Today, on the third day of the trading week, it’s worth examining XAUUSD and USOIL from the commodities market, EURUSD from the forex market, and BTCUSD from the cryptocurrency market. We will review their recent performance, current status, and anticipate potential changes before the week ends.

XAUUSD

Sentimental Analysis

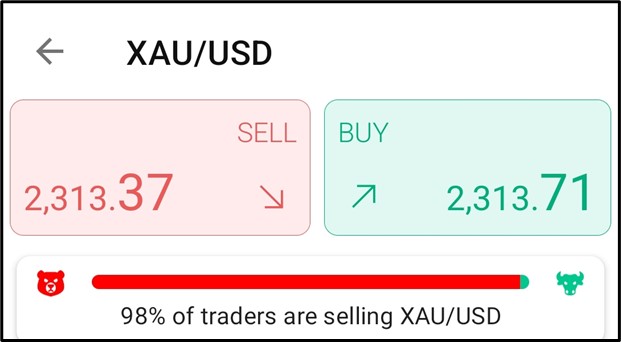

On the BDSwiss app, 98% of traders are selling XAUUSD, and 2% are buying.

Technical Analysis

Potential resistance breakout to the upside in 1hr chart of XAUUSD at $2317.37.

If breakout holds:

Target 1: $2325.49.

Target 2: $2335.82 if $2325.49 is broken.

If breakout fails:

Target 1: $2310.98.

Target 2: $2305.97 if $2310.98 is broken.

Apply risk management

Fundamental Analysis

Gold is holding steady around $2,300 early Wednesday, consolidating its recent gains. Traders are cautious and staying on the sidelines ahead of the crucial US Federal Reserve interest rate decision and the release of the US inflation data. Gold remains focused on reaching $2,277.

EURUSD

Sentimental Analysis

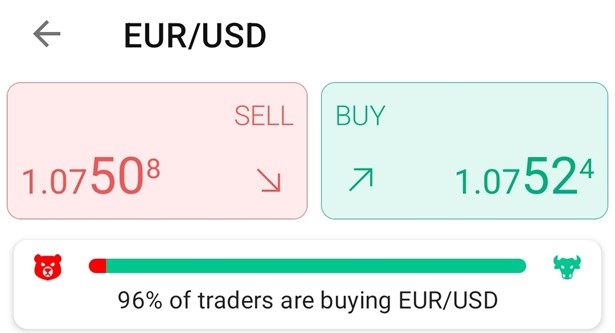

On the BDSwiss mobile app, 96% of traders are buying EURUSD, and 4% are selling it.

Technical Analysis

Support rejection spotted in 1hr chart of EURUSD at 1.07234.

If rejection holds:

Target 1: 1.07663.

Target 2: 1.07975 if 1.07663 is broken.

If rejection fails:

Target 1: 1.06722.

Target 2: 1.06058 if 1.06722 is broken.

Apply Risk Management

Fundamental Analysis

Tuesday saw the US Dollar (USD) keep up its post-NFP strong recovery, pushing EUR/USD to reach new six-week lows near 1.0720. Aside from the Greenback’s solid showing, the pair’s losses were influenced by developments in the European political scene following the parliamentary elections, along with increasing speculation leading up to the French snap elections scheduled for June 30.

BTCUSD

Sentimental Analysis

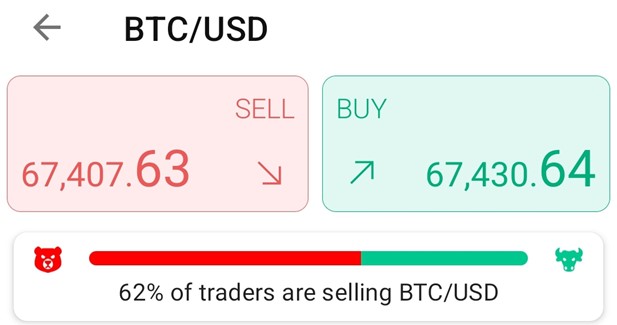

On the BDSwiss mobile app, 62% of traders are selling BTCUSD, while 38% are buying.

Technical Analysis

Support rejection spotted in 1hr BTCUSD chart at $66043.90.

If rejection holds:

Target 1: $67312.81.

Target 2: $68308.96 if $67312.81 is broken.

If rejection fails:

Target 1: $64431.08.

Target 2: $62376.48 if $64431.08 is broken

Apply risk management

Fundamental Analysis

As crypto investors wait for the Fed’s decision on rates, Bitcoin falls to the $67,000 level.

USOIL

Sentimental Analysis

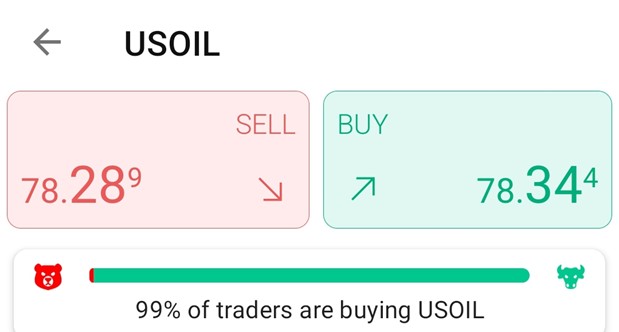

According to sentiment analysis on the BDSwiss mobile app, most traders (99%) are buying USOIL, with only a small percentage (1%) selling it.

Technical Analysis

Potential downtrendline breakout in USOIL 1hr chart at $78.21.

If breakout holds:

Target 1: $79.78.

Target 2: $81.78 if $79.78 is broken.

If breakout fails:

Target 1: $76.97.

Target 2: $76.00 if $76.97 is broken.

Apply risk management

Fundamental Analysis

Oil prices are increasing due to reports of decreasing U.S. crude oil stocks and higher global demand. Brent crude is up by 0.5% at $82.32 per barrel, while WTI is trading 0.7% higher at $78.42 per barrel. According to a Wall Street Journal survey, commercial crude stocks are expected to have dropped by 1.2 million barrels last week. The EIA raised its 2024 forecast for global oil consumption growth by about 200,000 barrels per day to 1.1 million barrels per day, while OPEC maintained its optimistic demand-growth predictions.

Sources:

BDSwiss Mobile App

BDSwiss Academy Page on Tradingview

https://www.tradingview.com/u/BDSwiss_Academy/