Today, Wednesday, is ideal for market analysis. Let’s examine XAUUSD and USOIL (commodities), EURUSD (forex), BTCUSD (cryptocurrency), and Nvidia (stocks) to review recent performance, current positions, and potential moves by week’s end.

XAUUSD

Sentimental Analysis

BDSwiss Mobile App indicates 82% of traders are short on XAUUSD, while 18% are long.

Technical Analysis

Potential Downside Breakout: XAUUSD at $2317.07 on 1hr chart

Bearish Scenario:

Target 1: $2280.19

Target 2: $2233.28 (if $2280.19 breaks)

Bullish Reversal:

Target 1: $2346.08

Target 2: $2368.85 (if $2346.08 breaks)

Apply Risk Management

Fundamental Analysis

Gold: Flirts with weekly low amid Fed rate-cut uncertainty

Trend: Weak for second consecutive day due to Fed’s hawkish stance

Outlook: September rate cut possibility limits USD gains

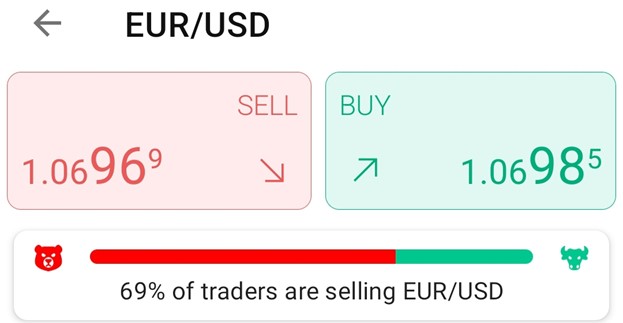

EURUSD

Sentimental Analysis

According to BDSwiss Mobile App, sentiment shows 69% short positions on EURUSD and 31% long positions.

Downtrendline Rejection: EURUSD at 1.07406 on 1hr chart

Bearish Scenario:

Target 1: 1.06961

Target 2: 1.06396 (if 1.06961 breaks)

Bullish Scenario:

Target 1: 1.07755

Target 2: 1.08030 (if 1.07755 breaks)

Apply Risk Management

Fundamental Analysis

EUR/USD declines below 1.0700 as USD strengthens. The pair continues to fall in Wednesday’s European session due to persistent USD strength, despite improved risk sentiment. Hawkish Fed expectations and EU political concerns add pressure ahead of mid-tier US data.

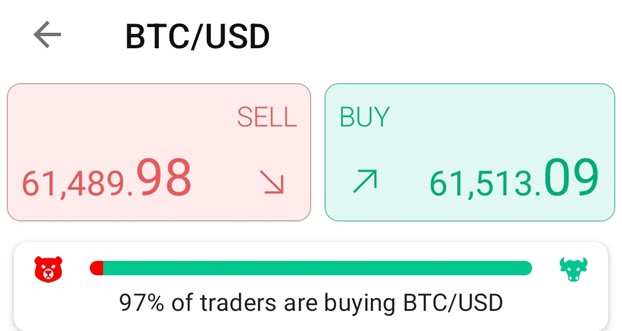

BTCUSD

Sentimental Analysis

According to the BDSwiss Mobile App, 97% of traders are long on BTCUSD, while 3% are short.

Technical Analysis

Downtrendline Rejection: BTCUSD at $62,563.87 on 30-min chart

Bearish Scenario:

Target 1: $61,480.41

Target 2: $60,102.18 (if $61,480.41 breaks)

Bullish Scenario:

Target 1: $63,416.30

Target 2: $64,085.50 (if $63,416.30 breaks)

Apply Risk Management

Fundamental Analysis

The upcoming BTC and ETH options expiry on Deribit accounts for over 40% of the total notional options open interest. More than 25% of these options are expected to expire “in the money.” Traders are anticipating a bullish shift in bitcoin and ether next month.

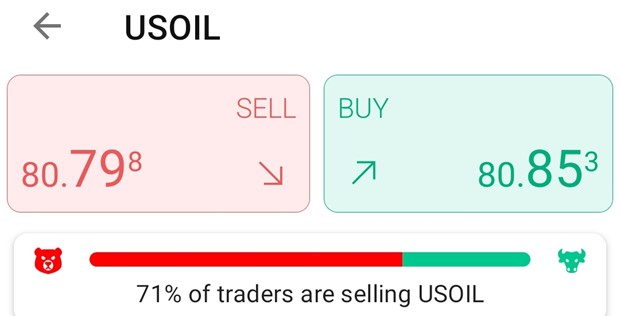

USOIL

Sentimental Analysis

According to BDSwiss Mobile App, USOIL has a 71% sell and 29% buy sentiment among traders.

Technical Analysis

Uptrendline Rejection: USOIL on 1hr chart at $80.46

Bullish Targets:

Target 1: $82.67

Target 2: $85.49 (if $82.67 breaks)

Bearish Targets:

Target 1: $78.71

Target 2: $77.34 (if $78.71 breaks)

Apply Risk Management

Fundamental Analysis

On Wednesday, oil steadied near a two-month high, supported by Q3 inventory drawdown forecasts and Middle East conflict risks.

Sources:

https://www.fxstreet.com/markets/commodities/metals/gold