On July 31, 2024, Zoom Video Communications, Inc. (NASDAQ: ZM) announced via a press release that it would report its Q2 FY25 earnings post-market close on August 21, 2024. The earnings release, which occurred yesterday, was followed by a live Zoom Webinar at 2:00 pm PT / 5:00 pm ET, accessible through Zoom’s investor relations page. For those unable to join, a replay became available roughly two hours after the event wrapped.

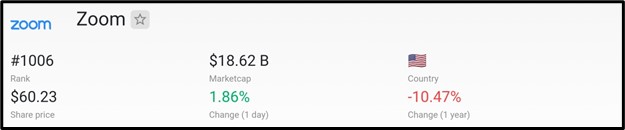

Market Cap

At a $18.62 billion market cap as of August 2024, Zoom ranks as the 1006th most valuable company globally, according to companiesmarketcap.com data.

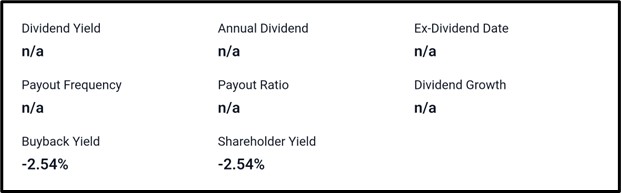

Dividend Information

Zoom’s shareholder yield stands at -2.54%, primarily due to buyback yield, as the company does not offer a dividend. Metrics such as dividend yield, payout ratio, and dividend growth are not applicable, reflecting an absence of dividend distribution at this time.

Recent Development At Zoom

Here are the latest updates from Zoom:

Zoom highlights new customer experience solutions at CEM Africa 2024.

Zoom enhances security with post-quantum end-to-end encryption in Zoom Workplace.

Workvivo by Zoom chosen as the preferred migration partner for Meta’s Workplace.

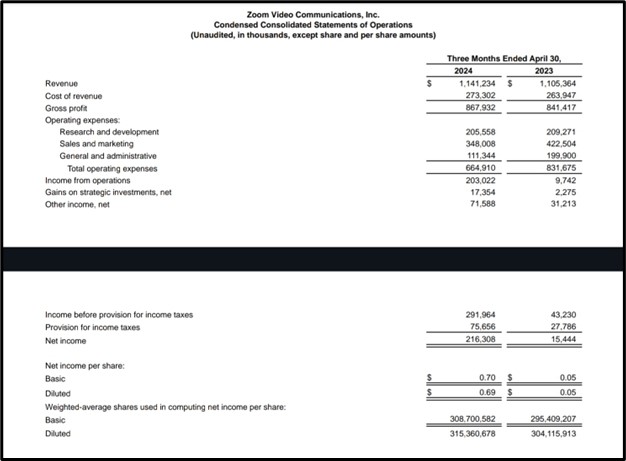

Q1 Earnings Report Recap

Zoom’s Q2 2024 revenue rose to $1.14B, up from $1.11B YoY, showing steady top-line growth.

Gross profit expanded to $867.9M, with a slight YoY increase in cost of revenue.

Operating expenses fell to $664.9M, down from $831.7M, driven by reduced marketing and G&A costs.

Net income surged to $216.3M from $15.4M YoY, with EPS jumping to $0.70 (basic) from $0.05.

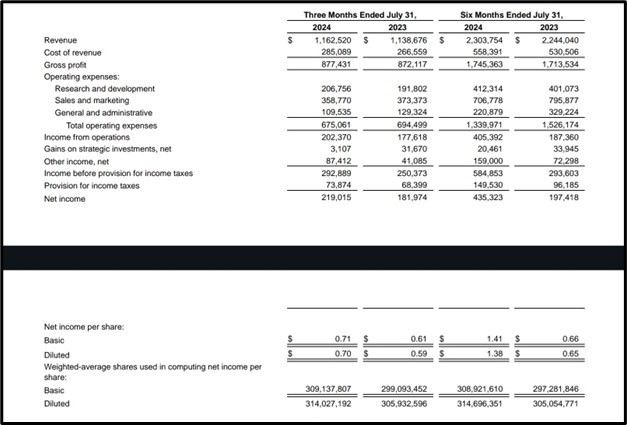

Q2 Earnings Report Recap

Zoom’s Q2 2024 revenue reached $1.16B, a slight YoY increase from $1.14B, with gross profit hitting $877M.

Operating expenses declined to $675M from $694M YoY, mainly due to a drop in sales and marketing.

Net income for the quarter jumped to $219M, up from $182M YoY, translating to a 16% EPS growth.

For the six months, net income surged to $435M with EPS rising to $1.41 (basic) from $0.66 in the previous period.

Technical Analysis

Zoom’s potential bullish breakout identified on the 4HR chart at $60.94.

If confirmed, upside targets are $63.05 and $64.70.

Failure to hold breakout may trigger downside moves to $58.27 and $54.87.

Apply Risk Management

Conclusion

In Q1, Zoom demonstrated steady growth with revenue reaching $1.14B, accompanied by significant improvements in profitability, as net income surged to $216.3M. In Q2, Zoom continued its upward trajectory with revenue increasing slightly to $1.16B and net income rising to $219M, reflecting solid cost management and a 16% EPS growth. Looking ahead, Zoom’s strategic innovations and potential bullish breakout signal positive momentum.

Source :

https://companiesmarketcap.com/zoom/marketcap/

https://stockanalysis.com/stocks/zm/dividend/