates at the Dec 2015 meeting). This time around people expect a hike much sooner after the tapering ends. The Federal Open Market Committee (FOMC) members themselves predict one rate hike in 2022; the market sees two hikes. It’s not the taper we have to worry about; it’s what comes after.